This week, 700Credit announced a product alliance with Tekion and its Automotive Retail Cloud (ARC).

Executives explained the new alliance will provide Tekion dealers with seamless access to 700Credit’s credit report and compliance platform, optimizing the sales process and providing a smooth workflow.

Tekion has tried to challenge what it calls the traditional DMS paradigm by fully leveraging a cloud-native platform. ARC is a platform that includes all functionalities of a dealer management system (DMS) and accompanying tech stack to fully operate a retail automotive business.

“Tekion has jumped on to the DMS scene with quite a splash and is being quickly adopted by dealerships across the country,” 700Credit Managing Director Ken Hill said in a news release.

“We are extremely excited to have Tekion as a partner and welcome their customer base to our 700Credit family. Their integration of our cloud-based credit and compliance modules fits well into the Tekion workflow,” Hill continued.

Tekion senior vice president of commercial operations Napoleon Rumteen shared this perspective on working with the provider of credit reports, compliance solutions and soft-pull products.

"Tekion is driven to continuously expand seamless integrations in the automotive ecosystem to optimize the dealer and consumer experience. Partnering with 700Credit is a no-brainer in staying true to our commitment,” Rumteen said.

CreditMiner announced this week it’s now offering soft-pull pre-screen technology from Equifax as part of the CreditMiner API solution suite.

The company explained this integration is designed to help auto finance companies and dealers provide real-time pre-approvals to consumers who are considering financing a vehicle.

“As more of the car buying process moves online, we see that consumers are interested in getting pre-approved earlier in the search process. Our pre-screen technology is a win for the consumer, dealer and lender,” CreditMiner chief operating officer Sam Vukas said in a news release.

“It gives the consumer confidence to move forward in the buying process and gives dealers and lenders valuable insight on the consumer to help speed up the process and create a personalized buying experience,” Vukas continued.

With the CreditMiner API implemented, consumers who are searching for a vehicle online can get pre-approval early in the search process without having to enter detailed personal information such Social Security Number and date of birth.

CreditMiner pre-screen solutions can provide pre-approval and accurate payment information to consumers based on their credit score and selected vehicle, instead of estimated offers, using consumer provided information.

“Partnering with Equifax gives us a best-in-class soft pull pre-screen solution for lenders and dealers to offer a firm offer of credit to a consumer based on their credit score and vehicle,” CreditMiner vice president of strategic partnerships Ken Luna said.

“This offering will help create a more efficient interaction with consumers to meet consumers’ expectations of accurate information when they are ready to finance their vehicle,” Luna continued.

CreditMiner went on to say pre-approval information will be provided to the consumer, dealer and finance companies to help create a more seamless and transparent buying process, more important than ever as the vehicle-buying journey is shifting to digital at an accelerated pace.

“Today’s car buyers have high expectations of what the online shopping experience should be,” said Angelica Jeffreys, vice president and sales leader of Equifax Automotive Services.

“Working with CreditMiner is another way that Equifax is helping dealers and lenders streamline and personalize the car buying process for their customers,” Jeffreys added.

DriveItAway is continuing to forge partnerships to help dealerships turn vehicles while giving consumers the opportunity to secure transportation and rebuild their credit.

Via a news release distributed Tuesday, the provider of subscription to ownership technology that can enable anyone, regardless of down payment or credit score, a transparent risk-free digital process to buy a used vehicle, announced its partnership with the newly launched fintech platform CredEvolv.

The DriveItAway partnership with CredEvolv grew out of the longstanding relationship the company has with Get Credit Healthy and its founder Elizabeth Karwowski, a company recently acquired by CredEvolv.

“The mission of DriveItAway has always been to eliminate the friction, for dealers and consumers, to enable more people to first drive, and then buy, their used vehicle of choice, regardless of credit score or immediate down payment availability,” DriveItAway chief executive officer John Possumato said in the news release.

“Now, with our partnership with the new CredEvolv platform, we can help our customers accomplish broader lifelong goals of achieving and maintaining good credit for sustainable financial success,” Possumato continued.

The enhanced CredEvolv platform features an expanded, comprehensive technology, leveraging consumer permissioned data, proprietary analytics, and personalized credit coaching to guide the journey to credit well-being.

CredEvolv offers end-to-end credit education and remediation support for consumers, while also helping finance companies and servicers retain more clients and drive significant incremental revenue.

CredEvolv’s proprietary technology platform can help finance comapnies and servicers connect borrowers with HUD-certified non-profit counseling agencies to provide complete financial well-being for consumers, including credit remediation and education, as well as debt management services.

CredEvolv’s cloud-based platform also has the ability to scale to millions of transactions, while still providing a customized experience for users.

“More than half of Americans have been turned down for a car loan, credit card, or other loan. Not only does this create stress, it can hold people back from opportunities. DriveItAway is a natural partnership for CredEvolv given our aligned missions,” CredEvolv co-founder and chief executive officer Jeff Walker said in the news release. “CredEvolv was created to bridge the gap of no or low credit and offer a solution that not only puts consumers on a path to qualify for the initial loan they’re seeking but sets them up for life-long credit health.”

CredEvolv co-founder and president Steve Romano then added, “Driving better outcomes for consumers doesn’t have to be complicated or confusing. Our shared mission with DriveItAway will help empower and enable consumers to fulfill their goal of owning a car.

“At CredEvolv, we’re marrying state-of-the-art financial technology with social responsibility to reduce the psychological and financial burden millions of individuals face and make it simple for them to get on a path to financial wellness, while also creating increased value and ROI for our partners,” Romano went on to say.

DriveItAway explained that its “Try It Before You Buy It, Pay as You Go” turnkey platform for dealers may be the only way for those individuals who are struggling to gather a down payment or who are credit challenged to purchase the used vehicle of their choice.

The company said every subscription payment accumulates toward the down payment at a prearranged purchase price established at the beginning of the process.

“The platform appeals to all potential used car buyers, who would like to try a used car out for an unlimited period of time, before making any purchase commitment,” DriveItAway said about its platform before adding that it “de-risks” a used-vehicle purchase for all buyers “in a way never achieved by any online or traditional automotive retailer. Pick your used car off the lot and drive it, until and if you decide to buy it, with the money paid in for your subscription applied to the prearranged purchase price.”

For more information, call DriveItAway at (203) 491-4283 or send an email to [email protected].

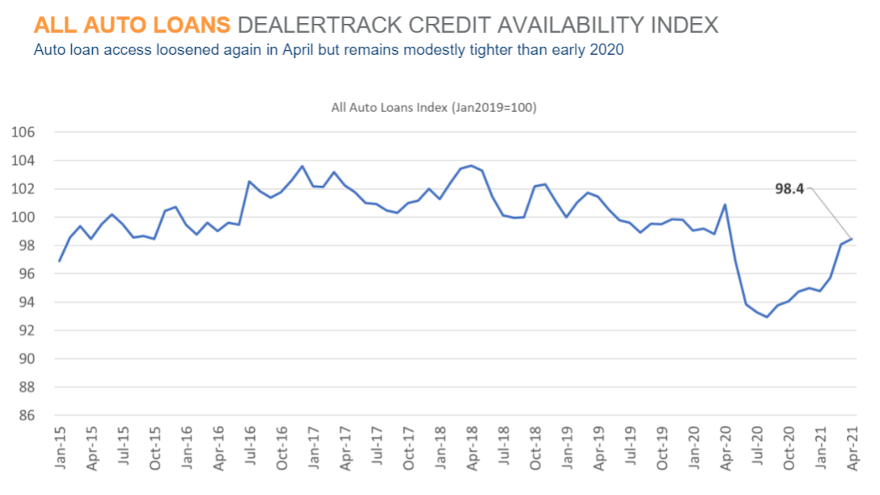

Cox Automotive reported this week that auto financing availability in April was the most accessible since April 2020, according to the Dealertrack Auto Credit Availability Index.

But analysts acknowledged that making year-over-year comparisons is challenging, since they’re versus the outset of the pandemic.

The index reading increased 0.4% to 98.4 in April, reflecting that credit was easier to get in the month compared to March. Analysts said access is tighter by 2.4% year-over-year, but that comparison is against “abnormal credit conditions” from April 2020.

Compared to February 2020, Cox Automotive said access is tighter by just 0.7%.

Looking closer at the data, analysts discovered that financing provided through independent dealers tightened the most.

“On a year-over-year basis, independent used financing, non-captive new-vehicle financing and franchised used financing are now looser,” Cox Automotive said in the report that accompanied the latest index update.

“Other channels remain tighter year-over-year, with new-vehicle loans and used CPO having tightened the most,” analysts added.

Cox Automotive also mentioned credit availability loosened the most in April at captives, expanding by 1.1%, while credit tightened at credit unions by 1.3%.

“On a year-over-year basis, auto-focused finance companies and banks have loosened credit access, while credit unions are unchanged, and captives have tightened,” analysts said.

“However, the year-over-year comparison for captives is against a time when lending by captives was particularly aggressive during the pandemic lockdown period,” they continued.

“However, the subprime share and the negative equity share increased while down payments also increased, and those factors moved against credit expansion,” analysts went on to say.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Across all auto financing in April, Cox Automotive said approval rates increased, yield spreads narrowed and the share of terms longer than 72 months increased, which all made credit more accessible.

Cox Automotive also included some general consumer observations and what they could mean for vehicle retailing and financing.

“The trend in daily new COVID cases ended April on a declining trend as substantial progress was made in vaccinations so that more than 100 million Americans were fully vaccinated,” Cox Automotive said.

“Consumer confidence according to the Conference Board increased 11.7% in April and left confidence down only 8% compared to February 2020,” analysts continued. “Plans to purchase a vehicle in the next six months jumped in April to a 23-month high.”

Some applicants might be landing at your subprime auto finance company in part because of the amount of student loan debt detailed on their credit report.

Senate Democrats recently proposed eliminating up to $50,000 in federal student loan debt per consumer, a strategy questioned by Consumer Bankers Association president and chief executive officer Richard Hunt.

Last week, Hunt shared his concern because, in his view, the wiping away of that debt comes without a “serious attempt” to bring about what he described as fundamental, long-lasting reforms aimed at lowering college tuition.

“Focusing on after-the-fact student loan debt alone is a temporary patch which ignores the underlying problem — the skyrocketing cost of college fueled by two decades of federal over-lending,” Hunt said in a statement released by CBA.

“Every dollar of federal lending has been shown to have a direct correlation to increases in tuition. Without reigning in runaway lending from the Department of Education, which holds and originates enough student loans to be the fifth-largest bank in the country, future borrowers will continue to accumulate mountains of debt,” Hunt continued.

According to CBA, over the last two decades, the price of college tuition has increased nearly 200% and the amount of student loan debt held by Americans has gone up with it. The association pegged it as soaring from a little more than $600 billion in 2008 to nearly $1.5 trillion today.

CBA also said about 92% of that debt is from the federal government.

So how do these holders of federal student loan debt sometimes land within the subprime segment when seeking auto financing?

“These federal loans have a double-digit delinquency and default rate and lack plain-language disclosures on the total costs of the loan,” CBA said.

Hunt cautions that not finding a wide-ranging remedy might result in some consumers continuing to struggle with student-loan debt — perhaps even spiling over into their other credit obligations such as a vehicle installment contract.

“The majority of Americans struggling to repay their student loans — about 90% from the federal government — did not graduate but have debt without the advanced earning potential of a degree,” Hunt said.

“Simply forgiving debt for graduates with the largest loans will likely help those earning the highest wages. Any serious proposal must go beyond debt forgiveness alone, which does nothing to solve the root cause of skyrocketing college tuitions,” he went on to say.

At least one industry expert used some positive adjectives when assembling reaction after the Federal Reserve released consumer credit data for December.

The credit data arrived after a federal forecast projecting how long it might take for the U.S. job market to rebound from the pandemic.

According to data released on Friday, the Fed said that in 2020, revolving credit decreased 11.2% and nonrevolving credit increased 3.9%, leaving total consumer credit little changed.

The Fed added that consumer credit increased at a seasonally adjusted annual rate of 2.7% in the fourth quarter and at a rate of 2.8% in December.

Upon seeing that information Curt Long, the chief economist and vice president of research at the National Association of Federally Insured Credit Unions offered this assessment.

“On a seasonally-adjusted basis, consumer credit growth decelerated in December but still showed a solid gain. Revolving credit contracted once again, and has now fallen in nine of the last 10 months,” Long said. “Nonrevolving credit has surpassed its pre-pandemic level as interest rates remain at all-time lows and consumers shift spending to big-ticket items.

“Lenders have tightened standards through the pandemic, but that seems to have tapered off as the latest senior loan officer survey showed more banks reported easing standards for credit cards than tightening; a modest net amount of banks also reported easing standards on auto loans,” Long continued.

“NAFCU expects modest growth in consumer credit into the summer, followed by a more robust recovery,” he went on to say.

Long added more information specific to the credit-union market, noting that its portfolio of consumer credit increased 2.6% from a year earlier, which was above the overall growth of 0.1%.

Over the past 12 months, Long indicated that credit unions’ share of the market has risen by 0.3 percentage points to 11.8%. Meanwhile, he said banks’ share fell by 2.1 percentage points to 40.3%, and financial companies’ share ticked up by 0.4 percentage points to 13.2%.

Ahead of the Fed’s latest consumer credit data being released, the Congressional Budget Office shared its economic outlook, looking ahead as far as 2031. The outlook focused on one important element to consumers being able to use credit — having viable employment.

The CBO outlook pointed out that pandemic impact was focused on particular sectors of the economy, such as travel and hospitality, and job losses were concentrated among lower-wage workers. The CBO is projecting that the economic expansion that began last year will continue. Specifically, real (inflation-adjusted) gross domestic product (GDP) is expected to return to its pre-pandemic level during the middle of this year and to surpass its potential (that is, its maximum sustainable) level in early 2025.

In CBO’s projections, the unemployment rate gradually declines through 2026, and the number of people employed returns to its pre-pandemic level in 2024.

The CBO forecast prompted a swift reaction from new Treasury Secretary Janet Yellen, beginning a statement by saying the “CBO forecast is more evidence that we desperately need Congress to act on a rescue package.

“Last year, the economy shrunk more than any other since the end of World War II. With the growth that the CBO projects, it will be years before the country reaches full employment again,” Yellen continued.

“Then there are the more immediate concerns: Can we get the vaccine distributed quickly? Will people keep a roof over their heads? Will their unemployment benefits last until the end of the crisis? Will families go hungry? Will small businesses survive?

“All this is why we’re proposing the American Rescue Plan: So Americans can make it to the other side of this crisis and be met there by a strong, growing economy,” she went on to say.

Finance companies likely remember what happened during the Great Recession 12 years ago when the credit market seized up as bad a car engine without oil.

The Federal Reserve reiterated the significant steps it’s taking to ensure finance companies have the raw material to keep their portfolios growing. But the pace providers might be buying paper still looks a bit uncertain.

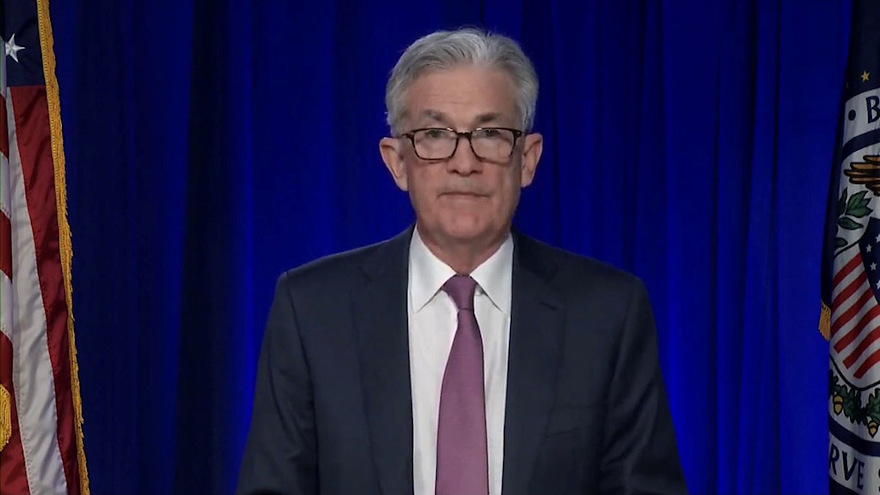

Fed chair Jerome Powell made public comments on Wednesday following the Federal Open Market Committee voting unanimously to leave interest rates unchanged.

“The Federal Reserve has also been taking broad and forceful actions to more directly support the flow of credit in the economy for households, for businesses large and small and for state and local governments. Preserving the flow of credit is essential for mitigating damage to the economy and promoting a robust recovery,” Powell said during his opening statement of Wednesday’s press conference.

“Many of our programs rely on emergency lending powers that require the support of the Treasury Department and are available only in very unusual circumstances, such as those we find ourselves in today. These programs serve as a backstop to key credit markets and have helped to restore the flow of credit from private lenders through normal channels,” Powell continued. “We have deployed these lending powers to an unprecedented extent, enabled in large part by financial backing and support from Congress and the Treasury.

“Although funds from the CARES Act will not be available to support new loans or new purchases of assets after Dec. 31, the Treasury could authorize support for emerging lending facilities, if needed, through the Exchange Stabilization Fund. When the time comes, after the crisis has passed, we will put these emergency tools back in the box,” he went on to say.

Cox Automotive chief economist Jonathan Smoke offered his latest assessment later on Wednesday through a blog post titled, “The Fed Will Keep Rates Low, But That Alone Won’t Sell Cars.”

Smoke pointed out that the 10-year U.S. Treasury yield ticked up this week, approaching the highest level he’s seen during the pandemic. He also mentioned that mortgages and auto financing rates have not followed Treasury’s path, meaning that providers are keeping their rates lower despite the underlying yields being higher.

“Yet despite these better conditions, we are not seeing auto demand respond,” Smoke said. “November saw a notable softening in sales, especially in the back half of the month as the third wave of COVID-19 grew. Consumer sentiment has also declined since October as conditions worsened.

“The Fed’s actions may not influence much in the near term as attention focuses more on stimulus, the initial distribution of vaccines and when we see signs that this third wave of the pandemic has passed its peak. The Fed is keeping rates low and credit broadly available, but this alone will not keep Americans buying,” Smoke added.

Meanwhile, Powell acknowledged the points Smoke made as well as the conundrum finance companies face when trying to form strategy for 2021.

“As we have emphasized throughout the pandemic, the outlook for the economy is extraordinarily uncertain and will depend in large part on the course of the virus. Recent news on vaccines has been very positive. However, significant challenges and uncertainties remain with regard to the timing, production, and distribution of vaccines, as well as their efficacy across different groups. It remains difficult to assess the timing and scope of the economic implications of these developments,” Powell said.

“The ongoing surge in new COVID-19 cases, both here in the United States and abroad, is particularly concerning, and the next few months are likely to be very challenging,” he added. “All of us have a role to play in our nation’s response to the pandemic. Following the advice of public health professionals to keep appropriate social distances and to wear masks in public will help get the economy back to full strength. A full economic recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.”

And among those activities could be acquiring a new or used vehicle with some kind of financing attached.

Looking ahead to 2021, Edmunds analysts also noted that there are still uncertainties ahead, but they remain confident that industry sales will continue at a steady pace without a dramatic decline like the one seen at the outset of the pandemic.

“Even if we face another wave of retail shutdowns, the good news is that dealers are far better prepared now for selling virtually than ever before,” Edmunds executive director of insights Jessica Caldwell said in a news release distributed on Thursday. “And vaccines on the way should only help keep consumer confidence high.”

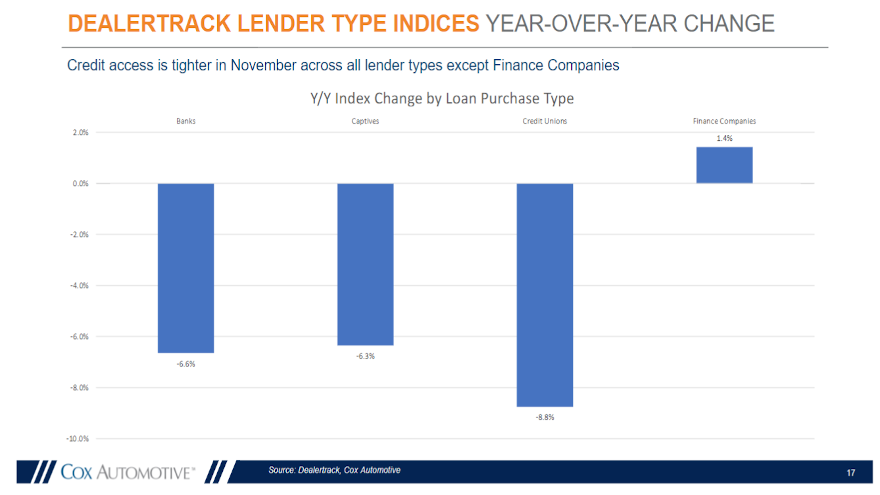

Cox Automotive recently launched a new industry measurement called the Dealertrack Credit Availability Index that’s geared to track how the auto-finance market is trending.

For the first installment, analysts discovered credit availability continued to improve in November for all types of financing. Cox Automotive indicated the index improved 0.8% in November to 94.8, reflecting that credit was easier to get than the previous month.

However, analysts determined access remains tighter by 5.1% year-over-year, or by 4.4% compared to February.

Looking at trends by provider category, Cox Automotive reported that credit tightened by 0.8% at credit unions, while access loosened at banks, captives and auto-focused finance companies.

“On a year-over-year basis, auto-focused finance companies have loosened credit access, while all other lender types have tightened,” analysts said in their update.

Cox Automotive explained the overall reading is baselined to January 2019 to provide a view of how credit access shifts over time. Each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity and down payments.

“Across all auto financing in November, approval rates increased from October, subprime share declined and negative equity share increased, while yield spreads declined, and the share of terms longer than 72 months increased,” Cox Automotive said.

“Auto-loan performance deteriorated again modestly in November, but performance remains better than last year or a typical year and much better than a typical recession. Loan delinquencies and defaults have been low because of stimulus support and loan accommodations,” analysts continued.

To back its assertions, Cox Automotive shared data it received from Equifax, which estimated that 3.1% of auto loans were under an accommodation as of Nov. 30. Equifax indicated that figure is down from 3.3% the company reported on Nov. 3 but is 2.4 percentage points higher than February.

Equifax also computed that 2.4% represents more than 1.9 million contracts that likely would have fallen into delinquency and possibly complete default by now.

According to Equifax, “the auto loan severe delinquency rate increased slightly and remains down from February.”

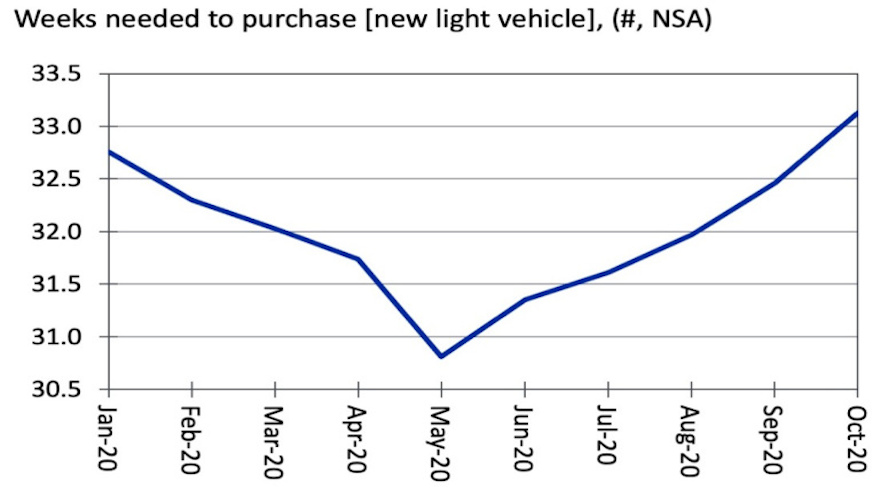

Cox Automotive and Moody’s Analytics are trying to use their collective brainpower to create a new way of analyzing and tracking vehicle affordability.

The companies recently launched what they’re calling the Vehicle Affordability Index, which is designed to quantify price movements in the new-vehicle market in relation to the spending power of the U.S. consumer. The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) will be updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book.

Going forward, experts said this industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.

In the current market, with high unemployment and an economy struggling to recover to pre-pandemic levels, Cox Automotive and Moody’s Analytics acknowledged that understanding the affordability of new vehicles is increasingly important to industry analysts and consumers alike. However, the answer is more complex than simply rising and falling Manufacturer’s Suggested Retail Prices (MSRPs).

To measure true vehicle affordability, Cox Automotive and Moody’s Analytics considered shifting household incomes, incentive spending by the automakers and dealers, and actual finance charges on new-vehicle financing when developing the VAI.

According to Cox Automotive chief economist Jonathan Smoke: “Until now, the industry lacked visibility into consumer spending power and interest rate changes relative to the movement of new vehicle prices. The Cox Automotive/Moody’s Analytics Vehicle Affordability Index is filling this void by providing a comparative way to measure affordability while eliminating guesswork and prognostication.”

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index for October stood at 33.13, representing the number of weeks of income needed for a median-income household to pay off a new vehicle.

The firms explained that measuring in weeks provides a consistent, straightforward unit that captures the affordability of new vehicles.

In the early stages of the pandemic, Cox Automotive and Moody’s Analytics pointed out that affordability improved as incomes were supported by the CARES Act in the form of stimulus payments and enhanced unemployment benefits, while interest rates declined and incentives peaked in the new-vehicle market.

However, affordability has been declining as average transaction prices continue to rise, and household income has fallen, according to the companies.

“Looking ahead, we expect new vehicle affordability to continue decreasing over the next months without further federal fiscal policy action,” said Michael Brisson, auto economist at Moody’s Analytics.

“The COVID-19 pandemic is intensifying at an alarming rate, dampening consumer demand, putting continued stress on the labor market, and depressing incomes. Despite falling interest rates, dropping incomes may push new vehicles out of reach for the average consumer,” Brisson went on to say.