Most of the major financing metrics Edmunds tracks regularly are poised to set new records.

With the retail price of new and used vehicles so high, Edmunds reported on Friday that the average amount financed and monthly payments recorded during the first quarter are at the highest levels analysts have ever seen.

Read more

Contract holders in your portfolio who prefer to make their monthly payment in person with cash at a physical location now have more options thanks to the latest development from PayNearMe.

The payments platform announced last week that Walgreens has joined the PayNearMe retail network, which enables PayNearMe clients’ customers to facilitate cash payments at nearly 9,000 Walgreens stores across the country.

According to a news release, PayNearMe’s cash network now exceeds 40,000 retail locations nationwide, made possible through its expanded partnership with the Green Dot Network.

“Approximately 78% of the U.S. population lives within five miles of a Walgreens or Duane Reade store,” PayNearMe chief revenue officer and general manager Michael Kaplan said in the news release. “With Walgreens in our retail network, our clients can now offer their cash-preferred customers even more convenience by allowing them to pay their bills in the same location where they shop.

“In the last 12 months alone, PayNearMe has increased its retail footprint by nearly 50%. That means our clients can now offer even more convenience to their customers who prefer or need to use cash to pay bills or make other non-commerce transactions,” Kaplan continued. “They can simply walk into one of thousands of retail locations across the country, show a cashier the scannable code on their smartphone, pay with cash and collect a receipt that confirms the transaction is complete.”

In addition to Walgreens, PayNearMe recently added more than 4,600 Walmart locations to its network through its expanded partnership with Green Dot, a financial technology company committed to giving all people the power to bank seamlessly, affordably, and with confidence.

PayNearMe also said that it expects to launch additional retailers to the network.

“The Green Dot Network, which features more than 90,000 cash reload locations, is a valuable asset to partners as they focus on empowering customers with more seamless, secure, convenient access to their money,” said Brandon Thompson, executive vice president of retail, tax, direct and pay card at Green Dot. “Now with PayNearMe, Walgreens customers can easily pay their bills using cash at any of Walgreens’ nearly 9,000 stores nationwide.”

Arriving just a few days after new research showed the volume of consumers living paycheck to paycheck, the Capital One Insights Center released new research timed to the two-year anniversary of the COVID-19 pandemic that shows the gap between lower and higher earners continues to widen against new affordability pressures.

As part of the Capital One’s ongoing Marketplace Index survey, this latest research released on Monday delved into the disproportionate impact of the pandemic across income groups against the backdrop of rising inflation.

Read more

Alviere and AutoPayPlus are collaborating so when consumers maintain their monthly payments on their installment contracts, they can receive a reward to be spent within the dealership’s service drive.

It’s part of the offering from Alviere, a leading global embedded finance technology platform, and AutoPayPlus, a leading automated payment service.

AutoPayPlus offers vehicle buyers and other consumers flexible payment options matched to their paychecks, which can lead to better budgeting, prevent late fees, and can accelerate the contract payoff. Since 2003, the company has enrolled more than 250,000 members and processed more than $5.65 billion in monthly payments, primarily through the automotive industry and the company’s long-term relationships with independent agents and dealerships nationwide.

Working with its dealership partners, AutoPayPlus will provide vehicle buyers enrolled in its automated payment service with a prepaid promotional debit card that can be used exclusively at the selling dealership’s service department.

The new card also offers AutoPayPlus dealership partners the added advantage of a new dealer loyalty program. This loyalty program can help dealerships to increase profits from customer-pay service, to boost customer retention at no additional cost to the customer or dealer and to transform vehicle purchases into lifelong relationships with those buyers.

“AutoPayPlus is another example of how Alviere’s embedded financial services platform can help brands transform relationships with consumers from one dimensional single events into continuous, long-term, deep, value-driven connections,” Alviere co-founder and chief executive officer Yuval Brisker said in a news release.

“Alviere expects to work with clients across the automotive landscape to offer a fast time-to-market, easy path to delivering new financial services to existing as well as new customers without any of the heavy lifting of being a financial services provider,” Brisker continued.

AutoPayPlus and Alviere also said they plan to launch additional embedded finance solutions later this year, deepening the deployment of the financial services products available on the Alviere platform.

“At AutoPayPlus, we’re always looking for new ways to build customer loyalty and retention,” AutoPayPlus founder and CEO Robert Steenbergh said. “Alviere enables AutoPayPlus to transition from being a valuable resource in helping dealers close a one-off purchase into a trusted partner that can now offer the opportunity for dealers to create long-term relationships that are critical to driving repeat business.

“And now every dealer partner can send buyers home with a card in their pocket that lets dealers send offers that will bring car buyers back to the dealership for deals and offers long after the buyer drives off the lot,” Steenbergh went on to say.

To learn more details, visit the Alviere website or the AutoPayPlus homepage.

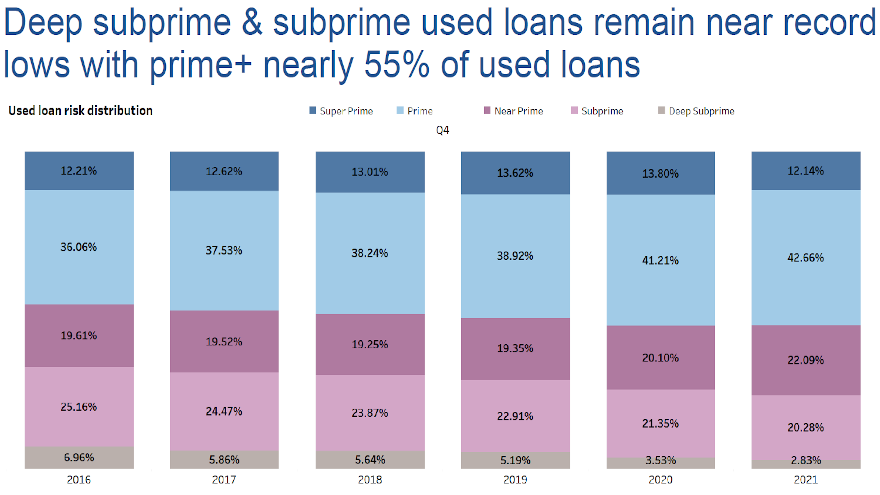

To use the industry vernacular, Experian’s newest State of the Automotive Finance Market report reinforced how much more money is on the street nowadays.

According to Experian’s fourth-quarter report released on Thursday, the average amount financed and monthly payments both jumped significantly year-over-year for both used- and new-vehicle financing.

Read more

Monthly payments for both used- and new-vehicle financing is projected to break records, according to data gathered and tracked by Edmunds.

Read more