A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

KBRA carefully explains softening credit performance

Tuesday, Sep. 21, 2021, 01:59 PM

SubPrime Auto Finance News Staff

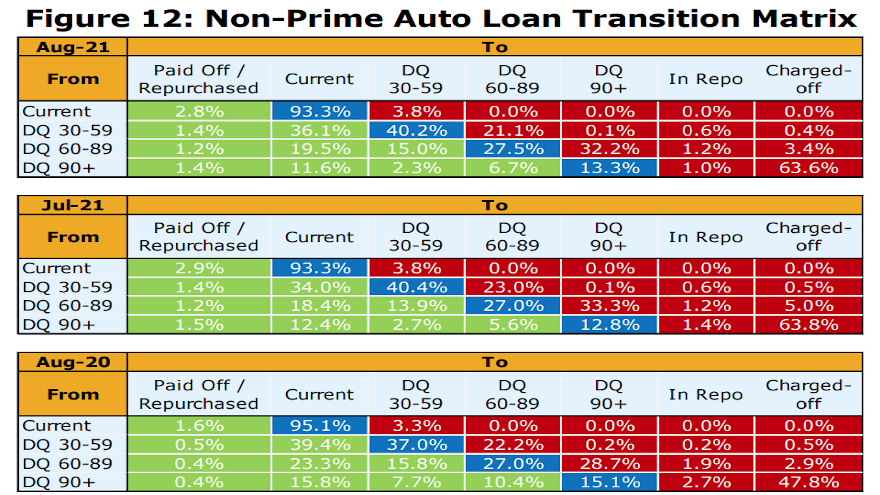

The word choices Kroll Bond Rating Agency (KBRA) used to describe its latest auto-finance indexes might be reassuring to executive and managers even if their collections are deteriorating. KBRA reported on Monday that August remittance reports showed softening credit performance ... [Read More]

Making sense of trends in retail sales, unemployment, vaccinations & more

Monday, Sep. 20, 2021, 03:05 PM

Nick Zulovich, Senior Editor

Experts at Cox Automotive, the National Association of Federally-Insured Credit Unions (NAFCU) and S&P Global Ratings all tried to make sense of recent trends such as retail sales, unemployment, the pandemic and more. [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

PODCAST: Another visit with Joe St. John of StoneEagle F&I

Thursday, Sep. 16, 2021, 07:17 PM

SubPrime Auto Finance News Staff

One of the most enthusiastic and knowledgeable regular guests on the Auto Remarketing Podcast recently returned, as StoneEagle F&I senior vice president of business development Joe St. John came back to discuss what’s happening in dealership finance offices nowadays. We ... [Read More]

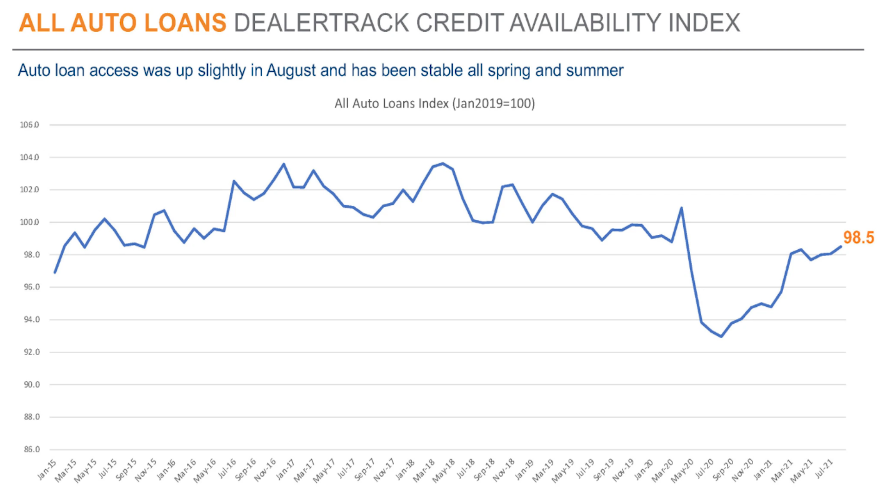

Mixed trends within Cox Automotive’s financing indexes for August

Thursday, Sep. 16, 2021, 03:20 PM

SubPrime Auto Finance News Staff

Cox Automotive’s newest updates of indexes that track auto financing showed mixed developments with regard to dealerships being able to get their potential buyers financed and providers’ appetite to build portfolios. [Read More]

KeyBank sells $3.2B auto portfolio

Wednesday, Sep. 15, 2021, 04:02 PM

SubPrime Auto Finance News Staff

In an effort to satisfy shareholders, KeyCorp is getting out of auto financing. Last week, KeyCorp announced that KeyBank has sold its indirect retail auto portfolio, and that KeyCorp has entered into an accelerated share repurchase (ASR) program. According to ... [Read More]

PODCAST: Lena Bourgeois of Equifax on auto-finance trends that demand more attention

Wednesday, Sep. 15, 2021, 04:00 PM

SubPrime Auto Finance News Staff

In this episode of the Auto Remarketing Podcast, Lena Bourgeois discussed auto-finance metrics that are not getting as much attention nowadays but perhaps should. The senior vice president and general manager of automotive services at Equifax also shared anecdotes from recent ... [Read More]

Clarion Capital Partners invests in OpenRoad Lending

Monday, Sep. 13, 2021, 04:21 PM

SubPrime Auto Finance News Staff

With some consumers benefitting from refinancing their retail installment contract, the investment world is seeing an opportunity, too. On Monday, OpenRoad Lending and Clarion Capital Partners announced that the New York-based private equity firm that focuses on making equity investments ... [Read More]

RateGenius spots lowest average refinancing rate so far in 2021

Monday, Sep. 13, 2021, 04:10 PM

SubPrime Auto Finance News Staff

RateGenius’ monthly Auto Refinance Rate Report found that the average overall auto refinance interest rate for August came in the lowest of any month so far this year. [Read More]

AutoPayPlus unveils fintech solution to increase dealer profit

Friday, Sep. 10, 2021, 02:28 PM

SubPrime Auto Finance News Staff

AutoPayPlus acknowledged every dealership’s primary business goal and ongoing challenge revolve around one, single metric: profit. To help managers and principals in that department, AutoPayPlus unveiled an all-new solution this week designed to increase profit per vehicle and service retention ... [Read More]

LAUNCHER.SOLUTIONS & Carleton complete integration to enhance contract compliance

Friday, Sep. 10, 2021, 02:26 PM

SubPrime Auto Finance News Staff

LAUNCHER.SOLUTIONS and Carleton recently finalized an integration of two of their primary products that serve finance companies. The integration involves the appTRAKER Loan Origination System LAUNCHER.SOLUTIONS with CarletonCalcs from Carleton. The companies explained through a news release that CarletonCalcs is ... [Read More]

X