Market Scan Information Systems and Experian recently released a solution for finance companies that want to know what underwriting strategy their competitors might be using to add to their portfolio.

Through a collaboration, Experian and Market Scan will offer mGauge, what they described as a state-of-the-art analysis tool for finance companies hoping to gain more insight into the interest rates that competitors offer based on geography, vehicle and credit risk tier.

“We are excited and proud to join with Experian to evolve automotive commerce,” Market Scan president and co-founder Rusty West said in a news release. “With Experian’s extensive industry relationships and Market Scan’s unique software, data and calculation technologies, this joint effort builds on the natural synergies between our two companies.

“Together, we will offer one-of-a-kind solutions that empower automotive lenders and OEMs to create compelling and competitive programs for their clients and specific offers directed at consumers,” West continued.

Powered by Market Scan’s proprietary technology, analytics and data, mGauge can analyze competitors’ published lease and retail financing programs. This insight can enable finance companies to create and offer competitive finance options for in-market vehicle buyers and dealers — ultimately leading to an increased bottom line and improved customer loyalty.

For example, a finance company could see that a competitor will offer a subprime car shopper a specific rate on a full-sized pickup truck — opening the door to offer a better interest rate or match the contract terms.

“In an overly competitive marketplace, lenders need to find ways to attract and retain car shoppers — comparable loans terms are a keen way to accomplish that goal,” said John Gray, Experian’s president of automotive.

“Unique insight into how competitors are pricing vehicles can level the playing field across the lender spectrum,” Gray continued. “More importantly, consumers can access favorable loan terms that can make vehicles more affordable and improve their financial health down the road.”

To learn more about mGauge, visit www.marketscan.com/OEM/Products/mGauge. For more information about Experian’s automotive suite of products and services, visit www.experian.com/automotive/auto-data.

A fintech company that says it regularly processes more than $2 billion in mortgages and consumer loans daily in connection with providers such as Wells Fargo and U.S. Bank now is getting into the auto-finance business.

This week, Blend launched a new auto financing product, advancing what the digital lending platform calls its mission to bring simplicity and transparency to consumer banking.

Blend believes its new auto product will improve the vehicle purchase and refinance experiences for consumers, while helping finance companies drive efficiency, increase online application completion and improve fund rates.

Blend emphasized consumer behaviors about how to get financed to purchase a vehicle are changing rapidly, with buyers expecting a digital, mobile-friendly experience that allows them to research, apply, and receive financing offers before ever setting foot in a dealership.

According to the 2018 J.D. Power 2018 U.S. Consumer Financing Satisfaction Study, 47% of auto finance customers shopped online for vehicle financing prior to visiting a dealership. Blend’s auto loans product can help increase operational and marketing efficiencies, while providing finance companies with a quick and easy way to interact with their customers at an important inflection point in the vehicle purchase journey.

“We’re excited to roll out our auto financing product to help lenders enhance the level of service and experience they provide to consumers,” said Olivia Teich, Blend’s head of product.

“Blend’s technology uses verified data to eliminate steps and the passing around of documents, streamlining the application process for consumers and reducing origination costs,” Teich continued in a news release. “These improvements will help get car buyers on the road faster and create efficiencies that enable financial institutions to handle more loans.”

Blend’s expansion into auto financing follows its recent launch of two new products — deposit accounts and home equity — supplementing its core mortgage offering. Together, Blend says these offerings provide the foundation for a unified digital lending platform across consumer banking products, making the journey from application to close fast and easy for consumers, while helping lenders increase productivity, deepen customer relationships, and deliver exceptional customer experiences.

After piloting the new auto product, Blend said a $38 billion Midwest-based bank reported a three-fold increase in application completion, and a 10% increase in approval rates with Blend’s technology.

Since going live with Blend across all markets seven months ago, the bank also reported a 150% year-over-year increase in auto applications funded.

For more information on Blend’s auto financing product, visit https://blend.com/blog/news/announcing-blend-auto-loans/.

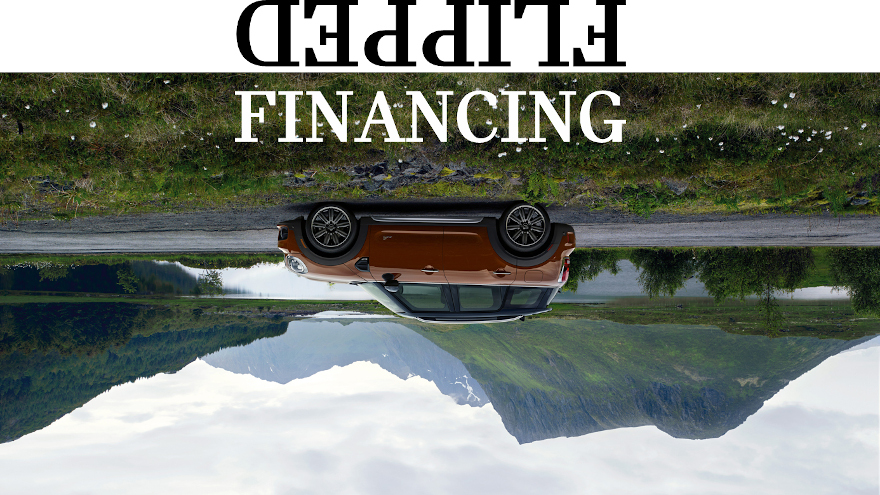

The image associated with this report provides a vivid glimpse of what a luxury automaker and its captive finance company are trying to do.

Last week, MINI USA and MINI Financial Services announced the introduction of Flipped Financing, a vehicle financing program that can help franchised dealers put consumers at the heart of what the companies say is an easier and simplified purchase experience.

With Flipped Financing, all approved credit applicants receive one interest rate as advertised, up-font and without any surprises. At the same time, the program can create a straightforward and clear-cut purchase process that eliminates the need for potentially lengthy negotiations or hassle for both the customer and the dealer.

“After a successful pilot program, during which we received direct feedback from dealers and customers alike, we’re incredibly excited to roll out Flipped Financing to all MINI dealers in the U.S.,” said Ian Smith, chief executive officer of BMW Group Financial Services Americas.

“We are confident that this is the start of a sustainable, long-term program that will not only help create a transparent and pleasurable purchase process for our customers, but will also allow them to get in and out of the showroom quicker so that they can spend more time having fun behind the wheel of their new MINI,” Smith continued in a news release.

In a rapidly changing retail environment, MINI aims to provide a simplified process for both dealers and customers with Flipped Financing.

For MINI dealers, this new program represents an opportunity to make it easier for dealer F&I offices to be more effective at satisfying customers with a faster, simpler and easier transaction. For customers, Flipped Financing offers one rate across the board to all whose credit applications are approved, along with a clean and simple process.

In addition, the company said MINI Flipped Financing removes added pressure for customers to purchase protection products at the time of sale. Customers now have up to 30 days after purchase of their new MINI to learn about and decide on purchasing additional products. This flexibility also offers dealers additional touchpoint opportunities to connect with their customers.

“As the name implies, MINI has flipped the typically complex auto financing process on its head,” the company said. “With a crystal-clear financing process and uniform rate for all, MINI Flipped Financing is the true definition of ‘what you see is what you get’ — one rate, zero pressure and no nonsense.

For customers interested in learning more about MINI Flipped Financing available exclusively through MINI Financial Services, visit www.MINIUSA.com/flipped-financing, or a MINI dealer.

As the captive gears up to be a part of next month’s Automotive Intelligence Summit, GM Financial recently expanded its commitment to Spring Labs, the company developing the Spring Protocol, a blockchain-based platform designed to transform how information and data are shared globally.

Spring Labs announced that GM Financial is a part of the company’s efforts to raise $23 million in Series A funding. The round was led by GreatPoint Ventures with significant participation from existing investors, including August Capital, as well as General Motors Ventures, the corporate venture capital arm of General Motors, RRE Ventures, Galaxy Digital, Multicoin Capital, The Pritzker Group and CardWorks.

“We’re pleased to announce our Series A with strong participation from existing and new strategic investors, enabling us to accelerate the development of new products as well as the Spring Protocol itself,” said Adam Jiwan, chief executive officer and co-founder of Spring Labs.

“Additionally, we’re excited to expand our relationship with GM Financial, which has demonstrated its commitment to innovation and collaboration over the past year, playing an active role in the evaluation of products and use cases on the Spring Protocol,” Jiwan continued.

Back in February, GM Financial announced its collaboration with Spring Labs as part of its Spring Founding Industry Partners (SFIP) Program, which is geared to drive improved data management standards to help address critical auto finance industry issues like identity verification and synthetic identity fraud.

Via the GM Ventures investment, GM Financial joins more than 20 other leading financial services institutions in co-developing the first applications to be built on the Spring Protocol — all part of the company’s continued effort to better serve and protect customers and dealers.

As other forms of credit mature and evolve, such as the adoption of chip-enabled credit cards, the companies pointed out that auto financing fraud has become a path of less resistance, having increased by a rate of nearly five times from 2011 to 2018. The companies estimated fraud-related losses in auto financing cost the industry between $4 and $6 billion per year, with a large portion of that fraud resulting from the abundance of synthetic identities, a form of fraud wherein identity thieves establish credit accounts using a mix of genuine and fake customer information, such as a real customer’s name, but a fake address.

As a result, the first products being built on the blockchain-based Spring Protocol are Spring Verify for enhanced identity verification, Spring Defense for fraud monitoring and mitigation, and Spring Protect for loan stacking prevention.

These products are designed to improve customer on-boarding processes by reducing costs while improving data availability, security and granularity. Spring Labs insisted its products will deliver valuable anonymous data to lenders in a variety of verticals, including unsecured consumer lending, small business lending, credit card issuance, secured auto lending and more.

“GM Financial is excited to deepen its relationship with Spring Labs, and we look forward to the launch of the Spring products as we believe they have the potential to better protect our customers from fraudulent activity,” GM Financial chief strategy officer Mike Kanarios said.

GM Financial likely will be discussed this investment and more when the captive appears during the Automotive Intelligence Summit (AIS), which runs from July 23-25 in Raleigh, N.C.

During a fireside chat titled, “Cybersecurity for the Future of Auto,” AIS attendees will discover the answers to the most pressing cybersecurity issues that the auto and auto finance industry are facing along with what cybersecurity technologies are receiving the most investment and why? AIS chair Bill Zadeits and Ryan Bachman, SVP and global chief information security officer at GM Financial, will explore the complexity and importance of the intersection of data privacy and cybersecurity.

More details about the Automotive Intelligence Summit can be found by going to www.autointelsummit.com.

Part of the reason Cherokee Media Group launched the Automotive Intelligence Summit: Fintech adoption among consumers has nearly doubled over the past 18 months, according to the latest EY Global FinTech Adoption Index.

EY shared on Monday that the adoption rate is growing faster than anticipated, because 64% of digitally active consumers across 27 markets use fintech, and awareness is even higher globally.

This year, EY added the first-ever Small and Medium-Sized Enterprise (SME) FinTech Adoption Index given fintech’s expansion beyond consumers. EY member firms surveyed more than 1,000 organizations in five countries and found that one-quarter of organizations have used at least one fintech across the following four categories in the past six months: banking and payments, financial management, financing and insurance.

“Fintech organizations are no longer fringe disruptors and have grown into sophisticated competitors,” said Matt Hatch, a partner at Ernst & Young and the EY Americas fintech leader. “Now, financial incumbents are taking note and offering fintech solutions, forming ecosystems that are replacing traditional partnerships.

“We fully expect this trend to accelerate as nonfinancial companies enter the space and leverage technology and innovation to provide frictionless, transparent and highly-personalized services,” Hatch continued.

EY also will have a major presence again this summer during the Automotive Intelligence Summit, which runs July 23-25 in Raleigh, N.C. As the agenda nears completion, a lineup of keynote speakers and panelists have come together that might pique your interest — especially if the following are top of mind for you, your business, or your industry: digital retailing, fintech solutions, cybersecurity, data privacy, customer experience, the future of auto dealerships, Mobility-as-a-Service and more.

Early bird registration is available through June 7 by going to www.autointelsummit.com.

What’s driving fintech adoption?

EY firms interviewed more than 27,000 people to better understand how consumers are interacting with fintech, and the results are promising, according to the firm.

Based on the survey results, money transfer and payments services continue to be the most popular in both awareness and adoption, as only 4% of global consumers are unaware of at least one money transfer and payment fintech service. EY found that adoption rates continue to lag in the U.S., while Europe’s investments in open banking have contributed to higher adoption rates in that region.

Experts also pointed out that SMEs are further behind in their adoption journey compared to consumers. When an SME uses fintech services, EY explained they have essentially selected this company as an approved vendor, so 25% is considered high, and the adoption rate is expected to climb.

Survey findings showed more than one-fifth (22%) of non-adopters already use fintech services in three of the four categories defined in the survey methodology, which means they are on the verge of becoming fintech adopters.

By this measure, EY calculated the global adoption rate could surge from 25% to 64%.

The impact of trust on fintech adoption

The survey indicated that trust plays a large role in fintech adoption, as non-adopters choose to remain with traditional financial services, because they trust them more than fintech challengers.

EY acknowledged that many fintech propositions rely on data sharing, which can present a barrier for adoption. Nearly half (46%) of adopters are comfortable with their primary banking institution sharing their financial data with other organizations if it means better offers on products or services, but less than a quarter (23%) would share data with nonfinancial services companies.

EY suggested this trust gap can create a huge opportunity for financial institutions and fintech challengers as 31% of adopters say they are willing to share data with fintech challengers. Although nonfinancial services companies might lead innovation, EY said they don’t have full confidence when it comes to providing financial services. Still, 68% of surveyed consumers are willing to consider a financial services product offered by a nonfinancial services company.

The SME FinTech Adoption Index found similar trends. SME FinTech adopters are also more open to sharing data with FinTech companies (89%) and other financial services companies (70%) over nonfinancial services companies (63%).

The future landscape

Looking ahead for both consumers and SMEs, EY highlighted newly developed ecosystems will encourage industry convergence as fintech challengers continue to develop and mature, incumbent companies offer new innovative solutions and nonfinancial services companies expand their offerings.

“We’re optimistic about collaboration between FinTech and traditional financial services companies in the future,” Hatch said. “Just under half (47%) of consumers are happy to use financial services from a nonfinancial services company if that company is working in partnership with the traditional financial services company.

Similarly, SMEs are interested in joining fintech ecosystems that integrate different propositions offered by challengers, incumbents and, in some cases, nonfinancial services companies,” he went on to say. “These ecosystems will continue to make financial services accessible for both consumers and businesses while enhancing the overall experience.”

About the research

The EY study is based on more than 27,000 online interviews with digitally active adults between Feb. 4 and March 11 across 27 markets:

— Argentina

— Australia

— Belgium and Luxembourg (treated as one market)

— Brazil

— Canada

— Chile

— China (mainland)

— Colombia

— France

— Germany

— Hong Kong

— India

— Ireland

— Italy

— Japan

— Mexico

— The Netherlands

— Peru

— Russia

— Singapore

— South Africa

— South Korea

— Spain

— Sweden

— Switzerland

— United Kingdom

— United States

EY explained a regular fintech user is defined as an individual who has used two or more fintech services during the past six months.

The 2019 survey placed fintechs into five categories: money transfer and payments, budgeting and financial planning, savings and investments, borrowing and insurance. There are now 19 individual services, but the survey used the same 10 “buckets” as 2017 to enable year-over-year comparison.

The SME survey is based on 1,000 online interviews with senior decision-makers of SME organizations between Jan. 15 and 30. Senior decision-makers were defined as owners, managing directors, CEOs and other C-level executives responsible for business strategy, operations or financial decisions. An SME fintech adopter was determined to have used services provided by a fintech in all four of the following categories in the past six months: banking and payments, financial management, financing and insurance.

Auto Financial Group (AFG) closed the first quarter by adding 11 new credit unions to the AFG Balloon Lending Program.

AFG also increased the number of new customer signings in Q1 compared to every quarter in 2018. The company is looking to continue that momentum with more credit unions in its client portfolio, including:

— Cinfed Credit Union

— Traverse Catholic Federal Credit Union

— Financial Builders Federal Credit Union

— Velocity Credit Union

— MountainCrest Credit Union

— CapEd Federal Credit Union

— Ray Federal Credit Union

— Forest Area Federal Credit Union

— Med5 Federal Credit Union

— PenFed Credit Union

— LifeWay Credit Union

AFG highlighted these 11 credit unions represent combined assets of more than $26.5 billion and a reach increase of more than 333 million consumers across 10 states.

“We welcome these financial institutions to the growing AFG family,” AFG chief executive officer Richard Epley said in a news release. “The geographic diversity of these newly signed credit unions demonstrates that the demand for residual-based financing solutions continues to rise across the United States.”

Velocity executive vice president and chief operating officer Jack Jordan seems ready to get to work with AFG to help members in the Texas cities of Austin, Round Rock and Cedar Park.

“Velocity Credit Union has long been a leader in automotive lending in our market, and we are always interested in new products that benefit our members and our indirect dealer group. Auto Financial Group’s balloon loan program provides a great way to expand our lending services, offer a compelling alternative to leasing, provide a new way to address the rising cost of vehicles and to meet consumer demand for more flexible loan terms,” Jordan said.

“Auto Financial Group is, hands down, the leader in balloon lending in the credit union industry. They have years of experience and staying power in this business, along with excellent technology and service to support the program. AFG is a very good fit to help Velocity meet its financial and service goals for years to come,” Jordan went on to say.

Learn more about AFG’s programs by going to this website.

On Monday, Aston Martin The Americas and Chase announced an exclusive private-label agreement.

Chase said it will provide Aston Martin customers with retail installment contracts and leases under the financial brand, Aston Martin Financial Services. The bank will also provide commercial lending and treasury services for Aston Martin dealerships in the U.S.

“We’re thrilled Aston Martin The Americas selected us to deliver for its customers and dealers,” Chase Auto chief executive officer Mark O’Donovan said. “We look forward to helping Aston Martin The Americas grow its business and provide our customers with a first-class financing experience.”

Chase insisted it will have an experienced team delivering financing to Aston Martin’s U.S. customers under the Aston Martin Financial Services brand. This offering includes sales and servicing professionals to support the 35 Aston Martin dealers as well as marketing support to extend Aston Martin’s brand throughout the entire financing or leasing process.

“Aston Martin Financial Services will continue to deliver customers a seamless experience as they prepare for their dream car to grace the driveway,” Aston Martin The Americas’ president Laura Schwab said. “Customers may confidently and efficiently close the deal, and return to the magic of the open road, behind the wheel of the world’s most beautiful cars.”

For more information about Chase Auto, visit www.chase.com/auto or www.chasedealer.com.

With the momentum that has lifted the banking sector’s performance over the first half of the decade slowing in major markets — perhaps even auto financing — Boston Consulting Group (BCG) says banks must leverage digital technology to battle disruption and stem the threat of disintermediation brought on by fast-moving, newer entrants.

If banks stand pat on the technology front, BCG cautioned that institutions might pay the price with regard to staying power and profitability, according to a new report titled, Global Risk 2019: Creating a More Digital, Resilient Bank.

This ninth annual survey of the health and performance of the banking industry by BCG examined global and regional profitability levels and how institutions can raise them, exploring ongoing regulatory trends and how banks can navigate them. Experts also examined how core risk and treasury functions must adapt both their operating models and their roles in the wider banking organization to be more efficient and effective.

“As digitization opens the financial services ecosystem to new and niche players, we expect to see fewer full-stack banks,” said Gerold Grasshoff, the global leader of BCG’s risk management segment and a coauthor of the report.

“As the banking value chain breaks up, banks will get the opportunity to reposition themselves. They will likely pursue a mix of strategies, such as becoming platform leaders, being specialist providers and promoting infrastructure-as-a-service offerings,” Grasshoff continued.

“The cost basis will also change, and banks will need to be leaner and more efficient if they are to compete effectively against digitally mature peers and fintechs,” he went on to say in the report that can be downloaded here.

A three-speed world for economic profitability

According to the report, while banking remains profitable on an absolute basis, BCG found that total economic profit (EP) — which adjusts for risk and capital costs — softened again in 2017 (the last year for which year-end statistics are available). It was a second straight year of decline.

Since reaching a global-average high of 16 basis points in 2015, experts noticed that EP has slumped, falling to just 8 basis points in 2017. With that slide, BCG surmised that average banking performance is now on a par with that of 2013, when the banking industry started to regain its footing after the global recession.

In Europe, BCG pointed out that banks have remained mired in negative growth, hemmed in by low interest rates and nonperforming loans. By contrast, banks in North America have benefited from increasing interest rates, although rising costs edged total EP down for the second straight year.

In Asia-Pacific, the report showed banks experienced the third consecutive year of declining EP.

“Overall, banking remains a three-speed world in which European banks continue to struggle, North American and Asia-Pacific banks strive to stay the course, and the developing markets of South America and the Middle East and Africa continue to show high profitability. Yet systemic issues hound each region,” BCG said.

Setting the regulatory stage for the future of banking

The report explained that for regulators, instilling trust in the strength and resiliency of financial markets has become a dominant focus.

“Banks must improve the quality and efficiency of regulatory compliance to meet their ongoing financial stability, prudent-operations and resolution obligations,” report authors said. “Achieving this will require finding leaner and smarter ways to manage the high volume of regulatory revisions, as well as experimenting with new technologies and partnerships to drive down the cost of know-your-customer documentation and to improve anti-money-laundering processes.

“Keen to protect financial markets from future shocks, regulators are trying to anticipate the ways that technology will reshape the banking ecosystem and, with it, their own role in establishing guidance and ensuring consistent standards,” authors added.

Since 2009, BCG tallied that banks worldwide have paid $372 billion in penalties. The firm tabulated that regulators assessed $27 billion in penalties on European and North American banks in 2018, an increase of $5 billion year-over-year.

Mortgage-related misconduct in the U.S., money laundering and interbank-offered-rate-related market manipulation across regions are among the factors sparking regulatory ire, according to the report.

As banks digitize, so must risk and treasury

The report went on to mention that banks’ risk and treasury functions will change in profound ways during the coming years.

Experts projected both functions face a broader mandate with a larger slate of risks to manage, a growing need for integrated steering to protect banks’ interests and an equally growing need to make the most strategic use of banks’ balance sheet resources.

“Delivering on this mandate will require risk and treasury to operate faster and more incisively, backed by real-time data, predictive analytics and end-to-end automation,” report authors said.

“Risk and treasury functions that commit to ‘going digital’ in these ways will become not only more efficient operators but also more effective strategic partners in delivering value to banks,” they added.

As someone with backgrounds in science and mathematics, Market Scan co-founder and president Rusty West has greatly enjoyed the past 25 years as a developer and engineer involved with vehicle retailing and financing.

West shared his perspectives with Nick on how technology is impacting not only vehicle leasing, but also other aspects of how consumers, dealerships and finance companies all are interacting nowadays.

The full discussion can be found below.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

You can also listen to the latest episode in the window below.

Catch the latest episodes on the Auto Remarketing Podcast homepage and on our Soundcloud page.

Along with offering an update on how its uniFI platform has been adopted, Dealertrack’s Cheryl Miller joined Nick for another podcast to discuss how dealerships and finance companies are answering the call to respond to consumer demand for transparency and ease of use.

The senior vice president and general manager for Dealertrack F&I and Registration and Titling Solutions also touched on what trends are piquing her interest most for the rest of the year.

The full discussion can be found below.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

You can also listen to the latest episode in the window below.

Catch the latest episodes on the Auto Remarketing Podcast homepage and on our Soundcloud page.