A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

9 recipients of 2024 NARS Industry Awards

Wednesday, May. 1, 2024, 02:05 PM

SubPrime Auto Finance News Staff

The American Recovery Association handed out nine industry awards during this year’s North American Repossessors Summit. The 2024 NARS Industry Awards recognized repossession agents as well as representatives from finance companies and service providers. Along with explanations of each award ... [Read More]

EFG adds experienced trio to key dealer profitability positions

Wednesday, May. 1, 2024, 09:57 AM

SubPrime Auto Finance News Staff

EFG Companies has added three senior executives with more than 70 years of experience in retail automotive sales and F&I management combined. Joining the firm recently named as a USA Today National Standard Top Employer are: —Adam Fifield as vice ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Agora Data CEO in running for EY entrepreneur honor

Wednesday, May. 1, 2024, 09:56 AM

SubPrime Auto Finance News Staff

Agora Data CEO Steve Burke was named an Entrepreneur of the Year 2024 Southwest Award finalist by Ernst & Young. Now in its 38th year, the company highlighted the Entrepreneur of the Year program is a competitive business award endeavor ... [Read More]

Experian survey: Personal finance knowledge gaps lead to costly mistakes

Tuesday, Apr. 30, 2024, 10:29 AM

SubPrime Auto Finance News Staff

Country music singer Tracy Lawrence released the song, “Lessons Learned,” in 2000. The chorus contains the lines, “Oh lessons learned, man they sure run deep; they don’t go away and they don’t come cheap.” It’s 24 years later, and new ... [Read More]

Allied Solutions & FINOFR integrate further to spot chances to add protection products after origination

Monday, Apr. 29, 2024, 11:22 AM

SubPrime Auto Finance News Staff

Allied Solutions and FINOFR recently expanded their ongoing partnership to expand their digital footprint for financial institutions. The result is an integration called Vehicle Protection Reset, which merges FINOFR’s platform with Allied Solutions’ iQQ and Direct Impact Marketing solutions. By ... [Read More]

700Credit rolls out driver’s license authentication integration with iTapMenu

Monday, Apr. 29, 2024, 11:21 AM

SubPrime Auto Finance News Staff

Last week, 700Credit — a provider of credit reports, compliance solutions, soft pull, identity verification and fraud detection platforms — announced an integration with iTapMenu, an F&I menu platform that offers e-signature and e-payment solutions. The new integration includes the ... [Read More]

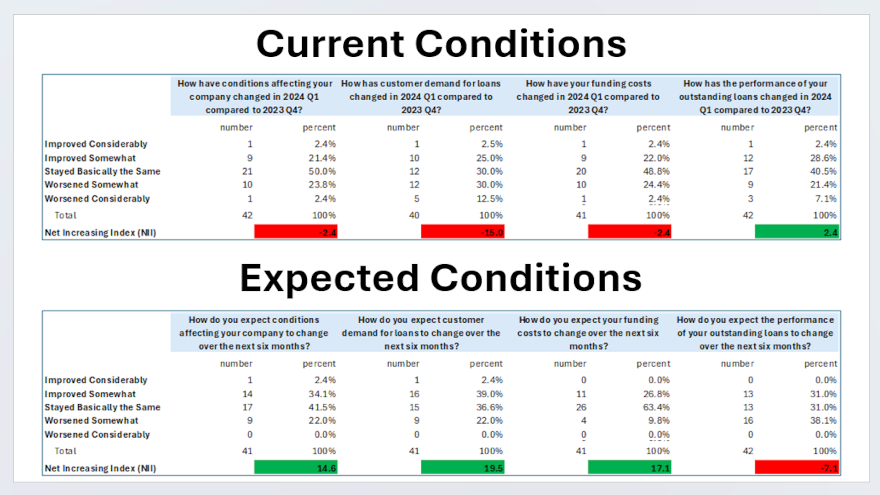

AFSA unveils Consumer Credit Conditions Index

Monday, Apr. 22, 2024, 11:58 AM

SubPrime Auto Finance News Staff

The American Financial Services Association (AFSA) leveraged its membership base to create its latest ongoing project — the Consumer Credit Conditions Index (C3 Index). AFSA revealed the first findings from this initiative, which is meant to fill a need among ... [Read More]

PODCAST: Lessons learned by 4 repo agents

Friday, Apr. 19, 2024, 10:09 AM

SubPrime Auto Finance News Staff

Four forthcoming repossession agents shared a variety of personal and professional anecdotes last week during the North American Repossessors Summit in Orlando, Fla. The session titled “What I Wish I’d Known … A Cautionary Tale for Small, Medium, & Large ... [Read More]

PODCAST: ARA president seeks ‘call for collaboration’

Friday, Apr. 19, 2024, 10:07 AM

SubPrime Auto Finance News Staff

American Recovery Association president Vaughn Clemmons addressed the record gathering for last week’s North American Repossessors Summit, sharing his “unfiltered beliefs on the state of our recovery industry.” Clemmons described the challenges and opportunities the industry has, asking for a ... [Read More]

APCO Holdings merges EasyCare & National Auto Care brands

Thursday, Apr. 18, 2024, 03:10 PM

SubPrime Auto Finance News Staff

This week, APCO Holdings announced it has merged two of its brands — EasyCare and National Auto Care — into a unified F&I “force” under the EasyCare brand. The merger follows the acquisition of National Auto Care last January. With ... [Read More]

X