This week, Inovatec Systems Corp. rebranded one of the key segments of its cloud-based software solutions for financial institutions.

Inovatec announced its Compass Lending Platform has been rebranded under the JAVELIN name. Under the JAVELIN moniker, the products now include:

— Compass Direct Portal is now JAVELIN Direct

— Compass Asset Finance is now JAVELIN LOS

— Compass Loan Management is now JAVELIN LMS

The company explained in a news release that the rebranded name, JAVELIN, was selected to help simplify and streamline the Inovatec brand. The firm pointed out the word “javelin” is synonymous with speed, streamlined precision and targeted accuracy.

These qualities make “Javelin” an ideal brand name for Inovatec’s proprietary technology, according to the company.

“The rebranding of our direct, LOS and LMS system was a pivotal decision for Inovatec, highlighting our strengths as a company,” Inovatec U.S. director of sales Brendon Aleski said in a news release. “The COVID-19 pandemic has drastically disrupted the way that lenders operate, exposing a need for more effective technology processes that enable quick decisions and reactions to the changing market.

“Lenders who partner with organizations like Inovatec can pivot their strategies almost immediately, ensuring stability, consistency and accuracy throughout their business operations,” Aleski went on to say.

JAVELIN by Inovatec is a state-of-the-art lending platform that can helps lender select the right deals while only paying for deals that are booked. The JAVELIN platform encompasses three different aspects of technology:

• JAVELIN Direct can streamline loan applications to lenders, making the job of completing and submitting credit applications fast and easy. With JAVELIN Direct, vendors and lenders can communicate in real time from the point of an application’s submission, all the way to booking the transaction. Real-time application updates and open communication across multiple channels is designed to ensure lenders always have the information they need to book the right deal. JAVELIN Direct Portal works both as a stand-alone module and as part of Inovatec’s complete lending platform.

• JAVELIN LOS is a loan origination system designed from the ground up to target the right deals. With Javelin Success Pricing, clients pay only for booked transactions. In addition to crediting, auditing and income verification for financing applications, JAVELIN LOS can support self-configurable credit decisioning, tolerance limits and risk parameters with full auto decisioning and scorecard capabilities. JAVELIN’s open API infrastructure is geared to eliminate barriers and expedite connectivity with internal and external data and service providers to drive efficiencies and optimize lender partnerships.

• JAVELIN LMS features electronic document management with robust loan servicing and after-care for loans, leasing, consumer/commercial customer service and collections and third-party vendor management. JAVELIN Loan Servicing is a fully secure loan and lease servicing system. Lenders can manage customer loans leases, repayments and collections all in one. Lenders also can manage loan fees, grace periods and penalties while maximizing flexibility with restructuring and refinancing options.

To learn more about Inovatec and its complete suite of lender-centric technologies, visit www.inovatec.com.

Point Predictive recently bolstered both its human and financial resources.

The San Diego-based company, which provides machine learning solutions to the financing industry to curb fraud and streamline operations, announced that it has completed its Series B growth financing.

Napier Park Financial Partners led the investment round with participation from the company’s existing investor, Mosaik Partners.

Point Predictive also announced it has hired Michael Housman as its new chief technology officer and promoted Eric Werab to chief revenue officer to facilitate the rapid growth Point Predictive is experiencing.

One of the first Emerging 8 honorees, Point Predictive has gained wide adoption of its Ai+Ni scoring solutions across the automotive and fintech markets during the last 18 months. The company said its Auto Fraud Manager, IncomePASS and Synthetic ID Alert solutions are quickly becoming de facto standards for auto-finance companies experiencing significant growth in their portfolios and looking to control their risk and streamline underwriting.

Point Predictive explained the new funding will help the company aggressively expand the executive, product, sales, and marketing teams as well as continue to grow its data scientist and engineering teams.

Point Predictive said it plans to enhance its solution portfolio in the automotive industry and expand into the mortgage, personal lending and other industries with their patented technology solutions.

To lead this growth, the company has hired Housman as CTO and promoted Werab to CRO.

Housman joined Point Predictive from RapportBoost.ai where he served as its chief data science officer.

Werab has been with Point Predictive for three years as the vice president of product strategy. Prior to joining the company, Werab led a software business in the risk and accounting space at Fiserv.

Point Predictive acknowledged that it expects to announce additional members of the expanded executive team during the fourth quarter.

“We believe Point Predictive is poised to transform the lending industry with their unique brand of Artificial and Natural Intelligence technology and their powerful proprietary consortium data,” Napier Park partner Steven Piaker said in a news release.

“As fraud continues to grow globally, the team at Point Predictive has figured out a way to power more trust in lending by informing lenders which consumers and loan actors they can trust, and which they cannot,” Piaker continued.

“We were impressed with their ability to apply their technology across multiple lending industries — auto, mortgage and fintech — and are excited to participate in Point Predictive’s future growth,” he went on to say.

The investment round follows a transformative year during which both Point Predictive’s data consortium and customer roster experienced unprecedented growth.

The auto fraud consortium now aggregates more than four billion risk attributes sourced from more than 70 million consumer loan applications, including loan performance and fraud information, obtained from 35 finance companies nationwide spanning more than 75,000 franchise and independent dealers.

Every month, more than 2 million auto-finance applications are scored with Point Predictive’s Ai technology adding more than 170 million risk attributes to the consortium.

“We are excited about the support from Napier Park and our current investor Mosaik Partners,” Point Predictive chief executive officer Tim Grace said. “Their investment, expertise in the space, and network will not only help us solidify our customer base in auto lending, mortgage lending and fintech, but it will also help us expand into new markets and delivery channels.

“We look forward to continuing our tradition of innovation and providing our customers and prospects with amazing results,” Grace went on to say.

In connection with the financing, Piaker will be joining Point Predictive’s board of directors.

For more information on Point Predictive and its solutions, send a message to [email protected].

Truist Financial Corp. recently unveiled a corporate venture capital division created by integrating investments in technology companies from the heritage SunTrust brand with BB&T Ventures.

The bank highlighted this firm — Truist Ventures — is focusing on strategic partnerships and investments to bring novel solutions to Truist clients and deliver on the company’s purpose to inspire and build better lives and communities.

“Truist Ventures positions us at the forefront in shaping the future of finance,” Truist chief digital and client experience officer Dontá Wilson said in a news release.

“There are many innovative entrepreneurs creating amazing technologies with the potential to transform how people interact with their finances,” Wilson continued. “Strategic partnerships and investments in innovative founders and companies help Truist deliver on our differentiating strategy of combining the right mix of human touch and technology to create experiences that help our clients, teammates and communities thrive.”

Truist also has appointed Vanessa Indriolo Vreeland, a seasoned executive with more than 20 years of private equity, venture capital and banking experience, to lead Truist Ventures.

“We are a different kind of venture firm. As the venture capital division of the sixth largest bank in the U.S., we have the scale to provide the capital early-stage companies need to grow. Yet, we’re nimble enough to deliver meaningful access to the deep domain expertise from our extensive network of teams across technology, investment banking, capital markets and innovation,” Vreeland said.

“We work closely with the companies in which we invest, leveraging our executive-level talent and industry experts to help them grow.”

The company explained Truist Ventures’ investment focus stretches beyond traditional financial technology into disruptive technologies that can enable Truist to deliver a human touch in new ways.

The division also seeks companies that have the potential to help redefine financial services and improve financial outcomes for Truist clients.

The firm’s newest undertaking as Truist Ventures’ is leading the latest funding round for global payments network Veem.

Truist explained that Veem looks to solves a critical pain point for small- and medium-sized businesses with a multi-rail technology system that can allow for seamless global payments.

Executives said this funding will go toward the development of a robust channel partner program that will widen their global footprint and help strengthen and expand their product suite and capabilities.

“Truist Ventures’ ability to lead our latest funding round in such an efficient and succinct manner is impressive. Through this round we were able to, very quickly, establish relationships with senior executives responsible for enterprise payments at the sixth-largest bank, providing Veem with unprecedented access to best-in-class expertise.” Veem chief executive officer Marwan Forzley said.

“We are excited to work with Truist to provide businesses around the world with access to our technology to modernize and simplify global payments,” Forzley went on to say.

To learn more about Truist Ventures, visit Truistventures.com.

A New Jersey Volvo dealership reaped the benefits of when fintech firms collaborate with the goal of making digital retailing more efficient for both stores and their customers.

When COVID-19 hit back in March, New Jersey was shut down and Prestige Volvo principal Matthew Haiken was forced to lay off the dealership’s sales department.

At that time, Haiken had an online presence mostly designed to create interest and inquiries.

However, Haiken realized that he had an opportunity to continue to operate by transforming his business into “an internet dealership,” fully set up to accommodate sales transactions.

That’s when FRIKINtech and Market Scan entered the situation.

Prestige Volvo turned to FRIKINtech to help him in this endeavor. FRIKINtech’s lead-generation service, coupled with its illumiQUOTE technology, enabled Haiken’s trained customer service staff to move a consumer through the online process and provide penny-certain accurate payment quotes, that were VIN-specific and transaction-able.

“COVID-19 presented a challenge for every dealer in automotive retailing,” Haiken said in a news release. “When your sales showroom and the manner in which you do almost all of your sales get shut down, you can feel sorry for yourself or realize this is a massive opportunity.

“Being a small but nimble business, driven by creativity and a willingness to reinvent our business model — and how we actually accommodate clients — were key drivers. Couple that with the cutting edge technology and solutions that FRIKINtech and Market Scan offer and you have a powerful recipe,” he continued.

“Objectively, we’re simply providing the consumers with the experience they have been looking for all along. Being the No. 1 volume dealer in the country, with 100% of deliveries taking place at the customers’ homes, would have been an absurd notion a year ago — but that’s the new normal for us,” Haiken went on to say.

FRIKINtech co-founder and chief executive officer Alex Snyder elaborated about how Prestige Volvo is a sterling example of dealers realizing that consumers have a significant interest in being able to shop, purchase, and even take delivery, without setting foot in a dealership.

“Matthew makes technology work for him. By centralizing the conversation on payments, and working with the customer in the same tool, Matthew’s team grew engagement beyond everyone’s wildest expectations,” Snyder said.

“Moving deals from the illumiQUOTE experience into Market Scan’s mDesking is totally seamless and empowers Prestige Volvo to be far more creative in making deals happen whether the customer is in the showroom or when they were forced to buy from home,” Snyder went on to say.

Finally, Market Scan co-founder and president Rusty West described how the coronavirus pandemic accelerated development for stores like Prestige Volvo to continue on a path that other stores have been navigating for a much longer time.

“We are excited to see how Market Scan’s mScanAPI technology and mDesking solution work in tandem with what FRIKINtech offers,” West said. “We have seen a gradual, but slow change in retailing over the past two decades. COVID-19 has changed everything overnight.

“With consumers’ expectations much higher than ever before, they are driving the necessary changes in digital, modern retailing to create a new normal,” West continued. “This change presents a paradigm challenge for dealers who embrace or resist digital retailing: they will fail, survive or thrive.

“It is obvious that Matthew and Prestige are fully committed to digital retailing, and it’s great to see them thrive in doing so,” West went on to say.

To learn more about FRIKINtech, visit www.frikintech.com. To learn more about Market Scan, visit www.marketscan.com.

In May 2019, Brian Jones founded Gravity Lending to build a portfolio of refinanced auto contracts, home improvement loans and other funding to help consumers with personal needs.

After Jones formed his company in Austin, Texas, he quickly realized that his operation needed a solution that could enable his team to provide a completely streamlined digital originations process, fast time to funding and an exceptional customer experience.

Enter Lightico, one of this year’s Emerging 8 honorees highlighted in Auto Fin Journal.

Jones indicated that Lightico provided Gravity Lending with rapid time-to-funding and a smooth customer experience. As a result, Gravity Lending has enjoyed:

• 400% growth in 2020, despite pandemic

• 16% faster time to funding

• 90% package back rate

• Exceptional service with 4.9 star customer reviews (222 out of 229 were five star)

• $25 million in loans during first 14 months of operations

• In August, the company was on pace to book $20 million in loans

“Being able to complete the entire eSignature and stip collection process easily and intuitively on the phone has really created an unbelievable customer experience for us. Almost all of our customer reviews are five star,” Jones said.

“We selected Lightico because the technology is secure, intuitive and provides the customer with a superior experience compared to other eSignature providers,” he continued. “The results show that we made the right choice in vendor and I would recommend Lightico to other lenders and banks seeking an eSignature solution.”

Jones and other auto-finance industry leaders are scheduled to discuss not only their experiences with Lightico but how they’ve navigated the challenges of COVID-19 and other business obstacles as the firm hosts its Auto Finance Innovators Forum on Oct. 14.

Auto Fin Journal is part of the all-digital event that’s also set to include executives from Ally Financial, Capital One, TD Auto Finance, and Westlake Financial Services. The agenda includes:

Session No. 1: Fully Digital Loan Originations: The Fastest Lender Wins The Race

Session No. 2: Under The Hood: The Tech That’s Powering The Most Innovative Auto Lenders

Session No. 3: What’s Driving Service Efficiency: Lessons from Leaders

Session No. 4: Synthetic Car Loan Fraud: Simple Secrets to Crush it Today

Session No. 5: Shifting Gears: How Auto Lenders Have Adapted to The New Normal

Session: No. 6: Live Q&A: Auto Lending Innovators & Pioneers: Your Questions Answered

The event begins at noon ET on Oct. 14, and the first 100 registrants will get the chance to win a NASCAR racing experience.

Registration can be completed on this website.

Volkswagen and Audi dealers that use Darwin Automotive’s digital F&I offerings potentially have some extra incentives to leverage.

This week, the F&I software provider announced that through its preferred provider relationship with Safe-Guard Products International, Volkswagen and Audi dealers offering the Volkswagen Drive Easy and Audi Pure Protection suite of F&I products now can qualify for special pricing and fee reimbursement incentives when using Darwin’s digital F&I options to rate, contract, and submit their F&I contracts electronically.

Officials added that this relationship between Darwin and SGI also enhances the sales tools available when offering Volkswagen Drive Easy and Audi Pure Protection products within the Darwin application.

The companies went on to mention in a news release that participating dealers will also receive Darwin’s Documents on Demand for free, which can enable a fully virtual F&I experience to accelerate dealers’ success in the virtual space.

“We're excited about the new relationship with Darwin Automotive and anticipate Darwin's F&I software accelerating growth of the Drive Easy and Pure Protection products in the marketplace," said Don Berry, director, protection services and insurance at VW Credit.

Darwin Automotive chief executive officer Phillip Battista added, “We are thrilled by this opportunity for participating Volkswagen Drive Easy and Audi Pure Protection dealers to improve their customer experience through the digitalization of F&I, allowing them to fully personalize options to enhance the purchase experience and improve dealer profitability.”

Darwin Automotive currently operates in all 50 states with more than 7,000 dealerships subscribed to its programs. Darwin said it delivered more than a half-million deals on its platform last month and is on track to deliver 6.5 million units for the year.

For more information, or to schedule a product demonstration, call (732) 781-9010 or visit www.darwinautomotive.com.

Whether you’re selling cars or cantaloupes, often the first question your potential customer is asking for is the specific cost of the item.

To help pinpoint that answer for automotive retailers when it comes to insurance, DealerPolicy on Thursday announced the launch of FastPass, a mobile experience that is designed to deliver instant, personalized insurance quotes to car buyers that are supposed to bring multiple benefits to both the customer and dealer.

FastPass can allow access to real-time competitive and personalized quotes from their mobile phones, allowing dealers to offer a seamless buying experience to their customers.

When customers save money on their insurance, DealerPolicy sees it as a real opportunity to reinvest that savings back into a dealership’s products and services.

“We’re absolutely thrilled to be bringing FastPass to market,” DealerPolicy chief executive officer Travis Fitzgerald said in a news release.

“FastPass presents our customers with a plethora of real-time insurance quotes and a first-of-its-kind Amazon-like experience for personal insurance. All of this is done at the precise point in time when it matters, right before entering the F&I office, and without increasing wait times at the dealership,” Fitzgerald continued.

FastPass can be accessed conveniently via mobile phone either at the dealership or from home and presents buyers with more comprehensive pricing and coverage options associated with their new and existing vehicles.

The average DealerPolicy insurance customer who saves money gains an average of $63 per month back into their budget, which can assist with making the vehicle purchase more affordable.

Dealers report an average increase of 34% in their back-end gross for deals where the customer also purchased an insurance policy through DealerPolicy Insurance.

Joseph Peoples, a salesperson at a dealership in North Carolina currently in the DealerPolicy network had this assessment of the tool: “FastPass just makes sense when interacting with my customers. It is very easy to understand and my customers find it easy to navigate on their own.”

The FastPass application is designed to be simple and intuitive to take just minutes to complete by leveraging DealerPolicy’s proprietary one-touch questionnaire and a robust aggregation of pre-fill solutions from leading data providers. Customers confirm a few details and FastPass instantly can pre-fill the rest, eliminating the need to complete lengthy forms.

Fueled by the J.D. Power Intelligent Match platform, quotes in FastPass are delivered with a score based on each customer’s personal preferences, allowing for a customized experience that factors in specific insurance needs as well as accurate price comparisons.

FastPass is available by going to this website.

This episode of the Auto Remarketing Podcast features Wayne Miller, executive director of The Venture Center, which collaborates with the FIS Fintech Accelerator program to identify and help startup firms accelerate the development of innovative solutions that bring new capabilities to the financial-services community.

Miller explained why this fintech research and development initiative is even more crucial as the industry navigates the challenges triggered by COVID-19.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

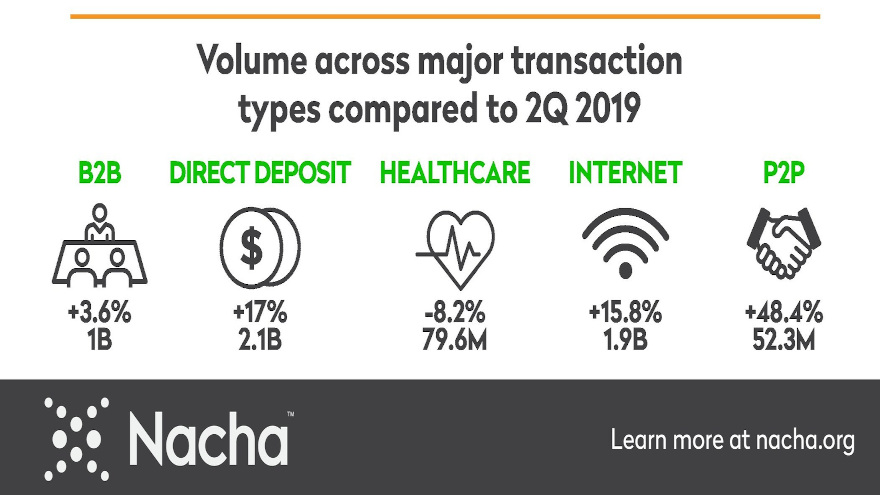

Last week, Nacha highlighted how much electronic financial transactions jumped year-over-year during the second quarter, triggered in part by the coronavirus pandemic.

The steward of the ACH Network, a payment system that universally connects all U.S. bank accounts and facilitates the movement of money and information, reported that Q2 ACH payment volume grew 7.9% compared to the same period a year earlier, reflecting the use of the ACH Network to deliver economic assistance to individuals and businesses, as well as an acceleration in the shift from paying by paper check to paying electronically.

Officials determined there were 6.6 billion payments made on the ACH Network during the quarter, representing a value of $14.7 trillion. Nacha indicated direct deposit payments rose 17%, due in part to federal and state assistance payments made to Americans in need.

“Direct deposit is the best way to reliably deliver pay and assistance to the vast majority of Americans,” Nacha president and chief executive officer Jane Larimer said in a news release. “All Direct Deposits are delivered on time and paid on the intended date. With same day ACH, urgent direct deposit payments can be initiated, and funds made available all within a single day.”

Nacha also noted Internet-initiated payments, which include primarily online bill payments and account-to-account transfers, increased by nearly 16%. Person-to-person transfers rose 48%. Officials explained both results are consistent with people making more payments remotely and shifting from paper checks to electronic payments.

Nacha went on to mention the pandemic’s impact was also apparent in some payment volume declines. Most dramatically, check conversion payments — in which a consumer’s paper check is processed electronically as an ACH payment — declined by 24%. At the point-of-sale, check conversion volume declined by approximately 45%.

Furthermore, officials pointed out a 4% decline in a recurring bill payment category is reflective of some disruption to certain types of monthly bills, such as mortgages, rent and loans, as well as the deferral of the federal tax payment deadline. Healthcare claim payments to medical and dental providers fell 8% from the second quarter of last year as many practices were shut.

Nacha closed its update by indicating same day ACH volume climbed 37% over a year earlier, with 81.6 million payments. The average dollar amount of a same day ACH payment increased by 33% in the second quarter, compared to the first quarter of 2020, as Nacha increased the allowable same day ACH transaction size to $100,000.

“ACH payments are for every day. As people, businesses and governments adapt to new conditions, they can rely on the ACH Network to deliver pay and benefits on time, to pay their bills, and so much more,” Larimer said.

In a preview of what he will discuss in more detail during the all-digital Automotive Intelligence Summit, DRN executive vice president and general manager of fintech Jeremiah Wheeler offered some insight into the company’s location data gathered since the coronavirus pandemic began.

Wheeler is also among the keynote presenters during the Auto Intel Summit presented by DRN that begins on July 27.

To listen to this podcast, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.