EasyCare, an APCO Holdings brand, introduced a new vehicle service contract (VSC) for dealerships this week in an effort to help store personnel cater to potential buyers who only want a simple presentation of F&I products.

APCO highlighted its new VSC can make it easier for dealers to present in the F&I office by integrating coverage options for many vehicle types and needs into one product, including electric vehicles.

Plus, the company said through a news release that this new product offers extended eligibility and more terms. The product can increase the value of consumer convenience benefits and includes options to help dealers retain service business.

“As F&I continues to be a success-driver for dealers, evolving coverage options are critical to helping dealers stay ahead of automotive buying trends and the market itself,” APCO Holdings chief executive officer Scot Eisenfelder said in the news release. “Our goal with this product is to cover as many vehicles and situations as we can to help dealers protect as many consumers as possible.”

To simplify the process of presenting a VSC to customers in the F&I office, EasyCare consolidated coverage for the following types of vehicles and situations into one form for VSC and one form for VSC with tire and wheel coverage:

— Gasoline vehicles

— EVs

— CPO wrap

— Medium duty trucks

— Lifted trucks

— Canadian vehicles with no factory warranty

— Snowplows and commercial vehicles including commercial snowplows

— Vehicles used for rideshare services

APCO went on to mention that dealers now can offer four levels of coverage to more consumers with an extension of eligibility to 200,000 miles and current model year plus 15.

“EasyCare’s new VSC has the same levels of coverage dealers have come to expect — ranging from stated component powertrain to exclusionary — to suit all types of budgets and driving habits,” the company said.

In addition to increasing eligibility, EasyCare’s new VSC can give consumers the chance to choose which substitute transportation option works best for them.

While a vehicle is in the shop for a covered repair, consumers can be reimbursed for rideshare vehicles, taxis and rental cars. The reimbursement allowance was also increased with an option to upgrade to an even higher amount.

Consumers will also see higher reimbursements for towing no matter where they take their vehicle for repairs, according to APCO.

APCO added that expanding EasyCare’s VSC to include EVs and EV components can allow dealers to protect their customers in this growing vehicle segment.

“Many EV buyers overlook that EVs have over 70% of their components in common with gasoline vehicles, making the protection offered by a VSC a smart investment in the event of a component failure,” the company said.

Furthermore, the new EasyCare VSC also includes a diminishing deductible option to help dealers increase service retention.

Designed to encourage customers to return to the dealership where they purchased their vehicle, APCO explained this option reduces the deductible amount for customers when they bring their vehicle to the selling dealer for covered repairs.

Eisenfelder noted that EasyCare’s new VSC gives dealers another tool to cater to each customer’s specific needs, helping to protect their investment and increasing their trade-in value when the time comes—while driving service business back to the selling dealership.

“Less than half of consumers in the U.S. can afford an unexpected large expense,” Eisenfelder said. “These contracts provide peace of mind to the consumer if their vehicle has a mechanical failure, plus it helps make that process less stressful by offering roadside assistance and a way for them to get where they need to be while their vehicle is repaired.”

For more information, visit https://easycare.com.

A report compiled by AmTrust Financial Services showed how much value consumers are getting from F&I products, especially guaranteed asset protection (GAP) coverage as well as owners who operate their vehicles where weather and road conditions are poor.

The AmTrust 2020 Extended Auto Warranty Advisor identified common trends for extended warranties and claim payouts based on more than 2.4 million auto warranty claims totaling approximately $1.5 billion across all major vehicle manufacturers over the five-year period from 2015 to 2019.

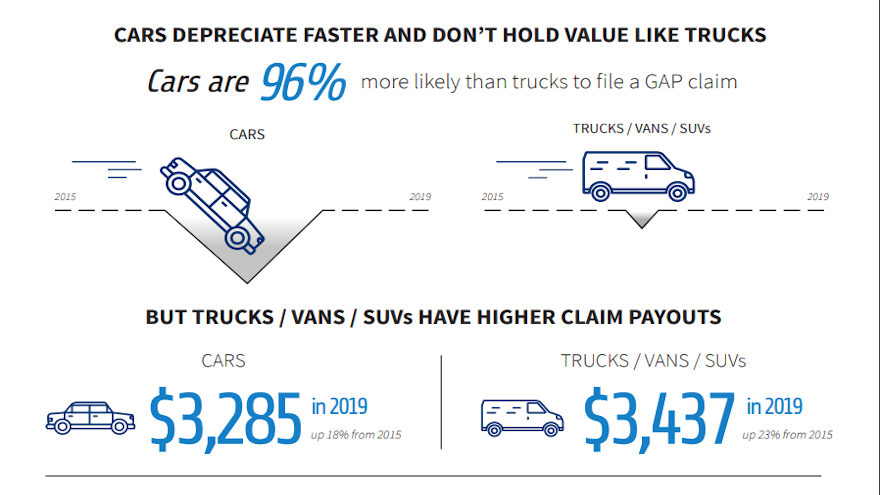

The global specialty property and casualty insurer and leading underwriter of extended warranties discovered car owners are almost twice as likely as van, truck or SUV owners to file a GAP claim — a 96% higher frequency of a claim to be exact. AmTrust noted that one of the leading reasons for this trend is that vans, trucks, and SUVs, on average, are holding more value, depreciating less than cars and leading to less total losses.

However, once GAP claims are filed, AmTrust determined the claim payout for a van, truck or SUV ($3,437 in 2019) is slightly higher than for a car ($3,285 in 2019) due to a higher average price for a van, truck, or SUV versus a car.

AmTrust reiterated that GAP coverage can help consumers protect their investment from the moment they drive off the lot. GAP protects the driver in cases where primary auto insurance carriers deem a vehicle “totaled” or stolen and there is a “GAP” between the amount the owner owes on financing or leases and what the vehicle is worth.

“Analyzing five years of data has given us new insights into what vehicle owners need to consider when evaluating whether they need all forms of extended auto warranty,” said Bruce Saulnier, president of AmTrust Specialty Risk, a division of AmTrust Financial.

“GAP average claim payouts are rising and more vehicle owners are getting value from these policies,” Saulnier continued in a news release.

AmTrust also analyzed vehicle service contract (VSC) claims across the U.S. by region — Northeast, Midwest, South and West.

The report showed claim payouts in the Midwest increased by 94% over the five-year period. The largest increase in claim payouts was related to windshield protection offerings, with claims increasing by 79% from 2015 to 2019.

Although the Northeast had by far the lowest average windshield claim payouts at $368, AmTrust pointed out this region had the highest costs for the repair and replacement of wheels covered by tire and wheel protection offerings, with an average claim payout of $321. The company suggested that this reading likely reflects winter weather conditions that create and worsen potholes and other bad road conditions.

The AmTrust 2020 Extended Auto Warranty Advisor also found that claims for repairs on new cars are lower than for used cars — $947 versus $1,169 in 2019. As vehicles age, report orchestrated acknowledged the likelihood of a major component breakdown such as engine or transmission increases, causing the average claim payouts of used cars to exceed new vehicles.

“Whether or not to purchase an auto extended warranty can be a challenging decision for consumers,” Saulnier said. “Our analysis of 2.4 million claims provides quantitative proof that GAP is needed now more than ever for borrowers taking out loans greater than their cars are worth and that the continued rise in vehicle repair costs over the last five years prove that auto extended warranties protect against out of pocket costs.

“There are also regional differences in claim frequency and repair costs for different components that should also be considered,” he continued.

“We hope our inaugural study of claims paid provides good insight for consumers, dealers and administrators on the value of these important protections,” Saulnier concluded.

The complete report can be downloaded here.

This week, AUL Corp. senior vice president of strategic product development Jason Garner announced the rollout of new enhanced options to the F&I provider’s core vehicle service contract policies for pre-owned units.

Targeting both independent and franchise dealers, AUL’s enhancements include options for unlimited time terms and coverage for hybrid/electric vehicles and hybrid/electric battery coverage.

Garner noted the new VSCs are backed by an A-rated insurance company and available for dealers now.

“We are in constant dialogue with our employees, partners and customers to ensure we provide the types of coverage our customers need and want most,” Garner said in a news release.

“Our product development and sales teams take that feedback and work in concert to craft comprehensive and effective policies to meet those needs, allowing us to stay at the leading edge of the industry,” he added.

This development arrived roughly a year after the company added GAP insurance, “AUL Tech” to cover a vehicle’s technology and infotainment systems as well as a full suite of other ancillary F&I products in an effort to become a “one-stop-shop” for agents, dealerships and financial institutions nationwide.

For more details, visit www.aulcorp.com.

Preferred Warranties Inc. (PWI) is looking to give dealers more tools as they resume used-vehicle sales in the face of a COVID-19 retail slowdown.

The KAR Global business unit on Wednesday announced comprehensive enhancements and savings on protection plan offerings.

“Many dealers are feeling the pain as COVID-19 takes its toll on the auto remarketing industry,” PWI president Edmund Field said. “To better support our dealers, we’re adapting our offerings to deliver extra value to them and their retail customers, providing more at lower price points to accommodate tighter budgets.”

PWI highlighted that program enhancements include extended terms and mileage bands to the popular Premier Plan, representing a lower cost to retail customers.

Furthermore, the company is reclassifying eligibility requirements of many makes and models, generating cost savings by decreasing class qualifications in some cases, and adding plan qualifications on vehicles never before accepted.

“Retail demand is still recovering, so standing out from the competition will be key to ramping up sales,” PWI vice president of sales Allison Marley said. “PWI’s program enhancements will help dealerships distinguish their offerings from others while bringing retail customers confidence about their purchasing decision.”

To provide dealers with further relief, PWI went on to mention that it is launching a promotion offering discounts on some of PWI’s most popular products.

Through July 31, eligible dealers can save between 10% and 15% on Base, Powertrain and Plus extended service contracts. To view additional promotional details, including terms and conditions, visit https://www.preferredwarranties.com/.

“PWI’s enhancements were designed to support our dealers with exactly what they need to jumpstart their sales and deliver extra revenue in the F&I space,” Field said. “Providing innovative solutions and the best customer experience in the industry is our primary focus—and through these relief offerings, we’re empowering our dealers to pay it forward to their customers.”

Established in 1992, PWI administers extended service contracts to more than 3,000 independent dealers. With a full menu of service contracts and extensive coverage levels, PWI insisted its products drive high levels of confidence, value and revenue for its authorized dealers.

To supplement product offerings, PWI provides service and training to assist dealers with selling these products, which in turn can create value and enhanced satisfaction for their customers.

Another provider entered the F&I marketplace this year to connect with consumers who did not opt to secure a vehicle service contract (VSC) at the time of their new- or used-vehicle purchase.

Vincent Odoardi, managing partner of Bedford Chrysler Dodge Jeep Ram in Bedford Hills, N.Y., put it this way in a news release about Servicecontract.com, “Some customers don’t like to make an on-the-spot decision. There is definitely business there — in what we call the ‘after, after-sale.’”

Site officials explained their intuitive new website was designed for consumers, to help customers understand their options and empower them to select their own vehicle service contract coverage, putting them in control of the transaction.

In addition to offering simple, customizable coverage options, Servicecontract.com is integrated with an advanced rating engine that can deliver confidence that Servicecontract.com VSCs are fairly priced.

Furthermore, Servicecontract.com is rolling out what it called an “unprecedented stacks” program that can provide two reward plans to allow consumers to reclaim unused premium payments.

“Consumers want to select their own coverage, on their own time,” said Michael Wymard, co-founder of Servicecontract.com. “We know many consumers are tired of feeling as if they are forced to buy long-term or mileage-limited service contracts in order to ensure their vehicle repairs are covered."

On the other side of the transaction, dealers had no way to recapture the lost opportunities from customers leaving the dealership without purchasing F&I products. These are the reasons why we launched Servicecontract.com,” Wymard continued.

Odoardi is convinced this provider has its place in the competitive F&I space.

“It’s an untapped market,” Odoardi said. “There is definitely at least 10% more VSC business we are missing out on in a given month after the vehicle sale. We talk about following up with those customers, but F&I managers have too many demands on their time, and it just doesn’t get done.”

Unique benefits of Servicecontract.com VSCs include:

— No term or mileage restrictions

— Month-to-month subscription coverage

— The ability to cancel at any time directly within the consumer online portal.

Created to empower dealers by meeting the needs of consumers, Servicecontract.com also want to serve as an experienced post-sale VSC partner, by including dealership-branded websites and telemarketing support powered by data-mining technology with direct DMS integration. Dealers are provided with seamless branding at every consumer touchpoint, and can select between multiple participation models.

“Our goal was to revolutionize the F&I process,” Wymard said. “Servicecontract.com was created to improve the consumer experience by giving them control of their vehicle protection.

“Simultaneously, we help dealers provide added value to their customers in the post-sale arena, while providing seamless assistance to recapture some of that lost revenue,” he continued.

The vehicle service contract market as a whole represents a $35 billion opportunity that is still growing, according to Colonnade Advisors’ Vehicle Service Contract Industry Market Commentary. And although the post-sale channel is currently the smallest of the four primary VSC sales channels, it currently represents $2.4 billion in annual sales.

Wymard insisted this market segment continues to grow as it is continuously replenished when factory warranties expire.

“Today’s drivers are predominantly digital natives, and prefer to shop online,” Wymard said. “If dealers want to reach them after they drive off the lot, they have to make the F&I experience easy and accessible at all hours, wherever they are most comfortable.

Servicecontract.com was created to be that virtual VSC partner for dealers to reach their customers post-sale,” he went on to say.