Private investment firm J.C. Flowers & Co. announced on Tuesday that it has signed a definitive agreement to make a majority investment in iLendingDIRECT, a leading auto refinance marketing company.

While terms of the transaction were not disclosed, J.C. Flowers said in a news release that the agreement is expected to close during the first half of this year.

The announcement also indicated that iLending chief executive officer Nancy Fitzgerald and president and chief executive officer Tom Holgate will remain investors in the company.

After the closing of the transaction, Fitzgerald will sit on the board of directors and serve as a strategic consultant to the company, focused on sourcing strategic partnerships for the business. Meanwhile, Holgate will take over as acting CEO of iLending.

Founded in 2006 and based in Englewood, Colo., iLending is a national leader in automotive refinancing. Through strategic partnerships with credit unions, banks and other financial institutions nationwide, the company offers consumers lower interest rates on auto loans and other creative financing solutions.

The relationships can result in iLending saving consumers thousands of dollars in interest and payments while providing financing partners with high quality paper that meet their footprint and credit criteria.

By utilizing its proprietary software platform, iLending refinances auto loans and offers vehicle service contracts, GAP waivers and other vehicle protection products directly to customers.

The Better Business Bureau listed iLending as an A+ Rated Accredited Business, and the company has been honored as one of the Denver Business Journal’s Best Places to Work annually since 2016.

“J.C. Flowers is widely viewed as a global leader for investment in financial services companies. Their interest in iLending is a testament to our team and what they have been able to accomplish for our customers,” Fitzgerald said in the news release. “J.C. Flowers’ commitment will further strengthen our operations and product lines, making us the premier choice in automotive refinancing.”

Holgate added, “Many of our customers have been negatively impacted by COVID-19. We are proud that we have been able to help them save some money in this time of financial stress.

“J.C. Flowers recognized the value iLending provides to its customers, which includes both lending partners and consumers. We look forward to working with their team now and long after the pandemic subsides,” Holgate went on to say.

Weil, Gotshal & Manges served as legal counsel to J.C. Flowers. Locke Lord served as legal counsel and Roth Capital acted as financial advisor to iLending.

“J.C. Flowers invests in niche financial services companies with strong potential. We were attracted to iLending by its strong growth, solid operational foundation, and its commitment and agility in meeting the needs of both consumers and lending partners under Nancy and Tom’s leadership,” J.C. Flowers managing director Tom Harding said.

“We expect demand for auto refinancing to remain strong as savvy consumers continue to look for ways to save money. We are excited to work with Nancy, Tom and the iLending team to grow the business to take advantage of the expected strong demand,” Harding continued.

Tresl is making an investment in a fellow fintech stemming from a relationship that began nearly two years ago.

And the firms are also rolling out a tool aimed to help banks and credit unions.

On Tuesday, Tresl announced that the company has made a strategic investment in CreditSnap, which describes itself as a next-generation lending platform based in San Antonio. Tresl said it also will take a seat on CreditSnap’s board of directors, according to a news release.

CreditSnap is an award winning fintech company that provides a lending and account opening platform to banks and credit unions as a white-labeled product. This same platform powers Tresl’s digital pre-qualification experience and helped Tresl achieve a 100% improvement in look-to-book ratio as well as improved customer satisfaction in both its auto refinance and auto purchase loan channels.

Based on "overwhelmingly positive" results, the two firms agreed to align officially with the shared objective of serving the needs of the bank and credit union community.

The relationship between Tresl and CreditSnap began in late 2018 when Tresl was looking for an innovative way to deliver highly accurate pre-qualified rates and terms to its customers. After extensively evaluating multiple solutions, Tresl found that CreditSnap’s SaaS solution was superior.

After some rapid configuration and setup, Tresl deployed CreditSnap’s pre-qualification engine in early 2019, overnight becoming CreditSnap’s largest client. In conjunction with other proprietary technology and operational optimizations Tresl has undertaken, the CreditSnap pre-qualification engine has allowed Tresl to unlock strong results, including more than 100% improvement in look-to-book ratio and improved customer satisfaction.

“CreditSnap’s pre-qualification engine served as a strong technology platform to fuel Tresl’s own growth over the last two years,” Tresl president and chief executive officer Christine Pierson, one of the 2020 Women in Auto Finance honorees.

“The CreditSnap system integrated seamlessly with Tresl’s proprietary digital platform, and it has allowed us to deliver more quality funded loans to our lending partners and a great lending experience to our customers,” Pierson continued.

Along with the strategic investment, Tresl and CreditSnap are also announcing an alliance to bring a new joint product proposition to the market known as BankingAmplified.

The companies explained this new product takes inspiration from Tresl’s customer experience and fulfillment capabilities, and CreditSnap’s pre-qualification based digital experience capabilities. The result is geared to a unique solution designed to support banks, credit unions and lending institutions in achieving their digitization and customer growth goals in a turnkey approach.

The companies explained the BankingAmplified program can enable financial institutions to do the following:

● Grow member / customer base by deploying borrower-friendly “no credit impact” pre-qualification technology, end to end digital fulfillment capabilities, highly curated customer acquisition methods, white-label consultative sales solutions, and compliant transaction solutions in all 50 states. In-turn, financial institutions will be fully equipped to compete with fintech lenders

● Increase share-of-wallet through intelligent cross-selling of products to existing and new customers

● Accelerate product go-to-market with turnkey digital experience and lead generation solutions, be it to grow high volume specialty transactions like auto lease purchases or to expand into high yield student loan refinancing and personal loans, or to offer non-traditional products like installment loans

“With the new BankingAmplified product offering, we aim to offer a complete turn-key fintech enablement solution to banks and credit unions, enabling them to effectively compete with major fintech lenders in the marketplace today,” Pierson said.

With this investment and product pipeline, CreditSnap president and co-founder Deepak Polamarasetty elaborated about the potential success for his firm as well as Tresl.

“Unlike fintech lenders, banks and credit unions are uniquely positioned to deliver personalized financial solutions to their customers,” Polamarasetty said. “What they lack, however, is the same cutting edge technology that solves for customer experience.

“BankingAmplified empowers these lending institutions to strike a healthy balance of tech and human touch — digital experience powered by next generation technology (with CreditSnap) and result-oriented customer experience that integrates 100% digital experiences with the consultative, omnichannel support of finance experts (with Tresl),” Polamarasetty went on to say.

Within a week, another Emerging 8 honoree received an injection of financial resources from the investment world.

Soon after an announcement by Volta, fellow honoree MotoRefi — an auto refinancing startup on a mission to help people save on their retail installment contracts — announced a $10 million Series A1 funding round. MotoRefi said the round was led by Moderne Ventures, whose partner Liza Benson will join the company’s board.

This Series A-1 round follows its Series A round, announced in February, which garnered $9.4 million for MotoRefi, bringing the 12-month fundraising total to nearly $20 million.

Since then, the company has been growing at a rapid clip. In 2020 alone, the company said it:

● grew its revenue six times

● doubled the number of finance companies on its platform;

● tripled its headcount

In adding MotoRefi to the Moderne portfolio, Benson said in a news release, “I couldn’t be more excited about MotoRefi’s trajectory and the team they’ve built. They are revolutionizing the auto finance space for consumer auto — a $1.2 trillion market — and are the unequaled tech leader in this largely untapped space.”

MotoRefi’s platform works with numerous credit unions, community banks and other finance companies in an effort to provide an “unparalleled” experience for both consumers and providers that fintech firm said can be up to 20 times more efficient than any other offering currently in the auto refinancing industry.

“We are tremendously excited to add Moderne Ventures and their wealth of consumer finance experience to the team,” MotoRefi chief executive officer Kevin Bennett said.

“Their partnership will enable us to accelerate our already strong growth trajectory, invest more deeply in our tech platform, grow the team and reach a growing segment of this large market,” Bennett continued. “It all adds up to more savings for consumers. That’s the mission.”

Volta certainly recharged its finances to begin 2021.

The Emerging 8 honoree previously highlighted in Auto Fin Journal and developer of commerce-centric electric vehicle charging networks announced an oversubscribed Series D financing of $125 million. Volta said this week that Goldman Sachs acted as exclusive placement agent to the company in connection with the financing.

Volta builds and operates an EV charging network with one of the highest utilization rates in the United States. Strategically placed in front of essential businesses such as grocery stores, pharmacies, banks and hospitals, Volta’s EV network supports a larger consumer trend toward vehicle electrification by placing fueling stations in parking lots directly where consumers already spend their time and money.

Currently located in 23 states and more than 200 municipalities, Volta highlighted that its unique approach has gained significant acceptance and penetration in the market.

“The electrification of mobility is one of the largest infrastructural shifts of our generation and Volta’s charging network is ready to anchor the accompanying consumer behavior that will change along with it,” Volta founder and chief executive officer Scott Mercer said.

“As we transition out of the carbon economy, we will see a fundamental transformation of our existing fueling infrastructure,” Mercer continued. “Businesses anticipating this shift can take advantage of a revenue transfer from gas stations to retail locations in the community where consumers go, live, shop and play.”

Unique to the EV market, Volta’s business model centers around evolving spending habits caused by the move to electric vehicles by building charging infrastructure that reinforces the desired behavior at each location.

Volta’s charging stations feature 55-inch digital displays, doubling as a sophisticated media platform providing brands a way to reach millions of shoppers seconds before they enter the store to make a purchase. These sponsor-supported charging stations provide free energy to customers who are able to plug in their vehicles where and when they shop.

Volta’s business partners who install charging stations experience immediate returns; they report an increase in spend, dwell time and engagement on site.

The Series D fundraising capped a banner timeframe for Volta, bringing the company’s total equity financing to more than $200 million. The capital raise will further accelerate Volta’s efforts to unlock the value of their contract portfolio and increase its investment in product, engineering and network infrastructure. It will also allow Volta to begin its international expansion.

“As consumer interest in environmental initiatives takes hold across the economy, Volta is positioning itself as a top-of-mind brand in the electric vehicle space,” Volta co-founder and president Chris Wendel said.

“Volta is accelerating the future of infrastructure as a catalyst with its unique business model that brings a differentiated value proposition to our real estate and retail partners,” Wendel continued. “By bringing charging stations to essential businesses, our end user will increase their dwell time, engagement and spend.”

Volta insisted that its approach is already gaining significant acceptance and penetration in the market. The company has signed agreements with well-known property owners including Albertsons Companies, Giant Food, Regency Centers, Wegmans and Topgolf.

In addition, Volta’s media network has attracted some of the world’s most notable brands including General Motors , Hulu, Nestlé, Polestar, Porsche and Unilever.

“Since our initial investment in Volta in 2018, excitement and interest in electrification — and specifically solving for public charging solutions — has continued to gain momentum,” said John Tough, managing partner at Energize Ventures, a major and existing investor in this round.

“Our conviction in this team has similarly grown, and we believe Volta is poised to lead this market as the most capital-efficient and highly utilized EV charging network in the country,” Tough added in the news release.

Lightico not only is gaining more clients, but the platform built so customers can interact digitally with auto-finance companies and other financial services firms is securing more funding resources, too.

On Tuesday, Lightico announced a $13 million investment led by Oxx, with participation from Capital One Ventures and Harmony Partners, to accelerate adoption of its digital customer interaction platform and bringing its total amount raised to $27 million.

Joining the round are previous Lightico investors, including lool Ventures, Crescendo Venture Partners, Mangrove Capital Partners and Spinach Angels.

The financing follows unprecedented, urgent demand for and adoption of end-to-end digital transformation. According to a McKinsey study, companies are accelerating their digitization plans by an average of seven years as a result of the pandemic.

Lightico highlighted the new capital will fuel the company’s scale, growing its customer base of mid to large enterprises and enable the company to deliver a more robust platform for digitizing customer journeys.

For example, the company explained bank loans and insurance claims can be processed quickly and securely using Lightico’s customer interaction platform.

Lightico can create a virtual collaboration window between the business and their client. The client can then access the collaboration window easily and securely on their mobile device, where they can share and receive documents, and process eSignatures, payments, identification and verification (ID&V) and more.

“The hardships of the past several months have challenged us all but they have also been an incredible catalyst for digital transformation across industries,” Lightico co-founder and chief executive officer Zviki Ben Ishay said in a news release.

“This investment isn’t just fuel for continued growth, but a strong vote of confidence in Lightico’s mobile-first platform and model that thrived during a challenging first half of 2020,” Ben Ishay continued. “We’re proud to have such incredible partners joining our mission of making business interactions simple and digital in a complex world.”

Lightico — one of this year’s Emerging 8 highlighted in Auto Fin Journal — helps its clients improve customer experience and efficiency, through faster turnaround times, higher completion rates and higher NPS –– significantly impacting bottom-line results. Clients include leading financial institutions, insurance providers, including companies like Capital One and GlaxoSmithKline.

“In today’s world, best-in-class remote customer service has never been more important––and Lightico is essential for providing it,” said Richard Anton, general partner at Oxx. “Lightico is much more than a ‘contract management’ solution. It solves the entire ‘last mile’ problem, allowing all the processes involved in customer transactions to be fulfilled completely digitally, in a frictionless and very user-friendly way.

“The Lightico team has created a strong platform for further growth and we’re thrilled to join Zviki and his superb team at this next stage of the journey,” Anton continued.

Adam Boutin, a partner at Capital One Ventures, added this perspective on the investment.

“Be it through our award-winning mobile app or cutting-edge virtual assistant, Eno, Capital One is at the forefront of meeting customers where they are,” Boutin said.

“COVID-19 has heightened the need for digitization in financial services and Lightico has helped us meet these challenges by providing an agile and seamless platform to quickly digitize servicing workflows,” Boutin went on to say. “By investing in Lightico we are recognizing the value of this partnership and continuing to support innovation in customer experience.”

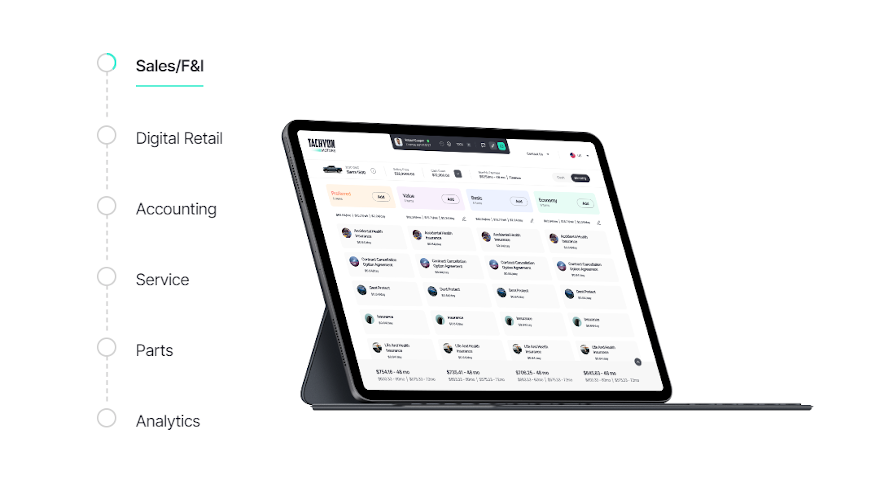

Fueled by its Series C financing round of $150 million, Tekion recently announced its valuation now stands at more than $1 billion.

And with an array of automakers and major dealership groups in the mix, the cloud technology company and provider of a Sofware as a Service retail operating platform have its eyes on making automotive retail similar to other popular places where consumers spend time and money nowadays.

“Today’s consumers receive outstanding personalized retail experiences from companies like Amazon, Apple, Google and Disney,” Tekion chief executive officer Jay Vijayan said in a news release. “Why shouldn’t they expect the same in their vehicle acquisition and service needs?

“We believe Tekion will be the trailblazer for enabling the modernization of the entire consumer journey and providing the best experiences and operational efficiencies, period. It’s time to even the playing field for the automotive retail industry,” Vijayan continued about its platform, Automotive Retail Cloud. “We are fortunate and proud to be supported by great investors from the world’s top OEM brands, top dealers in the country, venture and private equity firms.”

The latest funding round was led by Advent International, one of the largest and most experienced global private equity investors, with participation from Index Ventures, Exor (the holding company of Fiat Chrysler Automobiles and Ferrari), Airbus Ventures and FM Capital (a fund that includes a large number of top 100 dealers in the country as its limited partners).

Joe Serra is also an investor in Tekion’s series C round.

Tekion’s other key investors from the Automotive industry include General Motors, BMW iVentures and Nissan-Renault-Mitsubishi Alliance Ventures.

“We consider this as true validation of the value we are bringing to the industry,” Vijayan said about the $1 billion reading. “We are thrilled to welcome Advent as we scale our business, expand our products and transform what the auto retail experience should be.”

Tekion started on-boarding dealers on its Automotive Retail Cloud platform during the third quarter of last year and is growing rapidly nationwide by partnering with manufacturers and dealers of all sizes. Thus far, Tekion said dealers in 28 states use the Automotive Retail Cloud that’s already integrated with 17 OEM brands.

The company is targeting to complete the remaining OEM integrations early next year.

“Tekion is the true disrupter the industry has been waiting on for decades,” said Joe Serra, president Serra Automotive, who owns 50 dealerships representing 62 franchises spread across the country.

“I’m very impressed with their modern DMS platform and their awesome team,” Serra continued in the news release. “I’m so convinced that their technology and vision will transform automotive retail for consumers, dealers and manufacturers that I wanted to be a part of the change by investing in the company.”

More details about new funding

The company said Advent’s investment will provide Tekion with fresh capital to support additional investment in its platform and scaling the company.

“The automotive retail and dealer technology ecosystem are ripe for disruption. It has operated for too long with outdated technology and patchwork systems that fail to meet the needs of modern dealers and their customers,” said Eric Wei, a managing director on Advent’s technology investment team in Palo Alto, Calif.

“From the moment we started talking to Tekion’s dealers, we were blown away by the ease and speed of the migration process, especially from the multiple dealers who transitioned in one month’s time, entirely remotely during the COVID-19 pandemic,” continued Wei, who is joining Tekion’s board of directors along with Jon McNeill, an Advent advisory partner and former chief operating officer of Lyft and former president of global sales, marketing, delivery and service at Tesla.

“(Tekion’s) dealer-friendly approach to contract terms and data ownership will be a breath of fresh air for dealers. We are incredibly excited about the platform and the size of the opportunity,” Wei added.

Prior to Advent’s investment, Tekion had raised $65 million in equity financing from investors including Index Ventures, Storm Ventures, General Motors (GM), Alliance Ventures (Nissan-Renault-Mitsubishi), BMW iVentures, Exor, AME Cloud Ventures, alongside many dealer groups.

“We believe Tekion’s cloud-native technology, which simplifies sales and service for both consumers and dealership employees, has the potential to transform the automobile ownership experience,” FM Capital managing partner Mark Norman said.

Tekion explained that its Automotive Retail Cloud is designed to address the top pain points OEMs and dealers have been experiencing. The company said it has the first end-to-end cloud-native platform that brings every part of the retail journey in one seamless application.

In addition to advanced analytics, Tekion said it can provide open APIs and give dealers access to their data to glean valuable insights to help improve processes and experiences for their customers.

Tekion added that it also can provide enterprise scale capability for larger dealer groups with features such as centralized accounting and a highly secure data repository with the ability to access data from anywhere.

Dealer testimonials can be viewed at https://www.tekion.com/testimonials.

Point Predictive recently bolstered both its human and financial resources.

The San Diego-based company, which provides machine learning solutions to the financing industry to curb fraud and streamline operations, announced that it has completed its Series B growth financing.

Napier Park Financial Partners led the investment round with participation from the company’s existing investor, Mosaik Partners.

Point Predictive also announced it has hired Michael Housman as its new chief technology officer and promoted Eric Werab to chief revenue officer to facilitate the rapid growth Point Predictive is experiencing.

One of the first Emerging 8 honorees, Point Predictive has gained wide adoption of its Ai+Ni scoring solutions across the automotive and fintech markets during the last 18 months. The company said its Auto Fraud Manager, IncomePASS and Synthetic ID Alert solutions are quickly becoming de facto standards for auto-finance companies experiencing significant growth in their portfolios and looking to control their risk and streamline underwriting.

Point Predictive explained the new funding will help the company aggressively expand the executive, product, sales, and marketing teams as well as continue to grow its data scientist and engineering teams.

Point Predictive said it plans to enhance its solution portfolio in the automotive industry and expand into the mortgage, personal lending and other industries with their patented technology solutions.

To lead this growth, the company has hired Housman as CTO and promoted Werab to CRO.

Housman joined Point Predictive from RapportBoost.ai where he served as its chief data science officer.

Werab has been with Point Predictive for three years as the vice president of product strategy. Prior to joining the company, Werab led a software business in the risk and accounting space at Fiserv.

Point Predictive acknowledged that it expects to announce additional members of the expanded executive team during the fourth quarter.

“We believe Point Predictive is poised to transform the lending industry with their unique brand of Artificial and Natural Intelligence technology and their powerful proprietary consortium data,” Napier Park partner Steven Piaker said in a news release.

“As fraud continues to grow globally, the team at Point Predictive has figured out a way to power more trust in lending by informing lenders which consumers and loan actors they can trust, and which they cannot,” Piaker continued.

“We were impressed with their ability to apply their technology across multiple lending industries — auto, mortgage and fintech — and are excited to participate in Point Predictive’s future growth,” he went on to say.

The investment round follows a transformative year during which both Point Predictive’s data consortium and customer roster experienced unprecedented growth.

The auto fraud consortium now aggregates more than four billion risk attributes sourced from more than 70 million consumer loan applications, including loan performance and fraud information, obtained from 35 finance companies nationwide spanning more than 75,000 franchise and independent dealers.

Every month, more than 2 million auto-finance applications are scored with Point Predictive’s Ai technology adding more than 170 million risk attributes to the consortium.

“We are excited about the support from Napier Park and our current investor Mosaik Partners,” Point Predictive chief executive officer Tim Grace said. “Their investment, expertise in the space, and network will not only help us solidify our customer base in auto lending, mortgage lending and fintech, but it will also help us expand into new markets and delivery channels.

“We look forward to continuing our tradition of innovation and providing our customers and prospects with amazing results,” Grace went on to say.

In connection with the financing, Piaker will be joining Point Predictive’s board of directors.

For more information on Point Predictive and its solutions, send a message to [email protected].

Truist Financial Corp. recently unveiled a corporate venture capital division created by integrating investments in technology companies from the heritage SunTrust brand with BB&T Ventures.

The bank highlighted this firm — Truist Ventures — is focusing on strategic partnerships and investments to bring novel solutions to Truist clients and deliver on the company’s purpose to inspire and build better lives and communities.

“Truist Ventures positions us at the forefront in shaping the future of finance,” Truist chief digital and client experience officer Dontá Wilson said in a news release.

“There are many innovative entrepreneurs creating amazing technologies with the potential to transform how people interact with their finances,” Wilson continued. “Strategic partnerships and investments in innovative founders and companies help Truist deliver on our differentiating strategy of combining the right mix of human touch and technology to create experiences that help our clients, teammates and communities thrive.”

Truist also has appointed Vanessa Indriolo Vreeland, a seasoned executive with more than 20 years of private equity, venture capital and banking experience, to lead Truist Ventures.

“We are a different kind of venture firm. As the venture capital division of the sixth largest bank in the U.S., we have the scale to provide the capital early-stage companies need to grow. Yet, we’re nimble enough to deliver meaningful access to the deep domain expertise from our extensive network of teams across technology, investment banking, capital markets and innovation,” Vreeland said.

“We work closely with the companies in which we invest, leveraging our executive-level talent and industry experts to help them grow.”

The company explained Truist Ventures’ investment focus stretches beyond traditional financial technology into disruptive technologies that can enable Truist to deliver a human touch in new ways.

The division also seeks companies that have the potential to help redefine financial services and improve financial outcomes for Truist clients.

The firm’s newest undertaking as Truist Ventures’ is leading the latest funding round for global payments network Veem.

Truist explained that Veem looks to solves a critical pain point for small- and medium-sized businesses with a multi-rail technology system that can allow for seamless global payments.

Executives said this funding will go toward the development of a robust channel partner program that will widen their global footprint and help strengthen and expand their product suite and capabilities.

“Truist Ventures’ ability to lead our latest funding round in such an efficient and succinct manner is impressive. Through this round we were able to, very quickly, establish relationships with senior executives responsible for enterprise payments at the sixth-largest bank, providing Veem with unprecedented access to best-in-class expertise.” Veem chief executive officer Marwan Forzley said.

“We are excited to work with Truist to provide businesses around the world with access to our technology to modernize and simplify global payments,” Forzley went on to say.

To learn more about Truist Ventures, visit Truistventures.com.

AutoNation has been pleased with how DigniFi helps customers in its service drive who might be stretched financially but still need their vehicles repaired.

And evidently, the investment world likes what it sees from the financing platform for auto repairs and services.

On Tuesday, DigniFi announced that it has raised $14 million in Series A funding from Austin-based BuildGroup, the permanent capital company started by Lanham Napier, formerly of RackSpace, and Exor Seeds, the venture arm of Exor N.V., the holding company of the Agnelli family, which is the controlling shareholder of Fiat Chrysler, Ferrari, CNHI, PartnerRe and Juventus.

In addition, DigniFi has signed an agreement with Neuberger Berman Private Equity to purchase up to $275 million of assets.

Company leadership said the financing enables DigniFi to grow its network of 5,000 auto service centers to get Americans back on the road at a moment when vehicles are essential.

“After months of financial uncertainty, Americans are eager to get back to work, and many will need their cars in working order to do that. Our network of auto service centers has grown by 500 locations over the last 90 days, spurred by this rising demand,” DigniFi chief executive officer Richard Counihan said in a news release.

“With BuildGroup, Exor, and Neuberger Berman backing us, we have never been in a better position to serve drivers and auto shops,” Counihan continued. “Our platform will stimulate local economies and help America recover strong.”

The platform appears to have stimulated repair orders and other service-drive work at AutoNation stores stemming from what Dave Wilmore, senior vice president of customer care and brand extensions at AutoNation, shared in the news release.

“AutoNation’s priority is keeping customers safe and on the road,” Wilmore said. “Through our partnership with DigniFi, we’ve been able to adapt to customer needs during these times, offering them access to an alternative way to finance their maintenance and repairs.”

For many Americans, vehicle repairs are a source of stress. Prior to COVID-19, AAA conducted a survey and found that 64% of Americans could not pay for an unexpected car repair without taking on debt.

For perspective, the average car repair costs between $500 and $600 according to AAA. Many consumers take on high-interest credit card debt or payday loans to cover unavoidable repairs. Or, they postpone service altogether because they’ve already used up their credit lines on essentials like food and healthcare.

To date, DigniFi’s platform has provided access to over $120 million of financing that covers all five profit centers of a dealership: F&I, sales, parts and accessories, service and collision. The company has gained nationwide traction by offering value to shops, lenders, and consumers.

Partner shops have increased profitability by selling more high gross margin products and services through DigniFi’s platform. Lenders have supported DigniFi because they gain access to a new asset class through automotive retailers and independent repair shops. And consumers benefit because they can access financing in their moment of need.

“DigniFi is a firm that leverages innovative technology to drive performance and creates an exciting opportunity for our investors,” said Zhengyuan Lu, managing director on Neuberger Berman’s Specialty Finance team.

Jim Curry, co-founder and managing partner of BuildGroup, added this perspective.

“During a time when many consumers are under heavy financial stress, DigniFi is helping those faced with costly car repairs gain access to fast and affordable loans,” Curry said. “The company’s mission and the scale at which DigniFi has integrated its offering with service centers and dealerships presented an attractive investment opportunity for BuildGroup and a great addition to our growing portfolio of modern business models.”

PowerBand Solutions continued its recent stretch of development activity on Monday by announcing it’s accepting an additional $2.7 million investment from Texas-based D&P Holdings as it prepares vehicle lease originations in the United States to begin this month.

PowerBand chief executive officer Kelly Jennings said the company has completed its mission that’s taken more than two years to offer a cloud-based platform aimed at transforming how consumers buy, sell, lease and finance vehicles. Jennings explained the platform removes “unnecessary middlemen” in the automotive retail sector and offers cloud-based solutions, allowing automotive transactions to be carried out from any location on smartphones and other devices.

The company indicated the latest capital injection from D&P will assist PowerBand’s U.S. leasing platform — MUSA Auto Finance (MUSA) — to begin offering leases in June, which Jennings says will “make it as easy to acquire a car with PowerBand as it is buying a product on Amazon.”

The investment will also be used to launch PowerBand’s consumer app, Driveaway, that can enable people across the United States to access virtual auctions to buy and sell used vehicles, from dealers and directly between consumers. Driveaway will offer consumers and commercial partners a wider auction audience to ensure the value of their vehicles is recognized, eliminate the cost of transporting vehicles to physical auction lots and charges fees only upon success.

“This is a milestone month for PowerBand, as we prepare to offer extensive credit facility agreements, from major US financial institutions, on our U.S. leasing platform, MUSA,” Jennings said in a news release. “We are preparing to begin U.S. lease originations in June.”

“I’m also delighted this additional investment from D&P minimizes dilution to our shareholders, who I want to thank for their unwavering patience and support as we now complete our two-year mission to deliver consumers, dealers and other commercial enterprises a powerful digital platform that eliminates unnecessary middlemen,” Jennings continued.

“PowerBand will allow consumers to buy, sell, lease or finance their vehicles on a smartphone or other digital device, from any location, as easily as they buy a product on Amazon. This is the digital innovation solution the automotive industry desperately needs, particularly as it emerges from the retail challenges of the COVID-19 pandemic,” Jennings went on to say.

D&P, which works directly with more than 850 dealerships in all 50 states, is one of the largest administrators of automotive warranty and insurance products in the United States. To date, it has invested $6 million in PowerBand.

“Our latest investment — part of our decision to invest up to USD $10 million in PowerBand as a whole — reflects our confidence that PowerBand’s cloud-based platform will transform how Americans buy, sell, lease and finance their vehicles,” D&P chief executive officer John Armstrong said.

“This is game-changing technology for the sector, particularly as automotive dealers look for ways to recover from the COVID-19 pandemic. D&P will also be offering consumers automotive insurance products on the PowerBand transaction platform, yet another benefit for consumers,” Armstrong went on to say.

MUSA, which is 60% owned by PowerBand, is already working with RouteOne. As a result of its proprietary technology, MUSA was awarded a contract by Tesla Motors to become a national leasing partner in 2018.

Driveaway is a smartphone-based app that is being piloted by D2D Auto Auctions. D2D is co-owned in a 50-50 partnership by PowerBand and Arkansas-based financier Bryan Hunt, director of J.B Hunt Transport.