Canadians are driving less. As a result, they are buying less.

The result of less driving, says Canadian Black Book, is a reduced sense of urgency when it comes to buying a new vehicle.

That is according to a CBB study using Ipsos research on Canadians’ car-buying habits.

Other findings of the research: Intent to buy alternative energy vehicles in the near term has also decreased, and the federal government’s recent announcement of a carbon tax increase over the next decade could bring movement toward more fuel-efficient cars, less car ownership, and increased use of shared transit methods.

For the study, Ipsos, on behalf of CBB, interviewed a sample of 1,000 Canadians in January who own or lease a car or truck or who are looking to purchase in the next two years.

CBB said its 2021 study reveals some numbers that it described as stunning. The study also shows major contrasts compared to the 2020 edition. The company conducted that work before the pandemic became widespread in Canada.

“CBB’s 2021 study illustrates how the COVID-19 pandemic and its economic repercussions have had a significant impact on how Canadians drive, travel, and approach buying a car,” Canadian Black Book said in a news release.

Driving less; buying less

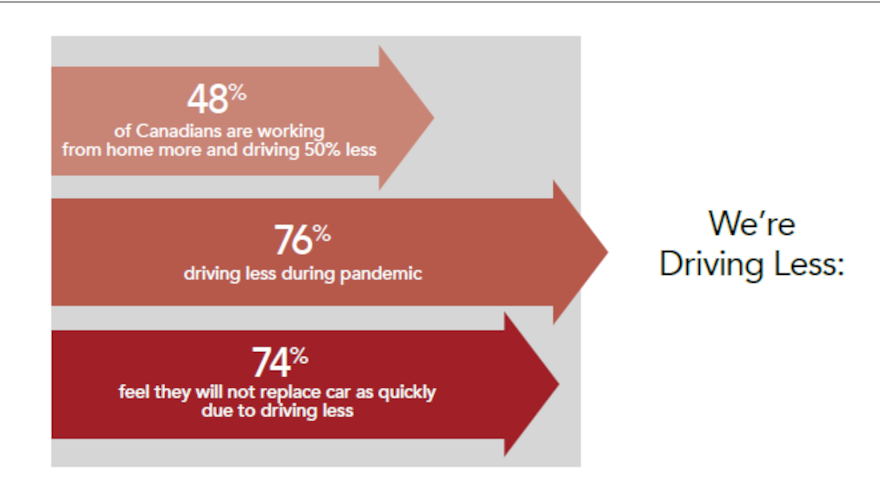

Seventy-six percent of Canadians are driving less since the beginning of the pandemic, and CBB said that that is the prominent catalyst and possibly the most significant change, directly connected to the effect of the pandemic.

Eighty-six percent of those 55 years of age or older say they are driving less. Eighty-two percent of those in Canadian households making more than $100,000 per year are driving less, as well.

EIghty-four percent of respondents from Alberta said they were driving less.

CBB research shows fewer total kilometers driven by Canadians because of the pandemic has had an impact on the auto industry, said David Robins, principal automotive analyst and head of Canadian vehicle valuations at Canadian Black Book.

“The resultant differences in automotive buying and shopping trends and attitudes over the past 12 months are considerable, which perhaps goes without saying,” Robins said. “However, they are very interesting to note and may help some industry people think differently about 2021 and beyond.”

People who are spending less time driving because they are working from home or learning remotely have decreased their driving by nearly 50% on average, compared to before the pandemic. According to the research, 48% are working from home more often. Seventy-four percent of those driving less often agree (20% strongly/54% somewhat) they will not need to replace their vehicle as quickly, because they are driving it less or shorter distances than usual.

Forty-four percent of respondents were likely to purchase a new vehicle in the next two years. That is a notable drop from 2020, when 52% suggested a vehicle purchase over the next two years.

“Over the last three or four years of this survey, the trend was that roughly 50% of Canadians, on average, intended to buy new vehicles within two years,” Robins said.

“The drop to 44% is well over the margin of error for this study and is a significant shift in intention to buy attitudes across Canada,” he adds.

Twenty percent of those surveyed have had to put off, delay or postpone their purchase as a result of the pandemic or recession. Eighty-eight percent of those who have delayed their decision to buy expect to postpone their purchase by a minimum of six months. Nineteen percent plan to delay their purchase by two years or more.

No rush to buy EVs, either

Intent to buy alternative energy vehicles in the near term has also decreased. Thirty percent of respondents say they would likely buy a battery-electric vehicle or a plug-in hybrid electric vehicle in the next five years.

That number is down significantly from last year, when 37% expressed intent to buy an EV. Quebec and Ontario residents are most likely to buy EVs in that time-frame, while the Prairie Provinces are less likely.

Those who are strongly considering purchasing a new vehicle in the next two years are also the most likely to say that in the next five years, they are going to be in the market for a BEV or PHEV.

People age 18 to 34 are most likely to buy EVs. Men are far more likely to consider an EV than females, and university graduates show strong interest in EVs.

Public transit, ridesharing sentiment unclear

Although use of ridesharing services instead of owning a vehicle remains popular, shifts in the market before and during the pandemic means near-term growth remains unclear. Eight percent of Canadians rely on ride sharing services instead of owning a vehicle, compared to 11% of respondents last year.

Seventeen percent rely on transit instead of owning a vehicle. Those aged 18 to 34 are most likely to use transit as their primary means of getting where they need to go.

Other insights

— Fifteen percent have bought a car to avoid the use of public transit or ride-sharing service or are considering it.

— When it comes to buying their next vehicle, 75% say that the current economic situation has no impact on whether they are more likely to buy new or used. Those who do feel an impact from the economic climate are more likely to say they would possibly buy a used vehicle rather than a new one.

— Twenty-six percent of Canadians agree that the pandemic has made them more willing to shop for and purchase a vehicle completely online. Seventy-four percent disagree, preferring to see in-person what they’re buying.

Similar to findings the firm uncovered from the United States, CarGurus determined through its latest analysis that Canadian consumers still have a sustained, high interest in purchasing vehicles amid the coronavirus pandemic.

This week, CarGurus released its second Canadian COVID-19 Sentiment Study, comparing the newest results to what analysts found back in April. CarGurus director of customer insights Madison Gross summarized the latest study that should be positive news to dealerships and finance companies.

“The benchmarked CarGurus Canada COVID-19 Sentiment Study showed us that while 2020 Canadian auto sales may be lagging, they are certainly not lost due to the pandemic,” Gross said in a news release.

“The study also shows us that COVID-19 has caused vehicle ownership to become more vital to consumers’ everyday lives, often replacing other transportation methods such as ride-sharing or public transit,” she continued.

CarGurus reported that fewer shoppers indicated a delay in making a vehicle purchase in June versus April. In addition, CarGurus pointed out that COVID-19 has even stimulated some new demand for vehicles.

Consider these survey findings:

— In June, 78% of car shoppers reported delaying their car purchases, down from 87% in April

— Only 2% of those who had planned to buy in 2020 before the pandemic have now delayed their purchase indefinitely, down from 6% in April

— 21% of those who either currently plan to purchase in 2020 but have yet to do so, or already purchased a vehicle in 2020, had actually not planned to buy a vehicle before the pandemic

Additionally, CarGurus vehicles are becoming more vital to consumers’ everyday lives as individuals and families emerge from the spring lockdown and reconsider what mobility looks like in the long-term.

Analysts mentioned these two particular survey points about that topic:

— 41% of respondents who previously used taxis or ride-sharing, and 50% of those who previously used public transportation, expect to decrease their use of these services — or stop using them entirely

— 45% of respondents say they see their vehicle as an escape or for fun and 32% of respondents say they expect to use their vehicle more going forward than before the pandemic

Across all industries, CarGurus acknowledged brands have adjusted their marketing and customer communications to the COVID-19 crisis. This latest study looked specifically at the car-shopper reaction to how automotive brands responded to the pandemic.

Analysts found the top brands that car shoppers recognized as having responded well to the crisis included

— Ford (18%)

— Toyota (17%)

— Honda (15%)

— BMW (10%)

— Hyundai (10%)

CarGurus added that 30% of car shoppers said no auto brands stood out as having responded well to the COVID-19 crisis.

In June, CarGurus surveyed 505 shoppers on their sentiments toward vehicle buying during the COVID-19 pandemic. All respondents had intentions to buy a vehicle in 2020, either before or after the pandemic.

In April, CarGurus surveyed 500 shoppers as the first iteration of this benchmarking study.

What CarGurus discovered through its U.S. survey is recapped in this report.

Foot traffic is up substantially at Ontario car dealerships.

That’s according to a study commissioned by TRADER Corp. and conducted by EQ Works that looked at dealership visits at 750 stores in the province during May and June.

Unique visitors to Ontario dealerships in June were up 56% month-over-month and total visits climbed 81%.

One-time visits climbed 46% from May and repeat visits were up 85%, the TRADER/EQ Works study found.

Visits for franchised dealerships in Ontario were up 154%, and independent dealerships had a 36% uptick in visits.

And the most popular day for dealership visits in Ontario? Monday, which had a 17% share of traffic in June, according to the study. The busiest time slot was 4-7 pm.

Moving online and sharing some of its own internal data, TRADER said that there were a record 22 million visits to its autoTRADER.ca marketplace in June, beating the prior record set a month before.

“Following a few challenging months surrounding the onset of the COVID-19 pandemic, we are observing promising consumer behavior data,” TRADER chief marketing officer Ian MacDonald said in a news release.

“Recent record-setting traffic on autoTRADER.ca coupled with a significant increase in dealership footfall affirms the auto industry’s current movement towards recovery.”

It will be interesting to see where conditions for dealers — in Ontario and throughout Canada — go from here.

In its weekly COVID-19 Market Update from Tuesday, Canadian Black Book discussed some overall auto retail trends in Canada.

In the summary of that report, CBB indicated that about 9% of annual new-car sales happen in July — during “more conventional times,” of course.

“Sales results from the months of May and June of 2020 were generally agreed by most in the industry to have been propped up by a considerable amount of pent-up demand from earlier, stagnant sales months, for new- and used-vehicle sales,” Canadian Black Book said in the report.

“As we get further away from those months, Canadian Black Book expects to see more clearly what the natural levels of demand through this COVID-19 recession will be.”

The decline in sales moderated substantially over spring months, slowing from a 75% decline in April to a 16.2% drop in June, CBB said. Its analysts anticipate “less pent-up demand in July and August, which will provide some clarity as to what the sales pace will be for the remainder of 2020.”

Year-to-date sales are off 34% year-over-year, and CBB expects there will be a 25% drop in new-car retail sales for full-year 2020.

Equifax Canada looked to provide some clarity as auto-finance providers continue to navigate the challenges created by the coronavirus pandemic.

The credit bureau recently released a whitepaper that reviewed credit-based insights for lenders to keep in mind as both dealers and consumers approach what Equifax Canada classified as a “new normal” for the Canadian auto-finance industry. Authors delved into three primary topics, including:

1. Past economic distress scenarios

2. Recent credit-related trends

3. Future of where we may land as a new normal

“As witnessed on a global scale, COVID-19 has struck a blow to many retail industries, arguably amongst one of the hardest hit being the automotive sector,” Equifax Canada wrote in the whitepaper titled, “Canadian Auto Finance Trends: Navigating the New Normal.”

Equifax Canada recapped that after automotive retail sales showed some positivity in January and February (up 0.7% and 2.1% year-over-year respectively), they declined 48% year-over-year in March, dropped an estimated 75% in April and was closed down 44% in May.

For the year, whitepaper authors indicated the Canadian baseline scenario for new-vehicle sales is estimated to decline 25% to 30% while used-vehicle sales are expected to drop but not as severe at about 10%

“Financing of a vehicle is a key part of the automotive cycle and with the onset of the pandemic, many consumers experiencing financial hardship with leases or loans have had options to consider payment deferrals and/or case-by-case reviews of accommodations by their lending institutions,” Equifax Canada said in the whitepaper.

“However, with unemployment expected to swell again to around 16%, 8.3 million Canadians having applied for either employment insurance or Canada Emergency Response Benefit (CERB) as of the end of May and indication of just over 1 in 5 Canadians living in households reporting difficulty meeting financial obligations, delinquencies as a lagging metric, are expected to turn upwards in the coming months,” authors went on to say.

The complete Equifax Canada whitepaper is available on this website.

Manheim Canada announced last week that it would be launching a service to disinfect and treat vehicles sold through the company’s simulcast auctions to help prevent customer exposure to COVID-19 and other viruses.

The Manheim Vehicle Disinfection Service started June 29 and is available at all of the company’s auctions throughout Canada.

The service uses a Canadian-made disinfecting agent developed by what Manheim described as a “leading sanitization solution provider.” The solution is approved by both the Environmental Protection Agency and the Government of Canada to combat COVID-19 and other viruses.

In a news release, the auction company said: “Manheim’s specially trained teams, equipped with PPE, perform this service with an atomizer through a process that disinfects the interior and popular exterior touchpoints of the vehicle with no negative effects on any instruments or materials and no post-treatment residue.”

Maria Soklis, president of parent company Cox Automotive Canada, said Manheim Vehicle Disinfection Service can help instill greater confidence among wholesale buyers.

“As we continue to work closely with our clients to develop and offer them solutions to address the various business needs and industry concerns around COVID-19, we are excited to introduce the Manheim Vehicle Disinfection Service,” Soklis said in a news release.

“With this new service, clients of Manheim Canada can now confidently purchase their used vehicles knowing that they have been through a thorough disinfecting treatment and, if they adhere to their own strict Personal Protective Equipment (PPE) guidelines, can pass that confidence on to their customers,” she said.

Auction sales volumes in the Canadian wholesale vehicle market are back to being at roughly 70% of where they would normally be, following another round of “significant growth” last week, according to Canadian Black Book.

And further gains are likely over the next few weeks, CBB said in its weekly COVID-19 Market Update released Tuesday.

“We continued to see significant growth in the wholesale marketplace last week. As the auctions recall more staff nationally, this will increase the capacity for sales,” CBB said in the report.

“Previously, the throughput of wholesale auctions was very limited by the closure of all physical auctions and temporary reductions in staff,” it added. “Total volume has yet to return to prior year levels.”

At the market’s worst point, auction sales were off 80% year-over-year, which happened during March’s widespread physical auction sale closures, CBB said.

Sales rates at auctions are also gaining steady ground each week. There were sales rates spotted above 80% and even around 90% last week, CBB said, with the latter beating pre-pandemic rates.

“The weeks of rock bottom, in some cases single-digit sales rates at auction, are now behind us,” CBB said. “Rates have been slowly climbing each week with some instability isolated to certain auctions along the way.”

In terms of supply coming into the wholesale arena, for the next months, that is likely to be “dramatically higher,” CBB said.

Driving that spike are the once-delayed lease returns coming back into the market, rental companies de-fleeting amid slower retail demand and climbing repossessions amid a tough economy.

Also driving that supply: there was a delay in vehicles coming back into wholesale in March-May amid the auctions scaling back, CBB said. However, those cars “will still be arriving for sale, albeit later than originally planned.”

Sharing more context on the off-lease impact, CBB said that even before the pandemic, lease maturities for 2020 were forecasted above 400,000 for the year, which would have been a record.

The pandemic, however, certainly had a big impact.

“Once the pandemic was underway and most manufacturing stopped, OEMs worked to facilitate lease extensions in order to push returns further into 2020 and to be able to reliably provide replacement vehicles,” CBB said. “As a result, we project at least 60% more additional units in the second part of 2020 (compared to the pre-COVID-19 estimates) due to a slowdown in sales in March/April/May, along with expected turn-ins of the lease extensions.”

Looking at a chart in the CBB data set, it was anticipated that the third quarter of this year would have about 90,000 lease returns. The revised forecast has it above 140,000 units. The Q4 2020 and Q1 2021 revised forecasts are on par with their respective original forecasts.

Q1 2020 and Q2 2020 actuals were less than original forecasts.

The Canadian Black Book Wholesale Used Vehicle Retention Index, which covers vehicles 2 to 6 years old, was down 5.0% year-over-year in May and fell 3.1% month-over-month, according to an update from the company this week.

The index’s reading was at 100.5 in May. In the last three months, it has dropped 7.8 points since reaching 108.3 in February. That streak includes a record 3.58-point dip in April and last month’s 3.2-point decline.

“It is our expectation that there are approximately 10 more points of potential decline before values begin to trend upwards towards the end of 2020,” Canadian Black Book said in a news release.

The CBB used index has remained above 100 for nearly three straight years, according to data from the company. In June 2017, it was at 99.9. Then beginning with July 2017, the index has been above 100 each month.

May's reading was the lowest since June 2017.

As far as the rest of this year, the used-vehicle market is likely to see several more months of soft prices, CBB said, as additional vehicle supply hits the market. Then, look for an improvement in the economy and used-vehicle prices.

Such reflects the “very strong cyclical nature” of the car business.

“We fully expect that once some of the extra supply we are expecting over the next 5-6 months has run through the market and the economy starts to strengthen that prices will start to rebound,” CBB said. “Until that time, it is a buyer’s market, and there are deals to be had out there in the lanes.”

Looking at more recent data, wholesale prices of cars ages 2 to 8 years old were down 0.58% last week. The week before, they dropped 0.6%, according to the latest COVID-19 Automotive Market Weekly Update from Canadian Black Book.

The average weekly decline the past eight weeks for cars has been 0.54%.

As for trucks, their wholesale prices were off 0.68% last week and 0.85% the week before. The weekly average the past eight weeks has been a 0.61% drop.

“Please note that these are weekly adjustments, so when you consider how much of a decline this would be over 52 weeks over a year, the numbers are daunting,” CBB said in a release.

Going back to the monthly index, CBB said June’s decline could be larger than May’s 3.2-point drop.

“It remains our outlook that wholesale prices will continue to decline, until we reach a total decline of 17% industry wide,” CBB said. “We have not yet seen retail asking prices follow the wholesale trends, but that is to be expected in the coming months.”

After the largest monthly decrease in its 15-year history, the Canadian Black Book vehicle value retention index continued its descent in May, pushed by declining consumer confidence and auto-market uncertainty.

And both wholesale and retail vehicle values are likely to continue falling.

That’s according to the latest COVID-19 Market Update from Canadian Black Book, released earlier this week.

But the report wasn’t all doom and gloom. Auction volumes are steadily picking backing up, for example.

Zeroing in on the retention index first, CBB said wholesale prices fell 3.20% last month. In April, they had dropped 3.58%, a record.

The total decrease from February is now at 7.76%.

“The decrease was driven by the collapse in consumer confidence, along with high levels of uncertainty about the current vehicle market due to the pandemic,” CBB said in the report.

And the price softness is expected to last for some time. Mirroring an environment, it said is a “new economic reality,” CBB said that “projected values will continue to stay well below pre-COVID-19 projections over the next two years.”

In the near term, CBB is forecasting that the rest of 2020 will see wholesale prices down an average of 17% from pre-COVID projections. This summer is likely to show a “larger difference,” CBB said, followed by a recovery likely to begin next year,

“We also anticipate that older (more than 6-years-old), less expensive vehicles in average condition will not decline as much due to increased demand for these units,” it said.

“The demand lift is expected to be driven by consumers seeking low cost reliable transportation. COVID-19 and social distancing practice is also expected to cause some regular transit riders and ride sharing customers transition to vehicle ownership,” CBB said.

Delving into some supply metrics that are likely to impact used-car values, CBB is forecasting a “large incremental influx” of supply in the second half of 2020.

“These units will flood the market from deferred lease returns, downsizing of rental fleets (including the expected sell-off of a large number of Hertz’s units), increased repossessions, and a backlog of un-sold inventory from the March-May time period,” CBB said.

“As a result, we maintain our projection that there will be a continued decline in wholesale prices over the next several months, with some improvement expected by winter.”

Looking further ahead, the company projects that even in 2023, the aftermath of COVID-19 will still be in play. But it anticipates pre-pandemic residual values by then, due to declines in used-car supply. That expected supply softening is driven by forecasted declines in retail and fleet sales “the remainder of 2020 and into 2021,” CBB said.

In its report, CBB also outlined what the impact to wholesale prices would be under a severe recession.

“In this scenario, we project a 25% drop in wholesale prices compared to a pre-COVID-19 baseline this summer/ fall, with a very slow recovery in 2021,” CBB said. “The effects of the pandemic and recession will still be impactful in 36 months, and we project a 10% market level decline of wholesale prices as compared to pre-COVID-19 projections for the second half of 2023.”

Amid these somewhat troubling projections on the pricing front, there were some silver linings in CBB’s report, including what it observed in auction activity and volume.

For instance, CBB noted that digital auctions across Canada “continue to show signs of returning to a more normal state. Prices are stabilizing, bidding and buying activity has increased, and auction personnel are returning.”

Auction volumes are also bouncing back, which has helped to stabilize prices, CBB said.

“This increase in volume appears to be leading to greater stability in prices. Previously, the throughput of wholesale auctions was limited by the closure of all physical auctions and the temporary reduction in staff by the auctions,” it noted. “Sales have yet to return to prior year levels, but that is expected to be the norm over the coming months. The number of sales bottomed out around an 80% year-over-year decline when most auctions closed their physical sales in March.”

What’s more, after hitting percentages in the teens at the outset of the pandemic and the stopping of physical auction operations, there has been a gradual, week-by-week increase in sales rates at auctions, albeit “with some instability along the way,” CBB sad.

“Last week, we observed sales rates continuing to climb as buyers appear to be getting more comfortable with the virtual bidding environment they are operating in,” CBB reported. “When more prospective buyers can return and walk the lot in advance of the sales, we expect this will boost confidence in bidding and elevate sales rates. We will continue a steady march towards historically ‘normal’ sale rates in the coming months.”

Close to three-fifths of Canadian shoppers surveyed by CarGurus last month plan on buying a vehicle this year, with 41% saying they had intended to, but are now putting off that purchase.

The survey, which was conducted among 500 Canadians, delved into car-shopping sentiments amid the pandemic, was released May 1 and included some findings pertinent to used cars.

“Even though the COVID-19 pandemic is having an impact on the automotive industry, our study showed that there are several bright spots among consumers who plan on purchasing a vehicle this year,” CarGurus director of customer insights Madison Gross said in a news release.

“Based on the data, consumers are mostly still planning major purchases such as a vehicle, but those sales are likely to be delayed until later in the year when economic activity begins to return to normal and certainty over economic outlook improves,” she said.

Used, new or unsure?

Once these consumers get in the position to buy, though, what are their plans? Fifty-eight percent initially planned on buying a new car and said they will go forward with that. Fourteen percent said they were planning to go new and are switching to used.

Sixteen percent planned on going used and still intend on doing so. Just 4% had planned to go used and are switching to new.

Eight percent were not sure of their plans.

Delayed but not indefinitely

While most still plan to buy this year, the CarGurus survey found that 87% are now planning on buying later than expected.

But still, 68% of consumers delaying their purchase are still conducting vehicle research.

And another positive nugget noted in the survey summary: “Only 6% who were planning to buy this year before the pandemic have now delayed their plans indefinitely.”

As Gross noted, the economic outlook and purchase plans run along similar timetables. Twenty-three percent anticipate normal economic activity to resume within three months and 33% intend on buying during that time frame, according to the CarGurus data.

Similarly, 57% are anticipating that the economy will resume normal activity within six months and a similar amount (53%) say they’ll buy during this time.

Getting more specific with the timetable, the CarGurus data showed that 16% intend on buying soon after the restrictions end, 4% planned to buy within a month, 12% in one to three months, 21% in four to six months and 28% in seven to 12 months. Thirteen percent said they planned to delay for more than a year and 5% were not sure.

Axis Auto Finance provided a wide-ranging shareholder update this week, including that the subprime automotive finance company closed on a $6.25 million term loan with a Schedule 1 bank.

From the onset of the pandemic and the government-mandated measures to combat the spread of the coronavirus, Axis said it has supported borrowers through payment accommodations or deferrals. To date, the company reported 12.5% of active customer accounts have been impacted.

The frequency of payment deferral requests declined significantly by the end of April, according to a news release Axis distributed this week.

While originations continued through the lockdown period, Axis explained that the finance company adjusted its underwriting approach to account for the difficult economic environment.

“With automotive dealership showrooms largely closed across the country, origination volumes were low through the last two months,” the company said. “With the re-opening of dealerships in several provinces, Axis is seeing a significant increase in weekly application volume since mid-May.”

Axis highlighted that management implemented necessary precautions to protect the well-being of its employees and customers, including:

• Switched to a fully remote work model

• Intensified cleaning and hygiene practices

• Suspended all in-person meetings and corporate travel

• Implemented social distancing protocols across the organization

• Suspended repossessions to not create further financial burden for affected customers

The finance company mentioned additional steps were taken to preserve liquidity, including cuts and/or deferrals of senior management compensation, employee layoffs, suspension of director fees and vendor supported payment deferrals. The company said these steps allowed Axis to retain a strong liquidity position to date and position the company for a smooth return to normal operations upon the lifting of government restrictions.

Meanwhile, Axis noted that its senior secured credit facility, which matured in March has been extended through July in light of the pandemic, is positioned with the intention to go through an orderly renewal process at that time. The company said it is in compliance with all terms and covenants of that facility as of the date hereof.

In addition, Axis has closed on a $6.25 million term loan. Together with unused amounts on its securitization facilities, Axis computed that it currently has more than $40 million in available growth capital.

Axis indicated that a $6.25 million term loan is backed by the Canadian Government under the Business Credit Availability Program (BCAP). Specifically, 80% of the principal of the loan is guaranteed by Export Development Canada (EDC).

Axis said the Loan bears interest at a rate of 4.00% per annum above the bank’s prime lending rate. Axis will also pay an EDC Guarantee fee of 1.8% annually of the loan amount.

The initial term of the loan is 12 months, but Axis said it may provide the bank with a written request to extend the loan maturity date by an additional 12 months no more than 90 days prior to the initial loan maturity date.

Under the terms of BCAP, Axis explained the proceeds of the loan may not be used to refinance existing debt obligations, for non-scheduled term debt repayment, any shareholder contributions, repayment of shareholder loans, stock buy-backs, executive bonuses or increase in executive compensation while any balance of the loan is outstanding and the EDC Guarantee is in place.