American Recovery Association president Dave Kennedy directly opened a message to repossession agents, finance companies, forwarders and other service providers by saying: “This year is going to be another year of turbulence in our industry.”

While auto defaults have risen for six months in a row, the last auto default reading before the pandemic was declared stood at 0.89% in February 2020, which is 50 basis points higher than what the metric was at the close of last year.

Even as repo volume slowly returns to more traditional levels, Kennedy reiterated the message he’s often conveyed as ARA president.

“I know many of you are tired of Kennedy singing the same tune, but let’s pay attention to the success agencies in Florida are having because they eliminated fragmentation and realized the truth that working unified is the only way to get results,” Kennedy continued in that industry message.

“So, I am once again reaching out to other leaders to stop the 50 years of negativity embrace the concepts of collaboration and unification and join together to change our world,” he added.

Kennedy pointed out another endeavor that’s looking to bring change to how repossessions and recoveries unfold — the Repo Alliance — the grassroots fund-raising and lobbying effort started nearly two years ago to have representation in Washington, D.C.

“The voice Repo Alliance has given us on the Hill has calmed the fires and has now opened the door for our industry to go from a defense posture to an offensive position,” Kennedy said. “We all know it’s the offense that puts the points and the big W on the board. Business has still been slow for many of us, but dig deep and support us/you through the efforts of the alliance.”

Kennedy also mentioned change is happening with one of ARA’s events, the North American Repossessors Summit (NARS). It’s on tap for June 21-22 in a new location, the Omni Interlocken Hotel in Denver.

ARA is offering early-bird discounts on registration through the end of January. More details can be found at reposummit.com.

Clashes involving repossession agents, forwarders and finance companies recently brought Jeremiah Wheeler of DRN | MVTRAC into the mix.

When agents stopped scanning license plates as a way to create industry attention about repossession fees, the move left Wheeler with a conundrum that he addressed during a frank conversation with Patrick Altes on the Repo America Podcast.

Wheeler offered some feedback aimed at helping agents, forwarders and finance companies all succeed in light of auto defaults trending higher now for six months in a row.

To listen to the conversation, go to this website.

Since Used Car Week took place with less than 60 days remaining in the year, two leading executives from Allied Solutions outlined their own professional goals for 2022 and also what the company is looking to accomplish during the next calendar year.

In this Auto Remarketing Podcast recorded in person at the Red Rock Resort in Las Vegas, Anne Holtzman and Suzi Straffon shared a portion of their agendas for the new year; one they each expect to be active in relation to repossessions, recoveries and potential refunds of ancillary products.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

COVID-19 is prompting Location Services to make significant changes.

After being impacted by the pandemic, the company announced on Thursday that it has made the decision to exit the direct recovery space and focus on building its existing forwarding model, which includes recovery, skip-tracing, remarketing, transport, keys and titles.

Along with moving its corporate headquarters to Indianapolis, Location Services also announced several key hires, including:

— John Nethery as chief financial officer and president of insightLPR

— Dimple Patel as vice president of finance and accounting

— Mike Suarez, senior vice president of operations

Furthermore, the company also shared that the LPR division, insightLPR, made a strategic acquisition last week of Riverland Technologies out of Jackson, Miss.

Through a news release, Location Services chief executive officer Jerry Kroshus elaborated a bit about all of the company’s strategic moves.

“We are exiting the direct model for now,” Kroshus said. “We are retaining our licenses where it makes sense to keep them. Also, some of our legacy owners will be purchasing parts of their business from us and we’ll continue to have a strategic relationship with them as they will continue to run insightLPR cameras and utilize our RepoRoute recovery software.”

Chief client and operations officer Jose Delgado added this perspective.

“We already have a robust network of recovery agents, as a good portion of our existing volume, approximately 50%, is forwarded,” Delgado said. “Having industry veterans such as Mohit Mahajan, Mike Suarez and Debbie Stokes overseeing the day-to-day operations is a key component to our success.

“Being headquartered in Indianapolis is also a huge plus as the talent pool is very strong here,” Delgado added.

With regard to people, in addition to Nethery’ s CFO responsibilities for both Location Services and insightLPR, the company said he will serve as president of insightLPR, which now has the resources of Riverland at its disposal.

Location Services highlighted that Riverland has an excellent reputation in the license plate recognition space and partners with cities, police forces and municipalities across the country, providing cutting edge camera technology and integrated software solutions.

Riverland has been in business for more than 15 years.

Nethery spent more than nine years at DRN as CFO and COO from 2010 to 2019, while Patel worked at DRN as the vice president of finance and controller from 2010 to 2017.

“I am very excited to join Location Services and to lead the insightLPR division,” Nethery said. “We are working on a great plan to provide excellent service options for the recovery, auto finance, law enforcement and commercial industries.

Kroshus added, “We have big plans for insightLPR, and we are confident that with John’s leadership and background, along with the demonstrated strength and experience of Riverland Technologies, we will build insightLPR into a very formidable option for our clients

“This is the other reason we exited the direct recovery model. We want to remain agnostic in the auto finance scanning space,” he went on to say.

Along with a reinforced executive time, Nethery pointed out that Location Services also has the full support of its parent company — Delaware Street Capital (DSC).

“We are committed to the forwarding and LPR models and we are confident that this pivot is the right decision,” DSC partner David Heller. “Jerry has assembled a seasoned team of top industry talent. We are eager to compete and produce great results for our clients.”

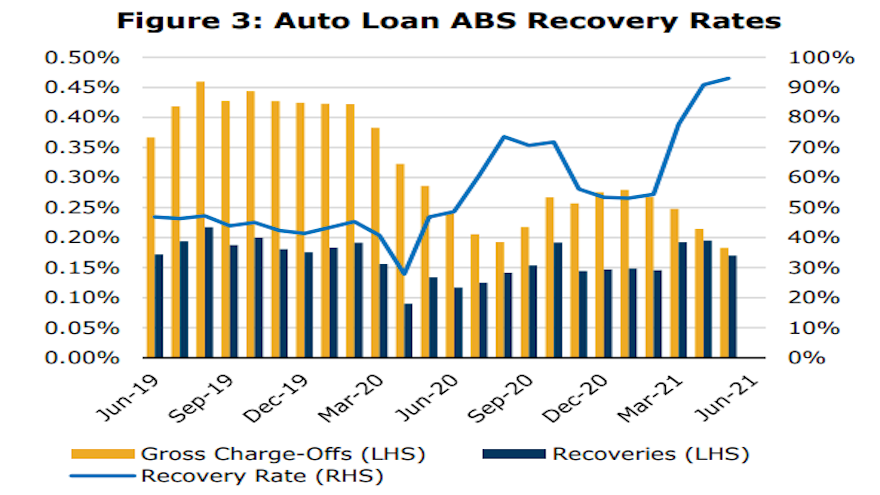

Kroll Bond Rating Agency (KBRA) released new research on Tuesday that analyzed the impacts of “skyrocketing” used-vehicle prices on auto finance credit performance metrics, as well as discusses future implications as the economy marches toward a return to pre-pandemic norms.

Read more

Wrongful repossessions might be the most heartburn-inducing, headache-creating part of auto finance.

Offering an assessment of the current landscape of recoveries and more on this episode of the Auto Remarketing Podcast is Sabrina Neff, a partner in the Houston office of Husch Blackwell, who also was named to the 2021 Texas Top Women Lawyers list published by Thomson Reuters Super Lawyers.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

The American Recovery Association (ARA) recently announced the new theme for the North American Repossessors Summit (NARS), which will return as an in-person event in October.

That theme, “Resilience: Rising Above and Committed to Building a Stronger Industry,” ties in significantly with a cautionary alert ARA sent soon afterward about a proposal working its way through Congress that would expand the definition of a debt collector and potentially increase risks to finance companies.

With headline sponsor Harding Brooks Insurance, ARA highlighted that with unity at the forefront of the summit, the NARS planning committee comprised of volunteers from all sides of the recovery industry established a theme that is designed to reflect the need for the entire industry to come together to rebuild and move forward in the wake of the pandemic.

Taking into consideration the unique obstacles business owners have overcome in the past year, ARA said it arrived at its theme for NARS that’s also sponsored by MVTRAC and set to take place at the Omni Las Colinas Hotel in Irving, Texas, on Oct. 7-8.

“We are thrilled to welcome back an in-person NARS event in 2021,” ARA president Dave Kennedy said in a news release. “While we planned a great NARS 2020 prior to postponing, the committee recognized the fundamental shift that the entire industry experienced over the past year. We knew we needed to bring an overall theme that represented the strength and perseverance our industry has shown.”

After having to be postponed due to safety issues and travel restrictions, ARA said the 12th NARS summit will bring recovery professionals from all over the country to be together once again and connect person-to-person.

During the summit, there will be various opportunities for exhibitors and sponsors, breakout sessions that foster collaboration and education and dynamic, inspiring speakers from within the industry and beyond. With the goals of establishing repossession standards and addressing the state of the industry, NARS 2021 will include empowering sessions that focus on fortifying the industry to withstand any obstacle.

Registration is open at reposummit.com, with extended regular registration pricing until Aug. 15. In addition, to incentivize and encourage business owners to bring members of their staff, the NARS committee has introduced discounted tiered pricing after the first two registrations.

ARA members also can receive early-bird registration prices until two weeks from the conference.

Controversial bill advances in House

In a separate message, ARA recapped what happened on the U.S. House floor on Thursday that could impact what's being discussed during NARS.

ARA said the House passed the Comprehensive Debt Collection Improvement Act (H.R. 2547) by a vote of 215-207. The measure, which now heads to the Senate for consideration, may have a “devastating” impact on the repossession industry, according to the association.

ARA recapped that Article 9-609 of the Uniform Commercial Code allows finance companies and their agents to repossess a vehicle as long there is no breach of peace.

“We are considered “enforcing a security interest” and not collecting a debt. And, until now it was understood that we are not under the requirements of the Fair Debt Collection Practices Act,” ARA said.

“All of this might change. If left unchallenged, the recovery professional would be reclassified as a debt collector,” the association continued.

ARA went into six more elements about how the measure could impact vehicle repossessions, including:

• As debt collectors, repossession agents would have to notify the debtor by a written notice, specifying the amount of money owed, who the creditor is, and advise them of what action they should take if they contest the debt.

• All contact with the consumer would need to contain language identifying yourself as a debt collector. Contact must be free of profane or abusive language (so agents need to hold their tongue or face a federal lawsuit).

• It would strengthen the government’s grip over a repossession agency’s name (like “Final Notice” or anything vaguely aggressive) or anything that could be at all misconstrued as a governmental agency (like “Nevada Recovery Bureau” for example).

• It could make it a federal offense to damage any property in the course of a repossession. Hitting a mailbox, or even drag marks on a driveway could be considered an FDCPA violation, which would allow the consumer to sue finance companies and repo agents in federal court.

• Even a third party (a neighbor, a relative, etc.) seeing the repossession in process may be a violation by “publicizing” the debt, which is forbidden by the FDCPA. Debt collectors are not allowed to make the existence of a debt known to uninvolved third parties. This alone could easily make a repossession from a place of employment impossible if a car on the hook is seen by any other employee there.

• It would restrict the times of day or night when you might be in contact with the consumer, even inadvertently. A debtor coming out to the driveway to interrupt a repossession would be a violation if it occurred after 9 p.m., for instance.

“All this could make repossession activity unbelievably complicated and legally risky,” ARA said.

The association emphasized the Repo Alliance is its “best line of defense.” The alliance is working with lobbyists at Van Scoyoc Associates in Washington D.C., and already speaking to members of Congress about the unintended and adverse consequences of this change to reclassify repossession agents as a debt collector.

To help support the efforts of the Repo Alliance, go to this website.

If you have read the content for some time generated by us here at Cherokee Media Group, you might already know of my great affinity and respect for repossession agents.

Rightfully so, much of our material highlights the exciting parts of the industry, such as digital retailing and financing, as well as the latest technology to make those processes flourish. But my opinion of repossession agents and what is asked of them ticked higher when I recently found a press release from the Massachusetts attorney general.

The press release detailed a settlement the Massachusetts AG reached with two finance companies involving dog leasing.

Yes, you read that correctly — dog leasing — which is illegal in Massachusetts, but evidently is permissible in other jurisdictions. Here is a segment of that press release:

“In some states, pet stores may offer the option of leasing as an alternative way to finance a dog. Under such an arrangement, the consumer must make monthly payments to the finance company for the duration of the lease. To buy the dog at the end of the lease, the consumer must make yet another payment to the finance company to finally own the dog. If a consumer misses a payment, the dog can be repossessed, just like a leased car.”

Repossessions of dogs like a vehicle? Even typing that sentence just now, I literally am shaking my head.

And I thought about how contentious a vehicle repossession sometimes is. As beloved as a pet can be, I can only imagine the emotions could soar if an agent is asked to recover a canine presumably worth thousands of dollars.

The entire situation prompted me to ask some of my contacts in the repossession world how often this scenario has happened in their careers, whether being asked to recover a dog or other live animals.

One contact shared about recovering the offspring of a horse that enjoyed such a successful racing career that the animal was a world champion in competitions orchestrated by the American Quarter Horse Association.

Another agent mentioned how credit unions have asked to secure cattle that were the collateral connected with a contract. It prompted the person to tell a quite an anecdote:

“I had to repossess a hundred head of cattle once. If you don’t think that was interesting, I got 99 when I asked where the 100th cow was. The farmer took me into the barn and there was an ear nailed to the wall. “He looked at me and said, ‘I ate him.’ End of story.”

Whether it’s a show dog, racehorse, beef cow or a full-size pickup with a lift kit, repossession agents are asked to recover quite a list of collateral. And they certainly respond to the challenge.

Here again is a salute to the repossession agent. You’re asked to do what few in any walk of life would. Thank you for the critical role you play in the automotive industry we all get to enjoy.

Nick Zulovich is senior editor at Cherokee Media Group and can be reached at [email protected].

Weltman, Weinberg & Reis Co. and DRN are joining forces for a free, two-part educational webinar in an effort to help the entire repossession and recovery industries prepare for what might be coming down the default pipeline this year.

In the first session of this two-part, complimentary series, Weltman’s collateral recovery, compliance and collections team will answer some of the most frequently asked questions about the early stages of recovery.

Shareholder Scott Weltman will moderate the session featuring Weltman shareholder Amy Holbrook, Weltman attorney Stefanie Collier and DRN executive vice president Jeremiah Wheeler.

The webinar is scheduled for 2 p.m. ET on May 5.

The companies said these experts will share their recovery expertise on how to improve operational efficiencies and recoveries in a compliant manner at every turn on the road to recovery.

Other top takeaways set to come from the opening segment include:

— The benefits of utilizing data analytics to locate vehicles

— Learn vital repossession compliance and communication guidelines

— The pros and cons of the replevins legal route and why it’s important to use this tool.

“With defaulted auto loans expected to be on the rise as a result of the COVID-19 pandemic, it’s important to make sure your recovery engine is running on all cylinders,” event organizers said. “The road to recovery is full of twists and turns. The auto recovery process is anything but easy to navigate. Strict rules control what a lender can — and can’t — do if a customer fails to make timely payments, insure the vehicle and/or interfere with repossession.

“It’s critical that you understand recovery compliance, plus how to leverage data solutions and legal remedies that can drive your success,” they went on to say.

Registration for the webinar can be completed on this website.

The American Recovery Association is hosting a free webinar focused on recovery litigation.

Patrick Newman and Tal Bakke of Bassford Remele intend to delve into several topics, including consumer notice and waiver issues as well as contractual provisions to consider in working with servicers and forwarders.

The legal experts also plan to mention concerns about repossessions raised by the Consumer Financial Protection Bureau (CFPB). It’s all part of the webinar scheduled for 2 p.m. (ET) on Wednesday.

“The recovery industry has faced obstacle after obstacle during the pandemic,” ARA said. “But as regulations begin to loosen, it is important to be knowledgeable on litigation that could affect the repossession process for you and your employees.”

“It is so important to educate yourself on different legal issues that could impact your everyday business processes,” the association went on to say.

Registration for the webinar can be completed here.