Despite significant objections from the American Financial Services Association, in collaboration with the Illinois Financial Services Association, the Independent Finance Association of Illinois and the Illinois Automobile Dealers Association, Gov. J.B. Pritzker signed into a law Illinois Senate Bill 1792 last week.

The signature created the Predatory Loan Prevention Act and instituted a 36% rate cap based on the federal military annual percentage rate for all loans including auto financing not exceeding $40,000.

In response, Carleton, a provider of compliant financing calculation and digital document software solutions, looked to provide some additional information about the new law that went into effect immediately and will significantly impact the extension of credit in the state of Illinois.

As the consumer-finance industry awaits to see if regulations are released for guidance implementing the law, Carleton recapped that it started calculation changes in order to help clients and partners stay ahead of this compliance challenge.

According to a news release, Carlton spelled out these details:

Significant provisions impacting computational requirements

The new law replaces existing maximum charge statutory requirements with:

—A 36% annual percentage rate limit

—Aligns computational requirements with the MAPR for the Military Lending Act

—The new 36% cap will extend to both loans and retail installment sales

Exempt institutions include:

—Federally chartered banks

—Savings banks

—Savings and loan associations

—Credit Unions

SB 1792 Aligns compliance requirements with the military apr

Carleton reiterated that the Military Loan Act defines “interest” for purposes of complying with the rate cap as including:

—Application fees

—Points, origination fees, participation fees — all fees in the TILA finance charge

—Any fee, premium, or charge for credit insurance

—Any debt protection charges/fees (cancellation and suspension)

—Any credit-related ancillary product sold in conjunction with the transaction

“The controversy over the undefined term “credit-related ancillary product” will extend to this legislation unless subsequent rules and regulations provide specific clarity,” Carlton said in the news release also posted on its website.

“To date, the Department of Defense has refused to define this term in relation to the MAPR calculation,” Carlton continued. “Hopefully, new rules and regulations implementing SB 1792 will dive further into the granular details on calculating a MAPR in compliance with this new law.

“Carleton has maintained regular communication with industry professionals and trade associations to ensure we are assisting our clients implement these necessary updates,” the firm went on to say.

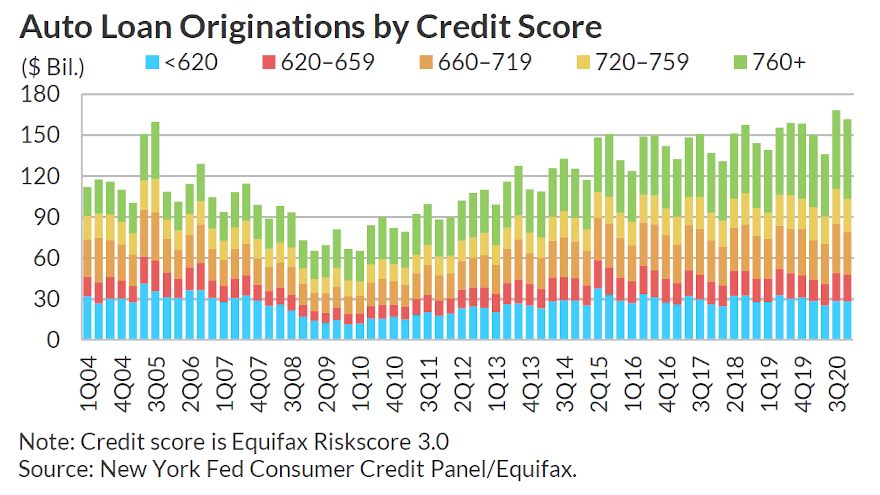

Fitch Ratings pinpointed subprime auto financing as one of five areas to watch should consumer indicators deteriorate; especially as federal assistance winds down and accommodations by finance companies expire.

Analysts made that assertion in a report shared with SubPrime Auto Finance News on Friday. Along with subprime auto financing, Fitch Ratings also mentioned certain segments of student loans, retail credit cards, unsecured consumer lending and mortgages to low- to moderate-income borrowers as the other credit segment the firm plans to monitor closely.

Fitch Ratings acknowledged that the most recent $1.9 trillion federal stimulus package provides substantial aid that will boost household income, specifically for lower- and middle-income individuals.

Among other measures, analysts recapped that the American Rescue Plan includes:

— One-time stimulus checks of $1,400 to individuals making less than $75,000

— Extends $300 enhanced unemployment benefits until Sept. 6

— Makes $10,000 of unemployment benefits tax free

— Grants fully refundable child tax credits

— Increases healthcare subsidies for those buying healthcare plans offered pursuant to the Affordable Care Act.

According to the Fitch Rating report, the Tax Policy Center estimated that the major tax provisions in the American Rescue Plan will lift after-tax income of the lowest income quintile by 20.4% and those in the second lowest quintile by 9.3%. However, Fitch Ratings pointed out that this boost in income is temporary, as the credits only apply for 2021.

“While the recent round of coronavirus stimulus will undoubtedly provide immediate financial boost to the U.S. consumers, particularly at the lower income levels, the long-term effects may not look as promising given a significant labor market dislocation due to the pandemic,” analysts said.

“We expect that as aid runs out and forbearance expires, weaker borrower loan performance is expected to worsen from current levels of strong performance,” they continued. “There will be an increase in defaults for those who may have been already struggling pre-pandemic and those with longer-term job loss.”

Fitch Ratings also touched on another element that’s impacting how it plans to monitor subprime auto financing and other credit products, noting that ABS asset performance has benefitted from credit tightening.

“Since the onset of the pandemic, many traditional lenders have pulled back from higher-risk lending and tightened their underwriting standards by raising minimum credit scores and down payment requirements,” analysts said. “This has restricted access to credit for many individuals with weaker credit profiles and lower incomes, as well as those who may have lost their jobs.”

Contract extensions for auto financing are trending down. Consumer expectations for their household financial situations are improving. President Biden just signed the newest federal stimulus package.

As individuals and industries acknowledged the first anniversary of COVID-19, analysts and experts are seeing a wide array of positive trends; ones that might help your current portfolio and future paper.

Beginning first with S&P Global Ratings, analysts there discovered that January showed extensions on auto paper in public asset-backed securities (ABS) decreased significantly relative to December.

For the public prime pools that the firm tracks, the monthly average extension rate decreased 27 basis points to 0.46% from 0.73%. And for public subprime pools, it dropped 134 basis points to 3.50% from 4.84%.

“We attribute the substantial improvement to stimulus checks that were paid in January ($600 per individual and child),” S&P Global Ratings analysts said in a news release. “These checks helped ease the financial burdens for many, thereby reducing the need for extensions. Employment levels also improved during the month, with nonfarm payroll employment increasing by 166,000.”

Even with the tremendous reduction in extension rates, S&P Global Ratings pointed out that they remained elevated relative to pre-pandemic levels recorded last January.

In the prime segment, extensions were 15% higher (0.46% versus 0.40%), while for public subprime issuances, they were 75% higher (3.50% compared with 2.00%).

“However, performance differed greatly by issuer, with many granting fewer extensions this January compared with a year ago,” analysts said.

Furthermore, S&P Global Ratings indicated the average number of full payments that have been made on contracts since their first COVID-19-related extension continues to grow. In December, analysts said they started to track the number of full payments made on contacts extended since March.

Consumer sentiment improves

Arriving this week, too, the Federal Reserve Bank of New York’s Center for Microeconomic Data released its February Survey of Consumer Expectations, which showed sharp increases in year-ahead gas and rent price growth expectations.

However, other segments of the survey showed positive trends.

For example, after remaining flat at 2% for the past seven months, the survey showed median one-year-ahead expected earnings growth increased to 2.2% in February, driven by respondents with more than a high school education. The overall median remains well below its year-ago level of 2.6%.

Analysts said mean unemployment expectations — or the average probability that the U.S. unemployment rate will be higher one year from now — decreased from 40.2% in January to 39.1% in February, falling slightly below its trailing 12-month average of 39.7%.

Also of note, the survey perceptions of credit access compared to a year ago and expectations for year-ahead credit availability both were largely unchanged in February. And the average perceived probability of missing a minimum debt payment over the next three months decreased from 10.5% in January to 10.1% in February, according to the survey, remaining below its 2020 average of 11.4%.

More stimulus funds

After the House and Senate passed the American Rescue Plan, President Biden signed it into law on Thursday. White House press secretary Jennifer Psaki said on Thursday afternoon that some individuals could see direct deposits into bank accounts as soon as this weekend.

Here’s an overview from the White House about the direct payments in the American Rescue Plan:

— For households who have already filed their income tax return for 2020, the IRS will use that information to determine eligibility and size of payments.

— For households that haven’t yet filed for 2020, the IRS will review records from 2019 to determine eligibility and size of payment. That includes those who used the “non-filer portal” for previous rounds of payments.

— For tax returns with direct deposit or bank account information, the IRS will be able to send money electronically. For those households for which Treasury cannot determine a bank account, paper checks or debit cards will be sent.

The White House then offered what the American Rescue Plan means for a typical family of four — with parents making $75,000 a year combined, and with children in school ages 8 and 5:

— That family of four will soon be getting $5,600 in direct payments, $1,400 for each parent and child.

— Because of the expanded Child Tax Credit, they will also get $2,600 more in tax credits than before.

“That’s $8,200 more in the pockets of this family as they try to weather this storm — on top of additional money in this bill to reopen schools safely, get shots in arms faster, and help those who have lost their jobs through no fault of their own,” the White House said.

Upbeat GDP forecast

Fueled in part by that federal stimulus, the first quarterly UCLA Anderson Forecast of 2021 expects robust growth for the U.S.

Following the 3.5% decline in real GDP in 2020, the national forecast called for 6.3% growth in 2021, 4.6% growth in 2022 and 2.7% growth in 2023. Forecasters said these rates of growth are considerably higher than the 2.3% rate the country averaged during the recovery from the Great Recession between 2010 and 2019.

The forecast also sees real GDP surpassing its 2019 peak by the end of the second quarter of this year and to surpass the trend it was on prior to the pandemic in early 2022.

“For the economy, a waning pandemic combined with fiscal relief means a strong year of growth in 2021 — one of the strongest years of growth in the last 60 years — followed by sustained higher growth rates in 2022 and 2023,” UCLA Anderson senior economist Leo Feler said in a news release.

“We have embarked on a once-in-a-lifetime policy experiment to test the ability of government intervention to make even deadly pandemic-sized economic shocks a short blip in our economic history,” Feler continued, also noting that governments around the world ensured a “vaccine race” by guaranteeing purchases and that U.S. policies helped keep businesses afloat and maintained employer-employee relationships.

“If the motto of the pandemic was to survive, the motto post-pandemic is to thrive, and because of the policies implemented to date, we’re in a position to have a rapid economic recovery,” he added.

“This all means we have the opportunity to test how much we can stimulate the economy and how rapidly employment can recover without overheating the economy,” Feler went on to say. “If real GDP goes above ‘potential GDP’ without generating sustained inflation, it will signal that we have been too modest in our assumptions about the productive potential of our economy … These next few years will help us discover if secular stagnation has been a myth we’ve mistakenly bought into and whether we have the capacity to grow much faster than we’ve done in decades.”

The CarGurus consumer sentiment study focused on auto finance found a significant portion of participants said that receiving pre-qualification for financing before visiting the dealership would be useful.

In fact, the study results released on Tuesday showed that 93% of vehicle shoppers agreed with that sentiment. However, consumer perception about the availability and the eventual finalization of that pre-qualification offer is considerably softer, according to the study.

CarGurus indicated only two in three shoppers were aware that pre-qualification was a possible option. And of those study participants who recently financed a vehicle, just 50% pre-qualified for financing before doing so.

The study also highlighted how pre-qualifying for auto financing can give shoppers more confidence, with 68% of participants believing that doing so would help them feel more confident and prepared to talk to dealers about financing.

Furthermore, 66% of those involved in the study found value in pre-qualification because they wanted to complete more of the shopping process before visiting the dealership.

However, 46% of shoppers are concerned that their pre-qualification rates would not be final, and 41% are concerned that they would have to repeat the financing process at the dealership, according to the CarGurus project.

Finally, when it comes to financing a vehicle, the study noted that 42% of shoppers wished they could see their monthly payment estimates while shopping for a vehicle online before visiting a dealership.

“Our research found that consumers are eager to purchase a vehicle in a similar fashion to buying a home, and they want know more about financing for this major purchase in advance instead of treating it as an afterthought,” CarGurus director of customer insights Madison Gross said in a news release.

“According to the study, there is also a lot of room to educate consumers on the general ideas around automotive finance, which should ultimately provide a better shopping experience for both consumers and dealerships,” Gross continued about the project that included respondents who either had intentions to buy a vehicle in the next 12 months or had purchased one in the past two years.

In addition to asking participants about pre-qualification in advance of visiting the dealership, the study also aimed to learn more about their overall automotive financing knowledge. The study also found:

• Shoppers believe that a vehicle’s price drives the most profit for dealerships (45%), while 30% think that auto financing does.

• When considering a loan for a vehicle, the monthly payment and interest rate equally mattered most to shoppers (37% each), followed by total price paid over the duration of the contract (18%) and term length (7%).

• When presented with an imaginary car shopping scenario involving a five-year contract with 5% APR for a $25,000 vehicle and $5,000 down payment, shoppers believed the following would have the greatest impact on monthly payments:

—46%: Whether the interest rate increased from 5% to 8%

—29%: If the contract length increased from five to six years

—24%: If there were no down payment

More specific study details can be found here.

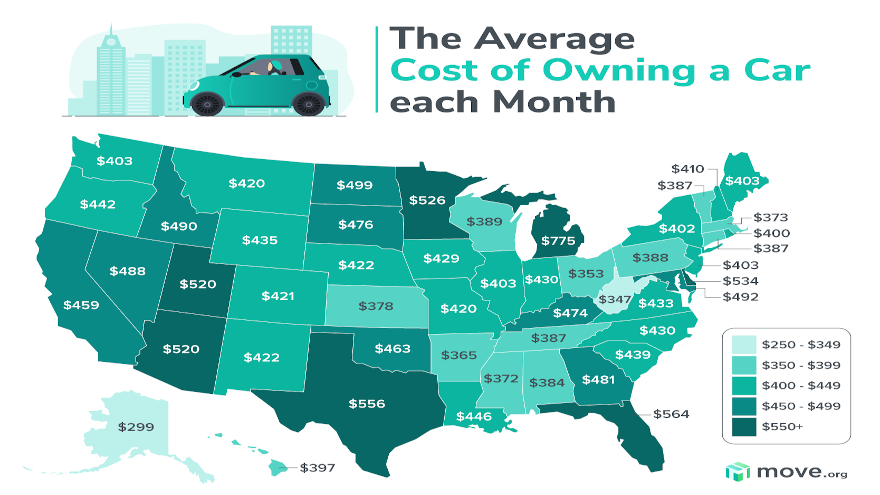

Dealerships and finance companies often try to educate their customers to understand that the cost of having a vehicle is more than just the monthly payment stipulated on the installment contract.

Analysts at Move.org — a website dedicated to helping consumers find the resources they need to relocate — dissected an array of data to pinpoint the average cost of owning a vehicle, breaking down the metrics by state.

Move.org discovered that Michigan residents have one of the lowest average annual figures for installment payments and maintenance, coming in at $2,005. However, the site determined Michigan residents have the highest overall average for total cost of ownership because of insurance requirements.

Analysts said that individuals in Michigan pay $9,304.28 annually to own a vehicle. That’s more than $4,000 above the national average. Of that figure, $5,740 goes toward insurance. The monthly average worked out to be $775.

Meanwhile, looking at just the ledger line for installment payments as well as maintenance, Move.org indicated that Texas vehicle operators have the highest annual costs at $4,145, the only state above the $4,000 threshold in that category of the site’s data set. But, Move.org pegged the annual cost for Lone Star State vehicle owners as being third nationally at $6,670.

On the other end of the spectrum, Move.org determined that Alaska vehicle owners have both the lowest annual costs for installment payments, maintenance as well as insurance, coming in all together at $3,586.

The complete data report can be viewed here.

Finance company executives and managers having a sit-down meal at a restaurant now might be even more enjoyable than for just the delicious dish and social comradery. Their outstanding portfolio might be much more appetizing, too, because of the rebound the job market made in February, aided by what’s cooking in the restaurant sector.

What one expert called “stronger than anticipated,” the U.S. Bureau of Labor Statistics (BLS) reported on Friday morning that total nonfarm payroll employment rose by 379,000 in February. It meant the unemployment rate was little changed at 6.2%.

BLS officials said the labor market continued to reflect the impact of the coronavirus pandemic.

BLS officials also noted most of the job gains occurred in leisure and hospitality, with smaller gains in temporary help services, health care and social assistance, retail trade and manufacturing. They also noted employment declined in state and local government education, construction and mining.

Moments after the numbers arrived, Curt Long, chief economist and vice president of research at the National Association of Federally-Insured Credit Unions (NAFCU), offered this reaction.

“The February jobs report was stronger than anticipated, thanks to a spike in restaurant employment,” Long said. “Private payrolls grew by 465,000, and restaurants accounted for over 60% of that total.

“With vaccine distribution continuing to accelerate and with the economy in the initial stages of a reopening, the coming months should see robust gains,” Long added.

The newest BLS data arrived after the Conference Board Consumer Confidence Index improved again in February. The index currently stands at 91.3, up from 88.9 in January.

The Present Situation Index — based on consumers’ assessment of current business and labor market conditions — climbed from 85.5 to 92.0.

However, the Expectations Index — based on consumers’ short-term outlook for income, business, and labor market conditions — fell marginally from 91.2 in January to 90.8 in February.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for the Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was Feb. 11.

Officials said the survey results did not fully capture the events surrounding the Texas power crisis nor the loosening of dining restrictions in New York City.

“After three months of consecutive declines in the Present Situation Index, consumers’ assessment of current conditions improved in February,” said Lynn Franco, senior director of economic indicators at the Conference Board. “This course reversal suggests economic growth has not slowed further.

“While the Expectations Index fell marginally in February, consumers remain cautiously optimistic, on the whole, about the outlook for the coming months. Notably, vacation intentions — particularly, plans to travel outside the U.S. and via air — saw an uptick and are poised to improve further as vaccination efforts expand,” Franco continued in another news release.

Consumers’ assessment of current conditions also improved in February, according to the Conference Board.

The percentage of consumers claiming business conditions are “good” increased from 15.8% to 16.5%, while the proportion claiming business conditions are “bad” fell from 42.4% to 39.9%.

Experts added that consumers’ assessment of the labor market also improved. The percentage of consumers saying jobs are “plentiful” increased from 20.0% to 21.9%, while those claiming jobs are “hard to get” declined from 22.5% to 21.2%.

All of that positive momentum could help the health of your outstanding portfolio, as this week Experian reported total open automotive finance balances grew 2.8% year-over-year, reaching $1.27 trillion during the fourth quarter.

Nicholas Financial president and chief executive officer Doug Marohn is back on the podcast for a discussion about the pandemic, fraud and the vitality of the subprime auto finance market.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Fueled by 14.7% growth year-over-year, Westlake Technology Holdings reported this week that the finance company with a diversified portfolio beyond just subprime paper ended 2020 with $12.14 billion in total managed assets.

Westlake highlighted nine other major achievements generated by its various divisions, including:

• Westlake Financial continued its strong push in prime credit financing with a 6% increase year-over-year in prime originations

• Overall, 50% of Westlake’s portfolio now consists of customers with a FICO score of 600 or higher.

• Western Funding reported a 21% year-over-year growth in deal volume and 37% growth in producing dealers for 2020.

• Westlake Capital Finance (WCF) closed the year with 152% growth in credit line and commercial real estate loans.

• Credit Union Leasing of America’s lease volume grew 43% in Q4 2020 compared to 2019.

• Wilshire Consumer Credit (WCC) reported a 90% increase in unsecured loans in 2020 compared to 2019 and expanded into 35 new states.

• Westlake Direct pre-qualified more than 5,000 customers and routed to auto dealers and reported $100 million in total managed assets.

• Westlake Portfolio Management (WPM) added $300 million in third-party servicing portfolios.

• Westlake Flooring Company increased its portfolio size by 24.8% and a 42.4% reduction in delinquency over 2019.

According to a news release, the company directly attributed this success to the dedication of its employees. Despite the challenges of the COVID-19 pandemic, Westlake said its employees quickly adapted to remote work and persevered through the year — allowing the company to experience growth over 2019.

Westlake Technology Holdings group president Ian Anderson said in the news release, “2020 was without a doubt a challenging year. As a result of the global pandemic, we had to learn and adapt quickly to the changed working environment. We are looking forward to 2021.”

And speaking of the current year, Westlake set an aggressive goal of 20% growth above the 2020 metrics.

Dealers looking to learn more about Westlake Technology Holdings product offers can visit www.westlakefinancial.com/dealer.

Some applicants might be landing at your subprime auto finance company in part because of the amount of student loan debt detailed on their credit report.

Senate Democrats recently proposed eliminating up to $50,000 in federal student loan debt per consumer, a strategy questioned by Consumer Bankers Association president and chief executive officer Richard Hunt.

Last week, Hunt shared his concern because, in his view, the wiping away of that debt comes without a “serious attempt” to bring about what he described as fundamental, long-lasting reforms aimed at lowering college tuition.

“Focusing on after-the-fact student loan debt alone is a temporary patch which ignores the underlying problem — the skyrocketing cost of college fueled by two decades of federal over-lending,” Hunt said in a statement released by CBA.

“Every dollar of federal lending has been shown to have a direct correlation to increases in tuition. Without reigning in runaway lending from the Department of Education, which holds and originates enough student loans to be the fifth-largest bank in the country, future borrowers will continue to accumulate mountains of debt,” Hunt continued.

According to CBA, over the last two decades, the price of college tuition has increased nearly 200% and the amount of student loan debt held by Americans has gone up with it. The association pegged it as soaring from a little more than $600 billion in 2008 to nearly $1.5 trillion today.

CBA also said about 92% of that debt is from the federal government.

So how do these holders of federal student loan debt sometimes land within the subprime segment when seeking auto financing?

“These federal loans have a double-digit delinquency and default rate and lack plain-language disclosures on the total costs of the loan,” CBA said.

Hunt cautions that not finding a wide-ranging remedy might result in some consumers continuing to struggle with student-loan debt — perhaps even spiling over into their other credit obligations such as a vehicle installment contract.

“The majority of Americans struggling to repay their student loans — about 90% from the federal government — did not graduate but have debt without the advanced earning potential of a degree,” Hunt said.

“Simply forgiving debt for graduates with the largest loans will likely help those earning the highest wages. Any serious proposal must go beyond debt forgiveness alone, which does nothing to solve the root cause of skyrocketing college tuitions,” he went on to say.

At least one industry expert used some positive adjectives when assembling reaction after the Federal Reserve released consumer credit data for December.

The credit data arrived after a federal forecast projecting how long it might take for the U.S. job market to rebound from the pandemic.

According to data released on Friday, the Fed said that in 2020, revolving credit decreased 11.2% and nonrevolving credit increased 3.9%, leaving total consumer credit little changed.

The Fed added that consumer credit increased at a seasonally adjusted annual rate of 2.7% in the fourth quarter and at a rate of 2.8% in December.

Upon seeing that information Curt Long, the chief economist and vice president of research at the National Association of Federally Insured Credit Unions offered this assessment.

“On a seasonally-adjusted basis, consumer credit growth decelerated in December but still showed a solid gain. Revolving credit contracted once again, and has now fallen in nine of the last 10 months,” Long said. “Nonrevolving credit has surpassed its pre-pandemic level as interest rates remain at all-time lows and consumers shift spending to big-ticket items.

“Lenders have tightened standards through the pandemic, but that seems to have tapered off as the latest senior loan officer survey showed more banks reported easing standards for credit cards than tightening; a modest net amount of banks also reported easing standards on auto loans,” Long continued.

“NAFCU expects modest growth in consumer credit into the summer, followed by a more robust recovery,” he went on to say.

Long added more information specific to the credit-union market, noting that its portfolio of consumer credit increased 2.6% from a year earlier, which was above the overall growth of 0.1%.

Over the past 12 months, Long indicated that credit unions’ share of the market has risen by 0.3 percentage points to 11.8%. Meanwhile, he said banks’ share fell by 2.1 percentage points to 40.3%, and financial companies’ share ticked up by 0.4 percentage points to 13.2%.

Ahead of the Fed’s latest consumer credit data being released, the Congressional Budget Office shared its economic outlook, looking ahead as far as 2031. The outlook focused on one important element to consumers being able to use credit — having viable employment.

The CBO outlook pointed out that pandemic impact was focused on particular sectors of the economy, such as travel and hospitality, and job losses were concentrated among lower-wage workers. The CBO is projecting that the economic expansion that began last year will continue. Specifically, real (inflation-adjusted) gross domestic product (GDP) is expected to return to its pre-pandemic level during the middle of this year and to surpass its potential (that is, its maximum sustainable) level in early 2025.

In CBO’s projections, the unemployment rate gradually declines through 2026, and the number of people employed returns to its pre-pandemic level in 2024.

The CBO forecast prompted a swift reaction from new Treasury Secretary Janet Yellen, beginning a statement by saying the “CBO forecast is more evidence that we desperately need Congress to act on a rescue package.

“Last year, the economy shrunk more than any other since the end of World War II. With the growth that the CBO projects, it will be years before the country reaches full employment again,” Yellen continued.

“Then there are the more immediate concerns: Can we get the vaccine distributed quickly? Will people keep a roof over their heads? Will their unemployment benefits last until the end of the crisis? Will families go hungry? Will small businesses survive?

“All this is why we’re proposing the American Rescue Plan: So Americans can make it to the other side of this crisis and be met there by a strong, growing economy,” she went on to say.