Experts say fraud is expected to surge amid uncertain economic conditions.

Experian recently released its 2023 Future of Fraud Forecast, focusing on five threats that could prove challenging for consumers and businesses this year.

This year’s annual predictions show that fraudsters will use some new deception techniques to outsmart businesses and deceive consumers.

According to PwC’s Global Economic Crime and Fraud Survey, 52% of companies with global annual revenues above $10 billion experienced fraud during the past 24 months and nearly one in five reported that their most disruptive incident had a financial impact of more than $50 million.

To help businesses and consumers prepare for fraudulent activity in 2023, Experian’s top fraud predictions include:

1. Fake texts from the boss

Given the prevalence of remote work, Experian predicts there’ll be a sharp rise in employer text fraud.

This occurs when the “boss” texts the employee to buy gift cards using a bogus reason, and then asks the employee to email the gift card numbers and codes. Fraudsters then use the gift cards, leaving the employee and/or the company with the expense.

2. Beware of fake job postings and mule schemes

Amid uncertain economic conditions, Experian predicts fraudsters will create fake remote job postings, specifically designed to lure consumers into applying for the job and providing private details such a Social Security Number and date of birth on a fake employment application. The job never materializes, and the fraudsters use the information provided to commit identity theft.

Experian also predicts that consumers could fall prey to mule recruiting schemes.

Experian explained this sequence happens when people sign up for work from home jobs and unintentionally act as a re-shipper of stolen goods or help move money through their personal bank accounts on behalf of fraudsters.

3. Frankenstein shoppers spell trouble for retailers

Synthetic identity fraud is the fastest growing financial crime in the United States, according to The Federal Reserve. This type of fraud involves a fraudster creating a synthetic or “Frankenstein” identity by combining real and false information and opening and building up lines of credit, eventually maxing out their credit limit and never paying it back.

Experian expects a new version of this fraud could result in major losses for retailers in the coming year. Fraudsters can create online shopper profiles using synthetic identities so that the fake shopper’s legitimacy is created to outsmart retailers’ fraud controls.

As the shopper’s profile matures, experts said criminals add stolen payment cards to the accounts. When the fraud eventually occurs, a single synthetic identity will have multiple credit lines to burn through across retailers, according to Experian.

4. Social media shopping fraud

Experian predicts in-app social commerce fraud could result in millions of dollars in losses. These apps are designed to make shopping easy, intuitive and compelling for consumers to make purchases without leaving the app.

Experts said this means legitimate brands are racing to make social commerce a part of their sales strategy. However, social commerce currently has very few identity verification and fraud detection controls in place, making the retailers that sell on these platforms easy targets for a surge in fraudulent purchases.

5. Peer-to-peer payment problems

Consumers love the convenience of peer-to-peer payments and usage continues to grow. Fraudsters also love peer-to-peer payment methods because they’re an instantaneous and irreversible way to move money, enabling fraudsters to get cash with less work and more profit.

Experian predicts fraudsters will gain even more unauthorized access to peer-to-peer payments by using multiple social engineering techniques. Consumers will be duped into buying fake items, sending the money to fraudsters and then never receiving their orders. They’ll also be tricked into giving their account credentials, enabling fraudsters to send cash to themselves.

“As fraudsters become more sophisticated and opportunistic, businesses need to proactively integrate the latest technology, data and advanced analytics to mitigate the growing fraud risk,” said Kathleen Peters, chief innovation officer at Experian Decision Analytics in North America.

“Experian is committed to continually innovating and bringing solutions to market that help protect consumers and enable businesses to detect and prevent current and future fraud,” Peters continued in a news release

Experian’s suite of fraud prevention and identity verification tools can help businesses detect and combat fraud. Experian estimates that its fraud prevention solutions helped clients save $11 billion in fraud losses globally last year.

To learn more about Experian’s fraud prevention solutions, visit https://www.experian.com/business/solutions/fraud-management.

Pete MacInnis, founder and CEO of eLEND Solutions, and his team rolled out a pair of new tools during NADA Show 2023 to help dealerships and finance companies.

First, eLEND Solutions launched of DealMaker, a digital finance pre-desking platform. MacInnis explained that the platform is an evolution of basic online payment calculator tools and the “educated guesswork used by most desk managers.”

Also, MacInnis and eLEND Solutions deployed of IDentify, a layered, multi-factor, identity verification solution designed to verify a customer’s true identity and establish “proof of presence” in an interaction.

Both tools are geared to help amid an uncertain economic landscape with fraud growing more prevalent.

With DealMaker, eLEND Solutions said it is designed to eliminate frictions and profit leaks by providing customer and vehicle-qualified payment terms matched to finance company fundable contract terms prior to the F&I handoff.

“Most digital retailing experiences promise more than they can deliver, especially when it comes to matching a consumer’s credit profile, vehicle selection and deal structure to a fundable purchase contract with lenders,” said MacInnis, who runs an automotive fintech company focused on accelerating “transactional” digital buying experiences.

With affordability representing a bigger challenge to vehicle buyers and monthly payments matter more than the selling price, eLEND Solutions contends that ensuring quoted payments are accurate is critical to modern retailing success.

Yet, in a new report from eLEND Solutions, based on a recent survey of auto dealerships, the majority said it’s common for payment estimator tools to provide inaccurate or unrealistic payment expectations.

DealMaker is designed to solve this matter and is currently being piloted by a handful of dealers across the country.

Here’s how DealMaker is designed to work:

• DealMaker is powered by a logic- and rules-based decision engine and pre-desking software that goes deeper than other tools that calculate payments based on factory cash, finance, and lease incentives with fully integrated rates and residuals.

• DealMaker is embedded within the dealer’s sales and finance workflow, similar to a finance company’s loan origination system (LOS) and empowers fundable deal structuring matching the vehicle model ID/trim level and the consumer’s entire credit profile to a waterfall of lender programs, including underwriting, pricing, loan advance and stipulations simultaneously.

• DealMaker includes advanced credit filtering and calculation logic for all makes, all models, new and used, all terms and all credit tiers.

• Consumer-submitted credit application and full credit file is parsed and filtered by DealMaker to determine ability, stability and credit qualifications.

• DealMaker’s rules-based decision engine then calculates debt-to-income, payment-to-income and loan-to-value ratios; identifies high credit, time on credit report and lender rules, which can vary depending on consumer qualifications.

• DealMaker’s loan program pricing varies by lender and is based on: is the vehicle new, pre-owned, or certified pre-owned? Is it the same brand as the captive lender, are there mileage limitations at different terms and more.

• DealMaker credit decision results are displayed instantly at the point of sale.

• DealMaker matches “The Deal” to the best lender fundable program.

•The near-final deal can be negotiated online or completed before the test drive ends.

A hybrid, pre-desking solution for digital retailing, MacInnis noted that DealMaker is powered by advanced credit filtering and calculation logic and can match a remote or in-store customer and vehicle-of-choice to a waterfall of qualifying finance company programs, “eliminating F&I guesswork.”

MacInnis mentioned that 88% of dealers report they would realize a 10% or more increase in F&I sales penetration if consumers are quoted qualified payment terms matched to finance company fundable contract terms, with dealer mark-ups, before getting to the F&I office.

Moreover, MacInnis said 85% of surveyed dealers estimate that this process could save 15 minutes or more in the F&I office (with over 30% saying it would save more than 30 minutes).

“Quoting transactional and fundable rate, term and payment options reduces frictions during the negotiation, leads to faster, more profitably structured deals and higher closing ratios. It can also positively impact F&I sales penetration,” MacInnis said.

“Making deals transparent is the linchpin to accelerating digital retailing into truly successful modern retailing. This, along with fully connected workflows, is the mission of DealMaker,” MacInnis went on to say.

Details of fraud-stopping tool

MacInnis said a combination of identity proofing technologies can dramatically reduce fraud risks by detecting account takeover, true name, synthetic and other forms of identity fraud in the vehicle purchase process.

In just the past year, eLEND Solution’s recent report found that 79% of dealers directly experienced an identity fraud-related vehicle loss at their dealership.

Furthermore, the report revealed that the large majority are not using any identity verification technologies as part of their fraud prevention strategy, instead choosing to rely on conventional methods such as photocopying IDs.

“These unsophisticated defenses are not only ineffective against increasingly sophisticated fraud schemes, but they also put dealerships at risk” MacInnis said in another news release. “This is why we developed IDentify, which offers unparalleled ID fraud protection for dealerships, including protections for both traditional (in-store) and digital retailing (remote) transactions” continued MacInnis.

IDentify offers a combination of multi-factor identity verification solutions:

• Identity Data Check can cross match customer-provided information against hundreds of databases, including government agencies, public utilities, cell phone carriers, etc. to verify the customer’s name, address, date of birth, Social Security and cell phone numbers.

• Confirm Identity is a multi-factor authentication and fraud prevention tool that can replace traditional out-of-wallet questions with a “proof of presence” feature that sends a one-time passcode to the cell phone number of the customer identified by the phone carrier.

Here’s how IDentify is designed to work:

• Once a customer has signaled a strong intent to buy, dealers can send an email link to a short form requesting their personal information and their consent to verify identity to protect against identity fraud.

• If a customer has already submitted a credit application through one of eLEND’s Credit Solutions, the consent language includes running the IDentify Data Check Report.

• In-store, dealers are able to get customer consent and run the IDentify Data Check Report through the dealer dashboard.

• Dealers have the option to run the Identity Data Check independently or in conjunction with the Confirm IDentify multi-factor authentication and fraud prevention tool.

• Results are displayed in the dealer dashboard, showing a match to customer name, address, date of birth, social security number and cell phone or an alert that warns there is no match to database records.

• IDentify can be implemented in any digital retail solution through APIs – an increasingly critical function as 95% of dealers attribute increased identity fraud to the increased digitization of the deal and remote buying.

Chuck Bell is corporate finance director for Bayway Auto Group and added perspectives in the news release from eLEND Solutions.

Bell said, “eLEND Solutions IDentify product is a core component of our digital retail strategy. It enables us to identify our customers before engaging in test drives and remote test-drives or deliveries. It has already saved us countless thousands of dollars.”

MacInnis added IDentify is fully integrated with eLEND Solutions’ ID Drive, a driver's license scanner that can perform dozens of forensic document tests in real time for robust authentication on any driver's license or any other government issued ID from the U.S., Canada, and Mexico, plus 160 worldwide jurisdictions.

Furthermore, MacInnis said eLEND’s Identification Solutions are integrated with eLEND’s Credit Solutions that match identity to credit application and credit report data. From pre-screen, pre-qualification and traditional hard credit pulls, all data is cross-referenced and integrated with Red Flag and Synthetic Fraud tools from companies such as 700Credit.

Among the episodes of the Auto Remarketing Podcast recorded during the 2023 Vehicle Finance Conference hosted by the American Financial Services Association, this one features Point Predictive chief fraud strategist Frank McKenna.

Our monthly look at fraud trends within auto finance and beyond came via an in-person conversation in Dallas.

To listen to the conversation, click on the link available below.

Download and subscribe to the Auto Remarketing Podcast on iTunes.

Alloy released a survey report on Monday indicating that 27% of respondents involved in financial services lost more than $1 million to fraud during the past 12 months.

The identity decisioning platform said 70% of respondents reported losing more than $500,000 to fraud, with fintech companies and regional banks being the most likely to report higher losses.

Alloy indicated 37% of fintech companies and 31% of regional banks estimated losing between $1 million and $10 million to fraud.

The firm’s annual State of Fraud Benchmark Report surveyed more than 250 decisionmakers working at financial institutions including community banks, fintech, crypto, national banks, regional banks, and online lending institutions. The survey ran from Sept. 8-20 and respondents came from roles across fraud, compliance, risk technology procurement, digital banking strategy and account opening.

Alloy acknowledged fraud continues to plague financial institutions of all sizes and across all segments.

According to the survey, one-third of respondents said they experienced between 1,000 and 10,000 fraud attacks in the past 12 months, while 91% of respondents said fraud has increased year-over-year since 2021.

“Fraud is the highest it’s ever been,” Alloy CEO and co-founder Tommy Nicholas said in a news release. “Rapid digitization and an influx of cash from pandemic relief scams have created the perfect conditions for fraudsters to thrive. Regardless of sector or size, financial institutions must do more to keep their customers’ assets safe from fraud, but without compromising on the customer experience.”

The report also found that fraud prevention is a costly and time-consuming enterprise for financial institutions.

In fact, two-thirds of respondents reported that more than half of their workforce is working on fraud-related activities.

The survey also showed 71% of respondents have increased their spending on fraud prevention year-over-year. Respondents were also concerned about additional ‘hidden’ costs of fraud such as legal repercussions, regulatory fines, reputational damage and loss of clients.

In other findings, respondents reported that the main barrier to defending against fraud is automation, with 46% of respondents cited a greater need for automation as the most common barrier to being prepared to combat fraud, followed by an absence of dedicated teams for fraud (41%) and the inability to adapt to new threats (39%).

For more insights, the full report can be found via this website.

The monthly installment of the Auto Remarketing Podcast dedicated to fraud prevention was recorded in person during Used Car Week in San Diego where Point Predictive is headquartered.

Chief fraud strategist Frank McKenna shared some recommendations for dealerships and finance companies as well as consumers to help stop fraud from impacting their holiday season.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

A recent dealer survey by eLEND Solutions showed how much stores feel exposed to fraud.

Last week, Point Predictive launched a solution to address that specific challenge and more with a tool to help finance companies vet dealerships based on their historical contract performance

Point Predictive highlighted DealerExplorer is a solution that can help auto finance companies evaluate prospective dealerships before adding them to their network by providing insights into the quality and quantity of deals originating from a dealership.

Point Predictive said through a news release that its tool can help finance companies better assess risks associated with dealerships they may be considering for their portfolio.

DealerExplorer can provide data for finance companies to evaluate prospective dealerships based on their contract performance history as seen in the Point Predictive data consortium.

Finance companies can receive comprehensive reports on prospective dealerships and can extract raw data from the report to use during their internal analysis and onboarding processes.

DealerExplorer users can expect to strengthen and expand their dealership portfolio and reduce the risk of default.

The solution can provide insights into more than 150,000 dealerships nationwide to ensure that finance companies are receiving high-quality applications and paper while forming successful partnerships with dealers.

“Historically, when indirect lenders are evaluating a dealership for addition to their portfolio, they have very limited information regarding the dealership’s historic loan performance and what kind of risks that dealership might present,” Point Predictive CEO Tim Grace said. “DealerExplorer leverages our data consortium to provide lenders with insights into dealerships they currently have no relationship with. This provides valuable information to help determine whether a particular dealership is a good fit to be added to a lender’s dealership network and can improve the quality of loans in their portfolio.”

The Point Predictive data consortium was purpose-built for risk management with:

—More than 120 million historical applications

—Reported income for more than 61 million consumers

—17 million employer records with 8,100 fake employers

—More than 200,000 Social Security Numbers tied to default

—102 million Social Security Numbers of deceased individuals

—More than $9.1 billion in contract with early payment defaults

—$1 billion in paper identified as fraudulent

—Millions of addresses and telephone numbers linked to risk of fraud or default.

To learn more about DealerExplorer visit https://pointpredictive.com/ or contact [email protected].

Most dealers who participated in a new survey from eLEND Solutions acknowledged they have a serious problem in connection with digital retailing and many do not have a proven strategy to solve it.

According to the fintech company’s new report titled, “Is Identity Fraud Jeopardizing Digital Retailing Profitability,” 60% of participating dealerships reported the loss of three or more vehicles to identity fraud during the past year.

Furthermore, the report based on a survey of more than 700 auto dealerships across the U.S. also revealed that while dealerships cite identity fraud as their top fraud challenge/concern, they almost unanimously agree that its increase is because of the increased digitization of the deal, since 67% lack adequate identity fraud protections.

“The pandemic changed a lot of things in the auto industry — and that is particularly true when it comes to fraud which, as this report underscores, is causing more and more losses for dealers — an estimated $619 million for franchise dealers alone,” eLEND Solutions CEO and founder Pete MacInnis said in a news release.

“Economic conditions and, especially, increasing digitization of the car buying process are driving more fraud but, unfortunately, this report reveals that most dealerships have not implemented ID verification technologies that can prevent it,” continued MacInnis, who is among the speakers set to appear during Used Car Week, which begins on Nov. 14 in San Diego.

According to the report, 84% of dealerships have directly experienced identity fraud at their dealership since the pandemic, with a third seeing an over 20% increase in identity fraud-related activities since the pandemic started.

And in just the past year, eLEND Solutions 79% of dealerships directly experienced an identity fraud-related vehicle loss at their store.

When asked to explain the increase in identity fraud, 95% of survey participants related it directly to the increase in the digitization of the deal and remote buying experiences, with 86% predicting that as more of the transaction moves online, identity fraud will increase and become harder to prevent.

The report also showed that losses are not limited to identity fraud, with most dealerships reporting an increase in credit application fraud in the past year.

According to the findings, 77% saw a 10-20% increase or more, with more than one-third reporting that one in every 100 applications at their dealership was fraudulent.

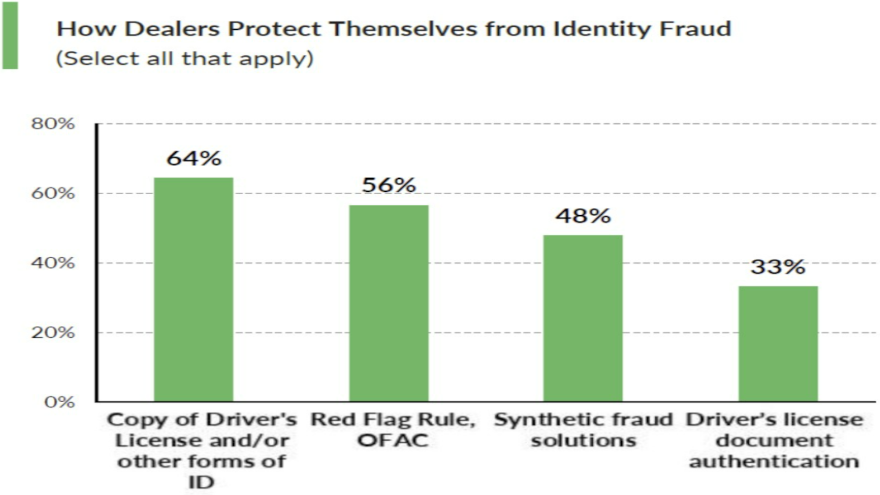

The report also investigated what dealerships have been doing to prevent fraud with photocopying the driver’s license / ID coming in No. 1 with 64% using this strategy, and the “Red Flags Rule” coming in second with 56% of stores doing this process.

Only 33% reported using critical document authentication as part of their process, a significant disconnect, according to eLEND Solutions.

“Without actually validating/authenticating ID documents and buyer identities, dealerships remain particularly vulnerable,” MacInnis said in the news release. “As more of the transaction becomes digital, embracing ID verification technologies that include forensic authentication of the driver’s license document, in conjunction with matching data extracted from the document against hundreds of databases, can easily help dealers minimize fraud risks before it becomes an expensive problem.”

Dealers were also asked about the timing of their credit pulls, a practice that rapidly evolved once the pandemic prompted more of the process to move online.

As compared to 2018, when only 8% of dealers said they pulled credit before the test drive, today 40% report doing so, with only 20% today waiting until right before the F&I handoff, versus 39% in 2018.

“This shift in credit pull timing is a dramatic and positive change in the way auto dealerships do business and, with the right technology in place, has positive implications for preventing fraud if dealerships take the opportunity to validate customer identity upfront with the simple swipe of a driver’s license — but only if document authentication is part of that process,” MacInnis said.

Other key data takeaways from the report included:

• 84%, say there has been a noticeable increase in identity fraud since the pandemic.

• 79% of dealers experienced an identity fraud-related vehicle loss at their dealership in the past year.

• 79% say that identity fraud has increased in their dealerships by over 10%, and nearly one-third say it has increased between 21% and 30%, or more.

• 60% reported a loss of three to five vehicles, or more, in the last twelve months.

• 89% of dealerships report an increase in loan application fraud in the past year.

• 34% report that one in every 100 applications at their dealership was fraudulent.

• 95% track identity fraud to the expansion of remote buying experiences and the digitization of the deal.

• 86% agree that as more of the transaction moves online, identity fraud will continue to grow and become even more challenging to prevent.

• 67% do not include driver’s license document authentication to protect themselves from identity fraud.

• 40% report pulling credit before the test drive, vs 8% in 2018.

• 93% say that if a driver’s license scan could be converted into a consumer consented pre-qualification it would be a meaningful benefit.

The complete report can be downloaded via this website.

Point Predictive chief fraud strategist Frank McKenna returned for his monthly visit on the Auto Remarketing Podcast.

With Halloween a week away, McKenna explained what “scary” financial things such as phantom loans and the dark web are and how they can greatly impact auto financing.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Perhaps as frustrating to auto finance companies as fraud infiltrating its portfolio is an applicant that might be OK, but somehow tripped a trigger inadvertently, and the potential paper went into the electronic trash.

To help limit the more than $100 billion of global sales revenue lost to false positives during the fraud detection process, TransUnion announced the launch of TruValidate Device Risk with Behavioral Analytics.

The solution is newly fortified by NeuroID’s behavioral analytics and aims to help businesses stop fraud — not good customers — based on device recognition, context, device and user behavior.

TransUnion highlighted the solution builds trusted connections by allowing users to join a global network of 6,000 fraud and security analysts, more than 10 billion known devices and more than 100 million detailed known fraud reports.

TransUnion’s TruValidate Device Risk with Behavioral Analytics is configurable, enabling users to measure the risk of a device and user by combining device intelligence and applicant behavior signals powered by NeuroID to their unique fraud challenges.

“Leveraging the right solutions to prevent fraud and identity theft is paramount to any business. In today’s dynamic economy where consumers often have many choices, it’s just as important to prevent a false positive wherein a ‘good’ customer may be turned away due to faulty technology or data,” said Shai Cohen, senior vice president and head of global fraud solutions at TransUnion.

“With the addition of NeuroID behavioral analytics technology to the TruValidate suite of solutions, our customers have access to an array of comprehensive and integrated tools to help them improve fraud detection while ensuring false positives are mitigated earlier in the customer journey,” Cohen continued.

TransUnion and NeuroID first partnered in 2020 to help insurance carriers find new ways to support customers, improve the customer experience and detect and prevent fraud. Key elements within the new solution include Behavior Insights, powered by NeuroID and Insights Center, powered by NeuroID.

TransUnion explained this technology uses behavioral analytics to help determine whether an applicant is genuine or risky based on how familiar the applicant is with the data that they are entering into a digital application. The proprietary process immediately can help enable deep visibility into a user’s unique digital interactions without collecting any personal data from the applicant.

“In addition to real-time scoring of individual applicant behavior, we also aggregate all behavior observed in an application to monitor broader behavioral trends. This aggregated data is displayed through a near-real time dashboard to help businesses more easily understand the behavior patterns of their risky and genuine applicants at scale — without requiring the support of a robust data science team,” NeuroID chief executive officer Jack Alton said. “This enables customers to optimize their applications for the different types of users they receive — adding step-up for risky applicants and reducing friction for genuine applicants.”

These new features work in tandem with TransUnion Device Risk’s existing anomaly detection, location intelligence and device reputation and device behavior analysis to help increase fraud capture and actionability.

“The new solution features patented neuroscience technology which can assess how familiar users are with the personal information they provide to a financial institution. By analyzing this data in real-time, these products can help provide critical information as to whether a loan applicant’s intentions are genuine, or deceptive, without adding any additional friction to the process,” said Jason Laky, executive vice president and head of financial services at TransUnion.

Based on the theme of going back to school, Point Predictive’s Frank McKenna and Justin Davis made their monthly visit for the Auto Remarketing Podcast to discuss developments associated with fraud.

McKenna and Davis shared what’s been the most interesting fraud element they’ve each learned so far this year and how it might be applicable to auto financing.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.