More consolidation in the recovery space arrived late on Tuesday as Automotive Intelligence Council member MBSi Corp. increased its collection of resources.

The provider of compliance-enabled repossession assignment management software and vendor management software announced the acquisition of My Recovery System and Vendor Transparency Solutions’ platforms. The company highlighted this acquisition allows MBSi to offer a single software ecosystem for repossession assignment management and vendor compliance management to recovery agents, forwarders and auto-finance companies.

The integration of My Recovery System’s back-office platform and Vendor Transparency Solutions’ web-based compliance management system with MBSi’s assignment volume, operating excellence and talent formalized what the company described as a “game-changing component” of MBSi’s overall solutions strategy.

“We are thrilled to be working with the My Recovery System and Vendor Transparency Solutions platforms and teams to provide a seamless software solution for the recovery industry,” MBSi president Cort DeHart said in a news release.

“By capitalizing on these easy-to-use platforms, we will be able to bring new efficiencies to the industry with a seamless software solution that includes routing, full back-office and compliance management. This, coupled with the talent of the teams, sets us apart to deliver real results,” DeHart continued.

Two leaders from My Recovery System and Vendor Transparency Solutions also described what the transaction means.

“I’m excited to be part of a growing company where designs and strategies bring efficiency and transparency to the auto finance recovery industry,” said Jeff Koistinen, founder and president of My Recovery System. “MBSi’s commitment to the recovery agents ties back to our collective mission to exceed the needs of agents.”

Vendor Transparency Solutions founder and president Max Pineiro added, “I couldn’t be happier to join the MBSi team as we work together to deliver next generation compliance management platforms for recovery agents, forwarders and lenders.”

MBSi indicated its teams will immediately begin working to integrate the platforms to provide data and secure access of sensitive consumer information. MBSi also said it will continue to partner with RISC, which provides vendor vetting, compliance training and lot inspection services.

MBSi is hosting a recovery agent user conference and appreciation event on April 17 at Texas Live!, an entertainment venue in Arlington, Texas, starting at 3 p.m. CT. The user conference is exclusive to recovery agents to learn more about the new platform, pricing and how to get started.

Recovery agents can register for the event here.

ACC Consumer Finance, a specialized indirect auto finance company, recently announced that it has selected Servicing Solutions as its primary servicer.

As a result of this agreement, Servicing Solutions will support ACC’s ride-hailing finance offering.

ACC Consumer Finance offers a fully integrated automobile financing platform geared toward ride-hailing drivers seeking to purchase vehicles from approved franchised and independent dealers throughout the nation.

“As we began to introduce and roll out ride hailing financing to auto dealers throughout the country, we knew we needed a seasoned servicing partner … one that has the experience and insight to truly understand our unique business model, and one that stays out in front of technological advancements and regulatory compliance developments,” ACC Consumer Finance chief operations officer David Colletti said in a news release.

“As we reviewed our options, it became clear that Servicing Solutions checks all the boxes and is without a doubt the right choice for ACC,” Colletti continued.

The newest client arrived on the heels of Servicing Solutions naming a new vice president of sales.

“We are excited to partner with the talented team at ACC,” Servicing Solutions president and chief executive officer Louis Ochoa said. “They are clearly filling a need in the ride hailing marketplace.

“By offering dealers increased revenue opportunities, while at the same time providing ride hailing drivers with an opportunity to purchase a vehicle, it is clearly a win-win proposition, and we’re happy to play a role in it,” Ochoa went on to say.

An executive with nearly 20 years of experience with Consolidated Asset Recovery Systems and Dealertrack now is part of the leadership team at Servicing Solutions.

The loan servicing organization specializing in primary and back up servicing announced on Wednesday that its new vice president of sales is Garrett Cline.

“I’ve known Garrett for years, and I can think of no one better suited to carry the Servicing Solutions message forward to companies looking to significantly improve their loan servicing function,” Servicing Solutions executive vice president of sales and marketing Jeff Swisher said.

“He is an accomplished sales and training leader with the ability to consult with companies to solve their most pressing business challenges. I’m excited to have him on board,” Swisher continued.

Prior to joining Servicing Solutions, Cline spent six years with Consolidated Asset Recovery Systems (CARS), a technology and services company focused on the repossession and remarketing of assets. He was responsible for new business development in the eastern United States within the automotive finance space.

Earlier in his career, Cline spent 12 years with Dealertrack Registration and Titling Services in various sales and training roles.

And in other company news, Servicing Solutions also is preparing to host a free educational webinar to help finance companies.

Servicing Solutions pointed out that a continued explosion in disruptive technologies has led to Internet and mobile-technology being used more than ever with financial transactions. However, along with this explosion comes an increased level of compliance and operational risk, corporate responsibility, as well as government regulation and oversight for companies attempting to keep up with the times and their customers’ ever-increasing set of demands.

This webinar will address the need to have a compliance readiness program in place within your business. Furthermore, it will cover best practices communications should an organization run afoul of a regulatory authority.

The training event set to include Robert Caracciola of Servicing Solutions along with Michael Thurman of Thurman Legal is scheduled for 2 p.m. ET on Tuesday. Attendees can register for this free webinar by going to this website.

Finance companies sometimes give grace to contract holders in hopes the individual can get back on the payment track since it’s potentially much more lucrative than having to go through the repossession and recovery processes.

Kroll Bond Rating Agency (KBRA) released a research report last Friday, examining the use of subprime auto finance extensions as a loss mitigation tool for ABS servicers. After taking a closer look at the performance of a specific provider, KBRA believes, in general, that the use of extensions ultimately benefits ABS investors by reducing delinquency and default rates.

However, analysts acknowledged a high rate of extensions within a securitized collateral pool can meaningfully increase bond duration and expose ABS investors — particularly owners of deeply subordinated tranches — to tail risks.

“As such, it is important for investors to understand each servicer’s policy regarding extensions, as well as how extensions are handled within ABS deal structures,” KBRA said.

Kroll Bond Rating Agency senior director of structured finance research Brian Ford shared the report with SubPrime Auto Finance News. Ford explained the project stemmed from the strategy used by Honor Finance in connection with its securitization launched in 2016.

Ford recapped that by early last year, Honor Finance granted extensions to as much as 22 percent of the contracts in the securitization, “well in excess of industry standards … which can mask poor collateral performance — i.e., by keeping delinquencies and default rates artificially low.”

Ford added in the report that “it is important for investors to understand each servicer’s policy regarding extensions, as well as how extensions are handled within ABS deal structures.”

The report touched on strategy employed by many finance companies regarding extensions. Some basic parameters often include:

— Customer must have paid a minimum of six to 12 contractual payments.

— Customer may not have had an extension during the preceding 12-month period.

— One extension occurrence of one or two months may be approved during any 12-month period, with a maximum of seven occurrences for contracts greater than 72 months.

—If the account is delinquent, the extension must bring the account completely current and resolve the delinquency at the time the extension is considered.

Ford pointed out that subprime issuers report monthly extension rates ranging between 2 percent and 6 percent. He added that most of the auto finance companies that KBRA rates actively monitor the success of their extension policy.

“Only a hand full of subprime auto loan securitizations contain specific structural triggers limiting the amount of extensions within the securitized pool,” Ford wrote in the report, referencing operations such as DriveTime and Tidewater.

“However, the legal final maturity of longest dated note class is typically set to equal the tenor of the longest receivable within the securitized pool, plus the maximum number of months that loan can be extended, per the issuer’s policy,” he continued. “Securitization documents typically include provisions that require the servicer to repurchase receivables that are extended past the maturity date of the bonds.

“Investors should understand each servicer’s extension policy and review transaction documents to determine what protections exist to reduce extension risk,” Ford reiterated.

With the auto finance default rate in December rising above 1 percent and new data showing more than 7 million people with a contract 90 days or more delinquent, it might be a busy year for repossessions and recoveries. To help agencies, Advantage GPS, a Procon Analytics company, formed a strategic partnership with the American Recovery Association (ARA).

According to a news release distributed on Wednesday, ARA made this move to continue developments that include what the association dubbed a “Unity Initiative” with Time Finance Adjusters. Together they plan to strengthen their relationships with other leading trades associations, including:

— National Automotive Finance Association

— American Financial Services Association

— National Association of Federally Insured Credit Unions

— National Independent Automobile Dealers Association

— Other state and regional trades associations

“Our Unity Initiative with TFA and the enhancement for our relationships with a variety of national trade associations and companies like Advantage GPS will only serve to create a better and more profitable environment for our members,” American Recovery Association executive director Les McCook said.

This specific partnership is designed to enhance the ability of ARA members to more quickly and less expensively locate and recovery finance company collateral.

“The strategic alliance between ARA and Advantage GPS comes at a time when the recovery association is moving forward with important initiatives to improve the health of the industry, work more closely with their finance partners and employ cutting-edge technology and artificial intelligence,” said David Meyer, president of Advantage GPS.

“We have just launched our newest product line, the low-cost, 4G, wire-free Revo family of GPS devices, which dovetails perfectly with the goals for recovery association,” Meyer continued.

Advantage GPS rolled out Revo earlier this year. It’s a wire-free GPS device designed to be a “smart” tool to mitigate losses for finance companies and also reducing costs for recovery agents.

The Advantage GPS platform includes smart impound lot technology, including all locations of ARA members across North America. The tool automatically can create geofences around ARA impound lots and send finance companies alerts when one of their vehicles enters.

Advantage GPS highlighted this capability, along with a risk mitigation dashboard that is powered by artificial intelligence, can enhance the ability for finance companies to mitigate losses, while making it easier for recovery companies to locate and access vehicles.

And now the company has a stronger bond with ARA.

“My relationship with Les and ARA has stemmed for nearly two decades,” Meyer said. “It’s exciting to partner with him and his team once again.”

McCook also said he has known Meyer for some time and understands the GPS collateral protection device industry well.

“We fully welcome working with an innovative group focused on eliminating outdated technology in the market,” McCook said. “In our industry, it’s crucial to track and implement the latest technologies to help our members thrive. Employing artificial intelligence to assist recovery agents in locating vehicles is a game-changer.

“We will look back on this, and wonder how we every did our jobs without it,” he added.

Dumb question: Who wants to make more money? We all do, of course. But is opening your business to more credit-challenged consumers worth chasing more delinquencies and repos? Good question; and one that becomes problematic if you don’t take the right steps to minimize your risk. But, can I reduce risk and make more money without spending more? Great question.

Traditionally, the industry’s approach to managing risk involves manual processes that are tedious and time-consuming. Maintaining and following up on exhaustive consumer records of everything — phone numbers, addresses, employment — requires time and manpower you simply don’t have. As a result, taking on the operational cost of expanding your subprime business could be a nonstarter. One look at the consumer contact and employment statistics for this market segment underscores the burden.

The information chase

According to the FactorTrust Underbanked Index: Consumer Stability report, a borrower who has changed his or her mobile phone number four or more times over a 90-day period has a 77 percent higher default risk than a borrower who has done so only twice. Additionally, a borrower who has had three or more ZIP codes over a 90-day period has a 63 percent higher default risk than a borrower with one ZIP code. Further, among the underbanked, 16 percent applied with a different employer within 30 days, 20 percent within 60 days, 23 percent within 120 days and 34 percent within one year.

Remember the Wayne Gretzky quote, “I skate to where the puck is going to be, not where it has been?” Keeping up with subprime consumers is like trying to predict where that puck will be, which is nearly impossible without the tools to help.

If cars could talk

There is an option for managing risk in the subprime market that supplements a dealer’s ability to vet these consumers: gathering vehicle intelligence. With advances in aftermarket telematics and driver analytics, the latest technology can provide customer insights far beyond the standard vehicle location data associated with early GPS systems.

When it launched onto the buy-here, pay-here scene more than 15 years ago, GPS made it much easier to find a vehicle for repo. Over the years, the technology has evolved to look at location data over time, with the ability to predict where a vehicle will likely be at any time of the day or night with incredible accuracy. For example, the technology can now identify a change of job or home address through deviations in driving patterns. Let’s face it, unless they’re the James Bond type, most people have a set daily routine bouncing back and forth between home and work. Modern GPS solutions can detect major life changes by analyzing location data in relation to time of day, day of week, and pattern frequency.

Similarly, these same algorithms can automate and expedite loan stipulations that typically require hours of calling to verify addresses and workplace information. It’s also useful in preparing agents for repossession, when needed, to better target the right place and time for recovery. Accurately predicting vehicle location under specific circumstances (such as during Monday night football) leads to easier, less costly and less risky recoveries.

Smart solutions combine vehicle intelligence with proactive alerts to further reduce operational costs. Cars that aren’t driving, aren’t paying, so automated alerts for “non-driving” scenarios, such as vehicles impounded to tow lots, abandoned vehicles, and battery disconnects save dealers thousands of dollars each year. The ability to set geo-fences — virtual boundaries around key locations like tow lots, state borders and ports of entry — can help you keep your finger on the pulse of your assets without any effort on your part.

As with any technology purchase, reliability should be one of the main evaluation criteria. Leading GPS providers have always-on platforms (ask about uptime and availability rates) and wide-reaching network support that keeps vehicles connected no matter where they roam. You should ask any provider you’re vetting about the quality and quantity of the data its devices track. It’s no longer enough to monitor vehicle location every 24 hours, as was the industry standard. You need near real-time visibility that can only come from telematics devices that report data at 5-minute intervals or less, giving you the confidence to act when action is warranted.

Finally, the unique value of modern telematics is its ability to drive increased payments. Gone are the days when “starter interrupt” was the only way to get the attention of a delinquent customer. With 85 percent of the U.S. population carrying smartphones, the key to customer engagement is mobile. If the GPS technology you’re considering (or currently using) doesn’t offer a mobile component that opens up a soft-touch but high visibility communication channel between you and your customer, keep shopping.

Ask and ye shall receive

To thrive and survive in this hyper-competitive business, dealers must look beyond their current constraints in servicing this segment. Advanced vehicle intelligence offers not only a safer path to do business with the subprime consumer, but also the operational efficiency necessary to improve the bottom line. If you’re thinking about GPS as a recovery tool, think again, and remember what your teacher said back in grade school: “there are no dumb questions” — except the ones you don’t ask your suppliers.

Brian Deeley is a director of product management at Spireon. He can be reached at [email protected].

Anyone who has been involved with the repossession industry over the past several years knows that the world looks very different today than before the Consumer Financial Protection Bureau arrived. Most of the focus during this period has been on third- and fourth-party oversight. Given the CFPB’s official position on vendor management, it is no longer acceptable to rely solely on the agent or repossession management company to keep their shops in order.

Today, extensive vetting, on-site visits to every storage lot, proper contracting, performance/compliance score cards and broader insurance coverage are the norm. As a result, lenders and regulators can be comfortable that the agents recovering cars on their behalf have been well vetted and are closely monitored. Indeed, the CFPB has expressed general satisfaction on this aspect of vendor management

At this point, there are two primary areas the CFPB is focused on when it comes to repossession:

1. Fees that consumers are charged for retrieving personal property, and to a lesser extent redeeming their vehicle

2. Repossessions made in error

Adequately addressing these issues will pretty much squeeze out the remaining regulatory concern and legal exposure.

The “fees” issue has largely been addressed, especially by major lenders. Most have either mandated that any consumer charges be billed back to the lender (and posted to the customer’s account) or the allowable charges have been capped at defined and reasonable levels. There is still the issue of ensuring that agents follow the requirements, but we will save that for another post.

This leaves the issue of repossessions in error as the final major area to be addressed. Indeed, the CFPB has referenced the matter in its last two bulletins.

The vast majority of repossession in errors occur due to communication breakdowns. We see two types:

1. Internal communication breakdown within the lender’s operation where the auto repossession management company or agent was not notified when a repossession order was put on hold or closed. As a repossession management vendor for lenders, there is not much we can do to impact their internal processes/operations.

2. Vendor(s) communication breakdowns when a hold/close has been issued properly by the lender but the proper communication and systems updating by all involved parties did not take place.

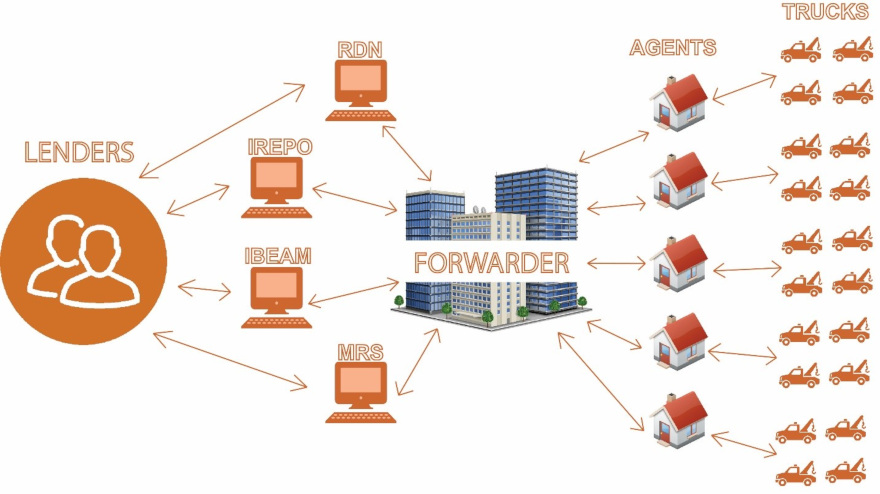

The latter is largely a technology issue. The lenders, management companies (forwarders) and agents generally operate on different platforms and degrees of sophistication. And for each of these players, there are multiple platform options. Breakdowns can occur at each point along the way and these breakdowns account for a large percentage of repossession in errors. The diagram at the top of this page illustrates the challenge and the components/integrations that must be in place to solve the problem.

To address the challenge, there must be close to real time communication from lender to forwarder to agency system of record to repo truck driver. Fortunately, recent improvements in systems integrations and the emergence of mobile platforms supporting repossession agency operations, provide solutions to the challenge, for the first time.

Today, there are two primary mobile platforms that, if integrated properly, can support the data exchange requirements. These are RDN/Clearplan and the Recovery Compliance Mobile (RCM) platform provided by MBSi. While each takes a somewhat different approach, both are solid systems that are designed to provide compliance functionality at the truck level. The recent acquisition of Clearplan by RDN and KAR Auction Services does offer some additional functionality and efficiencies made possible by the fact that the vast majority of repossession agencies use these two platforms as their systems of record.

If your institution relies on repossession management companies (forwarders) to coordinate the repossession activity, deep integrations with these platforms must be in place. Due to internal constraints, very few have the capability to facilitate the data between the various parties regardless of the source. At ALS Resolvion, we have invested heavily in these integrations and by mid-February, we will be only utilizing repossession agencies that deploy this type of mobile technology in the field.

Our expectation is that more and more lenders will be mandating real time “two-way” communication all the way down to the truck level. Doing so will bring us all very close to meeting both regulator and lender senior management expectations for squeezing out repossession made in error.

Mike Levison is the chief executive officer of ALS Resolvion. More details about the company can be found at www.alsresolvion.com.

Just ahead of the American Financial Services Association’s Vehicle Finance Conference, Allied Solutions announced the restructuring of its claims and recovery product, REPOPlus & Track.

The provider of insurance, lending and marketing products to financial institutions in the U.S. for more than 35 years, explained what’s new with REPOPlus & Track on Monday. In addition to claims and recovery services provided with REPOPlus, four distinct insurance monitoring options are available in an effort to offer flexibility to lenders seeking a cost-effective, efficient insurance tracking solution. They include:

— Auto Match

— Basic Track

— Active Track

— Advanced Track

After years of offering REPOPlus as a recovery service to finance companies, Allied Solutions indicated that it utilized this experience to develop value-added tracking options to maximize cost benefit.

The company highlighted each track offers a variety of support for electronic insurance notifications, loan files, paper insurance documents and borrower communications. These options can provide insurance monitoring and tracking support for a myriad of finance companies, including small to large volume and prime to subprime markets.

Allied Solutions insisted the combination of REPOPlus & Track with insurance monitoring options can provide finance companies a comprehensive loss and recovery and optimization program. Track solution options range from basic to full coverage of service monitoring.

“Allied Solutions recognizes that our clients have a diverse set of needs when it comes to their monitoring and optimization programs,”, CEO, Allied Solutions chief executive officer Pete Hilger said.

“We have created a comprehensive solution that ensures lenders receive the information they need to best measure and assess risk, protect their collateral and ensure optimization of insurance recovery claims,” Hilger went on to say.

Allied Solutions will share additional information about REPOPlus & Track during AFSA’s conference, which begins on Tuesday in San Francisco.

KAR Auction Services selected one of its executives who has been with the company for a decade for a role with its business unit — PAR North America — a provider of vehicle transition services with coast-to-coast solutions for recovery management, skip-tracing, remarketing and title services.

The company announced on Thursday that Stacey White — among the 2018 Women in Remarketing honorees — will lead the remarketing services division at PAR North America as senior vice president. KAR explained this appointment aims to further develop and expand PAR’s remarketing products for its customers.

“At PAR, we are working to transform the asset recovery industry to a more streamlined, convenient experience for our clients,”, PAR North America president Lisa Scott said.

“With more than 20 years of remarketing experience, Stacey understands our customers’ needs,” Scott continued. “She is a dedicated, driven automotive industry professional with a proven track record of success — a great addition to our already dynamic senior leadership team.”

In her new role, White will focus on implementing solutions that further streamline PAR’s customer experience. White will work to expand customer relationships, anticipate client needs and develop new services and tools to meet those needs.

White previously served as senior vice president of KAR enterprise optimization, overseeing procurement and sourcing strategies. She led a team charged with standardizing operations and processes at newly acquired auctions.

White joined KAR in 2008 as an operational compliance auditor. She began her career with GMAC in 1993 as an acquisitions administrator and worked in analyst roles for acquisitions, customer relations, accounting and remarketing.

Black Book responded to auto finance companies and buy-here, pay-here dealers still looking for help on how to comply with upcoming accounting changes in connection with reserving for losses.

On Wednesday, Black Book released a new educational white paper titled, “Analytic-Driven Data Helps Auto Finance Lenders Mitigate Risk & Become CECL Compliant.”

To recap, the Financial Accounting Standards Board (FASB) is looking to ensure that financial institutions have solid measures in place to ensure they have appropriate reserves for any future losses based on the life of each auto loan. As a result, the board has instituted its new Current Expected Credit Loss model (CECL).

The new model will require higher levels of loan loss reserves and lead to changes in lending practices and portfolio management. It will also require a significant amount of data capture, analysis and modeling to meet the implementation deadline of Dec. 15.

With CECL’s requirement that finance companies perform life-of-loan loss forecasting, as soon as the provider says yes to a contract, Black Book explained the company must begin reserving for potential losses on that loan. Black Book emphasized this requirement means each finance company must have a much better understanding of the borrower’s financial condition, as well as accurate historical and residual collateral insight, when they make the loan.

The Black Book white paper discusses how auto finance companies have the opportunity to rely even more on having the most accurate and up-to-date credit and collateral data on their portfolios in order to meet these new requirements.

“Auto finance companies can leverage this opportunity to convert this compliance need into a competitive advantage,” said Anil Goyal, executive vice president of operations for Black Book.

“By leveraging granular data and building loan-level analytic models, auto lenders will have a better understanding of risks and improve return on capital,” Goyal continued.

The white paper also addresses the following topics:

• Probability of default methodology

• Estimations of probability of default and loss given default with model samples

• CECL modeling and data readiness

• CECL’s effect on loan strategies

• How varying economic scenarios can impact lender strategies for CECL

To download the new white paper, go to this website.