F&I Sentinel — a leading compliance solutions provider with respect to the financing of F&I products — announced its founders have partnered with Calera Capital, a leading middle-market private equity firm.

According to a news release distributed on Monday, terms of the transaction that created a majority recapitalization of the business were not disclosed.

“With the increasing regulatory scrutiny regarding F&I products, regulators are analyzing whether finance companies have a program in place to monitor F&I products they finance,” F&I Sentinel co-founder and chief executive officer Stephen McDaniel said in the news release. “Our CITADEL platform offers a turn-key compliance solution that addresses the reputational, financial, litigation, and regulatory risks in connection with the sale and financing of F&I products.”

“We are excited to partner with Calera Capital to fuel F&I Sentinel’s future growth and expansion,” McDaniel continued.

Paul Walsh is senior managing director of Calera Capital.

“Automotive finance companies, banks and credit unions face complex compliance and risk mitigation challenges,” Walsh said. “F&I Sentinel represented a terrific opportunity to invest behind a market-leading business that provides unique technology and services to help financial institutions successfully navigate these issues.”

Brian Fearnow, managing director of Calera Capital, added: “F&I Sentinel adds tremendous value to all members of the vehicle financing ecosystem. We look forward to partnering with the management team to further enhance and extend the ways in which F&I Sentinel protects finance companies, dealers and consumers.”

Car Capital began 2022 by staying on the brisk development trajectory it established when launching last spring.

The new auto-finance technology company that strives to get any deal bought no matter the consumer credit background closed on another round of financial resources on Tuesday. Car Capital landed a $150 million three-year secured credit facility and a $6.125 million equity investment from funds managed by affiliates of Fortress Investment Group.

What the company called a “milestone transaction” through a news release provides Car Capital with the debt needed to continue to expand their rapidly growing business, fund more dealers, and increase the number of underserved consumers who want to purchase a vehicle.

“We are very pleased to partner with Fortress who has a long history of providing capital to fintech and automotive companies,” Car Capital co-founder and chief executive officer Justin Tisler said in the news release.

“The commitment, both on the debt and equity side, of such a respected market participant is a testament to our business model, team, and market opportunity,” Tisler continued.

Through its proprietary, fully digital platform, Dealer Electronic Auto Loan System (DEALS), Car Capital can allow dealer partners to approve 100% of their customers instantly, regardless of credit history.

With DEALS, Car Capital explained dealers have the ability to make 24/7 approval decisions based on the economics of each unique vehicle and consumer. And dealer partners get back-end profit based on performance, not a minimum portfolio size.

That technology and strategy impressed Dominick Ruggiero, who is managing director at Fortress Investment Group.

“Car Capital has built an exceptional business powered by proven, innovative technology and a business model that delivers substantial benefits to consumers and dealers alike,” Ruggiero said. “We are excited to provide a capital solution that positions Car Capital for significant continued growth in the years ahead.”

It’s been quite a week for Solutions by Text, provider of a text messaging platform for consumer financial services institutions.

First, the company announced raising of $35 million in growth financing. Edison Partners led the transaction with participation from Stifel Venture Bank, a division of Stifel Bank.

The company also announced the appointment of payments industry leader David Baxter as chief executive officer.

Under Baxter’s leadership, the company said it will use investment proceeds to accelerate the adoption and extensibility of compliant text-based solutions across the consumer finance lifecycle.

Executives highlighted that more than 1,400 consumer finance organizations, including leading auto finance, banking and lending brands, leverage Solutions by Text (SBT) to power compliant texting programs in support of their originations, servicing and collections initiatives. The company’s platform can enable controls and management over regulatory and carrier communication policies, including the Consumer Finance Protection Bureau’s latest Fair Debt Collection Practices Act (FDCPA) requirements.

“Eight in ten U.S. adults use text messaging on a regular basis. With Solutions by Text, financial institutions are meeting these consumers where and how they want to be met, and doing so with peace of mind,” said Kelly Ford, who is general partner at Edison Partners. Ford led the investment and joined the company’s board of directors.

“The company is uniquely positioned to scale growth in the fintech market with a team of deep regulatory compliance, messaging and payments expertise, not to mention a sizable loyal customer and partner base with significant embedded opportunity,” Ford continued in a news release.

Edison Partners’ investment coincides with the appointment of Baxter as the company’s CEO.

Baxter is a payments industry executive joining the company from ACI Worldwide, where he led sales for the past eight years. Baxter grew and scaled the ACI bill presentment and payment business, following the acquisition of Online Resources, from $20 million to more than $600 million, moving the company’s biller-focused segment from No. 12 to No. 1 in the industry.

SBT recapped that founders Danny and Mike Cantrell bootstrapped the company’s growth, which has been grounded in strong customer centricity. Both founders will continue to hold strategic customer-facing positions in the business going forward.

“We started SBT knowing there was a compelling need to give financial institutions compliance certainty as they seek to connect with consumers in the channels they use every day,” Danny Cantrell said in the news release. “As we’ve reached a new phase of growth, bringing on David is an important milestone. He’s an impressive growth leader, an innovator in payments, and I am thrilled to seize our incredible market opportunity with him at the helm.”

Joining Ford and Baxter on the board are co-founder Mike Cantrell and Edison director network members Ron Hynes and Nick Manolis. A payments industry veteran, Hynes is currently the CEO of Vesta and previously served with Ford on Bento for Business’ board of directors prior to its sale to U.S. Bank last quarter.

Manolis, SBT’s chairman, is an enterprise SaaS industry veteran who has successfully led Edison portfolio companies as CEO and as board director.

“I’ve long admired SBT’s leadership in compliant SMS, so it’s exciting to team with founders Danny and Mike Cantrell,” Baxter said. “Now more than ever, consumer finance organizations are taking a hard look at how to strengthen digital consumer relationships while maintaining compliance with national standards.

“Our opportunity to capture market share through existing and expanded platform capabilities is immense and we’ve assembled an exceptional team and board to turbo-charge this next chapter of growth. Edison’s fintech domain expertise and growth-stage operating know-how has already been invaluable,” Baxter went on to say.

Investment funds continue to flow into all parts of the automotive industry, with a second development arriving in recent days having a connection to auto financing and retailing.

This week, the CapStreet Group — a 31-year-old firm that invests in software, tech-enabled business services and industrial business services companies in the lower-middle market — announced that it has completed the majority recapitalization of Credit Bureau Connection (CBC), in partnership with the founder and other shareholders.

CBC is the third investment for CapStreet V, LP, which has $500 million of committed capital.

CBC offers credit report and compliance solutions to the automotive and general consumer finance industries across the United States. The company looks to optimize and automate the consumer finance qualification process through an easy to use and secure software platform accessible to end users directly or via standard API protocols made available to its extensive network of software affiliate partners.

CBC pointed out that its products and solutions place a heavy emphasis on compliance and identity verification to support the credit application and credit report process. The company said its secure, cloud-based products can help auto dealers and finance companies meet compliance requirements.

“We’ve witnessed a transformation in credit and compliance, especially in the automotive industry, and CBC remains at the forefront with our ever-expanding offering of technology-driven products and services. We’re excited to partner with the CapStreet team to help further accelerate our growth and market leadership” CBC founder Mike Green said.

“We have a collaborative and high-integrity culture at CBC with a mission to delight our customers by delivering one of the leading credit report and compliance solutions, and we are fortunate to have a partner that fully embraces our vision,” Green continued.

The CapStreet team involved in the CBC investment included Adrian Guerra, Walker Kahle, Nico Gayle and Evan Harmon.

“We are excited to join forces with Mike and the CBC team as we seek to drive additional value for customers and partners through the continued expansion of CBC’s credit compliance and analytics software platform,” said Guerra, who is partner with CapStreet.

Rick Pleczko, who is chief executive officer of the CapStreet operating executive group and executive chair at CBC, added, “The CBC platform is recognized as one of the most innovative and feature rich in the industry. We’re extremely pleased to help enable its future growth.”

Portico Capital served as the exclusive financial advisor to CBC.

“Eric and the Portico team have been terrific partners to CBC,” Green said. “From their pre-transaction diligence, guidance throughout the process, and ultimately helping us find the best partner and path forward, I can confidently say that they overdelivered on our expectations for the value an investment banking advisor could bring to our transaction.”

Eric Denlinger is a partner at Portico Capital Advisors

“CBC has established itself as the leading innovator in automotive credit and compliance. It was a pleasure to work with Mike Green and his entire team throughout the transaction,” Denlinger said. “The partnership with CapStreet will be a dramatic accelerator for the Company, and we are excited to watch the company’s next stage of growth.”

Willkie Farr & Gallagher LLP served as CapStreet’s legal counsel, and Cadwalader Wickersham & Taft LLP served as CBC’s legal counsel.

Also this week, Beekman Group, a private equity firm based in New York focused on building companies in the healthcare, consumer and the business services sectors, finalized a presence in the buy-here, pay-here industry.

Beekman announced that the firm has completed an investment in AutoManager to support growth and a recapitalization of the company.

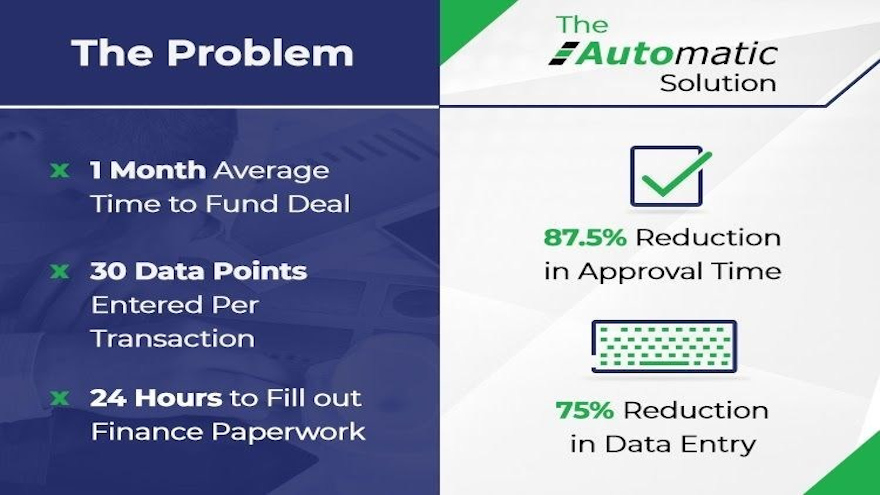

Automatic is trying to modernize what the fintech startup is calling an “outdated, fragmented independent dealer financing ecosystem.”

And it’s leveraging an equity crowdfunding campaign to continue on its path.

On Friday, Automatic announced the effort to generate resources for its platform that is designed to connect independent dealers with finance companies and F&I vendors.

Between the company’s unique platform and market-wide demand triggered by COVID-19 and chip shortages, Automatic is experiencing tremendous application and user growth with no end in sight,” the company said in a news release, adding that it already has built a dealer network approaching 1,000 operators.

“Capitalizing on present and emerging market trends, crowdfunding is sought to improve the product, make key hires and optimize their lending process to position Automatic as the No. 1 used car loan solution provider,” the company continued.

“In stark contrast to most equity crowdfunding campaigns that are launched by pre-revenue startups, Automatic is up and running and ramping up to strengthen their growth trajectory,” the company went on to say.

The crowdfunding campaign can be found via this website and more details about Automatic can be found at www.automaticusa.com.

With some consumers benefitting from refinancing their retail installment contract, the investment world is seeing an opportunity, too.

On Monday, OpenRoad Lending and Clarion Capital Partners announced that the New York-based private equity firm that focuses on making equity investments in lower middle market growth companies has completed a strategic investment in OpenRoad, a fast-growing direct-to-consumer auto finance company.

According to a news release, OpenRoad chief executive and co-founder Chris Goodman will retain a “meaningful” ownership stake and continue his role as CEO.

The terms of the transaction were not disclosed.

Founded in 2009 by the same executives who pioneered RoadLoans, OpenRoad partners with banks, credit unions and institutional investors to enable consumers to refinance their existing installment contract, lower their interest rates and achieve significant monthly savings.

In addition, OpenRoad offers value-add vehicle protection products such as GAP, vehicle service contracts and paintless dent repair.

Through its partnership with Clarion, OpenRoad said it plans to capitalize on its market position and explore additional business lines, such as financing for vehicle purchases, lease buyouts, car insurance and other consumer verticals.

OpenRoad added that will also leverage this investment to broaden its marketing channels and grow both organically and through acquisition.

“Over the past 12 years, we’ve built a tremendous operation known for saving customers money and delivering a convenient, modern online experience,” Goodman said in the news release. “We expect demand for auto refinancing to continue to rise as smart consumers look for ways to lower their expenses. That, combined with accelerating adoption of digital lending, will lead to significant growth for OpenRoad.

“We are excited to partner with Clarion and benefit from their extraordinary expertise, resources and network to grow our business, while delivering the best financing experience in the market,” he continued.

Clarion managing director Matthew Feldman added these perspectives.

“OpenRoad’s exceptional customer value proposition, proven operational foundation, and commitment to meeting the needs of its lending partners is what attracted us to the business and what provides real opportunity for expansion,” Feldman said in the news release. “We are excited to partner with Chris and the management team to enhance their offering within the core refinancing product and beyond.

“Both of our teams share a commitment to excellence, integrity and collaborative culture. We believe we have a great formula for success,” he went on to say.

On the transaction, Clarion received legal advice from Akerman LLP and Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, PC.

Financing for the transaction was provided by funds managed by Madison Capital Funding and PennantPark Investment Advisers, LLC. Colonnade Capital Partners served as exclusive financial advisor to OpenRoad. Munsch Hardt Kopf & Harr, PC served as legal counsel to OpenRoad.

The days of Santander Consumer USA Holdings (SC) as a publicly traded subprime auto finance company are numbered.

SC revealed just before the Fourth of July that it had received a non-binding proposal from its majority shareholder — Santander Holdings USA (SHUSA) — to acquire all of the outstanding common shares of SC that are not currently owned by SHUSA.

The decision about that proposal arrived via news release distributed early on Tuesday morning.

Officials said SC and SHUSA have entered into a definitive agreement whereby SHUSA will acquire SC for $41.50 per share in cash, which represents a total equity value of $12.7 billion.

The companies indicated the transaction is expected to close in the fourth quarter.

According to the news release, the transaction has been unanimously approved by the board of directors of SHUSA. The board of directors of SC formed a special committee consisting of the independent and disinterested directors to evaluate and negotiate the definitive agreement.

Acting upon the unanimous recommendation of the special committee, the board of directors of SC unanimously approved the transaction, according to the news release.

Under the terms of the definitive agreement, officials said a wholly-owned subsidiary of SHUSA will promptly commence a tender offer to acquire all of the outstanding shares of SC’s common stock that SHUSA does not yet own at a price of $41.50 per share in cash.

Following completion of the tender offer, officials noted that SHUSA will acquire all remaining shares not tendered in the offer through a second step merger at the same price as in the tender offer.

“The tender offer is not subject to a financing condition,” the companies said.

Officials went on to mention the offer price of $41.50 per share in cash represents a premium of approximately 14% to the $36.43 closing price of SC’s common stock on July 1, the day prior to the announcement of SHUSA’s initial, non-binding proposal to acquire shares of common stock of SC that SHUSA did not yet own.

The companies added that consummation of the tender offer is subject to various conditions, including regulatory approval of the board of governors of the Federal Reserve System and other customary conditions.

Upon completion of the transaction, SC will become a wholly owned subsidiary of SHUSA, according to the news release.

Piper Sandler is acting as financial advisor and Covington & Burling LLP is acting as legal counsel to the special committee. Hughes Hubbard & Reed LLP is acting as legal counsel to SC.

DriveItAway has a new institutional investor.

The platform that offers dealerships the chance to provide cash-strapped customers the opportunity to secure a vehicle via its rent-to-own technology announced this week that Knightsgate Ventures — a leading venture capital firm focused on social and financial returns — has become an institutional investor in the company.

DriveItAway chief executive officer John Possumato said, “The mission of DriveItAway has always been to eliminate the friction, for dealers and consumers, to enable more people to first drive, and then buy, the used vehicle of choice, regardless of credit score or immediate down payment availability.

“This allows, for the first time, high-quality, consumer-focused car dealerships to broaden their outreach with the same level of customer care to those credit or down payment challenged, and provides the best vehicle choice alternatives enabling immediate use and purchase,” Possumato continued in a news release.

“We found that this aligns perfectly with Knightsgate Ventures in their goal of funding a more equitable future while driving superior financial returns,” he went on to say.

DriveItAway explained its “Try It Before You Buy It, Pay as You Go” turnkey platform for dealers may be the only way for those that are down payment or credit challenged to purchase the used vehicle of their choice. That’s because every subscription payment accumulates toward the down payment at a prearranged purchase price established at the beginning of the process.

DriveItAway said its platform appeals to all potential used-vehicle buyers who would like to try a used model out for an unlimited period of time before making any purchase commitment.

The company highlighted the DriveItAway platform also “de-risks” a used car purchase for all buyers in a way never achieved by any online or traditional automotive retailer. Individuals can pick a vehicle off your lot and drive it until and if they decide to buy it with the money paid in for your subscription applied to the prearranged purchase price.

DriveItAway pointed out that it equips each vehicle with advanced telematics that can give a “live time” read on mileage, location and driving patterns. This data is valuable for vehicle owner/dealers as well as insurance purposes, allowing DriveItAway to provide highly competitive insurance rates and coverage that are part of the turnkey program for dealers and subscribers/buyers.

That process and infrastructure were among the reasons why Knightsgate Ventures decided to support DriveItAway.

“As a firm, we are always in search of innovative platforms that leverage technology to address significant issues in society,” Knightsgate Ventures partner Allen Bryant said in the news release.

“Individuals who cannot afford the down payments on vehicles are oftentimes the ones that need these vehicles the most. In today’s economy, cars have become more than just a mode of transportation but an income-producing asset,” Bryant continued. “DriveItAway is addressing a problem that has been around for decades in an effective and highly scalable solution.”

Possumato added that DriveItAway’s offering might be a pathway for electric vehicles to gain more retail appeal.

“Our ‘Try It Before You Buy It, Pay as You Go’ subscription/purchase program may be particularly useful to many as electric vehicles begin to be more widely introduced into the car market,” Possumato said.

“As recent studies suggest that many people are nervous about making an EV commitment without extensive research and investigation,” he continued, “what better way to really experience and investigate the benefits of an EV than to drive one, for as long as you want, risk-free, before you choose to buy?”

For more information, call DriveItAway at (203) 491-4283 or send a message to [email protected].

Lendbuzz is striving to modernize what it contends is an “outdated” auto-finance industry, with a focus on serving consumers who have thin or no credit history in the United States.

And its drive toward that modernization got quite a financial boost this week.

The platform based on artificial intelligence announced a $360 million investment, including $60 million in Series C equity financing led by Wellington Management joined by Goldman Sachs & Co and MUFG Innovation Partners, and $300 million in debt financing led by Goldman Sachs Bank USA.

According to a news release, the new growth capital will support the company’s fast expansion and allow Lendbuzz to further its mission of helping individuals currently underserved by the traditional credit system.

Wellington Management led the equity funding round joined by Goldman Sachs & Co and MUFG Innovation Partners, as well as existing investors including 83North, Eyal Ofer’s O.G. Tech, Arkin Holdings, Mivtach Shamir and Highsage Ventures.

Goldman Sachs Bank USA led the debt financing joined by Viola Credit.

The company, which partners with dealerships, offers an end-to-end origination and servicing platform that designed to fit into dealers’ existing F&I workflows and enable a seamless, digital experience for buyers.

“Lendbuzz was founded to expand access to credit for millions of consumers who are currently underserved by the traditional credit system,” Lendbuzz co-founder and chief executive officer Amitay Kalmar said in the news release. “This additional financing allows us to further accelerate our growth and continue improving the car purchase experience for our clients.”

Lendbuzz explained its underwriting model — powered by machine learning and proprietary algorithms — can allow the company to assess the risk of who could be creditworthy consumers who are underserved by traditional banks.

Compared to legacy underwriting systems that are based on FICO scoring and often utilize just a handful of data points, Lendbuzz said it analyzes thousands of data points — from transaction and spending patterns to education and employment history — in an effort to evaluate applicants better and more fairly.

Lendbuzz added that dealerships, in turn, are able to close additional business opportunities that otherwise would have been lost, and offer a frictionless and 100% paperless customer experience that enables real-time approval and faster funding.

The company highlighted that it grew its contract origination run rate more than 200% year-over-year during the first half of 2021 and continues its rapid geographic expansion within the U.S. to serve more dealerships and consumers.

Lendbuzz also mentioned it doubled its headcount in the past year to more than 100 employees and is continuing to recruit.

To find out about open positions at Lendbuzz, visit https://lendbuzz.com/careers.

US Equity Advantage (USEA) is looking to ensure its technological infrastructure can meet the demands triggered by the company’s aggressive expectations.

In a move the company said will enrich the customer experience, improve efficiencies and allow it to scale quickly to meet growth projections, USEA announced this week that it has replaced its legacy phone system with a cloud-based contact center solution.

Following a rigorous vetting process, the company selected Five9, a top-rated leader among contact center as a service (CCaaS) providers, for its cloud innovations that will help USEA reimagine its customer service offerings.

“Today’s consumers are accustomed to the conveniences of a digital experience. We needed a contact center solution with the expertise to meet our customers’ expectations, now and as technology evolves, while providing the capacity to scale up to support our business growth,” USEA chief executive officer Robert Steenbergh said in a news release.

“Another important consideration was our dealer partners,” Steenberg continued. “Understanding that our customers were their customers first, it is important that we deliver on the confidence they’ve placed in recommending our AutoPayPlus accelerated loan payment service.”

From that perspective, USEA explained that its goal was to elevate the customer journey by enhancing the various touchpoints they have with the company over the lifecycle of the relationship.

USEA said it selected Five9 for its robust CCaaS features and services, its ability to deliver rapid, scalable deployment and an exceptional customer experience as well as its consistent and reliable uptime.

Features of the new contact center solution include:

• The ability for customers to choose how they want to communicate with USEA, including voice, SMS/text, chat, video and email options.

• Integration with USEA’s customer relationship management (CRM) software to personalize interactions.

• Workforce optimization (WFO) to ensure responsive staffing and improved speed-to-answer and call duration benchmarks.

• Transparent performance data, such as operational metrics and key performance indicators, to detect trends and automate the quality process.

“To meet the expectations of today’s customers and provide great customer experience, organizations need to reimagine their offerings,” Five9 president Dan Burkland said.

“This often means offering an omnichannel solution that seamlessly follows the customer journey and arming agents with details from previous interactions, regardless of the prior channel of communication; thus freeing agents to focus directly on engaging with customers and providing more empathetic and human experiences,” Burkland continued.

“These exceptional customer service experiences not only create brand loyalists, but ultimately business success,” he went on to say.