Perhaps the sentiments held by the contract holders in your finance company’s portfolio aren’t quite as sullen as some of the recent consumer studies that have surfaced in the past month.

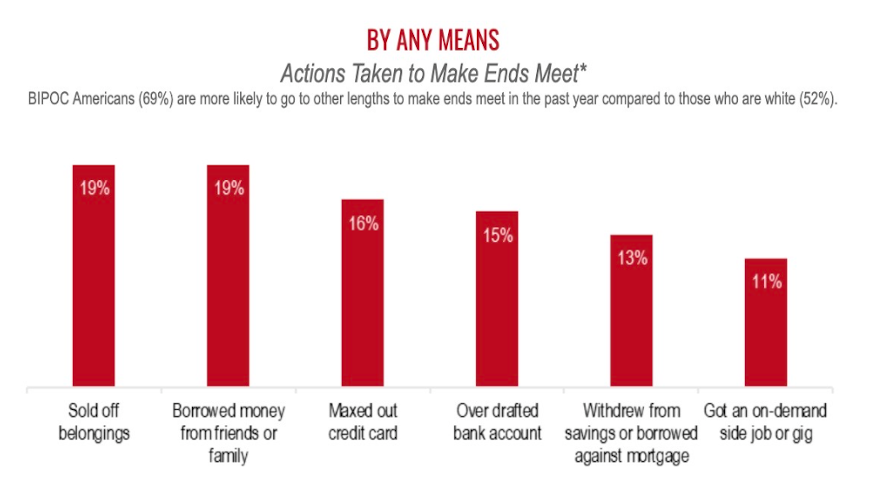

With debt-free aspirations sagging and a majority of individuals and families living paycheck to paycheck, Self Financial offered details on Wednesday from a new third-party survey that indicated half of Americans are feeling “trapped” in their financial situations.

Read more

This time, Allied Solutions’ newest initiative is connected to the beginning of the potential journey toward vehicle delivery.

This week, the service provider to credit unions and other firms involved with financial services launched a strategic collaboration with Scienaptic AI, a leading artificial intelligence-powered credit underwriting platform provider.

According to a news release from Allied Solutions, the partnership will provide an enhanced, personalized decisioning platform that will enable credit unions to book more paper, automate the processes and reduce risks.

“Allied continues to seek out partners that complement our business strategy and deliver solutions to help our clients grow and evolve their operations,” said Jack Imes, chief client lending consultant with Allied Solutions. “Partnering with Scienaptic will help our credit union clients safely and effectively evolve their lending efforts in this highly competitive lending market, while also addressing existing issues and inefficiencies.

“The cutting-edge AI will empower credit unions to go the extra mile and deliver better access to credit for all deserving members,” Imes continued in the news release.

Scienaptic AI co-founder and president Pankaj Jain added, “We are excited to be partnering with Allied Solutions. Scienaptic’s unique AI technology will augment and strengthen Allied Solutions’ product offerings.

“We are confident that their clients would be able to say ‘yes’ to more members and automate complex loan processes without increasing risk,” Jain went on to say.

This episode of the Auto Remarketing Podcast recorded during this year's American Financial Services Association’s Vehicle Finance Conference features Tracy McArthur, who is vice president of automotive lending at Equifax.

McArthur shared with senior editor Nick Zulovich about how finance companies are sharpening their underwriting in light of an array of circumstances influencing originations nowadays.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

TransUnion senior vice president and automotive business leader Satyan Merchant spent some of his time at the Vehicle Finance Conference hosted by the American Financial Service Association last week in Las Vegas discussing the growing credit vertical known as buy now, pay later.

In this episode of the Auto Remarketing Podcast, Merchant explained how data from buy now, pay later transactions is being blended into traditional tradelines to help underwriting by auto finance companies.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Going into this week’s Vehicle Finance Conference hosted by the American Financial Services Association, defi SOLUTIONS announced the introduction of a single, end-to-end solution for the entire auto finance and personal lending lifecycle.

Monday’s development arrived on the heels of the company’s fourth quarter announcement introducing the new, modern, modularly designed defi ORIGINATIONS system.

Company leadership explained the new, complete end-to-end solution will follow the design and build, look and feel standards of defi ORIGINATIONS and will also take advantage of the latest architecture and technologies to position lenders to innovate and meet the needs of contract holders for years to come.

“We do not have a single competitor whose products and services encompass the complete lifecycle of our clients and their customers, the borrowers,” defi SOLUTIONS chief executive officer Tom Allanson said in a news release. “We are in a unique position to add more value to our targeted market participants.”

The company defined this end-to-end solution as one that provides everything needed to satisfy the complete needs of the consumer — speed, ease, trust, value.

“With current, pending, large-scale servicing implementations, we’ll have reached a critical mass of our clients using both our originations and servicing platforms, and in many cases also one or more component of our business process outsourcing,” defi SOLUTIONS chief strategy officer Charles Sutherland said.

“Now is the time to take advantage of this momentum and the current work in progress on defi ORIGINATIONS to deliver a unified, modern, cloud-based capability,” Sutherland went on to say.

To learn more about the new tool, defi SOLUTIONS invited executives attending the AFSA Vehicle Finance Conference & Expo this week at The Bellagio | Las Vegas to stop by its booth in the exhibition area or reach out in advance or afterward to talk “about their unique lending lifecycles and needs for the short-term and long-run.”

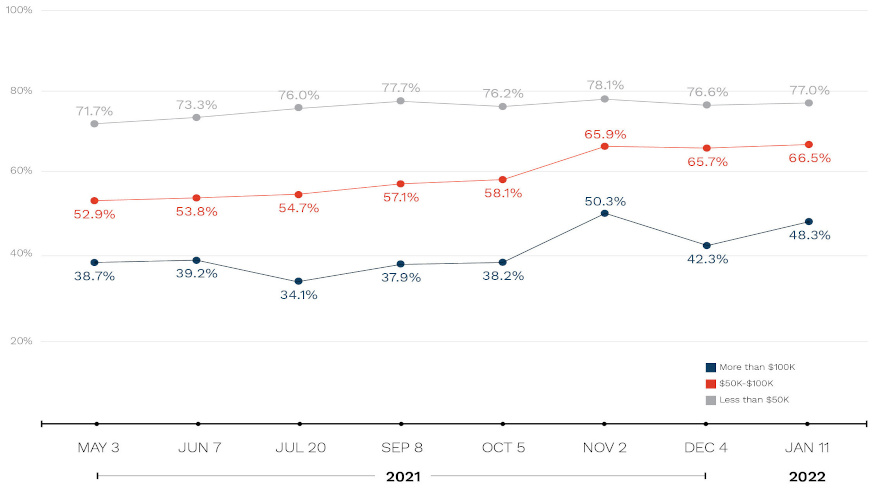

With inflation weighing on their minds, too, more evidence arrived on Thursday that shows that individuals who might need subprime auto financing aren’t necessarily on the lowest end of the income spectrum.

The number of consumers living paycheck to paycheck has increased steadily since April and stood at 64% in January — 12 percentage points higher than April 2021 — with a 3% jump in just a month between December and January.

Read more

VINData vice president Edie Hirtenstein and LAUNCHER.SOLUTIONS president Nikh Nath join the show to talk about the new partnership between their respective companies.

Launcher teamed up with VINData to provide its finance company customers with a deeper view into vehicle history, title data, vehicle values and more, all to help them manage risk and decisioning.

VINData’s reports include passenger cars, light trucks, SUVs, commercial trucks, RVs and motorcycles/powersport vehicles.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Exeter Finance first started to use software from Solifi — formerly known as IDS and White Clarke Group — nine years ago.

And this week, the finance company that specializes in non-prime credit decided to continue the utilization.

Solifi announced that Exeter extended its agreement to use the platform in more than 11,000 U.S. dealerships.

Exeter first selected Solifi originations software in 2013 for its ability to process high volumes of applications efficiently. The companies said through a news release that the volume has grown to more than 500,000 per month.

“We extended our relationship with Solifi because its technology platform is able to scale to meet our business needs, and Solifi continues to invest and deliver industry-leading auto finance software,” Exeter chief information officer Michele Rodgers said in a news release. “We are pleased to renew this strategic partnership, and we look forward to continued innovation in support of our future business needs.”

Solifi chief executive officer David Hamilton added in the news release, “We are proud to extend our relationship with Exeter Finance.

“It is our goal to deliver solutions to our customers that respond to the ever-changing business and market needs quickly, supporting their ability to grow,” Hamilton went on to say.

WalletHub recently released its latest Auto Financing Report, compiling lists of what analysts classified as the Top 20 cities where consumers overspend on vehicles and where they spend the least.

Perhaps managers and underwriters could review the lists and say these cities are where finance companies have the most and list risk in their portfolios since credit background played a role in how WalletHub assembled these rundowns.

In fact, WalletHub pointed out that compared with buyers who have excellent credit, individuals with fair credit will spend about six times more — or about $6,296 — in interest over the duration of a five-year installment contract that has an opening balance of $20,000.

And WalletHub also cited the Federal Reserve Bank of New York’s latest report on household indebtedness, which indicated that auto-finance balances have grown over the past nine years, increasing by another $28 billion in Q3 2020.

So, with all of those details in mind from its report that can be found online, here are the cities that WalletHub said overspend on cars:

Rio Grande City, Texas

Willis, Texas

Bastrop, La.

Donna, Texas

Deming, N.M.

San Juan, Texas

Uvalde, Texas

Alice, Texas

Livingston, Texas

San Luis, Ariz.

Mercedes, Texas

Leesville, La.

Brownsville, Texas

Weslaco, Texas

Moultrie, Ga.

Lake Placid, Fla.

Watertown, Wisc.

Dahlonega, Ga.

Alamo, Texas

Pharr, Texas

Meanwhile, here are the cities that WalletHub said spend the least on cars:

Birmingham, Mich.

Westfield, N.J.

San Carlos, Calif.

Belmont, Calif.

Manhattan Beach, Calif.

Garden City, N.Y.

Belmont, Mass.

Summit, N.J.

Chevy Chase, Md.

Lexington, Mass.

Ridgewood, N.J.

Bloomfield Hills, Mich.

Mill Valley, Calif.

Westport, Conn.

Palo Alto, Calif.

Cupertino, Calif.

Bronxville, N.Y.

Los Altos, Calif.

Darien, Conn.

Scarsdale, N.Y.

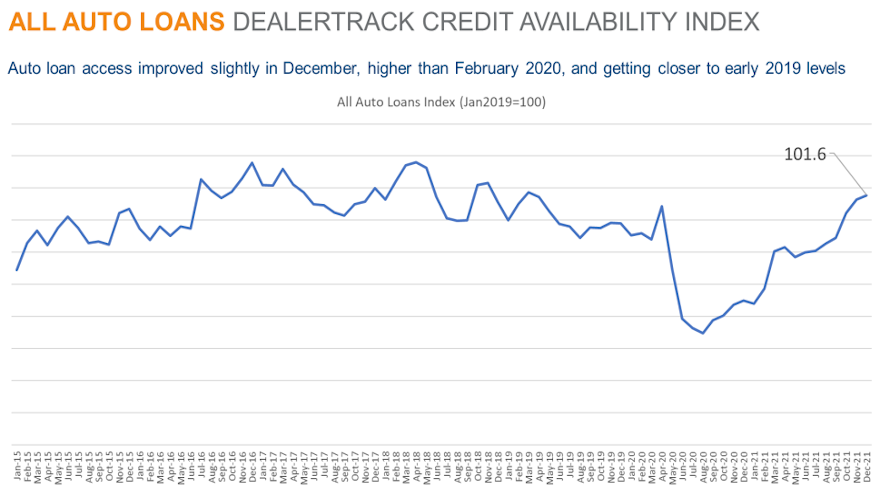

Well, perhaps auto financing is starting to look more like it did before the pandemic wreaked havoc on so much of our daily lives.

Cox Automotive said that access to auto credit expanded slightly in December, based on the Dealertrack Auto Credit Availability Index for all types of financing.

Read more