Protective Asset Protection believes that professional development is crucial to the success of every dealership today.

So, the provider of F&I programs and services announced this week that it has created new training opportunities for F&I professionals across the country.

“Protective is more than just a provider of superior F&I products, it’s also about creating the educational tools and resources needed to help dealers and their staff help protect their customers and the vehicle investments they make each day,” Protective senior vice president and chief distribution officer Rick Kurtz said in a news release.

“Because of this, we understand the importance of professional training opportunities, programs and curriculum that help dealers and their staff offer and explain the right F&I products to their customers,” Kurtz continued.

Several new dealership and F&I training opportunities now are being offered by the Protective Training Institute, including:

Pathway to F&I Success

The third Wednesday of every month, Protective will host two 30-minute sessions designed to introduce or reimagine ideas, processes, philosophies and psychologies that are currently being used by some of the most successful F&I managers in the country. Sessions will include about 10 minutes for Q&A.

The sessions include:

• F&I in 2022 and Beyond; Wednesday at 9 a.m. (ET) and 1 p.m. (ET)

• The Protective Fundamental F&I Process; Aug. 17 at 9 a.m. (ET) and 1 p.m. (ET)

• For the full schedule of trainings, visit www.protectiveassetprotection.com/F-I-Training/Training-Calendar.

Protective Agent Certification (PAC)

The Protective Agent Certification (PAC) class provides a comprehensive, end-to-end solution with all the knowledge and tools needed to successfully represent Protective in the marketplace. Taught by experienced Protective team members, this 2.5-day workshop will review all the Protective product offerings, technology options, program structures and business processes you will need to quickly build your book of Protective business.

This workshop is a blended learning approach, which includes the workshop and online products and processes available 24/7.

The next class will take place Oct. 11-13 (for agents only) at the Marriot St. Louis West.

For more information, visit www.protectiveassetprotection.com/F-I-Training/Courses.

F&I Sales Skills

This is a 2.5-day course instructed by seasoned and experienced sales trainers who provide real-world knowledge and practical skill building. This hands-on learning focuses on applying what was learned and interacting with peers.

Class participants will practice interview tactics and menu presentations using video role play exercises and real-world scenarios while learning from other F&I professionals from around the country. This course is designed for professionals new to the role and seasoned professionals in need of a refresher.

The next two classes will take place Tuesday through Thursday at the Hyatt Regency Orlando International Airport and Sept. 13-15 at the Marriott Phoenix Airport.

For more information, visit https://www.protectiveassetprotection.com/F-I-Training/Courses.

EFG Companies is looking to leverage lessons learned through the pandemic to help dealerships get the most out of their F&I activities.

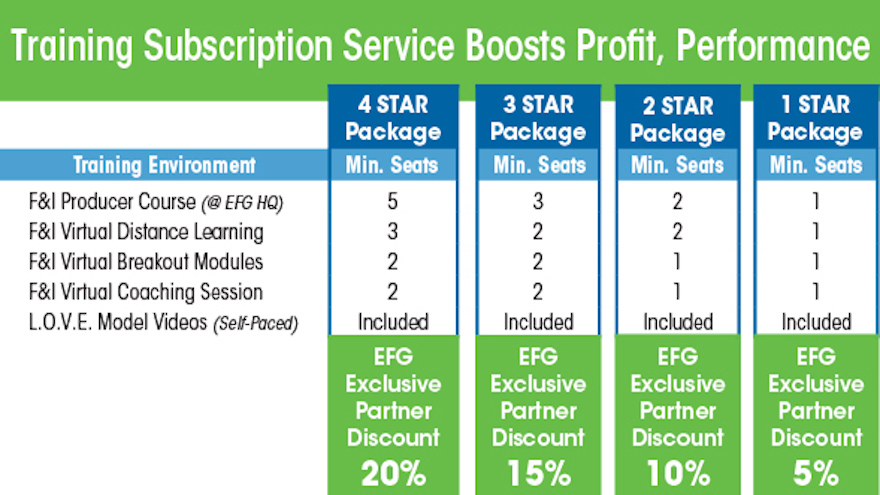

This week, EFG announced the debut of its modular training subscription service that when piloted during the pandemic, resulted in an 18% lift in profit per unit sold (PRU) for clients.

EFG highlighted that its subscription-based training model includes both digital and in-person options, delivering timely tools in a learning environment that works best for each employee.

According to a news release, the service also supports the new digital retailing model many automotive and powersports retail dealers are launching.

That news release also included experiences from George Vasquez, the general sales manager with Moritz Kia Fort Worth in Texas.

“We have used EFG’s in-classroom training for decades, and over the last few years began taking advantage of the company’s digital platform,” Vasquez said.

“Now, with a subscription service bringing both together from a formal training strategy and pricing standpoint, we see yet another opportunity to accelerate our success and increase our performance standards due to EFG’s partnership,” he said.

When the pandemic forced dealers to pivot their sales model for both in-person and online sales, EFG insisted it was ready.

Aside from the company’s in-person classroom training, EFG recapped that it had invested heavily in building its media-rich digital training platform. This foresight allowed EFG’s trainers to continue driving dealer success through live, on-demand training.

Additionally, students were provided with an in-depth library of training articles, videos, and podcasts on topics ranging from compliance and overcoming objections, to adjusting to the “new norm.”

EFG chief revenue officer Eric Fifield elaborated about what dealers can accomplish in this “new norm” when coupled with the company’s latest training offerings.

“Our one-year training subscription model is designed to provide dealers with a defined cadence, resulting in significant performance improvements,” Fifield said.

“In March 2021 alone, the automotive industry saw a significant rebound in sales. However, our partners who are taking advantage of EFG’s Training Services saw 30% higher performance increases over clients not utilizing our training.”

EFG’s Training Subscription Service is available through a combination of in-person classes, virtual distance learning, virtual breakout sessions, virtual coaching, as well as 24/7 access to EFG’s online L.O.V.E. training portal.

Dealer management can select their preferred subscription package across a wide variety of curriculum, benefiting from up to a 20% discount from standard training rates.

Learn more about EFG services by going to www.efgcompanies.com.

US Equity Advantage (USEA) approaches its business activities with the strategy that a well-done onboarding program enhances work performance, boosts job satisfaction, fosters company loyalty and lowers employee turnover rates.

Based on that premise, the biweekly installment contract payment service launched AutoPayPlus University, an expanded version of the learning management system it debuted in 2014 for its dealership partners.

According to a news release distributed this week, the 2.0 version also includes training for the company’s internal employees.

AutoPayPlus University provides enterprise training for new hires, both internally and externally, to strengthen brand consistency and best practices:

• For USEA’s dealer partners, it offers an easier process for new F&I hires to understand how the company’s biweekly payment plan works, including the costs and benefits. Components include a certification exam that must be successfully completed in order to offer USEA’s products to their customers, as well as a code of ethics agreement signed by dealership finance managers to demonstrate the commitment of their F&I personnel to operate in the customers’ best interests by fully disclosing in a clear and simple manner the costs and benefits of USEA’s biweekly loan payment services.

• For USEA employees, APP University is an efficient way to seamlessly train both Orlando-based and remote employees, especially customer service representatives, for their new roles, including learning about the company’s values, policies and procedures.

“Not only do we operate in a highly regulated industry, we are also entrusted with millions of dollars of our customers’ hard-earned money,” USEA chief executive officer Robert Steenbergh said in the news release.

“Compliance doesn’t simply mean staying on the right side of government regulations, it means doing everything humanly possible to safeguard what has been entrusted to you,” Steenbergh continued. “Education and continual training are the foundation for best practices that enable us to earn and maintain that trust.”

For more information, visit www.usequityadvantage.com.

Protective Asset Protection is serving up a six pack for dealerships.

While the stress triggered by COVID-19 might merit popular beverages that oftentimes come in packages of six, the provider of F&I programs, services and dealer owned warranty company programs announced this week that it has made available a new series of pre-recorded educational training webinars, designed to educate, motivate and improve the closing ability for F&I managers.

In a recent survey of dealers from around the country, Protective found that roughly half (49%) said F&I product sales translate well to the digital or online car shopping process for customers, whereas only one in five dealers said there is no difference.

To help dealers elevate their success selling F&I products to customers, the following training webinars are now available:

— Getting To 80: In this new world of digital presentation and no-contact delivery, the ability to connect with customers in F&I is more critical than ever. This brief webinar discusses key goal-setting strategies to help break through performance barriers, the advantages of getting support from everyone in the dealership and how to enhance the customer experience regardless of delivery platform, generation or product.

— Conducting Meaningful Sales Training: This webinar discusses ways to uncover and develop top performers by employing separate sales meetings and sales training.

— Generational Sales: For the first time in auto-shopping history, there are five generations of buyers at dealerships. Understanding the unique characteristics of each generation is a key to unlocking more sales. This webinar discusses the unique priorities of each generation and how to maximize presentations to meet their needs.

— Generational Myths: Each customer is unique and has their own reasons for buying, but are their reasons really based on the time period in which they were born? This webinar explores which of these generational constructs are real, and which ones might be myth. Learn how to use these ideas to create a powerful F&I presentation that will be effective for each generation.

— Creating Your Evidence Book to Engage the Customer: The difference between the most effective F&I producers and those who struggle is a function of their ability to communicate value. This webinar discusses how and what to use to present your case more effectively.

— Powerful Storytelling: How can storytelling improve dealership numbers at the end of the quarter? A well-told, captivating story can affect listeners on multiple levels. This discussion illustrates storytelling and provides a guide to get started in telling powerful stories.

“Selling F&I products successfully, regardless if the customer is buying online or sitting in front of you inside the dealership, requires the right combination of trust, education and consideration,” Protective Asset Protection vice president of training and specialty sales Bill Koster said in a news release.

“Our training curriculum is among the very best in the industry, and we pride ourselves on equipping our dealer partners and their staff with the right training that helps drive trust and education so they can achieve high transaction volume and increase repeat business,” Koster went on to say.

Go to this website to access the training videos.

Perhaps you cannot go to your local public library, but Protective Asset Protection recently made its library of professional development training courses available to all dealership personnel and agents.

The provider of F&I programs as well as services and dealer owned warranty company programs designed its educational curriculum to help industry professionals sharpen their skills during the COVID-19 pandemic and containment efforts.

Protective Asset Protection insisted that dealers will need to leverage new resources in order to provide the right F&I product experience in a quickly evolving retail environment where digital and contactless transactions continue even throughout the COVID-19 pandemic. According to a recent report from McKinsey & Co., companies will leverage training to survive and thrive in a post-COVID-19 world.

That report also said, “Increase the speed and productivity of digital solutions. To deal with the crisis and its aftermath, companies not only need to develop digital solutions quickly but also to adapt their organizations to new operating models and deliver these solutions to customers and employees at scale. Solving this ‘last mile’ challenge requires integrating businesses processes, incorporating data-driven decision making, and implementing change management.”

The Protective Asset Protection Training Institute’s online training solutions can provide the professional skills necessary for dealer and F&I professionals to be successful in today’s industry. The firm highlighted that each course is designed to maximize content retention with engaging videos, study guides and quizzes.

Officials went on to mention users may participate in the online courses at their own pace, at anytime and anywhere.

“Investing time and resources into more F&I training will benefit employees during COVID-19 while foot traffic is down from pre-virus levels,” said Bill Koster, vice president of specialty sales and training for Protective Asset Protection.

“All of the F&I training curriculum offered contain videos designed to help dealership personnel maximize their sales opportunities during COVID-19, and post-pandemic when online shopping will continue to be a growing makeup of transaction activity,” Koster went on to say.

Go to this website to access the F&I training institute.

Along with the opportunity to reconnect with other industry operators, the American Recovery Association is using this year’s North American Repossessors Summit to unveil a new program that’s been in development for several years.

During NARS 2020, the association will be debuting its new program — ARA University — an initiative to help members position themselves as industry leaders through courses to improve their business and growth.

Part of the event includes an “Introduction to ARA University” as Dan Johnson and Doug Duncan will take the stage to reveal a first look at the industry program that will give invaluable information to members looking to further their business growth.

“With an eye toward providing certifications and credibility to the repossession industry, this introduction will set the stage for the unified education of all sectors of the business,” ARA said about this portion of NARS 2020, which is set for May 7-8 in Irving, Texas.

The association elaborated about the speakers who will introduce ARA University

Johnson is the chief executive officer of Camping Companies in Phoenix. ARA highlighted that Johnson has considerable experience in organizational development across his career, gaining the respect of many professionals in the asset recovery industry due to his effective leadership of successful repossession companies and his contributions to the broader repossession community through his service with the American Recovery Association.

Doug Duncan is president of TalentValue, possessing 30 years of experience in business planning and human resources. Duncan’s clients are companies in a wide variety of industries including the supermarket industry and a large Midwest insurance company.

Complete details about NARS 2020 are available at www.reposummit.com.

Assurant is looking to help dealership employees in the finance department stay sharp.

The company recently launched Virtual Coach, a simulated, interactive classroom experience as part of the Assurant Virtual Learning Platform. The new programs are from the Assurant Performance Institute, which includes in-person training for F&I employees.

The Virtual Learning platform includes Assurant Virtual Coach — a video-based role-playing function allowing for individualized feedback and scoring.

“The Assurant Virtual Learning Platform and Virtual Coach represent a major step forward in the progression of our in-person training,” said Martin Jenns, senior vice president for global transformation at Assurant Global Automotive.

“The Virtual Coach is a continuation of our promise to dealers to provide them with customizable and innovative solutions that help them grow their business,” Jenns concluded.

The Assurant Learning Platform includes multiple modules for fundamental skill development. The on-demand modules are designed to mirror Assurant’s FSM 101 in-person class held in Chicago.

The Assurant Virtual Coach simulates the interactive classroom experience where students role-play with the instructor. Through the Virtual Coach, students can submit videos and receive direct feedback from the instructor that uses the same Performance Evaluation Form (PEF) methodology deployed in the live classroom programs.

“The Virtual Coach combines the best of our instructor-led programs by integrating the same guided discovery learning experience with the convenience of distance learning,” said Dave Worrall, senior director of global training and development at Assurant Global Automotive.

The Assurant Virtual Coach is slated to roll out during the second quarter with two program options tailored to an Assurant client’s training needs.

The basic level will include the FSM 101 virtual training modules, each three-to-five minutes in length, for on-demand learning.

The upgraded service will include the basic offering plus access to the Virtual Coach, complete with a record function, four annual written/video feedback sessions from a certified F&I instructor, and participation access to quarterly live webinars led by certified instructors.

For more details, go to assurant.com.

Recovery professionals that conduct activities in Massachusetts now have another training opportunity to maintain their compliance knowledge.

RISC recently launched the Massachusetts-specific collateral recovery training course as part of its CARS National Certification Program. The compliance services company emphasized that continually providing up-to-date training on state-mandated regulations is the goal of RISC.

“It’s crucial to let the industry know about updated regulations and provide comprehensive training for collateral recovery in Massachusetts and beyond,” RISC chief executive officer Stamatis Ferarolis said in a news release.

“We are committed to providing these updates and have hired the prestigious law firm, Hudson Cook, to help design the most current training programs in the nation,” continued Ferarolis, who also mentioned RISC will continue to evolve with the industry by building courses that will provide value to both clients and recovery agents.

Steve Digantgikis, owner of New England Adjustment Bureau, offered his assessment of how this RISC training can help. Digantgikis was the first operator to become certified through this Massachusetts-specific CARS program.

“The overview of Massachusetts regulations is very informative,” Digantgikis said. “It’s another great addition to RISC’s current CARS program to keep my recovery staff safe and knowledgeable.”

RISC highlighted the CARS certification is accepted by many domestic lending institutions and is completed by more than 4,000 recovery professionals annually. The course is available on RISC’s education platform for purchase at this website.

Protective Asset Protection is looking to get dealership personnel — especially individuals who work in the F&I office — reinvigorated about their jobs.

The provider of F&I programs, services and dealer-owned warranty company programs recently said that it recognizes the significant importance of ongoing dealer and F&I personnel training so the company introduced its Training Institute.

Protective Asset Protection explained the online curriculum program offers training for a diverse set of today’s most popular F&I products to help dealers increase profit potential and customer satisfaction levels.

Aside from the sheer opportunity to sell more because they know more, the company insisted that ongoing training is critical for F&I personnel to remain focused and engaged at the dealership. Protective Asset Protection cited a pair of sources to reinforce its claims.

According to the 2019 Dealership Staffing Study produced by Cox Automotive, approximately one-third of management employees do not feel excited or engaged in their jobs, including F&I personnel. These statistics are similar to a Gallup study that shows overall U.S. employee engagement below 35 percent.

The new Protective Asset Protection Training Institute’s online training solutions can provide F&I protection product knowledge and the professional skills necessary for dealer and F&I professionals to be successful in today industry. Each course is designed to maximize content retention with engaging videos, study guides and quizzes. Users may participate in the online courses at their own pace, at anytime and anywhere.

Training curriculum categories include specific F&I product areas such as vehicle service contracts, GAP, and ancillary products. Many of the courses available are divided into short lessons, and a certificate is received once each lesson is completed sufficiently.

F&I training has made a notable impact to the bottom line at franchise dealerships. The 2018 NADA Annual Report shows a nearly six percent increase of income as a percentage of new- and used-vehicle department gross profit over from 2016 through 2018.

“Better training is a clear investment in people, and when dealerships make this commitment the results are tangible with a positive impact to the dealership’s bottom line and customer satisfaction,” Protective Asset Protection vice president, Bill Koster said in a news release.

“The Protective Training Institute provides dealers and their F&I management personnel with a clear and distinct competitive advantage designed to positively impact each customer’s buying experience,” Koster went on to say.

For more information about Protective Asset Protection, call (800) 323-5771 or visit www.ProtectiveAssetProtection.com.