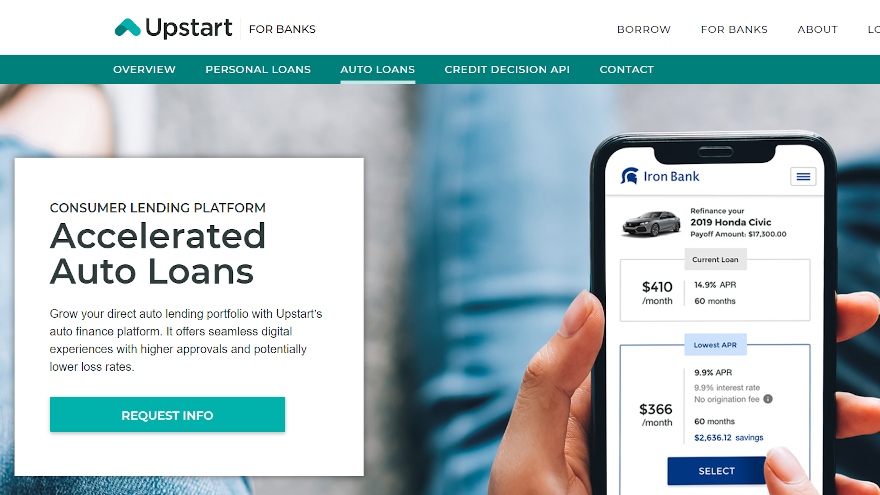

In June, Upstart Holdings broadened its offering by entering into the auto-financing market.

Last week, the platform fueled by artificial intelligence (AI) revealed an upcoming acquisition to strengthen its position in the auto sphere.

Upstart announced it has entered into a definitive agreement to acquire Prodigy Software, Inc., a provider of cloud-based automotive retail software.

According to a news release the transaction is expected to close in the second quarter and is subject to customary closing conditions.

In September, the first AI-enabled contract was originated on Upstart’s platform. In this initial phase, Upstart is enabling consumers to refinance “expensive and mispriced” contracts, saving consumers an average of $72 per month.

Following the initial launch, Upstart continues to roll this program out in states across the country.

With the acquisition of Prodigy, Upstart said it will accelerate its efforts to offer AI-enabled auto financing through thousands of dealers nationwide where the majority of financing is originated.

Executives described Prodigy as an end-to-end sales software that can bridge the gap between how dealerships operate and the new way that people are shopping for vehicles. More than $2 billion in vehicle sales have been powered by Prodigy at franchised dealers from top brands such as Toyota, Honda and Ford.

“While Amazon and Shopify have modernized the online shopping experience, the auto industry has been left behind. Upstart is on a path to reduce the cost of auto financing, and we can accelerate this opportunity with a modern multi-channel purchase experience,” Upstart co-founder and chief executive officer Dave Girouard said in the news release.

“Auto retail is among the largest buy-now-pay-later opportunities, and together with Prodigy, we aim to help dealers create a seamless and inclusive experience worthy of 2021,”

Since 2014, more than $9 billion in personal loans have been originated by Upstart’s bank partners. Incorporating more than 1,000 variables and trained on more than 10.5 million repayment events, Upstart’s AI-powered lending model can provide banks with up to 75% fewer defaults at the same approval rate.

And now with Prodigy’s technology set to be part of the equation, Upstart is looking to gain more momentum in auto financing, too.

“Our mission has always been to build the world’s best car buying experience, and for the majority of buyers today, that experience includes financing their vehicle. Prodigy CEO Michia Rohrssen said.

“Upstart’s demonstrably better lending technology will enable us to deliver more affordable and transparent auto loans to millions of consumers through our dealer network,” Rohrssen went on to say.

KeyBank recently reinforced its analytics capabilities by entering into a definitive agreement to acquire AQN Strategies, an analytics-driven consultancy with deep expertise in the financial services industry.

At the close of the transaction, AQN founder and managing partner Ben Sabloff was named Key’s head of analytics to take responsibility for leading customer-focused analytics strategies across the bank.

Founded in 2016, AQN’s highly experienced operators have worked with banks and fintechs across the industry to deliver value-based strategies by combining rigorous data and analytics capabilities with expertise across the credit and payments value chain.

The bank explained this acquisition aligns with Key’s relationship strategy and underscores its ongoing commitment to employ data-driven approaches that can enable a simultaneous expansion of customer reach while maintaining a rigorous focus on risk discipline.

“I am pleased to welcome Ben Sabloff and the AQN team to Key. Having worked with them over the past two years as a consultant to Key, I am excited to combine Key’s unique platform and AQN’s deep analytics expertise,” KeyBank head of payments and analytics Ken Gavrity said in the news release.

“The dynamic nature of our industry and the vast amounts of data available from our increasing digital environment require a relentless focus on insights and experimentation to drive customer value and create great customer experiences,” Gavrity continued. “Ben has created a world-class team and we look forward to his influence and leadership as we continue our digital and analytics transformation.”

Sabloff then added, “We’re very excited to join Key. We look forward to bringing our experience and our data-driven approach to drive strategies that will enable Key’s targeted scale strategy across its vast customer base.

“I’m confident that our people and capabilities are a natural complement to the bank’s strengths and strategy,” he went on to say.

Equifax looked to bolster its employment verification services and other offerings via an acquisition that closed on Tuesday.

Equifax announced that it finalized the acquisition of HIREtech, a technology-focused human capital management (HCM) and employer tax incentive firm. With this acquisition, Equifax said it has expanded its workforce solutions’ portfolio with the HIREtech suite of products, accelerating offerings for both employer and verification services.

As digital efficiency continues to accelerate in the human resources (HR) space, the company said acquiring HIREtech advances the Equifax commitment to help support the HR and Payroll industry with more automated and better data-driven services that help simplify complex, manual HR tasks.

“We are energized by the opportunities we can offer by adding the HIREtech capabilities to our differentiated Workforce Solutions’ Work NumberⓇ income and employment verification and HR services,” Equifax chief executive officer Mark Begor said in a news release.

“Our cloud native footprint has enhanced our ability to integrate new alliances and acquisitions and drive synergies more quickly — as we believe only Equifax can,” Begor continued. “We are reinvesting our strong 2020 financial performance to help continue the expansion of our unique data assets and capabilities, making bolt-on M&A central to our future growth strategy.”

Equifax highlighted that HIREtech offers a robust technology platform that offers businesses access to data and intelligence that helps guide important financial and hiring decisions.

Bridging the gap between human resources, tax and finance, Equifax said the HIREtech capabilities will help expedite innovation within the Workforce Solutions business unit at Equifax.

“This acquisition further reinforces the value that Equifax Workforce Solutions delivers as a provider of innovative, data-driven HR services, which has become critical as workforces shift to meet the evolving needs of employees and new work environments,” said Joe Muchnick, senior vice president at Equifax Workforce Solutions.

“Together we can accelerate our ability to help provide employers with new innovations and actionable insights that better support their workforce,” Mucknick added.

Now an Equifax company, officials reiterated that HIREtech is now part of the Workforce Solutions business unit at Equifax. The HIREtech leadership team has assumed roles with Equifax as part of the new Houston-based division of Equifax Workforce Solutions.

“It is an exciting time to be in the HR technology field,” HIREtech CEO Brian Cameron said. “Joining Equifax means we will be collaborating with sophisticated analytics teams and new cloud-based tools to help employers access the nearly real-time data and insights that help support critical financial and hiring decisions.”

On Monday, CDK Global announced it has completed the previously announced $1.45 billion sale of the CDK International business to Francisco Partners (FP), a leading global investment firm that specializes in partnering with technology businesses.

“We are very pleased that the transaction closed on schedule and appreciate all the efforts made by both companies to successfully complete the sale. I would like to thank all the International Business team members and wish them success in the future,” CDK Global president and chief executive officer Brian Krzanich said in a news release. “I look forward to continuing our growth strategy and focus on our North America business.”

According to another news release, CDK Global International has now been established as an independent business named Keyloop, which executives believe is uniquely positioned to help those involved in the automotive sector — both dealers and OEMs — respond to major changes over the coming decade as they transform the automotive retail experience.

Tom Kilroy is joining Keyloop immediately as the new chief executive officer. Neil Packham, former CEO of CDK Global International, will continue to support the business in an advisory capacity as it moves forward.

Kilroy previously was an operating partner at FP. He also held the position of chief operating officer of Finastra, a fintech company with more than 10,000 employees and revenues of approximately $2 billion.

The company said Kilroy brings deep experience of best-practices from global technology businesses providing mission-critical software.

The announcement went on to note that Keyloop intends to move swiftly and decisively to deliver on its mission of transforming the car buying and ownership experience in partnership with dealers and OEMs with the advent of connected cars, new retailing models and greatly increased digital engagement.

“Keyloop’s strong performance, impressive history and brilliant people are the key attributes that made it such an attractive company. FP acquired Keyloop not only because it recognized the superior product portfolio it has today, but also the potential for innovation in one of the world’s most critically important and rapidly evolving industries,” Kilroy said.

“We have all seen how technology players have set new standards for exceptional digital retail experiences. Now automotive consumers are starting to demand the same. As dealerships attract and serve the next generation of car buyers, digital transformation must be top of their agenda, and Keyloop will be the partner to help both them and the OEMs achieve this,” he continued.

“We are launching our company as Keyloop with the goal of enhancing the automotive customer experience for the better,” Kilroy added.

Based on cash it generated during the past year, Equifax reinforced its fraud-prevention toolbox by signing a definitive agreement to acquire Kount, a provider of artificial intelligence-driven fraud prevention and digital identity solutions.

According to a news release distributed on Friday, Equifax is paying $640 million in a transaction that is subject to customary closing conditions and regulatory review with the expectation of it closing during the first quarter.

As global digital transformation accelerates, driving customer interactions to digital channels in record numbers, Equifax acknowledged that businesses require new ways to establish digital identity trust in real-time to fight the growing problem of online fraud while reducing customer friction.

Equifax said this acquisition will expand its worldwide footprint in digital identity and fraud prevention solutions. Equifax added that the move also will help businesses better engage with their customers while combating fraud with the Kount Identity Trust Global Network, a risk-based authentication platform.

“As digital migration accelerates, managing authentication and online fraud while optimizing the consumer’s experience has become one of our customers’ top challenges. The acquisition of Kount will expand Equifax’s differentiated data assets to bring global businesses the information and solutions they need to establish identity trust online,” Equifax chief executive officer Mark Begor said in the news release.

“Equifax is taking advantage of our strong 2020 outperformance and cash generation to make this strategic acquisition,” Begor continued. “Our data and technology cloud investments allow us to quickly and aggressively integrate new data and analytics assets like Kount into our global capabilities and bring new market leading products and solutions to our customers.”

The result of a strong patent portfolio, Equifax highlighted the Kount Identity Trust Global Network uses artificial intelligence to link trust and fraud data signals from 32 billion digital interactions, 17 billion unique devices and five billion annual transactions across 200 countries and territories. As more signals are collected and combined with Kount’s AI-driven analytic insights, Equifax explained they become more predictive, helping to prevent digital fraud and protect against account takeovers in real-time while enabling personalized customer experiences.

“Together, Equifax and Kount will leverage a powerful set of differentiated data assets and advanced analytics to deliver a high performance, integrated view of both digitally-native transactions and signals and traditional offline identity fraud risk indicators while maintaining privacy and security at the highest levels,” said Sid Singh, president of United States Information Solutions (USIS) at Equifax.

“Whether you’re a bank, e-commerce provider, or a car dealer, today’s environment demands that consumers have the same — if not better — experience on their digital platform as they do on a major e-commerce retailer’s site,” Singh continued. We are enabling businesses across industries to establish strong digital identity trust behind every interaction while facilitating new forms of online engagement with current and prospective customers.”

Equifax reiterated that identity trust determines the level of trust for each identity behind every payment, account creation and login event. Businesses can determine the level of trust and risk they are comfortable accepting in order to block fraud in real time and to enable personalized customer experiences, according to experts.

Equifax emphasized that quick and accurate identity trust decisions can deliver safe payments, account creations and login events, while reducing digital fraud, chargebacks, false positives, and manual reviews.

“More than 9,000 brands worldwide rely on the Kount Identity Trust Global Network to protect against digital fraud while enabling personalized customer experiences and new e-commerce channels,” Kount CEO Bradley Wiskirchen said. “We are excited to be able to offer Kount solutions with an expansive set of Equifax data, analytics and products.

“Equifax’s global reach will accelerate Kount’s international adoption, allowing us to help more businesses around the world to better protect their digital innovations and their customers against emerging threats while improving the customer experience,” Wiskirchen added.

The full suite of Kount products powered by the Identity Trust Global Network that will be integrated into the Equifax Luminate Platform include:

— Kount Command for e-commerce fraud prevention with the Ominiscore AI-driven transaction safety rating

— Kount Control for account takeover prevention and digital account protection

— Kount Data on Demand for advanced analytics and actionable customer insights

— Near Real-Time Chargeback protection

Equifax mentioned that Luminate is a comprehensive fraud platform that can orchestrate multiple solutions with machine learning to provide risk managers with insights to help manage fraud decisions across the consumer account lifecycle.

The company added that Kount employees will join the Equifax USIS business unit and will continue to be based in Boise, Idaho.

The banking sector generated another major announcement on Monday as the parent companies of Huntington National Bank and TCF National Bank said they plan to merge.

The banks said they will combine an all-stock merger with a total market value of approximately $22 billion to create a top 10 U.S. regional bank with dual headquarters in Detroit and Columbus, Ohio.

Under the terms of the agreement, which was unanimously approved by the boards of directors of both companies, TCF will merge into Huntington, and the combined holding company and bank will operate under the Huntington name and brand following the closing of the transaction.

Upon closing that is expected to happen in the second quarter, Stephen Steinour will remain the chairman, president and CEO of the holding company and CEO and president of the bank. Gary Torgow will serve as chairman of the bank’s board of directors.

With a rich history of caring for customers and colleagues, executives highlighted in a news releases that the new organization will have a top 5 rank in approximately 70% of its deposit markets and will leverage its scale to serve customer needs through a distinctive, “People-First, Digitally-Powered” customer experience.

“This merger combines the best of both companies and provides the scale and resources to drive increased long-term shareholder value. Huntington is focused on accelerating digital investments to further enhance our award-winning people-first, digitally powered customer experience,” Steinour said.

“We look forward to welcoming the TCF Team Members. Together we will have a stronger company better able to support our customers and drive economic growth in the communities we serve,” he continued.

The headquarters for the commercial bank will be in Detroit where at least 800 employees of the combined company, nearly three times the number TCF had planned, will be housed in the downtown structure. Columbus will remain the headquarters for the holding company and the consumer bank.

“This partnership will provide us the opportunity for deeper investments in our communities, more jobs in Detroit, an increased commitment in Minneapolis and a better experience for our customers,” Torgow said.

“We will be a top regional bank, with the scale to compete and the passion to serve. Merging with the Huntington platform will be a great benefit to all of our stakeholders and will drive significant opportunities for our team members,” Torgow went on to say.

This merger arrived about a month after PNC Financial Services Group signed a definitive agreement to acquire BBVA USA Bancshares, including its U.S. banking subsidiary, BBVA USA, for a purchase price of $11.6 billion.

And a year ago, BB&T Corp. and SunTrust Banks finalized its merger to become Truist Financial Corp.

S&P Global and IHS Markit highlighted nine reasons why the definitive merger agreement they announced on Monday is going to be beneficial for stockholders and the clients that use their automotive and finance data.

According to a news release, S&P Global and IHS Markit will combine in an all-stock transaction that values IHS Markit at an enterprise value of $44 billion, including $4.8 billion of net debt.

Under the terms of the merger agreement — which has been unanimously approved by the boards of directors of both companies — officials said each share of IHS Markit common stock will be exchanged for a fixed ratio of 0.2838 shares of S&P Global common stock. Upon completion of the transaction, current S&P Global shareholders will own approximately 67.75% of the combined company on a fully diluted basis, while IHS Markit shareholders will own approximately 32.25%.

S&P Global and IHS Markit indicated the transaction is expected to close in the second half of 2021, subject to, among other things, the expiration or termination of the applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, other antitrust and regulatory approvals, and other customary closing conditions.

Officials added the transaction requires the approval of shareholders of both S&P Global and IHS Markit and is not subject to any financing conditions.

S&P Global president and chief executive officer Douglas Peterson will serve as CEO of the combined company.

“Through this exciting combination, we are able to better serve our markets and customers by creating new value and insights,” Peterson said in the release. “This merger increases scale while rounding out our combined capabilities, and accelerates and amplifies our ability to deliver customers the essential intelligence needed to make decisions with conviction.

“We are confident that the strengths of S&P Global and IHS Markit will enable meaningful growth and create attractive value for all stakeholders. We have been impressed by the IHS Markit team and look forward to welcoming the talented IHS Markit employees to S&P Global,” he continued.

Meanwhile, Lance Uggla, chairman and chief executive officer of IHS Markit, will stay on as a special advisor to the company for one year following closing.

“This transaction is a win for both IHS Markit and S&P Global as we leverage our respective strengths in information, data science, research and benchmarks,” Uggla said. “Our highly complementary products will deliver a broader set of offerings across multiple verticals for the benefit of our customers, employees and shareholders.

“Our cultures are well aligned, and the combined company will provide greater career opportunities for employees. We look forward to bringing together our teams to realize the potential of this combination,” he went on to say.

According to the announcement, the combined company’s board of directors will include the current S&P Global board of directors and four directors from the IHS Markit board. Richard Thornburgh, current chairman of S&P Global, will serve as chairman of the combined company.

The companies also noted the leadership team will comprise senior leaders from both organizations. Among the confirmations already made, Ewout Steenbergen, executive vice president and chief financial officer of S&P Global, will serve as chief financial officer of the combined company.

“The approach to integration planning will draw from the best practices of both companies to ensure continuity for customers, employees and other stakeholders,” the companies said.

Reasons for action

S&P Global and IHS Markit explained that their unique and highly complementary assets will leverage cutting-edge innovation and technology capability, including Kensho and the IHS Markit Data Lake, to enhance the customer value proposition and provide the intelligence customers need to make decisions with conviction.

The companies then elaborated about nine more reasons they made this move, including:

— Greater scale and business mix: The companies indicated the transaction creates a combined business with increased scale and world-class products in core market segments.

Officials said combined company will have balanced earnings across major industry segments and a resilient portfolio, providing additional financial flexibility to pursue value-creating opportunities.

— Creates strong offerings in high-growth adjacencies: Officials highlighted the combined company will be differentiated in attractive high-growth adjacencies, including ESG, climate and energy transition, private assets and SME, counterparty risk management, supply chain and trade, and alternative data, which together represent $20 billion of total addressable market, growing at least 10% annually.

As part of its ongoing commitment to remain on the cutting edge of technology and innovation, S&P Global and IHS Markit said they will continue to deploy well above $1 billion annually on technology.

— Increased customer value proposition: S&P Global and IHS Markit emphasized the transaction brings together both companies’ customer-first cultures and broadens their combined reach across client segments, workflows and use cases. The pro forma organization will serve diverse customer segments across financial services, corporates and governments with differentiated data and intelligence, including the potential to link and create novel insights from new data set combinations.

S&P Global and IHS Markit pointed out that their complementary product portfolios are expected to enable the combined company to serve new and expanded customer use cases in existing and new geographies.

— Best-in-class talent: Officials mentioned the combined company will benefit from two best-in-class workforces with deep expertise and strong, complementary cultures focused on serving the global needs of customers.

As a single organization, S&P Global and IHS Markit said the collective workforce will benefit from expanded opportunities for career development and growth.

— Enhanced growth profile: S&P Global and IHS Markit projected the pro forma company will have 76% recurring revenue and expects to realize 6.5-8.0% annual organic revenue growth in 2022 and 2023, balanced across major industry segments.

— Increased profitability: S&P Global and IHS Markit also highlighted the combined company will target 200 basis points of annual EBITA margin expansion.

— Attractive synergy opportunities and earnings accretion: S&P Global and IHS Markit said the transaction is expected to be accretive to earnings by the end of the second full year post-closing.

Officials predicted the combined company expects to deliver annual run-rate cost synergies of approximately $480 million, with approximately $390 million of those expected by the end of the second year post-closing and $350 million in run-rate revenue synergies for an expected total run-rate EBITA impact of approximately $680 million by the end of the fifth full year after closing.

— Maintains strong balance sheet to pursue further growth: Officials emphasized the combined company is expected to maintain a strong balance sheet and credit profile, with pro forma annual revenue of more than $11.6 billion.

S&P Global added that it intends to maintain a prudent and flexible capital structure and will target leverage of 2.0-2.5 times EBITA, on an agency-adjusted basis.

— Enhanced free cash flow generation to support attractive capital return: S&P Global and IHS Markit went on to noted that they expects to generate annual free cash flow exceeding $5 billion by 2023, with a targeted dividend payout ratio of 20-30% of adjusted diluted EPS and a targeted total capital return of at least 85% of free cash flow between dividends and share repurchases.

Officials noted that both companies expect to maintain their current dividend policies until the close of the transaction.

CUNA Mutual Group ventured deeper into the automotive and fintech worlds this week by acquiring one of this year’s Emerging 8 honorees.

The mutual insurance holding company acquired ForeverCar, the Chicago-based start-up company that protects vehicle owners from expensive repairs with mechanical repair coverage (MRC) policies delivered through online channels.

CUNA Mutual Group’s move involving ForeverCar arrived on the heels of acquiring digital lending platform CuneXus on Oct. 15.

Terms of both transactions were not disclosed, according to news releases.

Executives recapped that CMFG Ventures, the venture capital entity of CUNA Mutual Group, was an early-stage investor in ForeverCar in October 2016.

Combined with the acquisition of CuneXus, executives highlighted that adding ForeverCar’s digital platform and marketing capabilities further enhances CUNA Mutual Group’s lending and insurance product portfolio and its ability to reach and protect more consumers digitally.

“Our investments in start-ups such as ForeverCar and CuneXus, coupled with our focus on modernizing and digitizing our product portfolio, are essential efforts in responding to a rapidly evolving consumer experience,” CUNA Mutual Group president and chief executive officer Robert Trunzo said.

“We’ve been committed to helping people achieve financial security for more than 85 years, and lending insurance products, including MRC, have been an essential pillar of how we protect consumers and help them achieve a brighter financial future,” Trunzo continued.

The company also noted MRC is a core offering in CUNA Mutual Group’s lending solutions and payment protection products portfolio. The firm said it will continue to sell its MRC policies through the ForeverCar platform.

ForeverCar currently contracts with 180 credit unions as their official MRC provider.

“Maintaining those credit union — and member — relationships will be the top priority during the integration process,” CUNA Mutual Group said while adding the acquisition of ForeverCar expands direct-to-consumer channels and provides new growth opportunities.

CUNA Mutual Group also mentioned ForeverCar’s current customers will be fully supported, and the company will continue to operate in its Chicago location.

Meanwhile, CUNA Mutual Group pointed out that it was an early-stage investor in CuneXus, too, pushing funds into the Santa Rosa, Calif.-based start-up firm in January 2017. The financial aid helped CuneXus become an award-winning provider to financial institutions with its all-in-one digital lending platform that offers consumers a quick, easy and personalized online and mobile lending experience.

“We are continuing our journey into a more diverse, digital-first world,” Trunzo said when the CuneXus acquisition was made public.

“Our company is committed to using technology to enhance consumers’ access to financial solutions that work for them and create a more equitable financial system and society. This is a top priority for all of our core businesses,” Trunzo continued.

“CuneXus is on a strong growth trajectory, and adding their expertise and product solution to our company portfolio allows us to maximize its growth potential and enhance our long-standing efforts to make a brighter financial future accessible to everyone,” he went on to say.

The company highlighted that CuneXus is geared to provides a seamless lending experience across every touchpoint, from targeted email and postal mail loan offers, through online and mobile banking access, to branch and call center customer support. Its digital platform can enable financial institutions to offer pre-approved, “click-to-accept” consumer loans to customers where and when they need them.

CUNA Mutual Group went on to mention CuneXus’ platform uses a combination of a bank’s or credit union’s customer information and lending criteria, as well as customer credit history, behavior and location to identify the best potential loan offers for consumers — with no application necessary.

“We are genuinely excited to join the CUNA Mutual Group family,” CuneXus CEO Dave Buerger said. “Our capabilities and culture align very well, and we believe we can greatly enhance CUNA Mutual Group’s digital evolution in the lending space.”

Founded in 2008, CuneXus currently works with more than 140 financial institutions. It was named as a start-up to watch on KPMG’s global rundown of The 50 Best Fintech Innovators.

It also was the winner of the Best Consumer Lending Company in the 2020 Fintech Breakthrough Awards, the winner of the Callahan & Associates 2019 Innovation in Lending Award as well as the Top Emerging Technology Company at the 2019 LendIt Fintech Industry Awards.

Executives added that CuneXus’ current customers will be fully supported, and the company will continue to operate in its Santa Rosa location.

The coronavirus pandemic might be paralyzing many segments of the economy, but a fintech industry acquisition still surfaced this week worth more than $1 billion.

On Tuesday, online personal finance company SoFi announced it has signed a definitive agreement to acquire Galileo Financial Technologies, a financial services, API and payments platform. SoFi said it will pay total purchase consideration of $1.2 billion to acquire Galileo, comprising cash and stock.

The transaction is subject to regulatory approvals and other customary closing conditions, according to the companies.

SoFi highlighted Galileo’s digital payments platform can enable critical checking and savings account-like functionality via its powerful open APIs, providing companies with an easy way to create sophisticated consumer and business-to-business financial services. Galileo’s offerings are accessible via mobile, desktop and a physical debit card.

Galileo’s APIs power functionalities including account set-up, funding, direct deposit, ACH transfer, IVR, early paycheck direct deposit, bill pay, transaction notifications, check balance, and point of sale authorization as well as dozens of other capabilities.

According to a news release, Galileo processed more than $53 billion of annualized payments volume in March, up from $26 billion in September, with accelerating growth.

SoFi Money is already tightly integrated with Galileo’s payment platform including several of its leading account and events API functionalities.

Executives indicated Galileo and SoFi will work together to accelerate the pace of technology innovation to offer Galileo’s partners, and subsequently consumers everywhere, even more value. These new functionalities and services will further help Galileo’s current and new partners capture the secular shift of financial transactions from the physical-only to a multi-channel digital and physical platform.

With the addition of Galileo, SoFi explained that the move strengthens its capabilities, rounding out its technology ecosystem.

Additionally, the company pointed out the combination will extend the reach of its products to other Galileo partners in the United States and international markets, while offering diversification and scale to SoFi’s existing infrastructure.

“SoFi has established itself as a leader in the fintech sector, providing our more than one million members a full array of financial products to help them get their money right,” SoFi chief executive officer Anthony Noto said. “The response by our members to our innovation across borrowing, saving, spending, and investing has motivated us to think bigger, bolder and more expansively given the insatiable consumer appetite for financial services innovation.

Together with Galileo, we will partner to build on our companies’ strengths to drive even greater financial technology innovation, making those products and services available to both current and future partners,” Noto continued.

“While we march forward on our mission to help people achieve financial independence through our own direct efforts, with Galileo, we can enable a broader ecosystem of companies to join us in helping the world achieve financial independence,” he went on to say.

The announcement also indicated Galileo will continue to operate as an independent subsidiary of Social Finance, Inc. with Clay Wilkes as CEO. Galileo will collaborate with SoFi to accelerate the technology roadmap needs for consumer financial offerings, as well as offering the full SoFi suite of products and services to those Galileo partners who are looking to broaden their offering to better meet the needs of their customers.

“SoFi has built a very strong diversified financial services company focusing on a full suite of financial services. These are products that many of our leading fintech clients are asking for. Distributing products through our enterprise-class API is the vision behind this combination. I think it’s very powerful,” Wilkes said.

“We’re excited to work with SoFi to build on the services that have made Galileo the leading supplier of infrastructure services to leading financial, technology, and fintech companies,” Wilkes continued. “With the help of SoFi, we intend to continue to grow with and support all of our existing clients and the product roadmaps that they have defined.”

Noto also offered his assessment of what Wilkes brings to the new organization.

“Clay is an extraordinary founder and leader,” Noto said. “He has had an unwavering vision since starting Galileo 19 years ago. I could not be more excited by the opportunity to work side-by-side with a visionary who has not only built a great company, but one that has endured unprecedented technological and financial changes, through multiple economic cycles.

“With Clay at the helm, Galileo’s durability has resulted in its industry-leading position at the precipice of a massive multi-decade secular shift to digital financial services that we have already seen unfold across almost every other consumer industry sector,” Noto went on to say.

Goldman Sachs and Citigroup served as financial advisers and WilmerHale acted as legal adviser to SoFi. Qatalyst Partners served as financial adviser and Dorsey & Whitney acted as legal adviser to Galileo.

Fiserv bolstered its technology toolbox through an acquisition last week.

The global provider of payments and financial services technology solutions announced the acquisition of Bypass Mobile, an independent software vendor (ISV) and innovator in enterprise point-of-sale systems.

Officials explained the acquisition of Bypass will help power the next generation of omni-commerce capabilities from Fiserv, enabling enterprise businesses to deliver a seamless customer experience that spans physical and digital channels.

According to a news release, terms of the transaction were not disclosed.

Fiserv highlighted that Bypass provides robust back-office management tools and rich insights engines for sports and entertainment venues, food service management providers and national restaurant chains. The acquisition builds on an existing strategic relationship through which Bypass software is integrated into Fiserv technology.

More than 50 major stadiums and arenas already leverage the combination of Bypass and Fiserv technology, including Fiserv Forum in Milwaukee, Clover Park in Port St. Lucie, Florida and Citi Field in New York.

“Adding Bypass to our portfolio will make it easier for our clients to realize their digital transformation strategy, delivering interactions their customers are demanding,” said Devin McGranahan, senior group president of global business solutions at Fiserv. “With this combination, we will improve the omni-commerce experience for businesses and their customers, making it easier and more efficient to pay for goods and services.

“We look forward to working with Brandon and the Bypass team to make omni-commerce smoother and simpler for clients and their customer,” McGranahan continued.

The company insisted the powerful combination can enable the creation of new, secure purchasing experiences across connected devices, as Bypass integrates with the universal commerce platform from Fiserv. Businesses now can work with a single provider and benefit from increased operational efficiency, improved security and a more complete picture of customer interactions.

“We have long admired Fiserv and their commitment to delivering continuous innovation on behalf of their clients,” Bypass chief executive officer Brandon Lloyd said. “In an age of increasing customer expectations, it is critical that businesses have a robust and easy-to-use omni-commerce platform.

“In combination with Fiserv, we will help businesses accept payments efficiently while continuing to meet customer expectations by providing a variety of payment options,” Lloyd went on to say.

For more information on universal commerce capabilities from Fiserv, visit fisv.co/universalcommerce.