Experian senior director of automotive financial solutions Melinda Zabritski made a suggestion to finance companies after Experian released its Q3 2020 State of the Automotive Finance Market report on Thursday.

The recommendation came in connection with a metric that providers might already watch with a laser focus — delinquencies — even as the subprime segment continues to shrink to a new low.

According to the report, 30- and 60-day delinquency rates improved in the third quarter, coming in at 1.56% and 0.51%, respectively.

Comparatively, a year ago, Experian reported the 30-day delinquency rate stood at 2.25% and the 60-day delinquency rate sat at 0.75%.

“While the decline in 30- and 60-day delinquency rates is a positive trend for the industry, particularly with some of the accommodation programs coming to an end, we do need to consider the impact these programs have had on consumers,” Zabritski said in a news release.

“Some consumers likely leveraged financial assistance programs to manage through hardship, so it’s important for lenders to keep a close eye on how delinquency rates evolve over the coming quarters,” she continued. “Nonetheless, the improvement is a positive sign for the country’s economic recovery.”

Overall, the industry is taking on less risk as Experian pegged the subprime segment of all financing at 19.23% in the third quarter, representing a record low in its database.

And in Q3, analysts added that deep subprime financing remained below 3% of the overall market.

Beyond influencing consumers’ ability to manage monthly payments and perhaps how much appetite finance companies have for subprime, Experian pointed out the pandemic also has impacted overall volume.

However, despite fewer vehicle sales, analysts discovered outstanding balances still grew 2.8% from a year ago, reaching $1.2 trillion. This increases also comes at a time where a smaller percentage of vehicles are being financed.

Experian indicated the percentage of new vehicles with financing was 82.43% in Q3 compared to 86.99% the previous year. Similarly, the percentage of used vehicles with financing was 33.71% in Q3 compared with 39.79% over the same period.

“It is important to note, the drop in the percentage of vehicles with financing can also be attributed to an increase in cash transactions,” Experian said.

Prime consumers continue to opt for used vehicles

During the first few months of the pandemic, Experian recapped that automakers offered new-vehicle incentives to improve sales. As a result, analysts saw prime borrowers opt for new vehicles, reversing a trend they observed in previous quarters.

With fewer incentives offered during the third quarter, Experian found that a higher percentage of prime consumers shifted back to used.

In fact, analysts reported prime and super prime contract holders made up 55.3% of used vehicles financed during the quarter, a new high for used-vehicle financing.

Experian sees the shift back to the used vehicle market is likely driven by continued affordability conversations; a metric that Cox Automotive and Moody’s Analytics recently chose to track more closely.

The newest Experian report showed both the average amounts financed for both new and used vehicles increased in Q3.

The average amount financed for a new vehicle rose more than $2,000 over the previous year, reaching $34,635, while the average amount financed for a used vehicle climbed $945 to $21,438 over the same period.

Analysts explained the increases could also be attributed to consumer preference, with buyers leaning toward larger, more expensive vehicles.

Experian noted that small SUVs were the most purchased vehicles, making up 26.01% of contracts in Q3, followed by midsize SUVs at 24.15%.

Despite the increases in average amounts finance, Experian mentioned the increases in average monthly payment weren’t as sharp.

To be exact, analysts said the average new-vehicle payment amount increased $11 year-over-year, reaching $563 in Q3. The average used-vehicle payment ticked up $6 to $397.

To keep those monthly payment manageable, finance companies are absorbing more risk by stretching terms and edging rates lower.

Experian determined the average term for new vehicles financed during the third quarter increased slightly to 69.68 months, up from 68.98 months a year earlier. And the average term for used vehicles financed in Q3 increased from 64.49 months to 65.15 months.

Analysts went on to note that the average interest rate for a new-vehicle contract booked in Q3 saw sharp decrease, sliding from 5.38% in Q3 of last year to 4.22% in Q3 of this year. The average interest rate for used-vehicle paper originated in Q3 dropped from 9.09% to 8.43% year-over-year.

“With affordability still top of mind, particularly during the pandemic, lower interest rates have certainly helped consumers keep monthly payments at a manageable level,” Zabritski said.

“As the market evolves and financial situations shift, it’s important for lenders and dealers to stay close to the trends and make strategic decisions that help keep the industry moving forward and consumers in their vehicles.”

Additional findings for Q3

Experian closed its latest update by mentioning a trio of other trends, including:

• Average credit scores saw a sharp increase for new vehicles, jumping from 728 in Q3 2019 to 732 in Q3 2020. The average credit score for used vehicles also saw a one-point increase from 664 to 665 year-over-year.

• New-vehicle leasing continued decrease in Q3 2020, comprising 26.2% of new-vehicle financing, compared to 30.27% in Q3 2019.

• Captive finance companies continued to increase market share, rising from 30.85% in Q3 2019 to 34.49% in Q3 2020. The buy-here, pay-here segment saw a slight increase from 4.32% to 4.69%, while all other provider categories sustained year-over-year decreases.

To view the entire Q3 2020 State of the Automotive Finance Market report webinar, go to this website.

Cox Automotive and Moody’s Analytics are trying to use their collective brainpower to create a new way of analyzing and tracking vehicle affordability.

The companies recently launched what they’re calling the Vehicle Affordability Index, which is designed to quantify price movements in the new-vehicle market in relation to the spending power of the U.S. consumer. The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) will be updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book.

Going forward, experts said this industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.

In the current market, with high unemployment and an economy struggling to recover to pre-pandemic levels, Cox Automotive and Moody’s Analytics acknowledged that understanding the affordability of new vehicles is increasingly important to industry analysts and consumers alike. However, the answer is more complex than simply rising and falling Manufacturer’s Suggested Retail Prices (MSRPs).

To measure true vehicle affordability, Cox Automotive and Moody’s Analytics considered shifting household incomes, incentive spending by the automakers and dealers, and actual finance charges on new-vehicle financing when developing the VAI.

According to Cox Automotive chief economist Jonathan Smoke: “Until now, the industry lacked visibility into consumer spending power and interest rate changes relative to the movement of new vehicle prices. The Cox Automotive/Moody’s Analytics Vehicle Affordability Index is filling this void by providing a comparative way to measure affordability while eliminating guesswork and prognostication.”

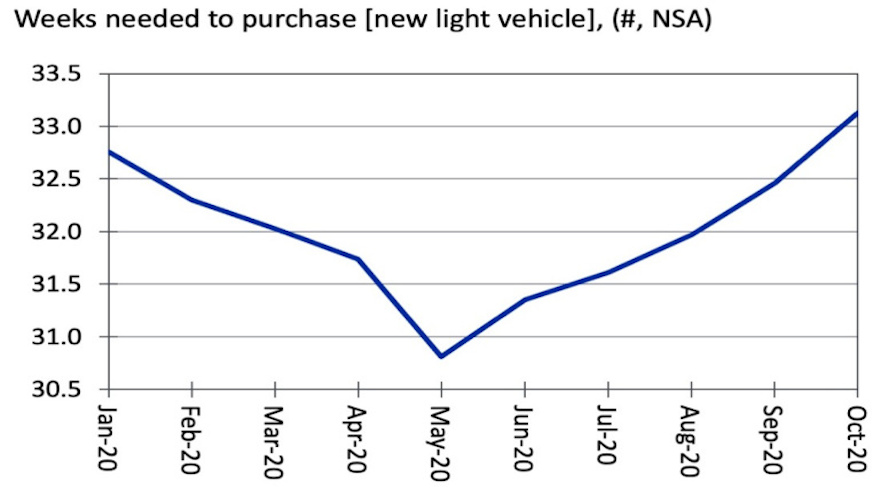

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index for October stood at 33.13, representing the number of weeks of income needed for a median-income household to pay off a new vehicle.

The firms explained that measuring in weeks provides a consistent, straightforward unit that captures the affordability of new vehicles.

In the early stages of the pandemic, Cox Automotive and Moody’s Analytics pointed out that affordability improved as incomes were supported by the CARES Act in the form of stimulus payments and enhanced unemployment benefits, while interest rates declined and incentives peaked in the new-vehicle market.

However, affordability has been declining as average transaction prices continue to rise, and household income has fallen, according to the companies.

“Looking ahead, we expect new vehicle affordability to continue decreasing over the next months without further federal fiscal policy action,” said Michael Brisson, auto economist at Moody’s Analytics.

“The COVID-19 pandemic is intensifying at an alarming rate, dampening consumer demand, putting continued stress on the labor market, and depressing incomes. Despite falling interest rates, dropping incomes may push new vehicles out of reach for the average consumer,” Brisson went on to say.

Equifax recently offered a week-long snapshot of auto financing originated during the middle of September, revealing the amount of subprime financing providers are booking.

According to Equifax estimates during the week of Sept. 13, the industry generated 14,100 retail installment contracts and leases, totaling $401.8 million.

Of that amount, analysts determined 1,400 contracts and leases were originated with to consumers with a VantageScore 3.0 credit score below 620, what Equifax generally considers to be subprime accounts. Equifax said those subprime accounts represented a corresponding total balance of $41.5 million.

Equifax also discovered the subprime volume was slightly lower when using the FICO Auto 8 credit score as the guide.

Analysts said 1,200 contracts and leases were originated during that week in September with consumers with a FICO Auto 8 credit score below 620; again, generally seen as subprime. Those deals had a corresponding total balance of $36.5 million.

Equifax also determined the average origination balance for all auto financing generated during that week in September came in at $28,408. The average for a subprime account was a little higher, sitting at $29,924.

When looking specifically at leases during that particular timeframe, Equifax indicated the average origination balance was $15,028. For a lease with a subprime consumer, the average lease amount was $15,974, according to analysts.

All told, Equifax estimated that leasing accounted for 38.3% of all auto accounts and 20.3% of all auto balances during its September reporting period.

Getting a little extra in the paycheck certainly can help in a myriad of ways, especially nowadays.

This week, Portfolio announced the launch of Portfolio Accelerate, a new spiff program for F&I professionals. Built upon a fully web-based platform, the program was designed to offer agents and dealers an easier way to reward top performers.

“We wanted our new spiff program to be a game-changer, and that required us to build around the wants and needs of our agents and dealers,” said Tanya Stevenson, Portfolio’s vice president of sales and marketing. “We determined early on that paper forms and checks were not going to cut it. We had to go digital.”

After completing a spiff agreement ad designating one or more administrators, agents and dealers can use a dedicated website to register F&I team members, each of whom will receive a debit card that can be co-branded with the servicing agency’s logo.

Portfolio Accelerate cards are reloaded as spiffs are earned and can be used wherever Visa is accepted, including ATMs, or to request checks or transfers to bank accounts.

Executives noted spiffs can be earned on nearly every Portfolio product and split among multiple recipients.

The program is live now and dealers are encouraged to contact their Portfolio agent to sign up.

Finance companies mitigated their risk a bit during the third quarter as data released by Edmunds on Thursday showed higher average down payments for both used and new financing booked during the past three months.

Edmunds determined the more robust increase in average down payments came in connection with new vehicles, rising to $4,457 in the third quarter, compared to $3,891 last quarter and $4,045 a year ago.

Edmunds data also indicated that the average transaction price (ATP) for new vehicles rose significantly during the third quarter. Edmunds estimated that the ATP in Q3 climbed to $39,303, compared to $38,893 last quarter and $37,207 in Q3 of 2019.

Meanwhile, the valuation analysts at Kelley Blue Book reported the estimated average transaction price for a light vehicle in the United States was $38,723 in September. KBB said on Thursday that new-vehicle prices increased $940 or 2.5% from last September while ticking up $23 or 0.1% from August.

Due to increases in average down payments and average transaction prices for new vehicles, Edmunds mentioned that finance companies mitigated risk in other ways, too, as average contract terms dipped slightly in Q3 compared to the previous quarter. Edmunds also mentioned the average annual percentage rate (APR) for new vehicles saw a small lift, hitting 4.6% in Q3 compared to 4.2% in Q2.

“It’s clear that consumers who are purchasing vehicles right now are feeling quite secure in their financial position despite the pandemic. The discouraging unemployment numbers we’re seeing across the country likely aren’t reflective of the Americans in the new car market,” Edmunds executive director of insights Jessica Caldwell said in a news release.

“New-car shoppers are putting down more money and taking advantage of continued low interest rates to upsize either to bigger vehicles or vehicles with more amenities,” Caldwell continued.

Kelley Blue Book analyst Sara Richards added this forward-looking perspective after reviewing that firm’s new-vehicle financing information.

“New-car transaction prices have climbed year-over-year, but remained flat for the past few months,” Richards said. “This may indicate supply challenges experienced over spring and summer have been corrected and OEMs are finally able to build up stock.

“If automakers seek to recover sales lost earlier in the year, incentives could climb dramatically, and transaction prices could remain flat or even dip in the future,” she went on to say.

Meanwhile, Edmunds analysts noted that some of these financing trends are trickling down into the used market as well.

Edmunds determined that the average down payment for a used vehicle also rose in the third quarter, climbing to $3,306 compared to $2,937 in the second quarter and $2,636 a year ago.

“These affluent car shoppers are also making the shift to used vehicles,” Caldwell said. “This could be due to supply shortages in the new market, or because some of these consumers are looking to be slightly more financially conservative with their vehicle purchase given the current economic environment.”

Quarterly New-Car Finance Data (Averages)

|

|

Q3 2020

|

Q2 2020

|

Q3 2019

|

|

Term

|

70.2

|

71.4

|

69.6

|

|

Monthly Payment

|

$568

|

$573

|

$556

|

|

Amount Financed

|

$34,683

|

$36,119

|

$32,674

|

|

APR

|

4.6%

|

4.2%

|

5.7%

|

|

Down Payment

|

$4,457

|

$3,891

|

$4,045

|

Quarterly Used-Car Finance Data (Averages)

|

|

Q3 2020

|

Q2 2020

|

Q3 2019

|

|

Term

|

67.7

|

67.8

|

67.5

|

|

Monthly Payment

|

$420

|

$412

|

$413

|

|

Amount Financed

|

$23,235

|

$22,701

|

$22,351

|

|

APR

|

7.9%

|

8.2%

|

8.5%

|

|

Down Payment

|

$3,306

|

$2,937

|

$2,636

|

Source: Edmunds

Protective Asset Protection wanted to get a reading about how COVID-19 impacted dealers and their efforts to quickly implement digital tools and resources available to consumers shopping for vehicles and F&I product options.

So, the provider of F&I programs, services and dealer owned warranty company programs commissioned an online survey of nearly 400 dealership executives.

According to the survey results released this week, Protective found that the COVID-19 pandemic forced many dealers to quickly implement digital retailing options, resulting in 68% of respondents saying they’re now offering F&I product selection and pricing online as a result of the COVID-19 pandemic, which forced many dealers to quickly implement digital retailing options.

The company reported only 58% of respondents said they were making these F&I options available online before the pandemic. Another 68% of participants said they’re now offering financing options/finance applications online, compared with 55% before the pandemic.

Protective Asset Protection also indicated that digital tools now made available to customers online has certainly had a positive impact for many dealers.

Roughly one in five dealers said their sales have increased as much as 10% since the pandemic went into effect, with dealers leveraging more digital tools.

Looking forward, while 19% of dealers believe their digital retail sales will remain flat, Protective discovered nearly a third — 29% to be exact — said they believe their digital sales will increase slightly.

With more digital retail resources now available, dealers say they will plan further updates and implementations in the coming months:

• Research/review F&I products/protection plans online (65%)

• Purchase F&I products online (55%)

• Select F&I products online (55%)

• Complete the F&I process (all paperwork) online (54%)

• Complete financing application online (47%)

Of those dealers saying they have implemented digital retailing tools online for F&I products, Protective Asset Protection indicated 63% of surveyed dealers said their customers purchased exterior appearance protection and tire and wheel protection.

Another 59% said their customers are purchasing GAP and vehicle service contracts.

“Creating a digital retailing environment with access to F&I product options is paramount to the success of any online retailing strategy,” said Rick Kurtz, senior vice president distribution at Protective Asset Protection.

“Customers today are accustomed to shopping online, and even leveraging online channels for researching financing options for a variety of other purchases,” Kurtz continued in a news release. “It’s important that dealers realize that better online availability will lead to a more educated and comfortable customer earlier in the shopping process, which ultimately improves the chance of a sale.”

Edmunds shared data with SubPrime Auto Finance News that average down payments in August climbed by more than $400 on new-car deals and by nearly $700 on used-vehicle transactions.

Experts and surveys both pointed to how previous federal government stimulus efforts helped consumers spend on big-ticket items like a vehicle. But the prospect for more capital injections directly to consumers took a significant hit this week as Comerica Bank chief economist Robert Dye projected when he said in the institution’s September economic outlook, “We may already be at the point where meaningful fiscal policy may be out of reach due to the rancorous political environment.”

What some lawmakers dubbed a “skinny” assistance package failed to generate enough approval votes on Thursday in the U.S. Senate to move forward, drawing a stinging reaction from Majority Leader Mitch McConnell who went on Twitter to say: “Every Senate Democrat just voted against hundreds of billions of dollars of COVID-19 relief. They blocked money for schools, testing, vaccines, unemployment insurance, and the Paycheck Protection Program.

“Their goal is clear: No help for American families before the election,” McConnell tweeted.

Had federal lawmakers been able to reach an agreement, the financial assistance to consumers could have helped vehicle sales. As mentioned previously, Edmunds told SubPrime Auto Finance News that the average down payment for a used vehicle financed in August came in at $3,353, up from $2,655 a year earlier. On the new-model side, the average down payment rose from $4,052 to $4,458

“For auto sales, particularly for used, any type of stimulus, whether it’s what we’ve seen since the pandemic or any type of tax refund, seems to gives sales wind behind them,” Edmunds executive director of insights Jessica Caldwell said in a phone conversation.

“I think whenever there is some sort of crisis, people are shocked,” Caldwell added later in the conversation. “The flip side of these situations is some people believe it’s the perfect time to make a big purchase because of the depressed market. We certainly saw that in April and May when automakers were offering those blockbuster deals like 0 percent for 84 months. I think with rates continuing to be relatively low, I still think people think it’s a good time to buy a car because they can take advantage of the rates.

“I think it’s interesting how these crises turn into buying opportunities for people who feel good about their own financial situation. We definitely do people see looking for a deal on the used-car side,” she went on to say.

Edmunds reported that the average interest rate on used-vehicle financing originated in August softened slightly to 7.92% from the year-ago reading of 8.50%. The average amount financed moved a bit higher to $23,081 from $22,252.

Along with finance companies taking on risk, Dye described the potential economic peril that might be ahead, especially as federal lawmakers bicker.

“A stricter approach to unemployment benefits, in the face of a massive new wave of unemployment, would have a chilling effect on the economy,” Dye said. “In such a case, we would expect that consumer spending would be reined in for lower-income households and for households with unemployed workers. Consumer confidence would fall as unemployment increased. The loss of purchasing power and loss of confidence would hamstring the consumer economy.

“A condition of extended demand destruction and curtailment would contribute to a huge capacity overhang for many businesses. Thus, the effects of the consumer squeeze would eventually be felt upstream in many heavy industries that are not directly linked to consumer spending. State and local tax collections would be further constrained, requiring deep cuts in government spending. Truly, the potential for a double-dip recession of historic magnitude is sobering,” he went on to say.

Edmunds' in-depth auto financing data can be found below:

New-Vehicle Data

|

Year

|

Term

|

Monthly Payment

|

Amount Financed

|

APR

|

Down Payment

|

|

2015

|

68.2

|

$487

|

$29,184

|

4.2

|

$3,257

|

|

2019

|

69.5

|

$555

|

$32,590

|

5.7

|

$4,052

|

|

2020

|

70.3

|

$570

|

$34,770

|

4.7

|

$4,458

|

Used-Vehicle Data

|

Year

|

Term

|

Monthly Payment

|

Amount Financed

|

APR

|

Down Payment

|

|

2015

|

66.3

|

$372

|

$20,383

|

7.66

|

$2,193

|

|

2019

|

67.4

|

$412

|

$22,252

|

8.50

|

$2,655

|

|

2020

|

67.6

|

$418

|

$23,081

|

7.92

|

$3,353

|

Source: Edmunds

Less than a month after launching its F&I solution, ZipDeal this week unveiled a free eBook the company said was created to help dealers combat the erosion of front-end profits on new and used vehicles with a customer-driven, digital vehicle delivery experience that.

ZipDeal chief executive officer and partner Tony Gomez elaborated about the eBook titled, The Auto Dealer’s Guide to a Profitable, Customer-Driven Vehicle Delivery Experience.

“With dealer front-end profits as low as 3%, dealers have to make it easy for sales representatives to sell more than just cars,” Gomez said in a news release. “This eBook explains how to implement a streamlined, post-sale, pre-F&I vehicle delivery system that puts customers in the driver’s seat for a personalized buying experience. While at the same time introducing additional sales opportunities, like protection products, that often are not presented.”

The eBook also guides dealers through the ZipDeal digital delivery experience, which was created by Lindsay Automotive owner Steve Lindsay. Brought to market by Gomez along with industry veterans Chip King, ZipDeal is designed to link 11 touchpoints between the end of vehicle negotiations and entering the F&I office on one customer-driven interactive tool.

ZipDeal also can lead customers through titling and registration, insurance information, finance and protection products, vehicle features, personal vehicle settings, posting online dealership reviews and more.

Lindsey emphasized the tool can ensure every customer is exposed to every product and accessory every time for additional revenue streams while giving customers a personalized experience and the control they want over the process.

“We piloted ZipDeal at our two stores and trained sales representatives on accessories and protection products (paint and fabric),” Lindsay said. “Within three months, our protection product sales increased from 5% to 28%, and our reps were earning as much as $3,000 a month in extra commissions.”

The eBook also includes practical steps, tips, and best practices to turn delivery pain points into profit points. An in-depth review of how to prepare a dealership for digital delivery provides instructions for how to establish new processes and systems, get team members on-board and excited about a new tool, and motivate associates to execute.

“There are a ton of studies out there showing that customers want more control over their buying experiences,” King said. “ZipDeal allows them to educate themselves and choose ancillary products at their own pace, which is proven to increase product penetration rates, dealers profits and customer satisfaction.”

Dealers can download the free eBook by going to this webpage.

For more information about ZipDeal, go to www.zipdeal.com.

Well, here comes another automotive industry statistic establishing an all-time reading during the coronavirus pandemic.

Findings from Experian’s Q2 2020 State of the Automotive Finance Market report release on Thursday morning indicated that the amount of financing originated during the second quarter that fell into subprime represented an all-time low. Analysts determined just 22.18% of the total financing booked in Q2 were subprime or deep subprime.

Experian classifies subprime and deep subprime as individuals with credit scores of 600 and lower.

At the midpoint of last year, Experian reported subprime and deep subprime financing constituted 23.41% originated during Q2. The recent high in the report’s data set going back eight years came in Q2 2013 when 28.32% of all financing was classified in the lowest credit tiers.

Experian also discovered that the overall amount of financing coming through the industry pipeline declined during the second quarter, reflecting the significant slowdown in retail vehicle transactions when stay-at-home orders arrived this spring.

Analysts determined the percentage of new vehicles with financing dropped from 87.62% in Q2 2019 to 85.54% in Q2 2020, while the percentage of used vehicles with financing decreased from 40.33% to 36.75% over the same period.

However, Experian emphasized that much of the overall decrease can be attributed to the early months of the pandemic. Analysts pointed out that in April their information showed new-vehicle sales fell 50.8% year-over-year, while used vehicle sales plummeted 54.0%.

In June, Experian highlighted that new- and used-vehicle sales rebounded as its data noted that new-vehicle sales were off only 10.6%, while used-vehicle sales actually increased by 0.2% compared to 2019.

“COVID-19 has impacted the industry, but the data shows manufacturers, dealers and lenders have adjusted to the current landscape,” Experian senior director of automotive financial solutions Melinda Zabritski said in a news release.

“For example, manufacturer incentives have helped new-car sales rebound over the past few months,” Zabritski continued. “The more the industry can stay on top of the trends, the better positioned they will be to continue to boost sales and navigate the recovery.”

With the option for consumers to take advantage of manufacturer incentives, Zabritski noted that she’s seen consumers with strong credit shift back into the new-vehicle market, reversing a trend she and her team have observed over the past several quarters.

Experian indicated prime and super-prime consumers made up 74.96% of new-vehicle financing in Q2 2020, up from 71.89% in Q2 2019. The report also showed that captives made up the largest share of new-vehicle financing (31.1%), up from 28.6% in Q2 2019.

Meanwhile, finance companies are absorbing more risk in order to keep payments manageable for their customers.

Experian found that the average amount financed for a new vehicle reached $36,072 in Q2, an increase of nearly $4,000 from a year ago. Analysts explained much of the increase appears to be driven by a shift in consumer preference.

During the quarter, Experian discovered full-size pickups became the most popular vehicle segment, making up 16.09%, followed closely by small SUVs at 14.33%.

“These vehicles tend to be more expensive,” Experian said while adding that the average amount financed for a full-size pickup in Q2 was $46,502.

Analysts pointed out the increase in the average amount financed for a used vehicle was much smaller, rising $760 from a year ago to reach $20,916.

Despite the increases in the average amount financed, Experian noticed the average monthly payments remained fairly steady.

Analysts indicated the average monthly payment for a new vehicle was $568, an increase of $18 from the previous year, while the average monthly payment for a used vehicle increased $5, bringing it to $397.

The limited increase in average monthly payment is likely attributed to the increase in the average term. For a new vehicle, the average came in at 71.54 months, up from 69.17 months in Q2 2019, while the average term for a used vehicle ticked up to 65.30 months from 64.82 months spotted in Q2 of last year.

Experian said that it’s important to note that the percentage of new-car contracts with terms between 85 and 96 months increased from 1.3% in Q2 2019 to 4.8% in Q2 of this year —with many of these deals extended to consumers with prime credit scores at 720 and higher.

In addition, analysts noticed that average interest rates for new vehicles decreased from 6.27% in Q2 2019 to 5.15% in Q2 2020. Similarly, average interest rates for used vehicles softened from 10.07% to 9.69% during the same time period.

“With vehicle loans becoming more expensive, we’ve seen lenders and consumers find ways to make monthly payments more affordable — relying on lower interest rates and extending loan terms,” Zabritski said.

“Lenders need to minimize risk and find finance options that meet the needs of car shoppers. Ensuring loans are affordable and fit within the consumers’ budgets will be a priority,” she went on to say.

A few other findings for Q2 from Experian included:

— Leasing saw a decrease year-over-year, making up 25.81% of new vehicles in Q2 2020, compared to 32.03% in Q2 2019.

— Hondas are the most commonly leased vehicle at 13.55% of the market.

The average credit score for new-vehicle financing increased four points year-over-year from 717 in Q2 2019 to 721 in Q2 2020. The average score for used-vehicle inched one point higher from 656 to 657.

To watch a webinar when Zabritski goes into more detail about the Q2 2020 State of the Automotive Finance Market report, register on this website.

CarGurus continues to build relationships with finance companies, with the newest one connected with a provider that caters in part to the subprime market.

On Tuesday, the online automotive marketplace announced that Global Lending Services has joined its financing platform that can allow eligible consumers to get pre-qualified for auto financing from the CarGurus website.

CarGurus launched its online financing capability last year through a partnership with Capital One and has since added Westlake Financial Services and now GLS as additional providers to its financing program.

CarGurus highlighted that adding a third finance company to the program will not only continue the transparent and efficient process that shoppers are used to experiencing on its site, but will also provide those shoppers with competitive rates for almost all of the U.S. vehicle inventory on CarGurus.

“As a trusted automotive shopping leader to both consumers and dealers, CarGurus is thrilled to welcome GLS as the latest lender to our financing platform,” CarGurus chief product officer Tom Caputo said in a news release. “Adding GLS is a win for shoppers that will see a wider selection of rates to choose from and a win for dealerships that will have better-informed, ready-to-buy shoppers coming to their locations.

“Financing is an often forgotten, yet crucial step in the online car shopping journey, and creating a marketplace of lenders for online auto financing will help consumers conduct this research earlier in the process and ultimately come to dealerships better prepared to buy a vehicle,” Caputo continued.

According to CarGurus buyer insights data, 36% of vehicle shoppers want to finance their vehicle online before their purchase. The CarGurus online financing platform not only can help enable shoppers to do so transparently, but also can ensure that dealerships both maintain financing flexibility and the ability to offer additional financing options to these down-funnel shoppers.

“We are excited to partner with CarGurus to provide customers financing options early on in their car buying experience and from the safety of their own home,” GLS chief executive officer Steve Thibodeau said. “The last few months have really highlighted the importance for customers to be able to complete as much of the buying process online, before heading into the dealership.

“Knowing that you’re approved and what your payment will be before you step into the dealership, allows customers to focus on the vehicle they want without the stress of financing,” Thibodeau went on to say. “For dealers, knowing they have qualified buyers being referred to their showrooms, improves sales volumes and cuts down on time in the finance office, leading to a better customer experience.”

For dealerships and finance companies with questions about the CarGurus financing platform, send a message to [email protected].