For the newest installment of Market Insights that covered the week that ended on the last day of July, Black Book used a moniker that might be quite delighting to dealers and a potential signal to consignors for some strategy modification.

Analysts arrived at their assertions after seeing that wholesale prices softened another 0.54% last week.

“As manufacturers find creative solutions to deal with the semiconductor chip shortage and dealerships continue to strategically procure inventory, wholesale prices declined for the fifth consecutive week,” Black Book said in the newest report.

“Although the last few weeks of declines don’t compare much to the prior 22 weeks’ average rate of increases, this change of direction may mark the turning point for the automotive market,” analysts continued. “New vehicles are being produced. However, some are without previously standard equipment like head-up displays, adaptive cruise and start-stop functions.”

Perhaps some late-model cars that are equipped with those features can be procured at auction for a slightly lower price based on Black Book’s newest volume-weighted information.

Analysts found that overall car segment values decreased 0.68% last week after declining 0.63% a week earlier.

Still going the opposite way of the overall trend are subcompact cars, which now have seen their prices increase for 25 consecutive weeks. Last week, the value rise was 0.23%.

More affordable car options for dealers looking for those pieces of inventory include full-size cars (down 1.19%), midsize cars (down 1.14%) and compact cars (down 1.02%).

In the truck world, Black Book indicated its volume-weighted data showed values for these units softened another 0.47% last week. That’s coming off of a 0.49%. value decline during the previous week.

However, the upward price beat goes on for compact and full-size vans, which each posted weekly value gains of 0.43%.

Analysts noticed that compact luxury crossover/SUVs sustained the steepest price decline at 1.01%, followed by midsize luxury crossovers/SUVs at 0.81%.

Perhaps, it’s potentially the second-most encouraging development for dealers who are looking for inventory.

Read more

Just like dealers might be walking away from the lanes because prices are too high, Tom Kontos has a theory that potential buyers might be doing the same thing on dealership lots for similar reasons.

The KAR Global chief economist shared his theory in the newest Kontos Kommentary after examining the latest company data and other information sources connected to used vehicles.

Read more

Of the 22 different vehicle segments Black Book tracks for its Market Insights, only three posted higher values last week compared to a week earlier.

The smallest two gains were connected with vehicles likely on either end of the buyer spectrum — subcompact cars for individuals on budget and premium sporty cars for those people who might have more wealth at their disposal.

The other segment to generate a value gain is likely needed by the service provider delivering goods to your home or coming by to make a repair, as Black Book said prices for compact vans rose 0.56%.

Perhaps those details are rather boring compared to how noteworthy wholesale-price trends have been, especially during the first half of the year when they rose for 23 consecutive weeks. Maybe the latest info should come as welcome relief to used-car managers looking for inventory, while their new-car colleagues wait for models to arrive from the factory.

“Used wholesale and retail prices are starting to stabilize in July (although at a remarkably high plateau), but new-car sales are still on a rollercoaster as the chip shortage is finally showing up in the new sales numbers,” Black Book said in the report released Tuesday.

Looking closer at car segments, Black Book’s volume-weighted data showed overall values of cars decreased 1.03% during the week that ended on Saturday. That’s more than double the softening analysts saw during the previous week when car prices dropped by 0.47%.

Values for those previously mentioned subcompact cars moved up by 0.19%. While prices for sporty premium cars officially count as an increase, analysts said it was just a minuscule uptick of 0.02%

Conversely, Black Book indicated compact cars posted the steepest value decline last week at 1.9%, followed by midsize cars (down 1.19%) and luxury cars (down 1.14%).

Analysts also noticed that value declines for trucks accelerated, too, as their volume-weighted data showed overall prices dropped 0.41% last week.

While prices rose for compact vans, Black Book said values for the other 12 truck segments all decreased with small pickups leading the way at 0.87%.

If the latest analysis from Edmunds is any indication, car dealers may be inclined to hold on to those trade-ins with 100,000 or more miles.

Cars with that level of mileage are selling at considerably higher prices and with quicker turn times than they were a year ago.

Vehicles with 100,000 to 109,999 miles fetched an average transaction price of $16,489 at dealerships last month, Edmunds said. Not only is that up 31% year-over-year,

Read more

If you can find the inventory you want, maybe you won’t be paying as much for it.

Black Book analysts spotted multiple positive developments for dealership personnel tasked with finding profitable inventory.

While prices might be softening noticeably, the latest installment of Market Insights also mentioned that volume still is down — especially units that need little to no reconditioning to stand tall on the front line.

Read more

Wholesale vehicle prices have peaked and it will likely be “several years” before they return to the record levels seen in recent months.

That’s according to analysis around Cox Automotive’s Manheim Used Vehicle Value Index, which reached an all-time high of 203 in May, but fell to 200.4 in June.

That ended a four-month string of record highs in the index, a streak that included the first time the index had reached 200.

Still, despite a slowdown from May …

Read more

And then after 23 consecutive weeks, wholesale prices finally dipped ever so slightly.

On Tuesday, Black Book spotted the first value decrease since January during the week that closed on Saturday as the United States prepared to celebrate the Fourth of July on the following day.

Read more

As the second quarter closes, Black Book is seeing more evidence that the steady — and unprecedented — climb in wholesale prices is running out of momentum with the Fourth of July holiday straight ahead.

Read more

Tom Kontos’ “parity” projections for the wholesale market are coming to fruition.

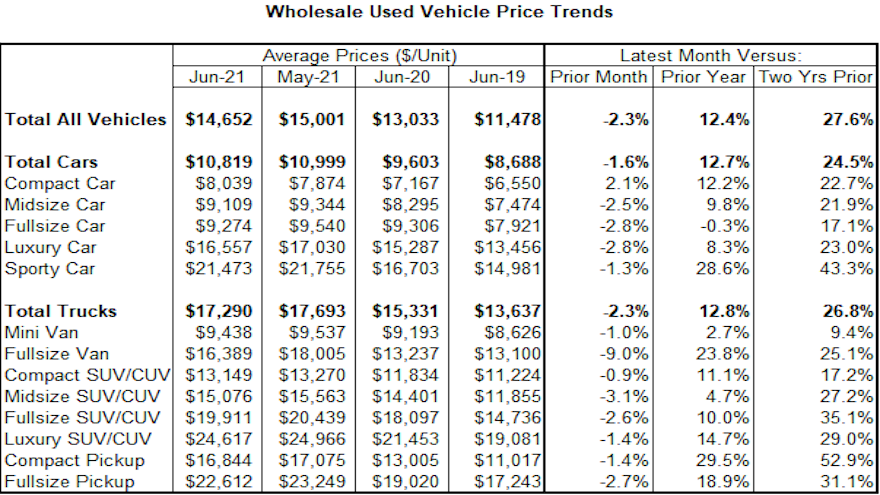

The KAR Global chief economist explained his thinking in the latest Kontos Kommentary that showed how average wholesale prices surged past $15,000 in May after passing the $14,000 for the first time ever just a month earlier.

Read more