One of the most enthusiastic and knowledgeable regular guests on the Auto Remarketing Podcast recently returned, as StoneEagle F&I senior vice president of business development Joe St. John came back to discuss what’s happening in dealership finance offices nowadays.

We also delved into another topic that’s one of St. John’s passions; mergers and acquisitions that are happening not only in the franchised dealership sector but also in the F&I space, too.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

AutoPayPlus acknowledged every dealership’s primary business goal and ongoing challenge revolve around one, single metric: profit.

To help managers and principals in that department, AutoPayPlus unveiled an all-new solution this week designed to increase profit per vehicle and service retention for dealerships in one easy step.

The company highlighted AutoPay+PERKS combines the company’s biweekly retail installment contract payment service with the added advantage of a dealer loyalty program to increase profits from customer-pay service and boost customer retention at no additional cost to the customer or dealer.

“The key to a dealership’s success today is to maximize its two primary profit sources,” AutoPayPlus chief executive officer Robert Steenbergh said in a news release.

“AutoPay+PERKS also gives agents something to offer their dealerships that no other biweekly program can deliver and continually build customer loyalty. Only that can combat the disrupters,” Steenbergh continued.

How does AutoPay+PERKS work?

The company explained that it begins at the point of sale by enrolling customers in AutoPayPlus, an F&I service that uses automated biweekly payments to help car buyers better afford their monthly payment, purchase additional products, shorten their trade cycle and return to the dealership with less negative equity.

A 10-year analysis by AutoPayPlus has shown that dealerships sell approximately 57% more F&I products on AutoPayPlus deals versus standard retail deals.

In addition, results from AutoPayPlus’ top dealer groups reveal a 63% increase in per-vehicle financed income on AutoPayPlus customers.

Once customers’ AutoPayPlus account has been active for six months and it’s time for their first service, AutoPayPlus sends them a debit Mastercard co-branded with the dealership’s logo and preloaded with $100 that can only be used at the selling dealership’s service department. A dealer boost program can allow dealers to load additional funds to the card, further incentivizing their customers’ return to the dealership.

The company added that AutoPay+PERKS is supported by a mobile app that lets customers access their perks from a dealer-branded service page, as well as receive factory recommended service scheduling reminders and recall alerts.

“AutoPay+PERKS is a guaranteed way to drive new customers to the service department that doesn’t interfere with any other existing retention program such as pre-paid maintenance,” Steenbergh said. “And, best of all, it’s easy and can be cost-free for dealerships to implement.”

When StoneEagle F&I senior vice president of business development Joe St. John worked as a dealership manager, he taped a dime to the phones of store employees in the finance department to remind them of the revenue goal for every delivered vehicle.

“Now, if you’re running less than $1,000 a car, you probably need to find another job,” St. John said during this episode of the Auto Remarketing Podcast when he highlighted the newest data gathered via StoneEagleMETRICS.

The specific data is included in the current edition of SubPrime Auto Finance News and a further discussion about it is available through the conversation with senior editor Nick Zulovich.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

APCO Holdings is looking to cater to the wide array of approaches to retailing vehicles with its latest strategy for reinsurance programs.

The provider and administrator of F&I products and home to the EasyCare and GWC Warranty brands said this week that it now is offering dealerships a consultative approach designed to match dealers’ unique business situations and goals with an appropriate reinsurance program structure.

The company explained the approach aims to educate dealers amid an increasingly complex reinsurance market, so they can better understand options and increase the probability of success.

“Multiple factors come into play when choosing a reinsurance program structure, but many dealers are presented with a one-size-fits-all approach that is not appropriate to their unique business models as well as their short-, medium- and long-term goals,” said Dave DeCredico, senior vice president of business operations at APCO Holdings.

In the past several years, APCO Holdings acknowledged significant activity has affected dealer F&I participation programs, including an increased number and variations of reinsurance program structures available, tax law changes that require disclosure on multiple levels, and increased market misinformation.

With APCO’s Consultative Approach, the company said a dealer receives an in-depth consultation from a reinsurance expert to determine which equity participation program best fits their individual needs.

APCO noted that the discussions can evaluate many factors including anticipated volumes, risk tolerance, programs to be written, income objectives, anticipated distribution plans and investment strategies.

APCO offers a variety of reinsurance program structures to dealerships, including non-controlled foreign corporation (NCFC), controlled foreign corporation (CFC), dealer owned warranty company (DOWC), retrospective premium program as well as a hybrid structure combining more than one of these options.

APCO’s consultative approach also includes recommendations and training for aligning a dealership’s F&I product strategy with its reinsurance strategy, in order to maximize profitability.

“This is an area of missed opportunities for many dealers,” DeCredico said. “The close alignment of F&I and reinsurance strategies is key to maximizing program profitability.”

DeCredico added that APCO’s consultative approach also includes an up-front evaluation, quarterly reinsurance statements and an in-depth, annual review of reinsurance positions to discuss new opportunities and areas for improvement.

For more information about the APCO Holdings’ family of brands, visit apcoholdings.com.

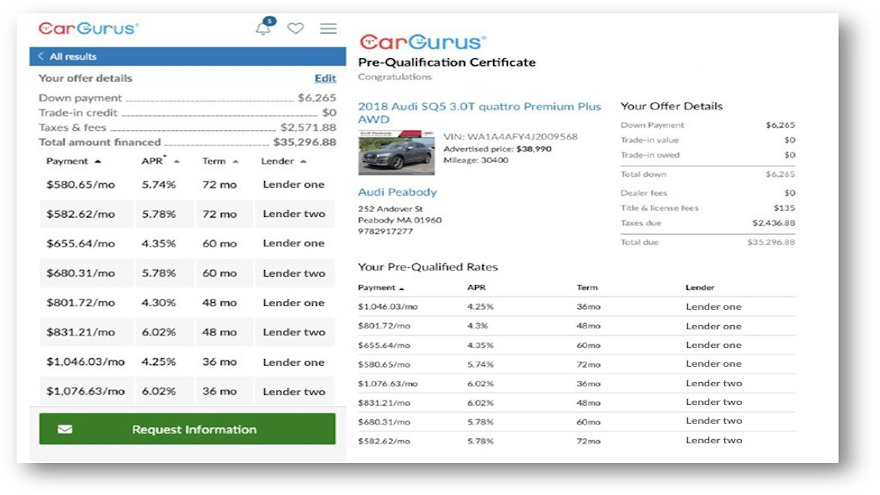

The next development in the working relationship involving CarGurus, Capital One, Westlake Financial and Global Lending Services (GLS) surfaced on Friday.

CarGurus announced a new feature that can enable shoppers to pre-qualify for financing as they search on CarGurus for their next vehicle; a program dubbed Finance in Advance. Pre-qualification offers are provided through CarGurus’ listing dealers that book paper through Capital One, Westlake Financial and Global Lending Services.

CarGurus forged a relationship with Capital One in May 2019 and then with Westlake later that year. CarGurus welcomed GLS into its portfolio of integrated financing providers in August.

Site leaders highlighted the service is the latest in CarGurus’ growing suite of digital retail products engineered to help consumers and dealers by bringing ease and transparency to the vehicle-shopping process.

“Financing is a critical, yet often forgotten about, part of purchasing a car. As the pioneers of trust and transparency in automotive retail, we believe that providing shoppers with information about financing rates will help guide better purchase decisions,” CarGurus vice president of consumer products Josh Berg said in a news release.

“Shoppers that use CarGurus’ pre-qualification tool will know the real costs of their desired vehicle and can go to the dealer ready to complete their financing. That results in saved time for both consumers and dealers,” Berg continued.

According to the CarGurus 2020 Buyer Journey report, 61% of consumers that buy at a dealership finance their purchase, and more than half (53%) do so through the dealership where they buy.

CarGurus explained Finance in Advance is designed to an easy-to-use feature for eligible shoppers to obtain pre-qualification for vehicle financing. Shoppers can go to https://www.cargurus.com/Cars/finance to pre-qualify for free and with no impact on their credit score.

Participating finance companies include Capital One, Westlake Financial and Global Lending Services, which in combination provide almost 90% coverage of all dealership listings on the CarGurus site.

CarGurus indicated the majority of shoppers are notified in a matter of minutes when they are pre-qualified and their personalized, pre-qualified offers are automatically applied to their vehicle search on CarGurus.

“This enables shoppers to filter their search results to vehicles where they are eligible for financing and ultimately compare real financing rates across those eligible vehicles,” site officials said.

Additionally, CarGurus mentioned shoppers also can customize the vehicle purchase terms like their down payment, estimate the value of their trade-in vehicle and apply that value to their deal.

Once a shopper has selected a vehicle and created a customized offer, they can print or email to themselves a certificate with their rates. Then, the shopper brings their certificate into the dealership where they complete the credit application and finalize the financing terms for that vehicle with the dealership.

AUL Corp. senior vice president of agency and dealer sales Paul McCarthy makes his debut on the podcast to describe how dealerships have pivoted their F&I marketing and presentations in light of the pandemic’s impact on vehicle sales.

McCarthy also shared some details about what the company plans to offer in 2021.

To listen to the entire conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

The Ohio Automobile Dealers Association looked to modernize how title work can be completed to help its members navigate market challenges and customer expectations.

And OADA turned to Dealertrack for a solution.

This week, OADA gave an exclusive endorsement to Dealertrack Registration and Title Solutions to assist Ohio’s more than 820 franchised dealers by providing a modernized and efficient titling process to its users.

Officials explained this exclusive endorsement will enable Dealertrack Registration and Title Solutions to further its footing in Ohio as it partners with OADA to help dealers build confidence in the accuracy and efficiency of taking their registration and titling processes digital.

“With proven expertise, user-inspired technology and superior service and implementation support,” Dealertrack said its Registration and Title Solutions is uniquely positioned to help Ohio dealers turn complex and time-consuming registration and title work into a simple, easy and accurate process while delivering the fast experience that today’s consumer demands.

“Faced with ongoing margin compression and changing customer expectations, dealers are working hard to find new ways to create process efficiencies and protect their bottom line,” said Kaitlin Gavin, vice president of operations at Dealertrack Registration and Title Solutions.

“Receiving this exclusive endorsement from OADA is a tremendous honor,” Gavin continued in a news release. “We are committed to proving best in class registration and titling solutions that help drive efficiency and improve the client experience for Ohio auto dealers.”

Dealertrack and OADA added that they will work in tandem to ensure long-term sustainability for dealerships as they look to the industry’s future.

“Ohio dealers want a registration and title partner with in-depth expertise to give them a simplified solution, superior service and confidence,” OADA president Zach Doran said. “Dealertrack fulfills that ask.

“OADA takes great efforts to find the right partners for our members and after discussions with a number of competitors in the market, we felt that Dealertrack’s services were the best possible option for our dealers,” Doran continued. “That is why we are excited to announce our endorsement for Dealertrack’s Registration and Title Solutions.”

For more information about Dealertrack, visit www.dealertrack.com and for more information on OADA, go to www.oada.com.

Protective Asset Protection wanted to get a reading about how COVID-19 impacted dealers and their efforts to quickly implement digital tools and resources available to consumers shopping for vehicles and F&I product options.

So, the provider of F&I programs, services and dealer owned warranty company programs commissioned an online survey of nearly 400 dealership executives.

According to the survey results released this week, Protective found that the COVID-19 pandemic forced many dealers to quickly implement digital retailing options, resulting in 68% of respondents saying they’re now offering F&I product selection and pricing online as a result of the COVID-19 pandemic, which forced many dealers to quickly implement digital retailing options.

The company reported only 58% of respondents said they were making these F&I options available online before the pandemic. Another 68% of participants said they’re now offering financing options/finance applications online, compared with 55% before the pandemic.

Protective Asset Protection also indicated that digital tools now made available to customers online has certainly had a positive impact for many dealers.

Roughly one in five dealers said their sales have increased as much as 10% since the pandemic went into effect, with dealers leveraging more digital tools.

Looking forward, while 19% of dealers believe their digital retail sales will remain flat, Protective discovered nearly a third — 29% to be exact — said they believe their digital sales will increase slightly.

With more digital retail resources now available, dealers say they will plan further updates and implementations in the coming months:

• Research/review F&I products/protection plans online (65%)

• Purchase F&I products online (55%)

• Select F&I products online (55%)

• Complete the F&I process (all paperwork) online (54%)

• Complete financing application online (47%)

Of those dealers saying they have implemented digital retailing tools online for F&I products, Protective Asset Protection indicated 63% of surveyed dealers said their customers purchased exterior appearance protection and tire and wheel protection.

Another 59% said their customers are purchasing GAP and vehicle service contracts.

“Creating a digital retailing environment with access to F&I product options is paramount to the success of any online retailing strategy,” said Rick Kurtz, senior vice president distribution at Protective Asset Protection.

“Customers today are accustomed to shopping online, and even leveraging online channels for researching financing options for a variety of other purchases,” Kurtz continued in a news release. “It’s important that dealers realize that better online availability will lead to a more educated and comfortable customer earlier in the shopping process, which ultimately improves the chance of a sale.”

Less than a month after launching its F&I solution, ZipDeal this week unveiled a free eBook the company said was created to help dealers combat the erosion of front-end profits on new and used vehicles with a customer-driven, digital vehicle delivery experience that.

ZipDeal chief executive officer and partner Tony Gomez elaborated about the eBook titled, The Auto Dealer’s Guide to a Profitable, Customer-Driven Vehicle Delivery Experience.

“With dealer front-end profits as low as 3%, dealers have to make it easy for sales representatives to sell more than just cars,” Gomez said in a news release. “This eBook explains how to implement a streamlined, post-sale, pre-F&I vehicle delivery system that puts customers in the driver’s seat for a personalized buying experience. While at the same time introducing additional sales opportunities, like protection products, that often are not presented.”

The eBook also guides dealers through the ZipDeal digital delivery experience, which was created by Lindsay Automotive owner Steve Lindsay. Brought to market by Gomez along with industry veterans Chip King, ZipDeal is designed to link 11 touchpoints between the end of vehicle negotiations and entering the F&I office on one customer-driven interactive tool.

ZipDeal also can lead customers through titling and registration, insurance information, finance and protection products, vehicle features, personal vehicle settings, posting online dealership reviews and more.

Lindsey emphasized the tool can ensure every customer is exposed to every product and accessory every time for additional revenue streams while giving customers a personalized experience and the control they want over the process.

“We piloted ZipDeal at our two stores and trained sales representatives on accessories and protection products (paint and fabric),” Lindsay said. “Within three months, our protection product sales increased from 5% to 28%, and our reps were earning as much as $3,000 a month in extra commissions.”

The eBook also includes practical steps, tips, and best practices to turn delivery pain points into profit points. An in-depth review of how to prepare a dealership for digital delivery provides instructions for how to establish new processes and systems, get team members on-board and excited about a new tool, and motivate associates to execute.

“There are a ton of studies out there showing that customers want more control over their buying experiences,” King said. “ZipDeal allows them to educate themselves and choose ancillary products at their own pace, which is proven to increase product penetration rates, dealers profits and customer satisfaction.”

Dealers can download the free eBook by going to this webpage.

For more information about ZipDeal, go to www.zipdeal.com.

Protective Asset Protection made another move this week aimed at helping dealerships during COVID-19.

After rolling out online training this spring, the provider of F&I programs, services and dealer owned warranty company programs announced an update to its retrospective (retro) programs that are designed to assist local dealerships meet the needs of their communities and employees.

Protective is reducing the production requirements for its retro programs. Beginning with the second quarter interest payment, the production requirements in all retro programs will be reduced by 25%.

In addition, the company said the year-end production requirement will also be reduced. This reduction will be applied across the remainder of the year and all levels, impacting each level of potential payout.

All other retro agreement requirements and conditions remain unchanged, and this change does not impact any other dealer participation programs, according to a company news release.

“Dealers are working harder than ever to serve their communities and remain open for new- and used-vehicle sales as well as the service and repair of these vehicles,” said Rick Kurtz, senior vice president of distribution at Protective Asset Protection.

“In addition to equipping dealers with the best F&I programs possible, we want to do everything we can to help dealers and their employees during this unprecedented time of operating a business,” Kurtz continued.

Under the structure of a retro program, the company explained payments to dealerships are retrospective commissions paid by Protective directly to a dealership.

Underwriting profits are calculated and paid out to dealers on an earned basis, and these can be paid either through investment income or commissions and distributed in advance with a future offset and payback liability.

Protective pointed out that operators should note that the dealer’s business corporation entity will most likely result in less income tax on retros received than previous to the 2017 Tax Cuts and Jobs Act.

For more information about Protective Asset Protection call (800) 323-5771 or visit www.ProtectiveAssetProtection.com.