Line 5, which partners with dealers to fund vehicle protection plans at all points along the credit spectrum, recently announced an integration with the technology solutions experts at TecAssured.

TecAssured is a leading provider of innovative technology solutions for the management, sales and end-to-end administration of automotive aftermarket, consumer and insurance products.

Line 5 now has been integrated with all TecAssured software applications, including ADMIN, MERGE and DIRECT. ADMIN is a base administration system that can be customized and adjusted to a dealership’s needs. It includes features for user management, report generation, a rating engine, accounts payable and receivable, claims administration and more.

MERGE is a product comparison tool, and DIRECT offers direct-to-consumer marketing.

“We’ve been delivering affordable financing options with guaranteed approvals, no down payments and low monthly rates for years, helping dealers better meet the needs of their customers and sell more products,” Line 5 said in a news release.

“Combine these services with the robust software solutions provided by TecAssured and you’ve got a top-tier system for more sales and improved customer satisfaction,” Line5 continued.

“This integration means that implementing Line 5 within a TecAssured software system is a great way to achieve a seamless and streamlined financing deployment experience,” Line5 went on to say.

“You can speed up the process for customers and agents and incorporate financing information within essential operational tools such as account management interfaces. Whether you already use TecAssured or are looking to add it to your arsenal, Line 5 makes integrated financing possible,” Line5 added.

This week, Launcher Solutions announced its third major development since the second half of May.

The newest one involved the technology provider specializing in automotive finance originations finalizing an integration partnership with Neo to help finance companies build a stronger portfolio and make smarter sales via Neo’s highly customized and comprehensive loan scoring algorithms.

Launcher reiterated that its origination system, appTRAKER LOS, was designed by subprime experts in the automotive finance industry with credit risk management at its core.

“The use of artificial intelligence is transforming the loan origination process by improving risk and fraud detection, especially in light of the current pandemic and resulting economic uncertainties. Our top priority has always been to connect our lenders with the best tools to improve their business processes and workflows such as the Neo scorecard,” Launcher president Nikh Nath said in a news release.

For Launcher clients, the company explained the ability to utilize the Neo’s scoring system will improve their risk management abilities with Neo’s A- based products.

Finance companies using appTRAKER LOS can use Neo to access a nearly endless number of attributes spanning customer stability, financial health, credit bureau, loan terms, purchase vehicle and more in real-time to provide a score for a loan.

Finance companies also may choose to let the appTRAKER LOS automate the decision-making process by utilizing the score or simply customize how it is presented to the underwriter; “in either case allowing them to make better and faster decisions on a deal,” according to Launch Solutions.

The company went on to say, “Neo’s unique approach enables auto lenders to approve even the toughest deals by providing not only a score, but also by specifying what down payment, loan terms, monthly payment etc., will make the deal approvable based on the lender’s historical data.”

This week’s development arrived after Launcher Solutions entered the credit-union market back in May with a tool tailored for those providers. Then in June, the company completed integration with HRI Analytics.

Nath discussed the current state of risk amid the coronavirus pandemic during an episode of the Auto Remarketing Podcast available through the window at the bottom of this report.

MBSi Corp. and Resolvion are making sure their firms are fully prepared when finance companies begin to start repossession and recovery activities again in full force.

The companies announced on Wednesday that they reached an agreement to complete full integration of Resolvion’s Wombat system with MBSi’s new RecoveryConnect platform.

Both firms have been in transition during the past year.

Resolvion completed a merger with Del Mar and in doing so created one of the largest repossession/skip management companies in the country. MBSi, which acquired MyRecoverySystem (MRS) and Vendor Transparency Solutions (VTS) in 2019, has been working to merge legacy systems to create the new RecoveryConnect, a comprehensive back-office platform with mapping and post-recovery scheduling capabilities.

Executives explained the Wombat-RecoveryConnect integration will provide agents the ability to receive and work all Resolvion repossession assignments in RecoveryConnect without the need to log in to Wombat.

“This integration is a win-win for all involved,” MBSi president Cort DeHart said. “For agents, it further reduces the number of systems they access, while improving compliance and efficiency.

“For Resolvion, it helps consolidate recent acquisitions into Wombat, as well as expand their commitment to mobile technology and the real-time benefits it brings,” DeHart continued. “For MBSi, it further enhances the service and compliance offerings to our lender, forwarder and agent partners.”

Resolvion chief executive officer Michael Levison added, “While we have been integrated on the lender side with MBSi for many years, this expansion will ensure our ability to seamlessly support both our lender clients and our agent partners regardless of the platform that they choose.”

Less than a month after entering into the credit-union space, LAUNCHER.SOLUTIONS (Launcher) finalized another integration; this time with HRI Analytics.

The technology provider specializing in loan originations explained integration aims to help finance companies make more intelligent underwriting decisions within Launcher’s loan origination system with HRI Analytics’ empirical data driven solutions.

The company reiterated Launcher’s platform, appTRAKER Loan Origination System, was designed by experts in the subprime automotive finance industry, so credit risk management is a top priority.

“We understand how important it is for lenders to have the ability to forecast loss and price their loan offerings in such a way as to drive portfolio yield,” Launcher president Nikh Nath said in a news release. “We chose to integrate with HRI Analytics to allow our lenders to assess risk in a more thorough manner.”

Launcher clients now can improve their risk management processes through this new integration. HRI Analytics utilizes empirical analyses of application data, standard and custom credit bureau attributes, and alternative data to develop custom lending scores. These scores are applied during the underwriting process to improve lenders’ decisioning, especially in lower-tier and thin-file credit situations.

When combined with appTRAKER LOS’s automation and auto-decision capabilities, Launcher insisted clients can expect a streamlined and efficient loan originations process that is custom-built for them.

Brian Hopper of HRI Analytics said, “Integrating with appTRAKER LOS will benefit our mutual clients in multiple ways, from tracking portfolio performance with quantifiable results to managing credit facilities and keeping scorecards current.”

Launcher previously completed integration with LexisNexis Risk Solutions to make more alternative data available to subprime auto-finance companies as well as with General Forensics to curtail power-booking.

Repay Holdings Corp. (REPAY) and Inovatec Systems Corp. now are working together to help finance companies with collections and other segments of their businesses connected with gathering payments from contract holders.

The provider of vertically integrated payment solutions recently announced a partnership with the provider of cloud-based lending solutions for all financial institutions.

As the proprietary payment platform of choice for Inovatec, REPAY highlighted that it now can enable lenders and finance companies on the Inovatec system to securely accept debit cards, credit cards, and ACH payments through its digital suite of consumer-facing payment channels, including text-to-pay, Interactive Voice Response (IVR) phone pay, the REPAY mobile app and online payment portals.

With its strength in business process automation, Inovatec’s configurable loan servicing and customer engagement platform can provide full servicing capabilities and portfolio analytics while allowing businesses to create customized processes and workflows throughout the lifecycle of a loan or lease.

“Inovatec’s extensive experience across automotive, equipment, and consumer sectors, along with its strong presence in the United States and Canada, makes this a valuable and exciting partnership to embark on,” REPAY chief revenue officer Susan Perlmutter said in a news release.

“These critical times have proven how important it is for lenders to offer convenient, easily accessible digital payment solutions to their customers to help reduce friction in the loan origination and repayment processes,” Perlmutter continued.

Inovatec’s cloud-based lending solutions for the automotive industry can streamline the process of submitting applications to finance companies. Combined with REPAY’s transaction processing platform, Inovatec insisted it now can ensure an optimal customer experience with a turnkey, fully digital solution that can be rapidly deployed end-to-end.

“We look forward to our partnership with REPAY and are thrilled to now have the ability to provide fast and secure payment processing solutions to our clients,” said Bryan Smith, head of customer growth and strategic partnerships at Inovatec.

“We selected REPAY as our platform of choice because of the company’s seamless integration capabilities, direct lending processing solution and distinct experience in the automotive industry,” Smith went on to say.

MenuMetric and 700Credit recently formed an alliance in an effort to help vehicle dealerships as well as marine, RV, and powersports stores.

The provider of credit reports, compliance solutions and consumer pre-qualification products and the web-based F&I menu platform offering connections to more than 180 popular providers developed a relationship they believe can enable efficient selection, presentation, and tracking of sales for F&I products and vehicle add-ons.

MenuMetric has integrated the 700Credit products into its system to provide seamless access to credit reports, compliance solutions and prescreen services to simplify workflow and speed the sales process.

“We are pleased to welcome MenuMetric to the 700Credit family. Their innovative F&I Menu platform integrates nicely with our products and will create and maximize efficiencies for their customers,” 700Credit managing director Ken Hill said in a news release.

“The addition of our QuickScreen Prescreen platform into their F&I menu software will give dealers a unique insight into their customer’s credit profile and estimated monthly payments on prospective vehicles before posting a hard inquiry,” Hill continued. “With the consumer’s FICO score and equity on trade-in, dealers can work the right deal, right away, putting the consumer in a vehicle they want with payments they can afford.”

MenuMetric director of operations Phil Imbery added, “We are very excited to offer 700Credit services to all of our dealers across the country. The suite of services offered by 700Credit adds a new level of features and options for our customers and helps us continue to help our dealers become more efficient and save time on every deal.”

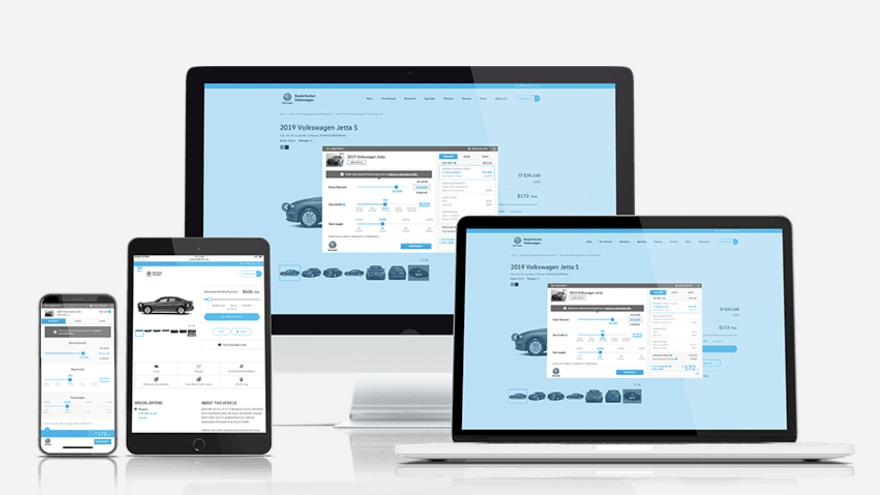

A refreshed F&I menu was part of the newest innovations rolled out by DealerSocket at the 2020 NADA Show.

That menu is connected with DealerSocket’s PrecisePrice digital retail solution and stems from an integration with F&I Express and its Express Digital Media.

DealerSocket highlighted PrecisePrice’s new VIN-specific F&I menu can extend the tool’s pricing capabilities by directly connecting the product to 160 F&I product providers. The connection can provide users with access to detailed product information and video content.

Other PrecisePrice enhancements include:

A new kiosk experience

To provide customers with the same digital experience in-store that dealers offer online, DealerSocket is rolling out a new customized version of its PrecisePrice digital retail software that scales to an iPad Pro and fits within a stand-up kiosk. This tool can enable vehicle shoppers to use an iPad with or without a kiosk format in-store to start or continue their shopping experience, on their own or while speaking with a knowledgeable salesperson.

Text label editing capabilities

PrecisePrice users can now edit text labels directly within the digital retail module. The company said this functionality is important for dealers looking to update their consumer experience based on specific dealership language and nomenclature.

New lead verification functionality

DealerSocket explained PrecisePrice’s new lead verification enhancement can solve a significant issue plaguing price-unlock features on dealer websites, where customers enter false information to access the dealership’s discounted pricing.

With this new feature available and integrated as an option into PrecisePrice, vehicle shoppers are asked to enter a valid phone number or email to receive a verification code which is then entered in the system to engage PrecisePrice and access the dealer’s special pricing. The new capability is especially useful for dealers representing brands with strict advertising guidelines.

The company went on to mention these innovations continue the strong momentum for DealerSocket’s digital retail tool from 2019 when PrecisePrice earned certifications from Volkswagen, Toyota, Lexus and Hyundai.

These certifications provide dealers representing those brands with exclusive access to data, reporting, and, in some cases, co-op dollars, according to DealerSocket.

Two operations that finance companies likely know and perhaps use their services — Dealertrack and IAA — now are working closely together.

On Thursday, Dealertrack announced a new integration with IAA. The companies said bringing together two technology solutions — IAA Loan Payoff and Dealertrack Accelerated Title — will help mitigate the time-consuming process of managing a total loss claim requiring contract payoff and title release.

Combined, the companies indicated this integration now offers finance companies and insurers one cohesive digital solution that can deliver positive and negative equity functionality, real-time payoff quotes, letters of guarantee, access to title vaults and direct connection, and ACH payments to finance companies.

According to a news release, the joint solution is currently in alpha pilot testing and will enter beta pilot testing in December.

Based on internal analysis and interactions with multiple insurance providers, IAA estimated that there are more than 5 million vehicles declared a total loss each year and approximately 60% to 70% have loans that need to be paid off. IAA pegged the historically manual workflow of the total loss process typically taking 45 to 90 days to complete end-to-end.

Based on the average price for vehicles declared total losses, IAA contends this process can tie up billions of dollars and slow consumers from returning to the auto retail market to purchase their next vehicle. IAA added this situation also can negatively impact the customer experience and impede the productivity and profitability of finance companies, insurers and the salvage auctions.

Integrating Dealertrack Accelerated Title and IAA Loan Payoff is geared to expand access to vehicle titles for all parties — finance copanies, insurers and salvage auctions. The companies believe the integration creates a more digital, automated workflow that can speed up the balance payoff and title release process, lowering operational costs and easing friction between all parties.

“Time is money and lenders and insurers today cannot afford to get bogged down by the lengthy total loss settlement and lien payoff process,” said Kaitlin Gavin, vice president and general manager of Dealertrack Registration and Title Solutions. “Dealertrack Accelerated Title is a solution that no one else in the auto industry offers.

Since inception, we have helped dealers efficiently submit more than $4 billion dollars in loan payoffs and receive expedited titles to ensure they can turn their inventory effectively,” Gavin continued in a news release.

“Partnering with IAA allows us to offer similar benefits to the total loss market, enabling insurers and lenders to seamlessly navigate total loss claims with negative equity that require a letter of guarantee from the lender,” Gavin went on to say.

Dealertrack sources auto financing from more than 7,400 provider partners and manages more than 52 million paper and electronic titles, making the company one of the largest automotive title management company in the U.S.

Dealertrack said its Accelerated Title solution can reduce the time it takes to process vehicle payoff and title release by up to 70%, creating cost savings for dealers accepting trade-ins.

Meanwhile, IAA Loan Payoff can enable digital connectivity between insurance companies and auto-finance companies to address negative equity liens and a letter of guarantee resulting in a faster total loss settlement and lien payoff process.

“We are pleased to be partnering with Dealertrack to address some of the most crucial pain points in the total loss claims process,” said Tim O’Day, president of U.S. operations for IAA.

“By linking our strong insurer partner base with Dealertrack’s robust network of lenders, we’re building an unprecedented digital connection to ensure titles can be processed and claims can be closed faster than ever,” O’Day added.

Two firms finalized an integration this week to make individuals’ credit scores more readily accessible earlier in the vehicle-sales cycle to help dealers and finance companies.

CoreLogic, a global provider of property information, insight, analytics and data-enabled solutions, announced that CoreLogic Credco integrated its Three-Bureau PreQual credit report and score solution on eLEND Solutions, an automotive technology company specializing in online and in-store credit and finance solutions.

The companies indicated the integration of the prequalification solution can give CoreLogic Credco customers who use eLEND instant, single-source access to a consumer’s credit report and FICO score from all three national credit bureaus — Experian, TransUnion or Equifax.

The Three-Bureau PreQual solution from CoreLogic Credco is a soft inquiry credit report and score that can provide dealers with an efficient, inexpensive and convenient way to prequalify potential buyers earlier in the sales cycle. The solution leverages a soft inquiry as opposed to a traditional credit report’s hard-pull, so a consumer’s credit score is not negatively impacted.

“We are excited to make our new Three-Bureau PreQual solution seamlessly available to all of the auto dealers currently using eLEND,” said Colby Park, senior leader of automotive credit solutions for CoreLogic. “We have found that dealers like the solution because it allows them to effectively manage their credit reporting costs while efficiently pre-qualifying prospective car buyers earlier in the process.

“Consumers benefit because, unlike a traditional hard-pull credit report and score, it doesn’t negatively impact their credit score when it matters most — like when they are shopping for a car and trying to understand their eligibility for financing. It’s a win-win,” Park continued in a news release.

Pete MacInnis, chief executive officer at eLEND Solutions, added, “We’re dedicated to providing tools that help auto dealers sell cars faster to improve their profitability and the consumer experience.

“Adding access to soft inquiry credit pulls through Three-Bureau PreQual will help set our auto dealer network up for future success by increasing speed and transparency within the sales cycle. Quickly providing access to additional insights into consumers’ credit standing, without impacting their credit score, will benefit consumers and auto salespeople alike,” MacInnis went on to say.

The Three-Bureau PreQual credit report and score are currently available by contacting CoreLogic Credco Specialists at (800) 694-1414 or via email at [email protected].

For more information about the Three-Bureau PreQual credit report and score from CoreLogic Credco, visit credcoservices.com/credit-services/three-bureau-prequal-solution.

At its recent User Summit, DealerSocket lauched a new integration between the software company’s Precise Price digital retailing solution and F&I Express’ network of approximately 160 F&I product providers.

The companies highlighted this new combination can enable an even more accurate and intuitive digital retailing process for dealers and their customers.

DealerSocket explained Precise Price was initially developed to address the strong interest among consumers to transact online from any mobile device and marked DealerSocket’s entrance into the burgeoning digital retail category. Precise Price was one of the first digital retailing platform to come equipped with integrated desking software, allowing for the delivery of dynamic price quotes with rebates, incentives, and all applicable taxes and fees factored into deal calculations.

“DealerSocket’s Precise Price integration with F&I Express’ digital media solution helps dealers and their customers have a better experience during the digital retail process,” said Brad Perry, co-founder and chief product officer of DealerSocket.

“Utilizing the integration within Precise Price leads to happy customers that convert and buy more backend protection packages. Our initial pilot found that dealers who used the integration saw a nearly 20% increase in backend gross,” Perry added in a news release.

Now, through Precise Price’s integration with F&I Express’ Digital Media solution, the platform is able to display VIN-specific, state-specific and dealer-specific F&I product rates and dynamic content.

This connection also allows can digital retailers, dealer websites, menu systems and other platforms to dynamically access F&I product ratings and content.

“Trends reveal that car buyers are becoming more partial to an online retail experience. In fact, research shows 71 percent of consumers prefer to get online information about their entire deal, including aftermarket add-ons,” F&I Express vice president and general manager Gary Peek said.

“By giving customers more transparency and authority over the course of their deal, Express Digital Media can help dealerships reach consumers earlier in their car buying journey,” Peek continued. “This can improve customer satisfaction and for revenue through more F&I sales.”