This week, Consumer Portfolio Services announced that it named PayNearMe as its primary payments partner, saying the service provider’s technology “is like gold.”

According to a news release, this partnership will accelerate the finance company’s digital transformation and deliver a “frictionless” customer experience across all digital payment types — cash, debit, ACH and mobile-first payment options including PayPal, Venmo and Apple Pay.

PayNearMe also will provide CPS the chance to digitize and simplify payments through every channel, including agent, web, mobile, IVR and digital wallet.

“PayNearMe has proven to be a key partner in our digital transformation,” CPS chief operating officer Mike Lavin said in the news release. “With its innovative technology solutions, we have eliminated onsite cash payments, dramatically reduced the number of customers who pay by check and transitioned the majority of our customers to electronic payments through greater pay options.”

Furthermore, CPS is using PayNearMe’s QR code payment technology to give its customers the ability to quickly and easily complete payments with many electronic payment options or with cash via PayNearMe’s retail network.

“Our goal is to make it as easy as possible for CPS customers to make their car loan payments on time,” PayNearMe vice president of customer success Dennis Esguerra said. “Consumers want the flexibility to use different payment types each billing cycle, such as paying by debit card one month, Venmo the next and cash another month.

“In fact, our research found that for 29% of consumers, having this flexibility would make it easier to pay bills on time. By adding PayPal and Venmo as payment types, CPS customers will have even more flexibility when they need to make a bill payment,” Esguerra continued.

Smart Link technology also is designed to makes it easier for CPS customers to make electronic payments from their smartphones via email, text or push notification.

“PayNearMe’s Smart Link technology is like gold,” Lavin said. “In as few as two taps on their smartphone, our customers can pay their bill using whatever payment type they prefer. That’s the type of innovation that makes it easier for our customers to pay their bills on time and sets PayNearMe apart as a great partner.

“We chose PayNearMe as our primary payments partner because their team understands our vision for the future, constantly presents us with new ways to create better digital experiences at scale, delivers incredible day-to-day support, and has the industry’s best bill payment technology platform,” he continued. “By expanding our relationship, we can further digitize customer payments, increase self-service transactions, and reduce payment-related call center interactions.”

AutoPayPlus acknowledged every dealership’s primary business goal and ongoing challenge revolve around one, single metric: profit.

To help managers and principals in that department, AutoPayPlus unveiled an all-new solution this week designed to increase profit per vehicle and service retention for dealerships in one easy step.

The company highlighted AutoPay+PERKS combines the company’s biweekly retail installment contract payment service with the added advantage of a dealer loyalty program to increase profits from customer-pay service and boost customer retention at no additional cost to the customer or dealer.

“The key to a dealership’s success today is to maximize its two primary profit sources,” AutoPayPlus chief executive officer Robert Steenbergh said in a news release.

“AutoPay+PERKS also gives agents something to offer their dealerships that no other biweekly program can deliver and continually build customer loyalty. Only that can combat the disrupters,” Steenbergh continued.

How does AutoPay+PERKS work?

The company explained that it begins at the point of sale by enrolling customers in AutoPayPlus, an F&I service that uses automated biweekly payments to help car buyers better afford their monthly payment, purchase additional products, shorten their trade cycle and return to the dealership with less negative equity.

A 10-year analysis by AutoPayPlus has shown that dealerships sell approximately 57% more F&I products on AutoPayPlus deals versus standard retail deals.

In addition, results from AutoPayPlus’ top dealer groups reveal a 63% increase in per-vehicle financed income on AutoPayPlus customers.

Once customers’ AutoPayPlus account has been active for six months and it’s time for their first service, AutoPayPlus sends them a debit Mastercard co-branded with the dealership’s logo and preloaded with $100 that can only be used at the selling dealership’s service department. A dealer boost program can allow dealers to load additional funds to the card, further incentivizing their customers’ return to the dealership.

The company added that AutoPay+PERKS is supported by a mobile app that lets customers access their perks from a dealer-branded service page, as well as receive factory recommended service scheduling reminders and recall alerts.

“AutoPay+PERKS is a guaranteed way to drive new customers to the service department that doesn’t interfere with any other existing retention program such as pre-paid maintenance,” Steenbergh said. “And, best of all, it’s easy and can be cost-free for dealerships to implement.”

Even when finance companies helped their customers with installment payment accommodations during the worst of the pandemic, providers oftentimes still saw funds following into their collection baskets.

That’s one of the conclusions from a new TransUnion study that found the majority of consumers continued to make payments on their accounts even when in an accommodation program.

TransUnion reported this week that enrollment in financial hardship programs grew significantly as a result of the COVID-19 pandemic to approximately 7% of all accounts for credit products such as auto financing and mortgages.

The study also showed that seven in 10 non-prime consumers and eight in 10 prime and above consumers made payments on hardship accounts while they were enrolled in such programs.

Additionally, analysts discovered more than 40% of accounts in these programs exited within the first three months of entering.

TransUnion explained that accounts in financial hardship — defined by factors such as a deferred payment, forbearance program, frozen account or frozen past due payment — have provided consumers with much-needed financial relief during the ongoing impacts of COVID-19.

While accommodation programs of various forms have been around since before the pandemic, expanded eligibility criteria under the CARES Act in March 2020 increased the reach of consumers who accessed hardship assistance, according to TransUnion.

“Traditionally, enrollment in a financial hardship program signified heightened consumer risk,” said Jason Laky, executive vice president of financial services at TransUnion. “In the era of COVID-19, however, the consumer makeup of those accessing hardship programs has been much more diverse in terms of credit profiles.

“As situations have stabilized, we’ve found that consumers who exhibited key credit behaviors within the first three months of accessing an accommodation program performed well over the long-term,” Laky continued in a news release.

TransUnion pointed out that the total percentage of accounts in “financial hardship” status showed a considerable increase from March to May of last year in the early months of the pandemic.

However, TransUnion’s May 2021 Consumer Credit Snapshot shows accounts in financial hardship status have dropped significantly compared to one year ago.

Accounts in Financial Hardship Status Down Markedly from Early Stages of the Pandemic

|

Percentage of Accounts in

Financial Hardship

|

May

2021

|

May

2020

|

March

2020

|

|

Auto Loans

|

2.09%

|

|

7.04%

|

|

0.64%

|

|

|

Credit Cards

|

2.16%

|

|

3.73%

|

|

0.01%

|

|

|

Mortgages

|

4.07%

|

|

7.48%

|

|

0.48%

|

|

|

Unsecured Personal Loans

|

2.35%

|

|

6.15%

|

|

1.56%

|

|

Source: TransUnion

TransUnion said consumers leveraged hardship programs during the pandemic due to varying financial concerns and issues they faced. As a result, TransUnion studied early consumer credit behaviors upon hardship entry to determine whether these behaviors were predictive of better future credit risk performance.

The length of time consumers stayed enrolled in a hardship program was a key signifier of risk level, according to analysts.

TransUnion explained consumers that were deemed “early exiters” (those who exited on all of their hardship accounts by month three) were lower risk than those who were enrolled in the programs for a longer period.

Analysts said consumers who exited early were also less likely to experience continued struggles and leverage financial accommodations again.

Roughly 80% of these early exiters stayed out of hardship programs nine months later, according to TransUnion’s findings. Analysts determined this trend was consistent across all risk tiers, but prime and above hardship consumers performed exceptionally well and showed a significantly lower delinquency rate if they exited the hardship program early — especially compared to non-prime early exiters where the future performance difference was less pronounced.

Analysts said prime plus consumers who made payments, exited the hardship programs early and exhibited the “opportunistic” credit behavior were all found to be lower risk. These consumers either paid off trades (closed with $0 balance), made a payment amount larger than their due amount at the end of the third month or decreased their balance.

“Lenders, banks and various financial institutions across the financial services landscape extended accommodations to consumers to help them withstand the challenges brought on by the pandemic,” said Matt Komos, vice president of research and consulting at TransUnion. “The consumers who enrolled in hardship programs and exited early or continued to make payments on accounts overwhelmingly used the programs for their intended purpose.

“Not only were these consumers much less likely to go delinquent, they were able to get a leg up during a difficult situation,” Komos added in the news release.

Komos elaborated about those points and more during an episode of the Auto Remarketing Podcast.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

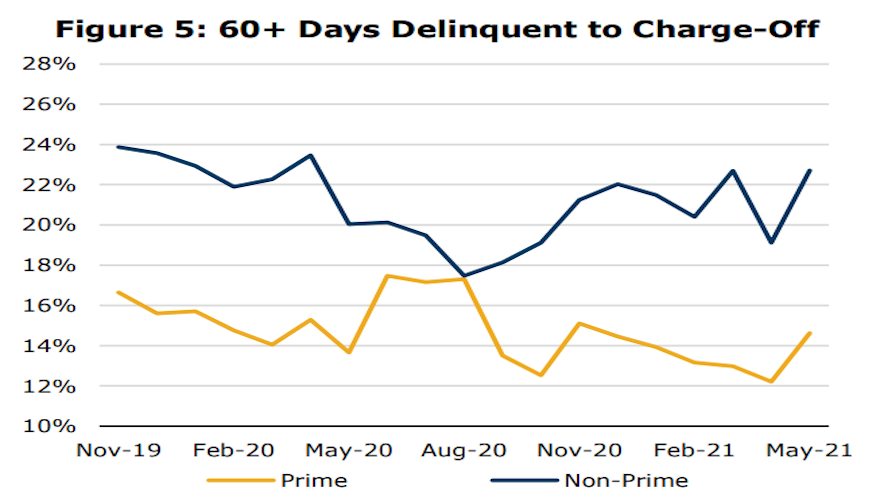

Kroll Bond Rating Agency (KBRA) highlighted how much federal stimulus money provided a positive bounce for maintaining monthly payments.

And according to the firm’s newest report, that bounce is losing its momentum, but the overall market still is solid as analysts said May remittance reports showed auto credit trends remained strong during the April collection period.

Read more

Defaults are a bad outcome for both lenders and borrowers, and research shows that the mismatched timing between a person’s income and their bills is one of the most common reasons for these financial shortfalls.

A new behavioral science experiment conducted by Duke University’s Common Cents Lab with customers of Beneficial State Bank (BSB) shows a simple, creative way that banks can reverse this trend and reduce defaults by eliminating mismatches.

Target smaller, more frequent payments

While banks cannot influence borrower externalities like the loss of a job or a medical emergency that might lead to a missed payment or default, they are better positioned to address income and expense mismatches.

Auto loans in particular can be challenging for income flows because the default monthly payment date is almost always the day a vehicle is purchased. And while loan payments are due on a specific date every month (e.g., the 15th), many people are paid on certain days of the week (e.g., every other Friday).

To help close this gap, a text-able recurring payments form was designed for BSB borrowers so they could sync the autopay of their loans with their income. The experiment randomized over 1,000 new BSB auto loan customers into either a control group or an experimental group. During BSB’s required welcome call for new loan recipients, the experimental group was texted a recurring payments form to help them sync payments with income. The control condition did not get the form.

The form made it easy to make multiple payments because smaller payments often help with budgeting. For example, if a monthly auto loan payment was $397 (the average in the U.S. for a used car), a borrower could choose to do two smaller payments of $198.50. Since millions of people get paid weekly, they could even split it into four weekly payments of $99.25.

Faster, cheaper payments with no defaults

Importantly, while both the control and experimental groups reported high interest in the program, those in the experimental group who received the enrollment form were 2.3 times as likely to enroll in automatic payments. The members of this group were also more likely to divide their payment into smaller sub-payments that synced with income.

As a result, the experimental group performed far better in terms of defaults, on-time payments, and total payments. None of the members in the experimental group defaulted on their loan while 17 members in the control group defaulted. The synced group also paid sooner — an average of 1.4 days before the due date compared to 2.75 days after the due date for the control group – which meant fewer late fees. And by the study’s conclusion, the experimental group had paid 100% of their loan payments while the control group had paid an average of 94.2% of their total loan payment.

The big opportunity for banks

Small changes in an approach like this — rooted in natural human preference and inclinations — are a highly effective way to positively impact people’s lives. For someone whose income is tight, knowing there will be money in the bank when a loan payment is due makes it easier to confidently sign up for autopay, which can then have additional long-reaching impacts.

When even a single late payment on your car loan can result in late fees and damage to a credit score, autopay can be a tremendous advantage. Not to mention the worst-case scenario of repossession, which can jeopardize a person’s ability to work and earn an income.

At the same time, beyond avoiding missed or late payments, syncing payments can also help to pay off an auto loan faster, a win-win for both the borrower and the lender.

The great news is that building a program to time loan payments with income is an easy one to institute for most banks and lenders. It requires a minimum of time and investment, can be rolled out across multiple loan types and platforms, and produces immediate and obvious bottom-line benefits.

Ultimately, implementing behaviorally informed solutions like these are simple, effective ways to produce good outcomes for everyone involved.

Richard Mathera, Lindsay Juarez, and Kristen Berman are part of the Common Cents Lab at Duke University.

TransUnion discovered another way this pestering pandemic influenced consumer behavior when it comes to individual’s auto financing.

On Wednesday, TransUnion released findings of a payment hierarchy study focusing on the three most popular credit products in the U.S. — auto financing, credit cards and mortgages.

TransUnion indicated approximately 27.8 million consumers held balances within all three categories as of Q3 2020, and analysts found mortgages were clearly prioritized over the other credit products.

In fact, TransUnion said this dynamic has held true since Q4 2017.

However, analysts explained that the pandemic has caused even greater prioritization of mortgages over the other credit products.

For those consumers possessing auto financing, credit cards and mortgages, the 30 days or more past due delinquency rate at 12 months following observation was lowest for mortgages at 0.75%, as of Q3 2020.

TransUnion indicated auto financing had the second-lowest delinquency rate at 1.13%, followed by credit cards at 1.95%.

Analysts pointed out these findings very likely are connected to the growth in home prices over the last several years as housing markets across the country have remained strong, and consumers’ desire to protect the equity in their homes. TransUnion also acknowledged that as lockdowns and the shift to work/school from home permeated during the pandemic, keeping current on home loan payments took on increased importance in 2020.

“Mortgage is once again the clear priority for U.S. borrowers,” said Matt Komos, TransUnion’s head of research and consulting in the U.S.

“The mantra, ‘you can’t drive your home to work’ doesn’t have the same effect when millions of Americans are waking up, showering, eating breakfast and taking only a few steps to their home office,” Komos continued in a news release.

In addition to more people working from home and rising home values, TransUnion noted that mortgage loan performance is likely benefitting from thousands of mortgage borrowers entering accommodation programs soon after the onset of the pandemic.

The study indicated subprime and near-prime credit risk mortgage borrowers have been benefitting the most from these programs as they were able to delay payments and maintain their accounts.

Also of note, analysts spotted a shift in the prioritization of payments if a consumer possessed only one credit card.

Of the 27.8 million U.S. consumers in the study possessing an auto financing, credit card and mortgage, only 5.3 million people had one credit card in their wallet. For this subset of the population, TransUnion said mortgage remains the clear priority, but consumers with only one credit card valued it more than their auto financing beginning in Q2 2020.

Analysts explained this shift suggests the heightened importance of maintaining access to at least one credit card as online commerce and digital transactions have become a daily necessity for many U.S. households.

TransUnion survey data highlighted that U.S. consumers valued their mortgages over other loans because the credit product has the highest perceived value of all expenses.

Furthermore, analysts said six in 10 U.S. consumers expected to receive a call from their lender if they missed one mortgage payment and more than half (52%) said their missed payment would have a negative impact to their credit score.

Nearly one in five consumers (17%) said they would experience foreclosure or their home would be repossessed if they miss a mortgage payment, according to TransUnion.

“The pandemic has changed so much in the world, but understanding why consumers are making important credit decisions only serves to better help the lending ecosystem in the future,” Komos said.

For more information about TransUnion’s payment hierarchy report, go to this website. TransUnion is also hosting a webinar on April 22 to discuss the findings. Registration for that event can be completed here.

Consumers Prioritizing Mortgages Above All Other Major Credit Products

|

Credit Product 30+ DPD Rate** – Timeframe

|

Q3 2020

|

Q3 2019

|

Q3 2018

|

Q3 2017

|

Q3 2016

|

|

Auto Loans

|

1.13%

|

1.42%

|

1.37%

|

1.37%

|

1.23%

|

|

Credit Cards

|

1.95%

|

2.62%

|

2.40%

|

2.41%

|

2.12%

|

|

Mortgage Loans

|

0.75%

|

1.28%

|

1.29%

|

1.40%

|

1.34%

|

**30+ days past due rate at 12 months for those borrowers possessing all three credit products. Source: TransUnion

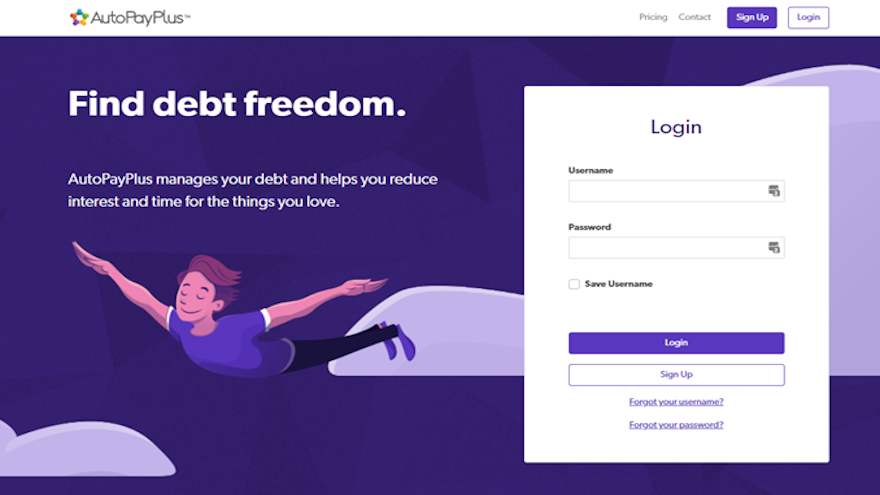

Resolved to continue and even expand its operations following a consent order reached with the Consumer Financial Protection Bureau, US Equity Advantage launched a new member portal for AutoPayPlus on Monday.

The company said that five main features are designed to enhance the customer experience with mobile optimization and the ability to track their loan progress, monitor their credit report and manage alerts and bulletins.

According to a news release, features of the new member portal include:

• A finance planner that analyzes members’ loans and credit information and suggests ways that they can save more money through debt-repayment strategies.

• Powerful visualization tools and interactive educational material that helps members understand what’s affecting their credit score and how to improve it.

• Free enrollment in TransUnion’s credit services by simply clicking the “Add My Credit Report” button. This value-added service provides continuous credit monitoring along with monthly credit scores, twice-a-year credit reports and a credit snapshot every three months.

• A password reset option that lets members bypass contacting the customer care team, making it faster and easier to gain access to their account.

• The ability to submit an email to our customer care team directly from the portal, should the member have any questions or concerns. Additionally, for members who prefer to speak to a customer care representative, AutoPayPlus has implemented a new callback feature that allows members to choose to hold or schedule a call back.

“I believe AutoPayPlus is the only payment service in the industry that provides a member portal for consumers to stay up-to-date on their account status,” USEA chief executive officer Robert Steenbergh said in the news release. “Our members can view details about each of their accounts, including debit schedules, amount of reduced interest, term reduction and improved equity status.

“The development of this new portal stems from our ongoing commitment to understanding our members’ needs and delivering consistently excellent service,” Steenbergh added. “Another way we are fulfilling this commitment is by recently increasing our support staff by 44 percent to meet and exceed the service expectations as we continue to grow and expand.”

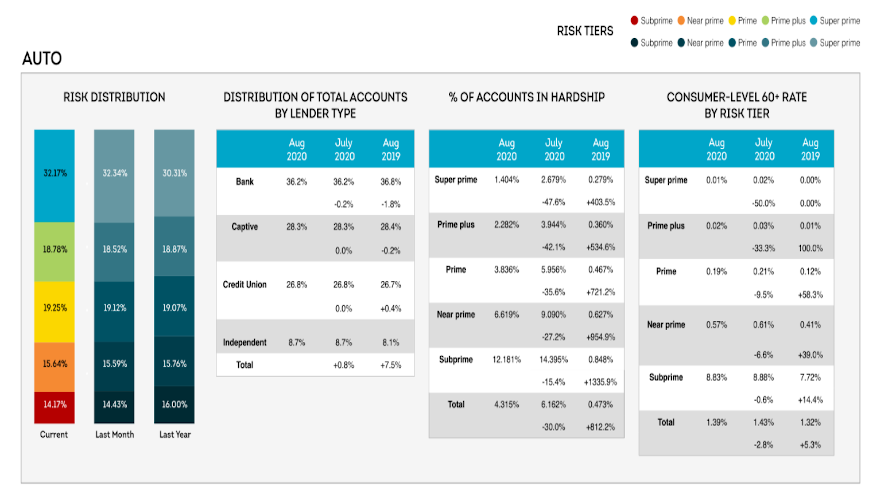

While credit performance has improved during recent reporting periods, TransUnion is cautious about the sustainability that contract holders can continue to make their monthly auto-finance payments along with other credit obligations. That sentiment stems from findings through its latest consumer survey.

TransUnion reported on Thursday that serious delinquency rates in August improved once more across all consumer credit segments — including auto financing, credit cards, mortgages and personal loans — even as the number of people in accommodation programs dropped for the second consecutive month.

That assertion is part of TransUnion’s latest Monthly Industry Snapshot, which also points to potential challenges in the near future.

Since the start of the pandemic in March, TransUnion indicated consumer performance has been mostly positive with continued month-over-month improvements for many of these credit products.

“A significant percentage of consumers utilized financial accommodations to defer or freeze payments during the early stages of the pandemic. As the first wave of consumers exit accommodation and a period of excess liquidity, they are returning to their debt obligations and continuing to perform,” said Matt Komos, vice president of research and consulting at TransUnion.

“Consumers who still remain in hardship could be more likely to face income losses and thus have more difficulty exiting these programs than consumers who may have entered into hardship programs as a precautionary measure,” Komos continued in a news release.

August Industry Snapshot of Consumer-Level Delinquency Performance by Credit Product

|

Timeframe

|

Auto

|

Credit Card

|

Mortgage

|

Personal Loans

|

|

August 2020

|

1.39%

|

1.23%*

|

1.03%

|

2.53%

|

|

July 2020

|

1.43%

|

1.37%*

|

1.08%

|

2.79%

|

|

June 2020

|

1.50%

|

1.48%*

|

1.07%

|

3.11%

|

|

May 2020

|

1.55%

|

1.76%*

|

1.14%

|

3.14%

|

|

April 2020

|

1.33%

|

1.87%*

|

1.27%

|

3.27%

|

|

March 2020

|

1.37%

|

1.96%*

|

1.40%

|

3.40%

|

|

August 2019

|

1.32%

|

1.72%*

|

1.45%

|

3.08%

|

*Credit card delinquency rate reported as 90+ DPD per industry-standard; all other products reported as 60+ DPD. Source: TransUnion

The August Monthly Industry Snapshot Report found the percentage of accounts in “financial hardship” continued a downward month-over-month trajectory for auto financing, credit cards, mortgages and personal loans from the months of July to August.

TransUnion explained its financial hardship data includes all accommodations on file at month’s end and includes any accounts that were in accommodation prior to the COVID-19 pandemic.

Across all credit products, analysts determined the percentage of accounts in financial hardship during the month of August dipped to pre-May levels. Accommodation programs provided consumers with payment flexibility and added liquidity during the course of the pandemic.

However, as the number of consumers leveraging such programs decreases and government relief funds are not expected to renew, TransUnion acknowledged many consumers may find themselves at what the credit bureau called “an inflection point.”

August Industry Snapshot of Financial Hardship Status by Credit Product

|

Timeframe

|

Auto

|

Credit Card

|

Mortgage

|

Personal Loans

|

|

August 2020

|

4.32%

|

2.21%

|

5.92%

|

5.14%

|

|

July 2020

|

6.16%

|

2.83%

|

6.15%

|

6.92%

|

|

June 2020

|

7.21%

|

3.57%

|

6.79%

|

7.03%

|

|

May 2020

|

7.04%

|

3.73%

|

7.48%

|

6.15%

|

|

April 2020

|

3.54%

|

3.22%

|

5.00%

|

3.57%

|

|

March 2020

|

0.64%

|

0.01%

|

0.48%

|

1.56%

|

|

August 2019

|

0.47%

|

0.01%

|

0.86%

|

0.26%

|

Source: TransUnion

Potential challenges on the horizon

While serious delinquency rates continued to decline in August, TransUnion observed some negative movement in 30-day delinquency rates.

Analysts explained this metric — which may serve as an early indication that an account will default and potentially be charged off — increased slightly in August for the two largest payments consumers often have to make: their vehicle and mortgage payments.

“This uptick for both products could signify that consumers are starting to roll forward on deferred payments as they come off of hardship programs,” Komos said.

“However, it’s still much too early to tell. It could simply be a missed or delayed payment that is late by a few days or weeks, though the consumer’s intention is still to make the payment,” he added.

Komos mentioned that close attention is being paid to delinquency levels as TransUnion’s latest Financial Hardship Survey from the week of Aug. 24 found that COVID-19 continues to financially impact consumers.

While TransUnion discovered the percentage of financially impacted Americans dipped to 52% — the lowest level since the ongoing survey series began in March — the concern among impacted consumers regarding their ability to pay bills and other obligations remains high (75%).

According to the survey, TransUnion reported that about one-third of impacted consumers are turning to savings to pay bills or loans and 13% cited they plan to open new credit cards. Despite these concerns, data from the monthly snapshot found that consumers are continuing to make payments as the average credit card balance per consumer dropped to $5,127 in August, compared to $5,686 the previous year.

In addition, TransUnion noted the average Aggregate Excess Payment (AEP) — defined as the average amount consumers are paying over their respective minimum payments — increased to $330 in August. Although analysts acknowledged that average is similar to what they observed at the same time last year when it came in at $300.

“Many consumers have continued to make payments even when enrolled in financial accommodation plans,” Komos said.

“The real litmus test in regards to consumer credit health will become apparent in the coming months when these safeguards begin to expire and consumers have less payment flexibility,” Komos went on to say.

TransUnion’s August Monthly Industry Snapshot features insights on consumer credit trends around personal loans, auto financing, credit cards and mortgage loans.

Additional resources for consumers looking to protect their credit during the COVID-19 pandemic can be found at transunion.com/covid-19.

S&P Global Ratings reported on Tuesday that contract extensions connected with public auto loan asset-backed securities (ABS) improved at an accelerated rate in July relative to June, representing the third consecutive month of declines.

The firm also noted the rates at which contract holders made a full payment after their extension expired.

Analysts discovered these trends based on loan-level data filed with the Securities and Exchange Commission.

Across the 17 prime shelves tracked by S&P Global Ratings, analysts indicated that extensions dropped 38% to 0.86% from 1.39% in June.

For the four subprime shelves in its analysis, the firm determined extensions decreased 31% to 5.29% from 7.66% in June.

Nonetheless, S&P Global Ratings said that extensions remained above pre-COVID-19 levels, at about 2.2 times January’s prime level and 2.6 times January’s subprime levels.

“These abnormally high deferrals are distorting traditional performance metrics, causing losses and delinquencies to be lower than otherwise,” analysts said in a news release, “and some securitizers think performance will not normalize until the fourth quarter of this year or first quarter of next year.”

S&P Global Ratings touched on what it believes to be three other key observations from the latest data, including:

• Of the extended loans from March to July, 82% and 64% in the prime and subprime sectors, respectively, have come out of extension status and remain outstanding.

• The vast majority of these loans continue to perform and remain current. However, analysts observed an uptick in 60-day delinquencies in July relative to June for these previously extended contracts.

• Of those prime and subprime contracts that have come out of extension status, 68% of the prime loans and 60% of the subprime contracts made a full payment in July.

Toyota Financial Services is looking to assist its customers with the latest turmoil to strike during this turbulent year.

Last week, the captive announced it is offering payment relief options to its customers affected by Hurricanes Laura and Isaias, as well as those impacted by the wildfires in California and the derecho which struck the Midwest earlier this month.

Officials said this broad outreach includes any Toyota Financial Services or Lexus Financial Services customer in the designated disaster areas.

Impacted lease and finance customers residing in the affected areas may be eligible to take advantage of several payment relief options, some of which include:

— Extensions and lease deferred payments

— Redirecting billing statements

— Arranging phone or online payments

“Toyota Financial Services cares about the safety and well-being of its customers and wants to help those impacted by these natural disasters,” the company said in a news release. “We extend our heartfelt thoughts to those affected by these devastating disasters.”

Customers who would like to discuss their account options are encouraged to contact TFS or LFS.

Toyota Financial Services customers may call (800) 874-8822 or contact TFS via email using the Mail Center function after logging into ToyotaFinancial.com.

Lexus Financial Services customers may call (800) 874-7050 or contact LFS via email using the Mail Center function after logging into LexusFinancial.com.