A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

NARS 2022 update: Theme and award nominations

Wednesday, Feb. 23, 2022, 04:42 PM

SubPrime Auto Finance News Staff

The American Recovery Association (ARA) is looking to honor some of the industry’s best during the annual North American Repossessors Summit (NARS), which will be conducted in a new location with a new theme. Along with seeking speaker submissions and ... [Read More]

Cox Automotive reaches finance-company milestone with titling tool

Wednesday, Feb. 23, 2022, 04:39 PM

SubPrime Auto Finance News Staff

Cox Automotive shared a pair of developments this week connected with Dealertrack. Along with an enhanced integration with 700 Credit, Cox Automotive said Dealertrack reached a new milestone with the addition of its 100th finance company using Dealertrack Accelerated Title. ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Launcher partners with VINData to give greater vehicle history context to finance companies

Wednesday, Feb. 23, 2022, 03:48 PM

SubPrime Auto Finance News Staff

LAUNCHER. SOLUTIONS has teamed up with VINData to provide its finance company customers with a deeper view into vehicle history, title data, vehicle values and more, all to help them manage risk and decisioning. Through Launcher’s appTRAKER Loan Origination System, ... [Read More]

TransUnion to acquire Verisk Financial Services for $515M

Tuesday, Feb. 22, 2022, 02:32 PM

SubPrime Auto Finance News Staff

The acquisition train just keeps gaining steam throughout the automotive industry. The latest momentum builder arrived on Tuesday when TransUnion said it has signed a definitive agreement to acquire Verisk Financial Services, the financial services business unit of Verisk, in ... [Read More]

CFPB smooths path for individuals to be part of rulemaking

Monday, Feb. 21, 2022, 04:07 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) wants to make it easier for individuals to have a say in how credit bureaus, auto finance companies and other providers of financial services are regulated by the agency. Last week, in an effort ... [Read More]

Hudson Cook welcomes 3 new attorneys

Friday, Feb. 18, 2022, 02:47 PM

SubPrime Auto Finance News Staff

About a month after elevating two of its current attorneys to be partners, Hudson Cook added to its portfolio legal expertise by welcoming a new partner and two new associates this week. Brought in to reinforce the firm’s litigation and ... [Read More]

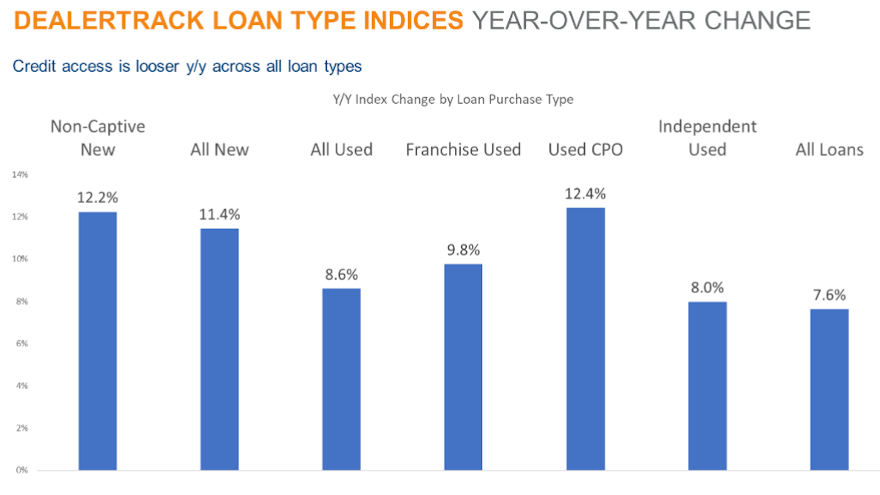

Auto credit access expands in January, with depth of projected March rate rise ‘a coin toss’

Thursday, Feb. 17, 2022, 04:49 PM

SubPrime Auto Finance News Staff

Access for all types of auto financing expanded in January, according to the newest Dealertrack Credit Availability Index. But change might be coming with the likelihood of interest rates rising, with one economist calling it a “coin toss” as to ... [Read More]

NAF Association names new executive director

Wednesday, Feb. 16, 2022, 04:41 PM

SubPrime Auto Finance News Staff

The National Automotive Finance Association now has its second-ever executive director. The NAF Association announced on Wednesday that Jennifer Martin will be its new executive director, succeeding Jack Tracey, who served in the position since the organization’s formation in 1996 ... [Read More]

Exeter Finance renews software agreement with Solifi

Wednesday, Feb. 16, 2022, 04:19 PM

SubPrime Auto Finance News Staff

Exeter Finance first started to use software from Solifi — formerly known as IDS and White Clarke Group — nine years ago. And this week, the finance company that specializes in non-prime credit decided to continue the utilization. Solifi announced ... [Read More]

Edmunds: 8 out of 10 consumers paid above MSRP for new models in January

Wednesday, Feb. 16, 2022, 04:16 PM

Nick Zulovich

If an individual with a less than prime credit background still somehow secured financing for a new vehicle in January, there’s a notable possibility that the installment contract will be underwater for some time, based on record-breaking data Edmunds shared ... [Read More]

X