A firm that was supposed to pull funds from contract holders’ bank accounts and deliver the money to auto-finance companies entered into a consent order with the Consumer Financial Protection Bureau this week.

And in a twist, the penalties levied by the CFPB against the company might not be completely delivered.

Here’s what has happened, according to a news release from the bureau.

The CFPB issued a consent order against SMART Payment Plan (SMART), finding that the company’s disclosures of its payment program contained misleading statements in violation of the Consumer Financial Protection Act of 2010’s prohibition against deceptive acts or practices. SMART is a limited liability company with its principal place of business in Austin, Texas.

The bureau recapped that SMART operated a payment program for auto financing called the SMART Plan that deducted payments from consumers’ bank accounts every two weeks and then forwarded these payments every month to the consumers’ contract holders.

The consent order imposes a judgment against SMART requiring it to pay $7.5 million in consumer redress and requirements to prevent future violations.

Bureau officials explained SMART provided consumers individualized “benefits summaries” that purported to state a specific amount of interest savings or other money savings consumers would get by enrolling in the SMART Plan. But SMART’s fees would ordinarily exceed the savings, according to the regulator.

“SMART’s disclosures thus created the misleading impression that consumers would save money using its product,” the CFPB said.

Now to the complicated part involving penalties.

The bureau said its ordered redress amount is suspended upon SMART’s payment of $1.5 million by Dec. 31 and a $1 civil money penalty to the regulator.

Officials indicated the suspension of the full payment for redress, as well as the $1 civil penalty, is based on SMART’s demonstrated inability to pay more based on sworn financial statements.

The CFPB added harmed consumers may be eligible for additional relief from the bureau’s civil penalty fund.

“The consent order prohibits SMART from making any misrepresentations about its payment programs,” officials reiterated.

“It also requires SMART to account for the total costs for its payment programs, as well as the net savings or costs after deducting any fees, whenever SMART makes claims about savings or financial benefits,” they went on to say.

The complete consent order can be downloaded here.

The American Recovery Association (ARA) recently distributed a message to the industry, reiterating its positions regarding personal property in repossessed vehicles. The move was triggered by the $5 million settlement Nissan’s captive finance company reached with the Consumer Financial Protection Bureau after the regulator said it found several violations by Nissan Motor Acceptance Corp. in connection with vehicle repossessions.

ARA focused its attention on one specific piece of the consent order, which states:

“The practice of withholding consumers’ personal property unless consumers paid an upfront fee to recover it caused or was likely to cause substantial injury that is not reasonably avoidable or outweighed by the countervailing benefits to consumers or competition.”

The association insisted that many states have recognized that a fee associated with handling personal property is a legitimate expense and a reasonable fee can be charged to the consumer.

That assertion led ARA to reiterate three points it also highlighted in a white paper compiled in August. The ARA said:

1. Nothing in this order changes what a collateral recovery agency is permitted to charge. The latest ARA White Paper on personal property demonstrates the validity for this fee and establishes the handling of personal property as a separate and distinct service not included in a repossession fee.

2. It states lenders must prohibit their repossessors from charging personal property fees directly to consumers and demanding fees as a condition of returning personal property. Nothing in the consent order prohibits the repossessor from collecting those fees by way of contractual agreement directly with the lender.

3. The CFPB, in several points in their Supervisory Highlights Oct 2016, suggest that the fees associated with personal property handling can be billed to the creditor.

“The legitimacy and permissibility of this fee has been established for 30 years,” ARA added in its latest message. “The handling of personal property is very time consuming. Occasionally, it is also unsafe.”

ARA recommended that finance companies collaborate with the legal counsel on how to proceed with this portion of the repossession process.

The Consumer Financial Protection Bureau offered collections and compliance professionals some light reading just before the weekend. It’s mere a 653-page document to update a regulation first passed four decades ago that has taken regulatory officials seven years to get to this juncture.

On Friday, the bureau issued its final rule to restate and clarify prohibitions on harassment and abuse, false or misleading representations, and unfair practices by debt collectors when collecting consumer debt. The regulator explained the rule focuses on debt collection communications and gives consumers more control over how often and through what means debt collectors can communicate with them regarding their debts.

The CFPB added that the rule also clarifies how the protections of the Fair Debt Collection Practices Act (FDCPA), which was passed in 1977, apply to newer communication technologies, such as email and text messages.

The entire new rule can be downloaded on this website.

Initial industry reaction to this rule seemed positive.

“AFSA and its members appreciate the time and consideration put forward by the CFPB in developing its debt collection rules under the Fair Debt Collection Practices Act (FDCPA),” American Financial Services Association senior vice president Celia Winslow said in a statement.

“Key to this rulemaking was ensuring that creditors would have the ability to contact their customers and work with them to remain current or to assist them if they faced hardships,” Winslow continued. “We have seen how crucial this flexibility can be over the past seven months, and focusing on third-party debt collectors in this rulemaking both protects consumers and means efficient, expeditious resolution by creditors, which in turn also benefits their customers.”

In its own news release, the CFPB pointed out that the rule is the result of a deliberative, thoughtful process spanning more than seven years and reflects engagement with consumer advocates, debt collectors, and other stakeholders.

Further, in developing the final rule, the bureau said it considered the more than 14,000 comments received during the public comment and rulemaking process.

As a result of this feedback, the regulator noted that the rule establishes a presumption on the number of calls debt collectors may place to reach consumers on a weekly basis. A debt collector is presumed to violate federal law if the debt collector places telephone calls to a particular person in connection with the collection of a particular debt more than seven times within seven consecutive days or within seven consecutive days of having had a telephone conversation about the debt, according to the new rule.

The CFPB said that the rule also clarifies how consumers may set limits on debt collection communications to reflect their preferences and the limits on communicating with third parties about a consumer’s debt. The rule requires debt collectors who communicate electronically to offer the consumer a reasonable and simple method to opt out of such communications at a specific email address or telephone number.

The rule also provides that consumers may, if the debt collector communicates through a medium of electronic communications, use that medium of electronic communications to place a cease communication request or notify the debt collector that they refuse to pay the debt.

The bureau went on to mention the rule further clarifies that the FDCPA’s general prohibition on harassing, oppressive or abusive conduct applies to telephone calls as well as other communication media, such as email and text messages, and provides examples demonstrating how the prohibition restricts emails and text messages. It also generally restates the FDCPA’s prohibitions regarding false, deceptive, or misleading representations or means and unfair or unconscionable means, according to the CFPB.

Officials closed by addressing one of the topics on which the bureau acknowledged that it received a great deal of feedback.

The bureau said it is not finalizing the proposed safe harbor for debt collectors against claims that an attorney falsely represented the attorney’s involvement in the preparation of a litigation submission. Officials noted that provision was proposed to bring greater clarity to this issue but, after receiving questions and comments from many stakeholders concerning the proposal, the bureau said it has decided not to finalize that provision.

“With the vast changes in communications since the FDCPA was passed more than four decades ago, it is important to provide clear rules of the road,” CFPB director Kathleen Kraninger said in the news release.

“Our debt collection rulemaking provides limits on debt collectors and provides clear rights for consumers. With this modernized debt collection rule, consumers will have greater control when communicating with debt collectors.”

The CFPB added the final rule also contains provisions on disputes, and record retention, among other topics. The bureau said it intends to issue a second debt collection final rule focused on consumer disclosures in December.

Dealerships ask their customers to complete and sign a wide array of contracts during the financing and delivery processes.

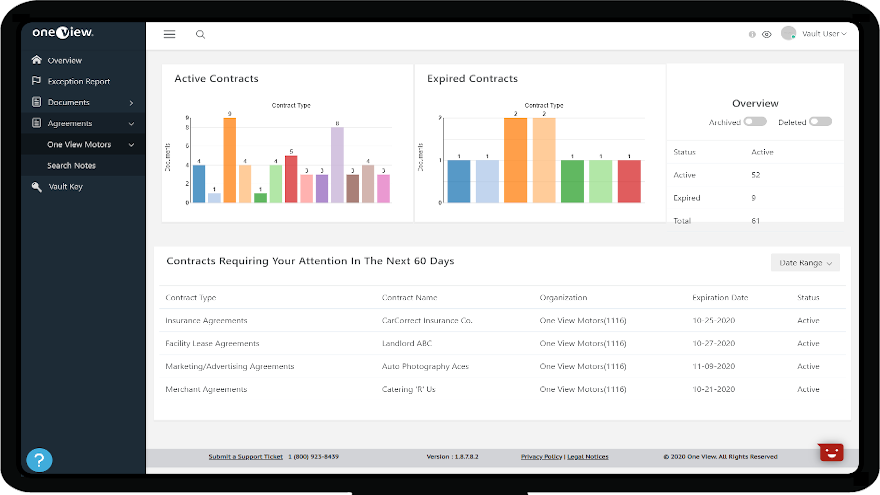

This week, One View rolled out a solution to help dealerships keep track of contracts they sign.

The auto industry-specific data solution specialist announced the release of its Vendor View contract storage and management platform. The web-based, user-friendly platform is designed to allow dealerships to upload copies of vendor contracts and receive automated notifications of upcoming contract renewal or expirations to better manage vendor relationships and control expenses.

The firm said Vendor View can be implemented as a standalone product or added to a dealer’s existing One View Vault subscription.

“Controlling expenses and staying up-to-date on vendor contracts has always been important to our dealer clients, but it’s even more important now as our industry recovers from the coronavirus pandemic,” One View founder and chief executive officer David DeHaven said.

“Vendor View is one central place where dealers can quickly view and compare all vendor terms and conditions so they are never caught off guard, and can make informed vendor decisions moving forward,” DeHaven said.

The company explained Vendor View can allow dealerships to manage all vendor contracts from one uniform platform. Dealerships can easily and securely scan and archive vendor agreements. This tool can replace the manual and time-consuming process of filing paper contracts, and then digging through file boxes in an effort to stay on top of contract terms and conditions.

The company went on to point out that one central location also can help dealerships avoid the “vendor gotcha moment” whereby forgotten terms and conditions result in an automatic contract renewal for a vendor that may no longer be a best fit.

When dealerships can quickly access and analyze digital contracts, One View said stores can avoid accidental renewals and are empowered to transition to new vendors when a contract ends or business needs change.

Five unique features simplify document management and ensure a contract renewal, change in pricing, or duplication of service, never slips through the cracks, including:

1. Automated notifications: Set and receive automated email notifications of upcoming contract renewals or expirations.

2. Upcoming renewals: Track all contracts with upcoming end dates via a user-friendly dashboard.

3. Search contracts: Locate contracts based on vendor, products and services provided, expense account, executed by, or contract dates.

4. Add context or updates: Post document notes to a select group of users to communicate a change or update.

5. Categorize vendors: Assess dealership spending by categorizing vendors into related groups. Use visual graphs to highlight percentage of dealership costs.

One View highlighted that it is a SOC 2 certified organization and held to the highest standards of data security. Developed by the American Institute of CPAs, SOC 2 defines criteria for managing customer data based on security, among other service principles.

All dealership vendor contracts are scanned and sent to One View Vendor View through encrypted transmission methods and databases are backed up redundantly to multiple datacenters to ensure business continuity and data integrity.

“Dealerships across the country are seeking ways to cut costs and run more efficiently,” DeHaven said. “We’re proud to offer a platform that makes it easy to view and manage vendor relationships with an eye to controlling costs, all within a top-of-the-line data center that meets the highest standards for security.”

For more information about One View Vendor View, visit this website.

Ignite Consulting Partners chief legal and compliance officer Steve Levine explained two of the most important potential ramifications stemming from the Consumer Financial Protection Bureau’s settlement with Nissan’s captive finance company.

To recap, the bureau said it found several violations by Nissan Motor Acceptance Corp. in connection with vehicle repossessions, leading to a settlement totaling $5 million.

In a message to clients as well as SubPrime Auto Finance News, Levine said, “Two big takeaways are be sure your state allows a fee to be charged by either the creditor or its agent for the return of personal property left in a vehicle. Many states prohibit this.

“Also, be transparent about payment fees being charged and communicating the availability of payment methods with lower or no fee,” he added.

Levine also acknowledged more potential compliance pitfalls are mentioned in the CFPB’s consent decree with Nissan’s captive than these two issues with repossessions. He welcomed dealerships and finance companies to engage in a more in-depth conversation with the firm by sending a message to [email protected].

“It’s worth noting that this is the second CFPB action taken against an auto finance company in a month, with a September action being announced against Lobel Financial on its loss damage waiver product. Rumors of the CFPB’s demise have been greatly exaggerated,” Levine said.

And as a side note, Levine mentioned activities on social media, too.

“Be aware that we’ve seen a few recent examples of creditors communicating with purported customers via Facebook only to find that the customer's account was a ‘dummy’ one,” he said. “Give careful consideration to your social media policies and the controls you have in place.”

For more details, go to ignitecp.com.

The Consumer Financial Protection Bureau issued a consent order in the auto-finance industry for the second time in less than a month; this time with Nissan’s captive.

According to a news release distributed on Tuesday, the bureau said it found several violations by Nissan Motor Acceptance Corp. (NMAC) in connection with vehicle repossessions, including:

— Wrongfully repossessed vehicles

— Kept personal property in consumers’ repossessed vehicles until consumers paid a storage fee

— Deprived consumers paying by phone of the ability to select payment options with significantly lower fees

— In its contract extension agreements, made a deceptive statement that appeared to limit consumers’ bankruptcy protections.

Officials said these actions violated the Consumer Financial Protection Act’s (CFPA) prohibition against unfair and deceptive acts and practices.

The CFPB explained the consent order requires NMAC to provide up to $1 million of cash redress to consumers subject to a wrongful repossession, credit any outstanding account charges associated with a wrongful repossession, and to pay a civil money penalty of $4 million.

The order also imposes certain requirements to prevent future violations and remediate consumers whose vehicles are wrongfully repossessed going forward.

When contacted by SubPrime Auto Finance News, NMAC offered this statement about the matter:

“Nissan Motor Acceptance Corporation (NMAC) has reached a voluntary agreement with the Consumer Financial Protection Bureau (CFPB) regarding claims of unfair and deceptive practices. NMAC denies any wrongdoing but has agreed to settle with the CFPB in the best interest for all parties. While NMAC disagrees with the CFPB’s claims, we take their assertions seriously and share their commitment to fair practices for all our customers. The actions NMAC will voluntarily take under this agreement are intended to further that commitment and to provide appropriate relief for affected customers.”

The bureau went into more detail about its findings that led to this consent order that arrived on the heels of an agreement with Lobel Financial. The order also is the largest since the CFPB’s consent order totaling nearly $12 million with Santander Consumer USA in November 2018.

The CFPB said it specifically found that from 2013 through September of 2019, NMAC repossessed hundreds of consumers’ vehicles despite the consumer having made payments or otherwise taken actions that should have prevented the repossession.

The bureau said it also found that from at least early 2014 through late August 2017, NMAC’s repossession agents with the captive’s knowledge, demanded that consumers pay a separate, upfront storage fee for personal property contained in repossessed vehicles. These agents refused to return consumers’ personal property until the consumers paid the fee, according to the regulator.

The CFPB went on to say that it further discovered that from 2012 through part of 2017, Nissan deprived consumers paying by phone of the ability to select pay-by-phone options with significantly lower fees. Officials said numerous consumers paid $7.95 more to make a phone payment than they would have if they had known of and selected a different payment option.

The bureau also found that when NMAC agreed to modify a consumer’s installment payments for tens of thousands of accounts that NMAC used agreements or written confirmations that included language that created the net misimpression that consumers could not file for bankruptcy.

The CPFB indicated that the consent order requires NMAC to refund fees paid by consumers, credit any outstanding charges stemming from the repossession, and pay consumers redress for each day the captive wrongfully held the vehicle.

NMAC an must also pay a civil money penalty of $4 million.

The consent order also requires NMAC to:

— Prohibit its repossession agents from charging personal property fees to consumers directly and from demanding fees as a condition of returning personal property

— Correct its repossession practices and conduct a quarterly review to discover and remediate any future wrongful repossessions

— Clearly disclose to consumers the fee for each method of making a payment by phone before consumers are asked which method they wish to use

— Stop using any language that creates the impression that consumers have surrendered their bankruptcy rights

The entire consent order can be found on this website.

Finance companies that reach consent orders with the Consumer Financial Protection Bureau received a bit more clarity about them this week.

The bureau issued a policy statement on applications for early termination of consent orders that outlines process for entities subject to a consent order and the standards that the bureau intends to use when evaluating applications.

In order for a consent order to be terminated early, the CFPB explained that an entity should have:

— Demonstrated that it meets certain threshold eligibility criteria

— Fully complied with the terms of the consent order

— A satisfactory compliance management system in applicable areas

“These conditions are designed to minimize the risk of new violations of law by the company and to protect consumers,” the regulator said in a news release.

Officials noted that an entity’s application for early termination should be submitted to the bureau point of contact specified in the consent order.

“In general, an application should demonstrate that the entity has satisfied all of the conditions for granting early termination described in the policy statement,” the CFPB said.

The agency went on to mention that bureau staff will review applications and make recommendations to the director about whether to terminate a consent order.

Under the policy, the sole authority to terminate a consent order remains with the bureau’s director and the termination decision is at their discretion.

The CFPB recapped that consent orders, which generally have a five-year term, describe the bureau’s findings and conclusions concerning the identified violations by an entity and generally impose injunctive relief, monetary relief, penalties and reporting, recordkeeping and cooperation requirements.

“They play an essential role in the bureau’s enforcement work by providing relief for consumers and deterring future violations,” the bureau added.

To read the entire policy statement regarding consent orders, go this website.

The Supreme Court began its term on Monday with plenty of turmoil swirling following the passing of Justice Ruth Bader Ginsburg in September and the U.S. Senate wrangling over how quickly the highest court goes back to nine members.

Nonetheless, Hudson Cook partner Mark Rooney said the Supreme Court will consider several cases affecting the consumer financial services industry. Rooney indicated four specific cases involve “substantive issues” of liability to consumers, questions relating to arbitrability and limits on government agency powers.

In a commentary posted on the firm’s website, Rooney elaborated about the complications stemming from the current status of the Supreme Court.

“The issues are important and complex in their own right but their ultimate disposition may be made more complicated in the wake of Justice Ginsburg's death and her expected replacement by Trump nominee Judge Amy Coney Barrett,” Rooney wrote.

“Justices generally are not involved in deciding cases if they did not take part in the oral argument. Under Supreme Court rules, a 4-4 tie vote among the participating justices means that the lower court's decision stands,” he continued.

Rooney added that three of the four cases that have a significant connection to financial services are scheduled for argument by Dec. 9.

“If Judge Barrett is not Justice Barrett by then, the Supreme Court's decision in those cases may effectively be no decision at all,” Rooney wrote.

Last week, Lobel Financial Corp. finalized a settlement with the Consumer Financial Protection Bureau totaling more than $1.4 million.

According to a news release, the bureau found that Lobel engaged in unfair practices with respect to the finance company’s loss damage waiver (LDW) product in violation of the Consumer Financial Protection Act (CFPA).

When a contract holder has insufficient insurance, rather than force-placing collateral-protection insurance, the CFPB said Lobel places the LDW product. The bureau said this product is not itself insurance on accounts and charges a monthly premium of approximately $70 for the LDW coverage.

Officials explained the LDW product provides that Lobel will pay for the cost of covered repairs and, in the event of a total vehicle loss, cancel the contract holder’s debt.

The CFPB said it found that Lobel continued to bill certain consumers for LDW coverage but then failed to provide it, and assessed fees from consumers that they were not obligated to pay.

The order requires Lobel to pay $1,345,224 in consumer redress to approximately 4,000 harmed consumers and a $100,000 civil money penalty.

The order also prohibits Lobel from failing to provide consumers with LDW coverage or similar products or services for which it has charged consumers or from charging consumers fees that are not authorized by its LDW contracts.

The regulator said Lobel’s LDW agreement — which all Lobel contract holders must sign — specifies that if at any time the contract holder fails to maintain car insurance subject to certain specifications, Lobel will add LDW coverage to the consumer’s account and impose a monthly charge.

If a contract holder becomes 10 or more days delinquent on a contract with LDW coverage, Lobel may stop the LDW coverage, according to the CFPB.

The bureau went on to say that its investigation found that since 2012 Lobel charged customers LDW premiums after they had become 10 days delinquent but did not provide them with LDW coverage.

“When these customers needed repairs or experienced total vehicle losses, Lobel denied their claims,” the CFPB said. “This practice was unfair under the CFPA because consumers were charged for a service that they did not receive.”

The bureau also found that Lobel charged some customers LDW-related fees that the finance company had not disclosed in its LDW contract.

“This practice was also unfair under the CFPA,” the CFPB said.

The entire consent order can be viewed here.

The Servicemembers Civil Relief Act (SCRA) created another action by federal enforcers.

Last week, the Justice Department reached an agreement with ASAP Towing & Storage Co. (ASAP) in Jacksonville, Fla., to resolve allegations that ASAP violated a federal law and the SCRA by auctioning off or otherwise disposing of vehicle owned by protected servicemembers without first obtaining court orders.

Under the agreement, ASAP must pay up to $99,500 to compensate servicemembers whose vehicles were unlawfully auctioned off while they were in military service. ASAP must also pay a $20,000 civil penalty to the U.S. Treasury.

The agreement, which is subject to court approval, resolves a suit filed by the Justice Department in the U.S. District Court for the Middle District of Florida.

“This case began with a member of the U.S. Navy who returned home from an overseas deployment in service to his country, only to find that a towing company had auctioned off his sole means of transportation,” said assistant attorney general Eric Dreiband of the Civil Rights Division.

“The Justice Department must protect his rights just as he is protecting ours,” Dreiband continued in a news release. “We appreciate that the company has worked cooperatively with us to reach a settlement that will compensate all of the servicemembers whose vehicles were taken from them.”

The department launched its investigation after becoming aware of a complaint by a U.S. Navy Lieutenant Junior Grade, alleging that ASAP had towed and auctioned his 2005 Chrysler PT Cruiser without obtaining the court order required by the SCRA, while he was deployed aboard a naval submarine.

The department’s complaint alleged that the Lieutenant’s vehicle had a military installation parking decal and contained “welcome aboard” documents for the naval submarine.

The department’s investigation revealed that between 2013 and 2020, ASAP auctioned multiple other vehicles registered to SCRA-protected servicemembers without obtaining the required court orders.

Officials said the settlement requires ASAP to adopt new procedures to investigate the military status of any registered owner prior to auctioning a vehicle. They added that ASAP will also be required to obtain a court order or a valid SCRA waiver prior to auctioning a vehicle owned by a protected servicemember.

“I am pleased that we were able to protect our servicemembers who are serving overseas by reaching a settlement with the ASAP Towing & Storage Company,” said U.S. Attorney Maria Chapa Lopez for the Middle District of Florida. “When servicemembers are deployed, and in harm’s way, fighting for our country, they should be able to find their personal vehicles where they left them when they return home.”

The department’s enforcement of the SCRA was conducted by the Civil Rights Division’s Housing and Civil Enforcement Section and U.S. Attorney’s Offices throughout the country.

Since 2011, officials said the department has obtained more than $474 million in monetary relief for more than 120,000 servicemembers through its enforcement of the SCRA.

For more information about the department’s SCRA enforcement efforts, visit www.servicemembers.gov.