In an effort to gain more timely information about how consumers are being impacted by COVID-19, TransUnion compiled a global report examining financial hardship and found that in the U.S., 87% of consumers who participated in a survey said they have a plan to navigate their challenges.

Charlie Wise, head of global research and consulting at TransUnion, offered more details about that plan, especially how auto-finance commitments fit into that strategy.

But first, Wise explained to Auto Fin Journal why it was important for TransUnion to orchestrate a revamped method for gaining information.

“It’s an interesting question that you raise from the standpoint of these are definitely challenges we’ve been thinking about dealing with, particularly when you look at a lot of the data that we typically work with, which is the credit data reported to us by banks, lenders and those actually in the credit market,” Wise said during a phone interview last week. “You think about the way that gets reported to us, there’s quite a lag in terms of when events actually occur to when things start to show up on credit files that are indicative of what’s actually going on in the market.

“When you think about things like delinquency, if someone is losing their job in March and then can’t make their April payments, that’s then reported delinquent in May and basically you’re into June before you’re reporting on something that happened back in March,” Wise continued. “Any earlier than that, you’re essentially seeing what that consumer’s status was as of time when they were employed and able to make their payment.

“It’s obviously very important data. It’s good to see. But if we want to understand on a much timelier basis; what’s dynamically happening in the market,” Wise went on to say. “We’re having to get more creative in terms of the things we look at, which this survey and study are intended to do exactly that, try to get that real time view of consumers. What are you experiencing right now? What bills can’t you pay right now and how are you responding? This is an opportunity for us to hear directly from consumers.”

Overall research findings

That creative way resulted in TransUnion’s latest report that showed millennials’ finances are being particularly impacted by the coronavirus pandemic.

TransUnion indicated the COVID-19 pandemic is causing similar financial hardship for consumers around the world, but its new research showed that millennials (those persons between the ages 26-40) are being challenged the most. A just-released including seven regions on five continents found that three in four millennials (76%) worldwide indicated their household incomes have been negatively impacted by the pandemic. This compares to 64% for all other generations.

In the weeks since the World Health Organization (WHO) declared the coronavirus (COVID-19) a pandemic on March 11, TransUnion said the company polled thousands of consumers in the U.S., Canada, Colombia, Hong Kong, India, South Africa and the U.K. to determine the impact of the pandemic on their finances. Research for the global report was conducted in mid-April and observed how COVID-19 has impacted millions of global consumers differently based on employer size, generational differences, government interventions and income dynamics.

“COVID-19 has brought about unprecedented financial challenges to people and businesses around the globe,” TransUnion chief executive officer Chris Cartwright said. “A thorough and fact-based understanding of these impacts and how best to respond to them is second only to our health and safety in terms of society’s successful recovery from this global pandemic.”

TransUnion reported a clear outcome from its research is that many consumers are worried about their finances, but the millennial generation is under the most stress, according to the report titled Global COVID-19 Consumer Financial Hardship Study.

In the seven regions featured in the study, 22% of millennials with household incomes negatively impacted have lost their job due to COVID-19 compared to 16% for all other generations. Just under half (45%) of millennials with incomes negatively impacted have seen their work hours reduced compared to 35% for the rest of the group. Impacts observed globally are similar in the U.S.

Analysts mentioned this pressure is compounded by the fact that 61% of millennials said they have dependent children living at home — a much greater rate than the 39% noted for other generations. In the U.S., 58% of millennials in the survey have dependent children living at home compared to 36% for other generations.

Millennials who have seen their household incomes negatively impacted also are having more pronounced problems with certain debt obligations. For instance, 63% with negatively impacted incomes report they will not be able to make their rent or mortgage payment compared to 54% for other generations. In the U.S., 61% of impacted Millennials are unable to pay for shelter compared to 57% for other generations.

“Millennials are the first generation to be fully immersed in mass-market digitalization and are savvy at securing credit,” Wise said. “While Gen Z can say the same, the big difference is that many millennials are more settled in their careers and are beginning to approach the peak earning period of their lives.”

Ingredients of financial plan

Whether they’re a millennial or a baby boomer, TransUnion discovered 87% of U.S. consumers who participated in the survey said they have a plan to keep their finances organized. Wise elaborated about the ingredients of that plan that might impact their auto-finance obligation.

“Specifically, when we looked at the plan, the questions gave people the option of selecting all that apply,” Wise said. “If you think about what’s going on right now, it may not be a single source of either income or relief that they’re looking for. They’re probably patching together several of these things. We look at all that apply.”

Wise noted that 14% of U.S. consumers mentioned a payment holiday went into their plan while another 14% said they’re looking to refinance or renegotiate current payments.

“You wouldn’t necessarily add those up because a lot of consumers might be looking at those at the same time,” Wise said.

Wise went on to mention other plan elements such as nearly half of consumers intending to use federal government stimulus funds for monthly payments and 35% looking to dip into saving accounts.

When it comes to credit cards, Wise pointed out that 31% of survey consumers said they would not pay off their entire balance, adding more ingredients to the overall financial plan.

Future expectations

During the conversation with Auto Fin Journal, Wise addressed what he and the TransUnion team see as the most important components to economic recovery.

“The first is simply going to be is when consumers are going to be able to leave their homes and safely get back to work. That is the crux of this,” Wise said. “This is not a situation like 2008 and 2009 where people are out of work because of a major economic collapse caused by essentially problems with the financial markets or problems with the organization. This has been driven by a closure of essentially our whole economy. Consumers can’t go to work so they can’t earn money. That’s the crux of it. There are many of us fortunate to be able to continue to work at home but many more have been furloughed, laid off entirely or seen their hours cuts. This is cutting into income and what we see in the survey.

“Then really the question is how quickly are those businesses going to be able to reopen and bring people back on,” he continued. “If this happens in the next 30 to 45 days, it will be a much different situation than if we’re still not able to interact for another six months or more. That’s really what it comes down to.

Wise also mentioned the role financial providers have, too.

“When consumers do come back, they’re going to need credit and be able to borrow,” Wise said. “In our data, we’ve seen a lot of things that have been deferred, like home purchases, auto purchases, vacations. Certainly, a large portion of our population are going to want to start doing those things and very quickly. It’s very important that lenders be ready and positioned to open up their credit spigots to allow people to buy the cars they’ve been deferring or buy the homes they’ve been saving for. It’s important that lenders be reticent to hit the go switch quickly, as well.”

Equifax is looking to offer its clients the tools they need to navigate these unprecedented times by recently launching a pair of solution kits.

As the company closely monitors the rapidly evolving COVID-19 situation and its significant financial impact on consumers and businesses around the globe. Equifax is helping organizations of all sizes respond to the impact of the crisis with new Equifax response packages.

Equifax highlighted these packages are based on customer and industry feedback and are designed to help organizations assess current and predicted trends during this period of market uncertainty. Complimentary consumer credit trend reports make actionable economic insights readily available, and services that evaluate accounts and portfolios allow businesses to better plan and manage their customers for the future.

“When it comes to navigating your business through today’s crisis and into a post-COVID-19 future, we believe that smarter insights drive smarter actions,” said Sid Singh, president of United States Information Solutions (USIS) at Equifax.

“Our new Equifax response packages apply our advanced analytics and alternative data assets to the creation of trended insights that can help organizations support consumers and maintain their financial health,” Singh continued in a news release.

“We’re also making summary consumer credit trend reports available free of charge — giving the businesses that drive our economy access to critical information when they need it most,” Singh went on to say.

The first package, Response FREE, is available to businesses of all sizes without cost. This package provides access to a weekly Consumer Credit Trends Report, a condensed view of city, state and national trends in auto, mortgage, credit card, consumer finance, home equity lines of credit (HELOC) and student loans made available in PDF format each week.

Equifax mentioned rrend information is reviewed in a Market Pulse webinar series focused on answering the questions top of mind to businesses during this time. Equifax Response FREE is also supplemented by consulting services where we recommend solutions that can help organizations assist and approve consumer loans during these uncertain times.

“Equifax response packages were developed to immediately help our customers respond to the impact of COVID-19 on their businesses,” said Mark Luber, USIS chief product officer at Equifax. “Organizations of all sizes are looking for macro insights into evolving economic trends. They also need new ways to work with consumers to strengthen virtual relationships when those customers need it most — when they’ve lost income and need new ways to get back on their feet.

“We’re making these solutions broadly available to help organizations around the country take the steps needed to strengthen their business and help consumers live their financial best,” Luber added.

Equifax highlighted the second package, Response NOW, builds on the insights provided in the Equifax Response FREE offering. It provides more granular access to anonymized Credit Trends data plus a new visualization tool that overlays economic insights with COVID-19 information and statistics to help establish economic scenarios for stress testing portfolios and forecasting impacts based on portfolio composition.

The company said Response NOW also offers solutions for understanding employment and income via The Work Number database, helping lenders better assist consumers who may have been affected by the pandemic.

Given the pace of change in the economy and employment landscape, Equifax emphasized The Work Number data can provide timely information essential for accelerated decision-making. Response NOW also includes a solution for lenders to help estimate impact on existing commercial loan portfolios.

For more information on the new Equifax response packages, go to this website.

Constant wants to reduce the burden finance company call centers are facing nowadays in assisting their customers who are experiencing job losses and income drops because of the coronavirus pandemic.

And the Maine-based financial technology company created a solution powered by artificial intelligence to provide this assistance.

Constant recently launched an AI-powered software platform for banks and non-bank consumer lenders that can provide faster and more accurate decisions about payment deferrals, loan modifications and other workouts.

The company insisted its solution significantly can reduce massive incoming call volume and long wait times caused by COVID-19 financial hardships.

“Millions of Americans have filed for unemployment against the backdrop of $16 trillion of consumer debt,” Constant chief executive officer Catherine Powers said in a news release.

“In response to lost wages, bank and non-bank lenders have directed borrowers to call for payment relief options. With mortgage forbearance requests alone increasing by nearly 2,000 percent, the COVID-19 crisis has shone a spotlight on the lack of preparedness to support hardship relief requests,” Powers continued.

Constant’s platform can evaluates a borrower’s real-time financial situation and provides repayment options and, when appropriate, loan modifications in a matter of minutes, without human intervention.

“Whether a lender or servicer is offering to skip payments or a more complex hardship solution, that effort can take weeks or months with the high volume of incoming requests for help,” Powers said.

“However, our platform can do it in minutes by engaging with the borrower, evaluating real-time, customer-specific information and automatically creating relief options that solve the problem and encourage payment performance – all within investor parameters.”

Constant president and chief operating officer Carissa Robb reflected back on the most recent incident that could compare to what the financial services industry is currently facing in connection with COVID-19.

“During the 2008/09 mortgage crisis, loss mitigation requests aged in queues for months,” Robb said. “Credit scores were damaged, customers were feeling defeated and their willingness to pay was lost.

“Yet, it appears there was little preparation for the next crisis,” Robb continued. “Instead technology investment and innovation focused on increasing credit origination volume, only to transfer the long-term management of these loans to manual servicing teams and antiquated operating systems. Constant is changing this.”

For further information on Constant and its offerings, visit constant.ai.

Driveways and parking lots often are the location for auto financing documents to be completed nowadays, not necessarily an F&I office at the dealership.

To help finance companies and dealers transact with less face-to-face interaction and fewer employees on site during these unprecedented times, Dealertrack is unveiling new enhancements to its F&I platform. According to a news release distributed on Thursday, the new enhancements will pair with the digital contracting capabilities already in place to enable a remote deal signing and delivery process.

Dealertrack acknowledged the current coronavirus pandemic has significantly accelerated consumer adoption of online car shopping. As a result, client requests for Dealertrack uniFI Digital Contracting are up 65% from February to March and traffic to Dealertrack’s Digital Contracting webpage is up 63% over the same time period, based on Dealertrack data.

As technology providers across the nation work to ensure dealers can meet consumers where they are in the vehicle-buying journey while social distancing, Dealertrack explained the addition of remote signing in combination with digital contracting — where permitted by local authorities — can help “take the deal over the finish line.”

Together, these capabilities can enable a remote and paperless workflow for the automotive eco-system on the Dealertrack platform, including:

• Digital Delivery (new): Remotely connect and send deal documents to consumers through an encrypted, online connection with a unique pairing code. This new technology can give dealers the ability to pair with multiple devices, including desktops, laptops, iPads and Android tablets with a 9-inch screen or larger.

• Assisted Remote Signing (new): As the need for electronic signatures continues to grow amid the current environment, Dealertrack emphasized it is now more important than ever for dealers to support technology and processes that will result in a legal contract. With Assisted Remote Signing using Dealertrack’s latest technology, Digital Delivery, a dealer can guide a secure signing ceremony that ensures the right person is always on the other end of the document and the final product is legally binding. Documents that can be signed include credit applications, credit bureau authorizations, privacy notices and funding package documents, such as aftermarket contracts.

• Local File Upload (new): Dealers now can upload stipulations and documents directly from a desktop into the funding package. The functionality is supported by several features, including the ability to categorize documents, easily drag and drop multiple files for a single upload, automatic virus scanning of documents before they are uploaded to the deal jacket and a 4MB capacity limit.

• Point of Sale Capture: Integrated directly into the Dealertrack platform, dealers can securely upload high-quality images of a customer’s driver’s license, W-2 and other required documents right from a tablet into the funding package.

• Live Funding Checklist and Real Time Error Display: Exclusive integrated finance company checklist and built-in verification alert can enable faster submission of an accurate contract, ultimately speeding up processing.

“In today’s climate where social distancing has taken precedence, dealers are moving fast to adapt to a virtual way of working. As their technology partner we are making that possible,” said Cheryl Miller, vice president of operations for Dealertrack F&I Solutions.

“With the introduction of Assisted Remote Signing via our new Digital Delivery technology coupled with Digital Contracting, dealers can feel confident knowing they have the flexibility they need to keep transactions on track even when that crucial in-store visit is no longer a viable option for customers.,” Miller continued in the news release.

One user in the Sunshine State already has a positive impression of Dealertrack’s latest enhancements.

“Assisted Remote Signing via Digital Delivery is a game-changer and the future of the car business,” said Cris Aviso, finance director at Regal Automotive in Lakeland, Florida. “This tool will help us perfect a more coherent car buying experience that is seamless, logical and smooth.”

For tips on how to keep the F&I process moving forward virtually, visit https://cloud.e.dealertrack.com/virtual.

The COVID-19 pandemic has halted two decades of global growth and raised several questions about how economies will function in the future.

Experts are assessing whether the international upheaval caused by the pandemic will have a long-lasting impact on trade and finance, including how businesses will adapt to a changing environment.

Where will future growth come from, and will it change our perspectives on what growth means?

Historically, to fuel growth, companies, governments and customers have consumed and discarded resources and products in ever greater quantities, while low-cost debt financing has supercharged expansion of the economy.

A linear model has supported this trajectory, described as “take, make, waste.”

However, as economies and businesses recover from the COVID-19 pandemic, there is likely to be a focus on minimizing waste and generating a maximum return on investment to replace lost revenues. Companies face the challenge of making the most of currently-limited resources while restoring previous production capacity.

This new global challenge coincides with a growing market of increasingly ethically-minded consumers, who believe that in a world of dwindling resources and emerging climate risks, sustainability is becoming an essential factor in their future buying decisions.

A growing ecosystem of companies built around a ‘circular economy’ mindset is exploring innovation in this area, with a focus on sustainable production, minimal waste, and extensive recycling and reuse to ‘close the loop’ between manufacturing and consumption.

Organizations such as the Ellen MacArthur Foundation, launched in 2010 to accelerate the transition to a circular economy, are driving progress in this area.

The foundation’s latest initiative is the CE100: a network to encourage collaboration between businesses, government, educational institutions and experts to create business ideas based around the circular economy concept.

Member companies include U.S. company Apeel Sciences, which has pioneered a plant-derived protective layer that can be applied to the surface of fruits and vegetables, keeping them fresher for longer, reducing food waste and removing the need for plastic packaging.

French company Lizee provides e-commerce and logistics solutions to help retail brands enter the sharing economy by renting their products, promoting the reuse of goods.

Loop is a shopping platform available in France and the USA focused on delivering products in reusable packaging. Once used, Loop collects the packaging, cleans it and sends it back to the brand for refilling. It then goes back into circulation.

Swedish company Omocom specializes in insurance solutions to meet the needs of the sharing economy, enabling the growth of products-as-service models and peer-to-peer rental platforms.

U.S. company Optoro specializes in reverse logistics, helping retailers to build circular business models and eliminate waste, with returned and excess goods going to secondary use.

However, this new circular economy will not establish itself spontaneously. New finance models are required to make the transition to sustainable, restorative business. Making this shift will not be simple and carries risk.

So how can companies and their financiers work together to decouple resource use from growth, and develop an economy that benefits everyone?

Address inherent risks

One of the key features of the circular economy will be the option to subscribe to, rather than own, a product — which is already possible in some sectors.

This type of service-based business model requires a different funding approach from finance companies. The auto industry provides a powerful example of this: under the future car-as-a-service model, consumers will not own the car, but instead pay a subscription fee for access to the vehicle.

Unlike an ownership-loan arrangement, this means that there is no option to repossess the vehicle if the customer misses subscription payments.

Banks will therefore have to build a valuation and risk model with companies that suit the specific characteristics of the business — in this case, probably developing a type of contract between consumer, company and bank that provides similar levels of comfort and restitution to asset repossession.

In the circular economy, contracts like this will be critical. To write good contracts, banks will have to become familiar with the individual business models of the companies they finance, as well as the implications of each model.

Another risky issue is that service-type or pay-per-use agreements, often being cheaper, tend to attract consumers with lower credit ratings.

Those consumers wouldn’t ordinarily be able to purchase the product, but they can afford to rent it. Before financing these business models, both businesses and finance companies need to establish thorough screening processes for customers and ensure that the business model has undergone robust bankruptcy tests.

Where the business model is too risky for traditional debt financing, finance companies could explore other options with their clients, such as partnering with equity providers or even crowdfunding a business, should the demand and support be there.

Many circular businesses are at the pilot stage or haven’t been operating long enough to have their success judged, more still require increased capital in the initial stages. This is where finance companies will have to work with their clients to understand risks and use pricing tools that incorporate sustainability as part of the business case to reach an appropriate and realistic financing solution.

Focus on the cash flow

Cash flow from circular business models will look, in many cases, very different. Instead of a single large loan to a customer, regular payments are collected across the lifespan of the product.

For example, in the case of auto subscriptions, instead of the car as the value driver in the business model, the cash flows and the relationship between company and customer become the principal source of value.

There are risks involved with this, and one solution for banks and companies is to reduce the payment windows or increase the payments to mitigate risk.

It isn’t a one-size-fits-all model, though; when companies and banks set out to develop and finance a circular business model, they should be aware that they can develop whatever payment structure they like. And since the value is no longer entirely tied to the lifetime of an asset, both the company and the bank should consider carefully the incentives that can be put in place to encourage a lasting relationship between customer and company.

The second-hand market and recyclability are other critical areas of cash flow for circular businesses selling access to assets. When there is a liquid, stable and transparent second-hand market for an asset, companies no longer have to write off the asset’s value when it reaches the end of its initial usability. Ultimately, this makes a case for financing an asset more robust.

As the world’s industries are recovering from the financial tremors of COVID-19, recycling and reusability will become an increasingly vital aspect of resource management and sustainability — both in the environmental sense and in assets’ secondary values.

Furthermore, financial institutions will be more likely to provide funding if companies understand the cost of their waste and actively squeeze every possible bit of value out of their assets. Companies should therefore be in the business of developing and using products that have positive residual value, or are constructed with cheap, speedy disassembly and recycling in mind.

Abandon the status quo

An important realization for both companies and their finance providers should be that there is no ‘right’ way. They can develop payment systems, contracts, solutions and incentives to suit their particular organization.

Banks must begin thinking circularly and asking some big (and often challenging) questions: how risky is this business – can we provide a different type of finance? What do we do if the company or customer goes bankrupt? Can we specify a payment structure that makes this a safer arrangement? How can we get the most out of the asset? Can we provide financing for research into assets that last longer, or can be more easily recycled?

As the global economy plots its recovery from COVID-19 and the world begins to see the establishment of new finance models for sustainable circular businesses, the cooperation of companies and banks is vital. Both must understand one another well and, in their solutions for future sustainability dilemmas, prioritize divergence from the “take, make, waste” model of the past in favor of “refurbishment, reuse and recycle.”

Brendan Gleeson is group CEO at White Clarke Group.

Fueled in part by the financial resources the fintech firm landed back in February, Digital Motors is now offering waived fees for its product that can turn any dealership website into an online store, empowering salespeople to sell remotely, while allowing customers to pre-desk their vehicle purchase from the safety of their own home.

And Digital Motors says it can complete this service for dealerships in just one day.

Founded by veterans of digital retailing and automotive financial technology, the company based in Irvine, Calif., has spent the past 18 months perfecting a unique platform that can keep dealers “in the driver seat.” Through its intelligent fintech engine, Digital Motors said it is able to configure each online store to the individual needs, economics and business rules of its dealership clients.

“Once a dealership selects our service, we create an online store that is accessible from their own website,” explained CEO of Digital Motors chief executive officer Andy Hinrichs in a news release. “We can get a ‘buy from home’ experience up and running in 24 hours.”

For a limited time, Digital Motors is waiving its customary setup and monthly Software-as-a-Service subscription fees to aid dealerships in navigating these challenging times.

The company explained that vehicle inventory is shown with transactable monthly lease or finance payments, taking into account available rebates, discounts and incentives.

Customers can directly apply their trade-in vehicle valuation and F&I product selection to their monthly payments backed by firm offers of credit from the dealership’s network of finance companies.

“The company is committed to helping dealers weather the current economic crisis,” Digital Motors chief operating officer Nick Stellman said.

“We vastly accelerated our product roadmap and will continue to make additional features and enhancements available over the coming weeks and months. Now is the perfect time for the auto industry to move into remote online sales,” Stellman went on to say.

For more details, go to digitalmotors.com.

Scot Hall, executive vice president of Swapalease.com and Wantalease.com, acknowledged he’s always been a “glass half-full” person. And the coronavirus pandemic hasn’t changed his mindset.

Hall joined senior editor Nick Zulovich for another episode of the podcast to discuss how digital paths of retailing and financing will be the way for how the automotive industry rebounds from this crisis.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

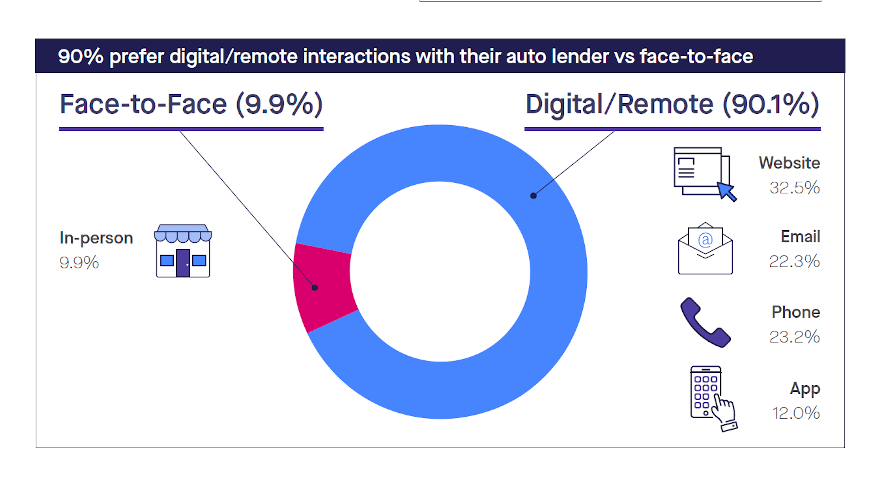

Lightico conducted a customer survey this past weekend and found an overwhelming majority of its auto-finance users — 90.1%, to be exact — currently prefer digital or remote interaction with their provider stemming from the ongoing coronavirus pandemic.

Meanwhile, Lightico also discovered that 40% of respondents either already have or are seeking modifications to their installment contracts through moves such as deferments, freezing payments or refinancing.

In the survey results, Lightico also further broke down how consumers are looking to connect with finance companies remotely. The findings included:

— Website: 32.5%

— Phone: 23.2%

— Email: 22.3%

— App: 12.0%

Lightico’s solution allows for finance companies to quickly, easily and digitally gather stipulations, e-signatures, payment and identification through an instant mobile interaction to significantly expedite loan origination and servicing.

In a separate blog post discussing the survey findings, Lightico said, “As was to be expected, a majority of consumers are concerned about the virus’ impact on their health and finances.

“Respondents overwhelmingly expressed a need for digital and remote ways of getting things done, with two-thirds saying they are more inclined to try new digital offerings now than before,” the company continued.

“If businesses want to navigate this difficult period, they must keep a finger on the pulse of consumers’ new reality –– offer solutions (like e-signatures) that consider the impossibility of face to face interactions and create easy, remote and digital services,” Lightico went on say.

Other highlights of the Lightico survey of 1,000 customers included:

— Seventy-six percent are concerned about going to their local bank or auto dealer

— Seventy-one percent who were considering a car purchase over the coming three to six months months are now reconsidering

— Fifty percent have or will take steps because of their financial concerns

— Fifty-one percent are concerned about their ability to pay back their car loan over the coming months

— Sixty-three percent of consumers would set up a direct debit (ACH) for their loans if their lender gave them a discount or a deferment

— Only 30% of lenders have reached out to help with loan payments

“The data is in line with anecdotal evidence that loan originations are down but that consumers are open to and need to adjust their loans over the coming months to deal with the new reality before us,” Lightico said.

The coronavirus pandemic has forced more consumers to shop online and dealers and fintech firms to polish their digital retailing endeavors.

And fraudsters are sharpening their deceptive tools, too.

On Tuesday, TransUnion released new research that quantifies the spike in digital commerce since social distancing became widespread globally. The company found a 23% increase in e-commerce transactions in the week following the World Health Organization declaring the COVID-19 outbreak a pandemic on March 11 compared to the average weekly volume in 2020.

“It is clear that social distancing has changed consumer shopping behaviors globally and will continue to do so for the foreseeable future,” said Greg Pierson, senior vice president of business planning and development at TransUnion.

“No doubt fraudsters will continue to follow the trends of good consumers and adjust their schemes accordingly,” Pierson continued.

In a recent survey of 1,068 Americans 18 and older, TransUnion found 22% have been targeted by digital fraud related to COVID-19. TransUnion’s findings arrived as the company releases its Global E-commerce in 2020 report.

In the report, TransUnion Global Fraud & Identity Solutions reported a 347% increase in account takeover and 391% rise in shipping fraud attempts globally against its online retail customers from 2018 to 2019.

“With so many reported data breaches, it’s not just about if your account will be hijacked, it’s about when,” said Melissa Gaddis, senior director of customer success for TransUnion Fraud & Identity Solutions.

“Once a fraudster breaks into an account, they have access to everything imaginable resulting in stolen credit card numbers and reward points, fraudulent purchases, and redirecting shipments to other addresses,” Gaddis continued.

TransUnion explained typical methods used to take over an account include buying login details on the dark web, credential stuffing, hacking, phishing, romance scams and social engineering.

Shipping fraud is when criminals take over a customer account but don’t change the shipping address in order to avoid detection. Once the package has shipped, they intercept it at the carrier site and change the shipping address.

Besides account takeover and shipping fraud, TransUnion revealed other significant e-commerce fraud and transaction trends:

— Forty-two percent decrease in promotion abuse from 2018 to 2019. Cybercriminals access accounts to drain loyalty points or create multiple new accounts to use the same promotion over and over, often against website and app terms. TransUnion believes this decrease can be attributed to fraudsters turning to more lucrative schemes such as account takeover.

— Seventy-eight percent of all e-commerce transactions came from mobile devices in 2019. That’s a 33% increase from 2018. TransUnion pointed out e-commerce companies are scrambling to ensure a mobile-first experience for consumers not just to browse but to buy.

— One hundred and eighteen percent increase in risky transactions from mobile devices in 2019. TransUnion acknowledged that fraudsters have taken notice that more e-commerce transactions are coming from mobile devices and are trying to replicate that consumer behavior in order to avoid detection.

“Although the death of brick and mortar has been well documented, there is still plenty of room for e-commerce growth with one report claiming online retail only makes up 14% of all global retail sales[1],” said Gaddis. “With so much room left for growth, it’s important that retailers stay ahead of the emerging transaction and retail trends to provide a friction-right experience for consumers and a fraudster-proof barrier.”

To download TransUnion’s Global E-commerce in 2020 report, go to this website.

Ally Financial is making sure Carvana has liquidity to keep its online vehicle retailing machine in motion no matter the challenges the coronavirus pandemic is presenting the industry.

Late on Tuesday, Carvana announced a significant increase and extension of its current loan purchase program with Ally Financial, highlighting the deep relationship that has been built between the two companies over the past six years.

According to a news release, Ally will provide up to $2.0 billion of capacity for the purchase of finance receivables over the next 12 months and broaden the set of customers covered by the agreement.

The move nearly doubles the most recent financial pledge Ally made to Carvana.

“This commitment from Ally puts Carvana in a strong position to provide our customers fair, simple financing in this time when so many need it,” Carvana founder and chief executive officer Ernie Garcia said.

Back in November 2018, Ally also announced funding to support retail contracts from and inventory needs of Carvana. At that time, the commitment was up to $2.3 billion in over the next 12 months.

“As we work through the current business challenges facing the auto industry, the Ally team remains unwavering in its focus on finding the best solutions to help our dealer customers,” said Doug Timmerman, president of auto finance for Ally.

“We’re pleased to have the expertise and agility to deliver a financing agreement that supports Carvana’s innovative, digital consumer experience,” Timmerman added.