This week, Credit Union Leasing of America (CULA) expanded its client footprint for the fourth time this year.

After previously expanding in the Northeast as well as into Texas, CULA announced that it now is partnering Utah’s University Federal Credit Union (UFCU).

The companies booked their first contracts in August, as the partnership makes University Federal Credit Union the only credit union in Utah to offer vehicle leasing.

University Federal Credit Union, which was founded in 1956, serves more than 100,000 members and their communities.

“Our core values are to create a positive impact on our community and to make a difference for every member, every day, and this means making sure a wide range of financial products are available to our members,” UFCU chief executive officer Jack Buttars said in a news release. “Finding the right vehicle at the right price has probably never been more challenging than it is today.

“Working with the terrific CULA team, who streamline the complexities of leasing — from analytics to insurance to operations to compliance — we are now able to ensure that our members have the opportunity to benefit from leasing’s more affordable payments and term flexibility, critical factors given the current market landscape,” Buttars continued.

In addition to Utah, CULA now has coverage in New Hampshire, Texas, Massachusetts, Michigan, Pennsylvania and California.

“We’re pleased to be able to further extend our footprint in the West, at a time when leasing is such an important option for consumers, by partnering with UFCU, an institution that exemplifies what credit unions are all about: serving the community,” CULA president Ken Sopp said. “Utah is a new state for us and we are excited to ‘pioneer’ credit union leasing here.

“Our leasing program can amplify the customer-centric values of University Federal Credit Union, while also expanding and diversifying their portfolio of services, helping to further enhance membership and yield,” Sopp went on to say.

CULA highlighted that that first six months of the year have been record breaking for the company, with more than $950 million in lease originations. That amount represents an 88.8% increase over the same period in 2019 and the highest period of originations in CULA’s more than 30-year history.

AutoFi is continuing to forge relationships with numerous companies that provide financing and perpetuate online vehicle retailing.

After connecting with Santander at the end of July and TrueCar during the first part of August, this week AutoFi finalized a relationship with Wells Fargo.

According to a news release, the new collaboration supports Wells Fargo’s goal of offering customers more digital options while also giving consumers the additional flexibility they want to quickly and easily conduct business.

Wells Fargo explained that shifting demographics, consumer tastes and the COVID 19 pandemic have all combined to accelerate the adoption of digital finance in automotive retail. The bank acknowledged consumers now expect a fully touchless digital purchasing option.

In fact, the June 2020 CarGurus U.S. COVID 19 Sentiment Study indicated that before the pandemic, 32% of vehicle shoppers were open to buying online. Now, 60% are open to the idea.

Working together, Wells Fargo and AutoFi said they will help consumers complete their digital purchase journey — including prequalifying to approval and financing — seamlessly and conveniently.

Customers of the country’s top automotive dealers, digital retailers, and online marketplaces can obtain real-time credit decisioning from Wells Fargo. After selecting the financing terms and monthly payment that work best for them, customers can easily shop for their vehicle, learn the value of their trade-in vehicle, and select financing and F&I products entirely online.

“Our customers are our top priority — both dealers and consumers. Across Wells Fargo, we are making investments in digital capabilities, so we can seamlessly serve customers across channels and provide choice in how they do business with us,” said Tanya Sanders, who became the head of Wells Fargo Auto in July.

“Joining the AutoFi platform helps us reach and serve more consumers and do it in a way that supports consumers’ changing car-buying habits,” Sanders added in the news release.

AutoFi pointed out that its platform and APIs can empower finance companies’ ability to reach and seamlessly serve more customers with a better vehicle-buying experience. The company also can help finance companies provide dealers with powerful tools to close sales faster.

AutoFi said hundreds of thousands of customers representing billions of dollars in vehicle sales and finance will come through its platform this year.

And that trajectory might continue with Wells Fargo now involved.

“We are thrilled to partner with the Wells Fargo Auto team. We share a common vision of using technology to deliver a delightful consumer purchase experience,” AutoFi chief executive officer Kevin Singerman said.

“By working together, we can bring tremendous value to both traditional and digital dealers as well as online marketplaces across the nation,” Singerman went on to say.

Dealers that work with credit unions now each have the potential for more success as two well-known companies in the respective spaces are collaborating.

On Thursday, CUDL, one of the nation’s largest credit union financing networks, announced an alliance with J.D. Power and CUDL’s AutoSMART online shopping program to expand inventory visibility for its dealer partners.

The companies highlighted the alliance between CUDL and J.D. Power allows dealerships participating in the CUDL AutoSMART program to have their inventory displayed on JDPower.com, providing greater digital exposure and the opportunity to drive more online customer requests for dealers.

According to a news release, JDPower.com averages 1.5 million monthly visits by consumers looking for their next vehicle.

Both J.D. Power and CUDL pointed out that leveraging digital retail technologies to engage potential buyers online — as well as improve sales efficiency — has become a key strategy for dealerships, particularly in the wake of COVID-19.

“By integrating AutoSmart dealer inventory into the JDPower.com experience, we will be providing shoppers with a comprehensive view of available vehicles in their backyard,” said Craig Jennings, president of the Autodata Solutions Division at J.D. Power. “CUDL AutoSmart dealers equally benefit by having access to a new and expanding audience of shoppers.”

CUDL’s AutoSMART program features more than 900 credit union branded digital storefronts, connecting 14,000 dealers and 1.5 million vehicles to millions of credit union members.

Officials added the program had a 40% increase in lead generation activity for dealers between year-end 2019 and year-end 2020.

“Our mission is to deliver an exceptional experience to our dealers through innovative solutions that drive more sales,” CU Direct chief revenue officer Phil DuPree said. “As part of this commitment, we are excited to be working with J.D. Power to provide our dealers with greater digital and marketplace exposure of their shops and inventory.”

Constant, a provider of digitized, self-service technologies, recently announced that it has partnered with DirectID, a global credit risk platform, in an effort to transform digital loan servicing and loss mitigation for banks and credit unions.

According to a news release, their integrated solution will enable borrowers and contract holders to self-serve for loan management tasks that usually require agent assistance.

In addition, through the use of Open Banking, the companies said their tool will provide an accurate picture of the borrower’s financial situation and risk level so their financial institution can provide timely, hyper-personalized support or product offers.

Despite the digitization of the front office, Constant and DirectID pointed out that loan servicing and loss mitigation processes are often still handled by people in the middle and back office who rely on manual, paper-based processes and green screen technology.

“This can lead to a delay in response times, costly errors, lost files and increased non-compliance risk,” the companies said in that news release. “As consumer protection efforts increase, the need for efficiency, flexibility and openness between previously disparate systems and processes across the life-cycle of a loan is more important than ever.”

Together, Constant and DirectID are leveraging their insights from real-time banking data and incorporate that information into self-serve features, allowing for accurate information and thoughtful decisions around managing repayment of consumer debt or new, timely product offers.

Ultimately, the companies said their solution can transform the borrower’s journey.

“With an increasing number of borrowers demanding faster turnaround, servicers need to review and refresh their strategies for managing borrower interactions and empower consumers to self-serve wherever possible,” Constant chief executive officer Catherine York Powers said through the news release.

“Partnering with DirectID and its open banking platform means we can offer our mutual clients a fully integrated digital, yet still human-centric ecosystem, and ensure their differentiators shine across all channels, physical and digital,” York Powers continued.

In order to explore and expand the use cases of Open Banking data in loan servicing and debt management, DirectID and Constant said they will work with five financial institutions in the U.S. in a “white-glove” partnership program.

They added that the program will run for 12 months and includes discounted implementation and subscription fees of the Constant Digital Servicing Portal, as well as free consultation hours.

“As we continue to grow our reach and capability, having a trusted set of partners is critical to our future success. We are delighted to have signed this agreement with Constant,” DirectID CEO and founder James Varga said.

“As a global credit risk insights provider, redefining the traditional credit risk life-cycle is our global mission,” Varga continued. “By partnering with Constant, we have an opportunity to transform digital loan servicing and loss mitigation for credit unions and banks globally.

“We’re really excited about the pilot solution and can’t wait to deliver the benefits of Open Banking to credit unions through their existing online banking experience,” he went on to say.

MotoRefi plans to leverage a trio of partners to broaden the use of its application programming interface (API) ecosystem that’s just been launched that the company says is key for enabling growth and bringing the Emerging 8 honoree’s refinancing technology to millions of consumers who want it.

The first three partners to use the new MotoRefi’s API and refinance technology are SoFi, Even Financial and Savvy, enabling these partner companies to bring MotoRefi’s pre-qualified refinance offers to their customers and potential saving them an average of $100 per month or more on their monthly vehicle payments.

At a time when many Americans are experiencing financial hardships, MotoRefi sees the opportunity to save money on a monthly vehicle payment potentially having a meaningful impact on their budgets.

Through the partnership and API functionality, SoFi, Even Financial and Savvy can provide their customers with direct access to MotoRefi’s competitive financing rates and easy-to-use refinance process. All three partners have launched or will launch MotoRefi’s API, according to a news release.

“This industry-changing technology is an incredible investment in MotoRefi’s future and will unlock a better financial future for millions of consumers,” MotoRefi chief executive officer Kevin Bennett said. “We are now able to serve customers through a vastly expanded financial ecosystem. We couldn’t be more proud to be partnering with SoFi, Even Financial and Savvy to bring this beneficial technology to more Americans.”

Jennifer Nuckles is executive vice president and group business unit leader at SoFi.

“For many, an auto loan is one of the largest line items — aside from a mortgage — in a consumer’s monthly budget. Yet, consumers aren’t always made aware of the levers they can pull to reduce their payments to ensure they’re paying down debt faster and with less interest,” Nuckles said.

“We’re looking forward to furthering our mission of helping people achieve financial independence through the Lantern and MotoRefi partnership,” she added.

The API launch comes on the heels of a year of record growth for MotoRefi along with a series of announcement since the beginning of the year, including

— Six times revenue growth during 2020

— Key executives joining its management team

— An expanded Washington, D.C., headquarters

— A $10 million Series 1A funding round with a new board member

For more information, go to www.motorefi.com.

DigniFi, AutoNation and TR Wholesale Solutions are all working together to help customers finance tires that offer superior safety and performance.

AutoNation uses TR Wholesale Solutions’ digital tire shopping platform to help its service advisors and customers shop, compare and order tires. By introducing DigniFi’s automotive financing platform into this experience, AutoNation and TR Wholesale Solutions can provide aid to customers who are having their wallets pinched nowadays.

According to a news release, the trio of companies came together since COVID-19 has changed how drivers approach vehicle repairs and maintenance. In fact, AutoNation reported that the dealer group saw an increase in service financing between July and December.

With record numbers of Americans out of work, AutoNation acknowledged drivers were hesitant to spend on high-ticket maintenance and repairs as well as new tires, which tend to be one of the highest-cost items for a newer vehicle still under warranty.

“New tires are the first major expense of the ownership cycle and the first defection point in service loyalty,” said Dave Wilmore, senior vice president of customer care and brand extensions at AutoNation.

“Service financing enables our customers to purchase the correct tires with a payment schedule they can handle,” Wilmore continued in the news release. “This partnership with DigniFi and TR Wholesale Solutions furthers our commitment to keep every customer safe on the road, no matter what their financial situation is.”

Aaron Reitman is vice president of corporate accounts at TR Wholesale Solutions, a Tire Rack company and one of America’s largest direct-to-retailer tire businesses and an independent tire tester.

“Tire selection is first and foremost about safety,” Reitman said. “Especially in a financially difficult year, drivers are tempted to replace their tires with a budget set, which tend to offer decreased performance on wet or snow-covered roads.

“With DigniFi integrated into our tire shopping tool, we can show customers that safer, higher-performance tires are within reach because flexible financing is just a few clicks away,” Reitman went on to say.

Since 2019, AutoNation has partnered with DigniFi to finance repairs and maintenance for customers. DigniFi said it has improved customer loyalty and engagement by offering transparency, choice and convenience in the service experience.

DigniFi also has enabled AutoNation associates to offer other premium auto services for their customers.

DigniFi’s automotive financing platform can help people afford vehicles, auto repairs, upgrades, accessories and trade-ins with flexible payment terms. Customers apply for financing on their personal smartphone and receive an instant decision from a lender.

On average, automotive businesses that offer DigniFi increase annual revenue by up to 20%, according to the company.

DigniFi chief executive officer Richard Counihan described the potential of this new collaboration with AutoNation and TR Wholesale Solutions, saying the companies “already lead the market in providing a seamless, digital shopping experience for tires.

“DigniFi can complement their strengths by making financing accessible to consumers who might otherwise skip, delay or underfund tire purchases,”

Tire financing from DigniFi is now available at 244 AutoNation stores and online at www.autonationtirestore.com.

Born from the close relationship involving Westlake Technology Holdings and Nowcom, Nowlake Technology is continuing to diversify its tech toolbox.

This week, Nowlake and Informed.IQ announced the launch of an originations automation solution that can streamline the collection, analysis and funding of contract applications.

The companies explained that Informed.IQ can analyze each application package, by first classifying all of the data and documents submitted by the consumer and identifying additional income sources for multi-income applicants. The solution then can verify the documents for accuracy, analyze the information on the documents and match it to the inputs on the credit applications all without any human involvement.

If any defects are detected in the application package, such as documents that are out of date range, Informed.IQ can reach out to the applicant on behalf of the dealer and Westlake to gather additional information.

The companies pointed out the technology even can help mitigate fraud by comparing the document to a known fraud database.

“Informed.IQ’s technology accurately calculates income, and verifies proof of residence, proof of identity, and insurance,” said Kyle Dietrich, senior vice president of originations with Westlake Financial.

“This technology will exponentially improve our funding time and service levels to our dealers while increasing Westlake’s scalability to process auto loan contracts,” Dietrich continued in a news release that also mentioned Nowlake and Informed.IQ have been collaborating on the technology for three years.

Dietrich pointed out that currently 70% of Westlake contract documents are cleared using the AI technology. Westlake expects this level to jump to 90% by the end of the year.

“Informed.IQ’s technology has helped us lower the average funding time by more than 50% with the fastest funding time now within one hour of receiving the deal package,” Deitrich continued.

Informed.IQ chief executive officer Justin Wickett elaborated about working with Nowlake Technology, which is the parent company of Westlake Financial.

“Nowlake and Informed.IQ have been collaborating closely for several years to provide automation and hands-off funding,” Wickett said. “The goal of the partnership is to fully automate the analysis and funding of consumers' auto financing applications at various points of their journey: at the time of online applications, at the dealerships as dealers submit financing applications, at the point of underwriting, or at the time of funding.”

Nowlake’s latest actions with Informed.IQ arrived about a month after Carsfast formed a strategic partnership with NowLake to enable consumers to buy and finance vehicles through SMS chatbots.

Two previous Emerging 8 honorees now are working together.

Last week, Lightico, a leader of next-generation digital customer interactions, announced a partnership with TruDecision, a provider of sophisticated finance company tools through an analytic platform as a service.

The companies highlighted their partnership brings Lightico’s seamless, cost-effective contracting and TruDecision’s income validation and credit optimization tools to auto finance companies, helping them minimize risk and maximize efficiency.

Lightico and TruDecision explained that their united platform can provide finance companies an effective solution to their digitization gaps with a significant return on investment that can be rapidly and seamless deployed without requiring significant capital expenditure.

“The auto-lending market is set to become far more competitive in the coming year,” TruDecision chief executive officer Daniel Parry said in a news release.

“Lenders can only move so much on price to stay competitive,” Parry continued. They must become more efficient in terms of speed, service-levels and operating expense in order to increase yield and volume. This is why a digital end-to-end process in originations is an imperative.”

TruDecision is trying to transform the market by delivering cutting-edge tools and decision customization on a subscription basis, making analytic sophistication accessible to finance companies of any size.

TruDecision’s income validation, credit scoring, price optimization and servicing models are a natural extension to Lightico’s front-end platform, according to the companies.

Lightico can equip auto finance companies with an easily customizable and mobile-first platform that integrates seamlessly into existing workflows and can complete entire customer journeys from simply and in real-time. Lightico can create a virtual collaboration window between the business and their client who can then share and receive documents, and process eSignatures, payments, identification and verification (ID&V) and more in a secure, easy environment.

Lightico’s technology has already been implemented in leading auto finance companies, banks, insurance companies, telcos and more to decrease turnaround time and increase customer satisfaction.

“Digitizing auto lending provides massive benefits both to lenders and to consumers – and it is a requirement to stay competitive today,” Lightico chief executive officer Zviki Ben Ishay said. “A critical aspect of that, however, is staying compliant, reducing fraud and risk in a fast, seamless way.

By bringing together Lightico’s and TruDecision’s technology together, consumers will have an excellent experience, lenders will become more efficient and risk will be kept to a minimum,” Ben Ishay

Lightico and TruDecision will be hosting the Auto Finance Innovators Summit on Wednesday, featuring a host of panel discussions and other presentations geared to focus on the latest industry developments.

To register, go to this website.

MUSA Auto Finance now is fueled with technology provided by defi SOLUTIONS.

This week, MUSA Auto Finance announced its partnership with defi SOLUTIONS to handle the day-to-day servicing of the company’s entire lease portfolio. MUSA said in a news release that it will now focus all its efforts on growing originations and creating what executives believe to be “a surprisingly easy leasing experience through automation.”

Pete Siciliano, who recently joined MUSA Auto Finance as chief operating officer, said customers will noticeably benefit from this partnership.

“Since our operations will become more streamlined by leveraging defi SOLUTIONS’ existing, scalable servicing platform, we can pass these savings on to our customers in the form of lower rates,” Siciliano said. “We’ll also continue to improve the leasing experience by focusing on what MUSA knows best – innovative technology and automation.”

Before joining MUSA, Siciliano served as COO for Freedom Truck Finance and held leadership roles with Sierra Auto Finance, Exeter Finance, GE Money and Ford Motor Credit. He brings over 30 years of automobile, commercial truck and mortgage finance experience to MUSA Auto Finance.

Siciliano will oversee the defi SOLUTIONS partnership to ensure the successful implementation of MUSA’s servicing strategies in 2021 and beyond.

“By teaming up with defi SOLUTIONS, we will gain tremendous efficiencies in our operations while also providing world-class service to our customers,” MUSA Auto Finance chief executive offer Jeff Morgan said. “We’re thrilled that defi SOLUTIONS brings in-depth servicing experience across the full credit spectrum since MUSA originates from subprime all the way through super-prime.

“In addition, defi SOLUTIONS has a strong history of servicing leases. This is a rare find and especially important to MUSA. Auto leases are structured differently from standard loans, with unique terminology and nuances,” Morgan continued. “We are confident that defi SOLUTIONS will expertly execute MUSA’s servicing strategy, delivering another year of strong performance across the portfolio.”

Susie Storey, chief sales officer at defi SOLUTIONS, said the MUSA partnership is exciting for defi SOLUTIONS because both companies are driven by technology.

“We’ve seen MUSA create first-of-its-kind automation for leases,” Storey said. “And at defi, we’ve developed a modern, modular and robust servicing platform to deliver our servicing operations,” she said. “I see this collaboration as two tech companies joining forces to deliver a fantastic leasing product to the market.”

Morgan added that he looks forward to expanding into new business lines as a result of the efficiency gains.

“Our vision for MUSA is growing larger by the day, and strategic partnerships like this one set us up for hitting those long-term goals even faster,” he said.

For more information, visit www.musaautofinance.com.

Fair secured a significant new path this week to grow its used-vehicle leasing business, announcing that the platform now will be offered through LendingTree, one of the largest online lending marketplaces.

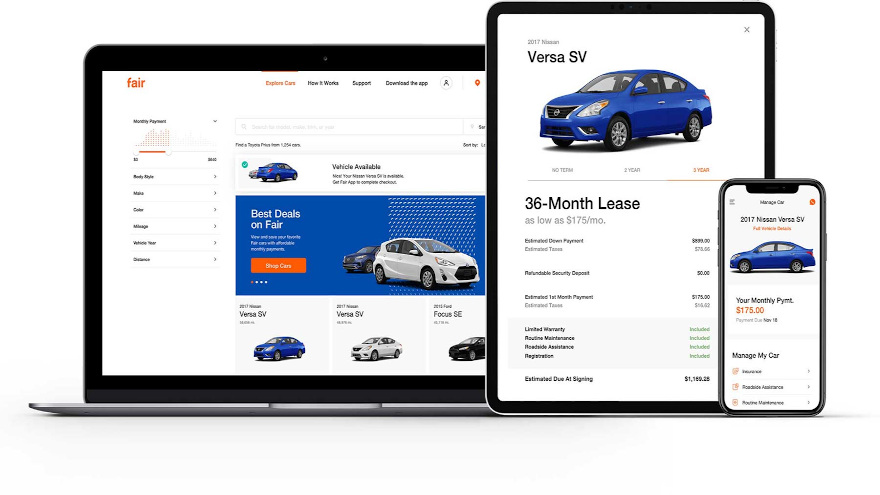

Through the partnership that Fair called a “true watershed moment,” visitors to LendingTree can be instantly pre-qualified for a personalized monthly payment for either a month-to-month, two-year or three-year vehicle lease originated by Fair, the company detailed in a news release . The user would then receive a link to check out with the Fair app.

Fair highlighted visitors also will be able to shop other local inventory available on its website, select the vehicle they want, sign for it on the web or Fair app and drive it for the length they choose — all without any dealer negotiation or physical paperwork.

In addition, Fair pointed out that every leased vehicle comes with routine maintenance, roadside assistance and a limited warranty that last as long as the leaseholder keeps the vehicle.

“This partnership is a clear acknowledgment of Fair’s market leadership as a simple, affordable and flexible alternative to traditional auto financing options,” Fair chief executive officer Bradley Stewart said.

“For the first time, Fair customers will be able to use LendingTree’s expansive platform to connect with Fair to lease a used car from right where they are and for as long as they choose, representing a true watershed moment in Fair’s adoption potential.”

LendingTree auto loans general manager Mike Funderburk explained why the company entered into this relationship with Fair.

“LendingTree shares Fair’s commitment to improving access to mobility for the millions of consumers who rely on us for straightforward and affordable financing solutions,” Funderburk said. “Together we can leverage our mutual synergies and unique digital platforms to forge a new era for today’s auto shoppers.”