Black Book and CoreLane Technologies now are working together so finance companies have a clear view of the collateral attached to their paper.

According to a news release distributed on Tuesday, Black Book announced the integration of its vehicle pricing, data, and analytics into CoreLane Technologies’ CreditLane product.

CoreLane Technologies, a provider of transactional connectivity solutions for dealers and finance companies, now will be able to let dealerships submit credit applications with precise vehicle valuations, including the latest VIN-specific data enhancements that Black Book has to offer — History Adjusted Valuations and Enhanced VIN matching.

“This partnership allows lenders the ability to communicate faster with dealers and speeds up the overall underwriting and funding process while reducing errors,” said Evan Lindbeck, vice president of operations at CoreLane Technologies.

CreditLane also can help to facilitate dealer onboarding, improve marketing to dealers and filter applications so finance companies can be as efficient as possible.

“This partnership is a great way for both dealers and lenders to close more deals,” Black Book executive vice president of revenue Jared Kalfus said. “We’re excited that both can now use this data to reduce their risk and increase their profits.”

Experian is looking to help finance companies complete one of the most important parts of underwriting — verification of income and employment status.

This week, Experian introduced new verification capabilities that can connect finance companies to more than 120 million consumer permissioned payroll accounts.

By leveraging technology from Citadel API, Experian is bolstering its existing suite of digital verification solutions to provide finance companies and other lenders with access to permissioned payroll records from more than 40 of the top payroll providers across the United States.

“We’re committed to creating greater financial opportunities for consumers, while helping lenders extend credit responsibly,” said Michele Bodda, president of Experian Mortgage, Employer Services and Verification Solutions.

“This depends on ensuring our clients are prepared with the best insights the market has to offer. With this new solution from Citadel API, we’re empowering consumers to take control of their data while giving our clients new, flexible options to achieve their verification needs,” Bodda continued in a news release.

Experian’s new partnership with Citadel API can allow consumers to allow access to their payroll accounts when applying for financing, a mortgage or employment by authorizing use of their payroll provider login credentials.

Using this consumer permissioned data, Experian said it can deliver a verified income and employment report back to the finance company, lender or verifier.

“Experian understands that investing in Citadel API’s technology can improve their customer’s experience,” Citadel API chief executive officer Kirill Klokov said in the news release.

“In partnership with Experian, we can help millions of consumers unlock their data to verify their income and employment status, enabling quicker mortgage and loan approvals often with better rates. Together, we can help consumers take control of their data and bring more transparency into the process,” Klokov continued.

Adding consumer permissioned access to payroll data to Experian’s Verification of Income and Employment suite of services is the next step in Experian’s long-term commitment to expanding its consumer permissioned verification capabilities.

Experian’s first consumer permissioned solution, Experian AccountView was introduced in 2016, and the company said the tool continues to receive strong interest and adoption from finance companies and lenders.

Experian AccountView leverages permissioned bank data to help lenders quickly verify income, employment and assets.

The company went on to say that both consumer permissioned offerings as well as Experian Verify — Experian’s real-time income and employment solution — can give finance companies and lender maximum coverage options for verifying income and employment so they can avoid complex and costly manual processes.

Experian Verify can provide finance companies, lenders, employment screeners and government verifiers instant access to millions of active payroll records from Experian’s growing network of exclusive employer records.

The solution launched earlier this spring and has already become one of Experian’s most successful product adoptions, according to the company.

To learn more about Experian’s Verification Solutions business and solutions, visit www.experian.com/verify.

TurboPass initially formed a relationship with Westlake Financial last summer to help the finance company and its network of dealerships during the underwriting process.

Operating now as NowLake Technology, TurboPass is even more entrenched with that company. In a move that became effective this week, the 14,000 DealerCenter users not already signed up with TurboPass now will be getting access through DealerCenter to pull TurboPass reports.

Previously available to nearly 2,000 dealers, TurboPass looks to help stores gain faster funding and more down payment, while also offering fraud prevention with reduced finance company fees.

By using TurboPass, dealers can send their customer a text to validate the customer’s down payment ability in seconds, saving valuable time in the vehicle buying and closing process. A unique TurboPass code is generated for each customer, allowing dealers to view, print and submit the customer’s stips in the deal jacket.

“Verifying stips has continually been one of the slowest parts of the funding process. TurboPass over the past year has proven itself to be the fastest solution to getting POI and POR for car buyers and we’re proud to now offer TurboPass reports directly inside our platform,” said Jay Kamdar, president of NowCom, which fuels DealerCenter.

To send the TurboPass invite link within DealerCenter, dealers can open up their deal package and find their buyer’s name at the top, then click the TurboPass report option, which is located just under the credit report option inside the deal. A pop-up window will appear to confirm they want to invite their customer. Once confirmed, the buyer will receive the text invite.

Once the prompts of the text message are completed by the buyer, a PDF of the report will be available next to the TurboPass report button that was first selected.

With this integration, all DealerCenter users without a current TurboPass subscription are being given a trial of three free reports. After dealers have used their three free reports, they’ll be prompted to sign up for one of TurboPass’ monthly subscriptions.

“DealerCenter has always been an industry leading platform that provides all the products necessary for a dealer to be successful with their lenders. We’re beyond excited to have our tool available in the platform and continue to powerfully contribute to serving dealers across the country,” TurboPass chief executive officer Mike Jarman said.

For more details, go to www.turbopassreport.com.

After recently forging a relationship with an independent dealership group, Scienaptic bolstered its client roster of independent finance companies on Monday.

The credit decision platform provider fueled by artificial intelligence now is working with Right Direction Financial Services, which looks to provide financing for individuals seeking to rebuild or establish their credit through high-quality, certified pre-owned vehicles.

Scienaptic highlighted via a news release that deployment of its AI-powered platform will allow Right Direction Financial Service to enhance its underwriting capabilities to reach and support more potential customers, while mitigating risk.

Right Direction Financial Services was founded in 2011. The company said it is committed to ensuring its customers have affordable payments that align with their payroll periods and reporting their payment history to the major credit reporting agencies.

Executives went on to mention this implementation positions Right Direction Financial Services to reach more consumers to grow its business while offering faster, stronger AI-powered credit decisioning for its underwriting process.

“Being able to provide fast and easy access to vehicle financing anywhere, anytime is crucial for meeting the demands of our customers,” said Miro Radujkovic, Vice President of Consumer Lending & Collections at Right Direction Financial.

“Leveraging Scienaptic’s AI-enhanced decision-making capabilities means that we can make sharper loan decisions and effectively reach more borrowers to help them quickly and responsibly purchase the perfect vehicle to chart their own course to success,” Radujkovic continued in the news release.

Scienaptic president Pankaj Jain added, “Scienaptic’s adaptive, AI-driven credit underwriting platform means Right Direction Financial can streamline and enhance its loan decisioning process.

“Our partnership will allow the company to significantly increase both its potential reach and loan decisioning capacity for its customers, putting more people behind the wheel, all without increasing risk,” Jain went on to say.

No doubt a key component to having a healthy auto-finance portfolio is the contract holders being gainfully employed.

The U.S. Bureau of Labor Statistics shared some positive news on that front on Friday.

The Labor Department reported that nonfarm payroll employment increased by 943,000 in July, and the unemployment rate fell by 0.5 percentage points to 5.4%.

Officials said notable job gains occurred in leisure and hospitality, in local government education, and in professional and business services.

Reflecting the initial impact of the coronavirus pandemic on the labor market, officials tabulated that job losses totaled 22.4 million during the February-April 2020 recession (a drop of 1.7 million in March and 20.7 million in April). As economic activity resumed, job gains in May through November totaled 12.6 million, according to the Labor Department.

Officials then mentioned employment declined again in December (a drop of 306,000 jobs), following a surge in the number of coronavirus cases. The Labor Department noted job growth restarted in January of this year, and nonfarm payroll employment has increased by 4.3 million over the past seven months.

However, officials acknowledged employment is down by 5.7 million, or 3.7%, from the pre-pandemic employment peak in February 2020.

Looking closer at the latest data, the Labor Department said strong job growth continued in leisure and hospitality, which added 380,000 jobs in July. Officials also highlighted employment gains continued in food services and drinking places (up 253,000); accommodation (up 74,000); and arts, entertainment, and recreation (up 53,000).

The leisure and hospitality industry has added 2.1 million jobs since January and accounts for about half of all nonfarm jobs added thus far this year, according to the Labor Department. However, employment in the industry is down by 1.7 million, or 10.3%, since February 2020.

Also of note, officials said employment continued to increase in July in local government education (up 221,000) and private education (up 40,000).

After the Labor Department released its July jobs report, Curt Long, who is chief economist and vice president of research at the National Association of Federally-Insured Credit Unions (NAFCU) shared this assessment.

“The July jobs report was almost uniformly positive with strong job gains resulting in a large drop in the unemployment rate,” Long said in a news release. “The retail sector did not enjoy a share in the gains, losing over 5,000 jobs during the month, but otherwise gains were broad.

“This report will add to mounting pressure on the Fed to taper asset purchases,” he added.

Perhaps one of the most difficult challenges for finance companies to overcome through the pandemic was verifying an applicant’s employment and income.

Michele Bodda, president of Experian Mortgage, Employer Services and Verification Solutions, appeared on this episode of the Auto Remarketing Podcast to describe the latest trends involving these two crucial pieces of the underwriting process.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

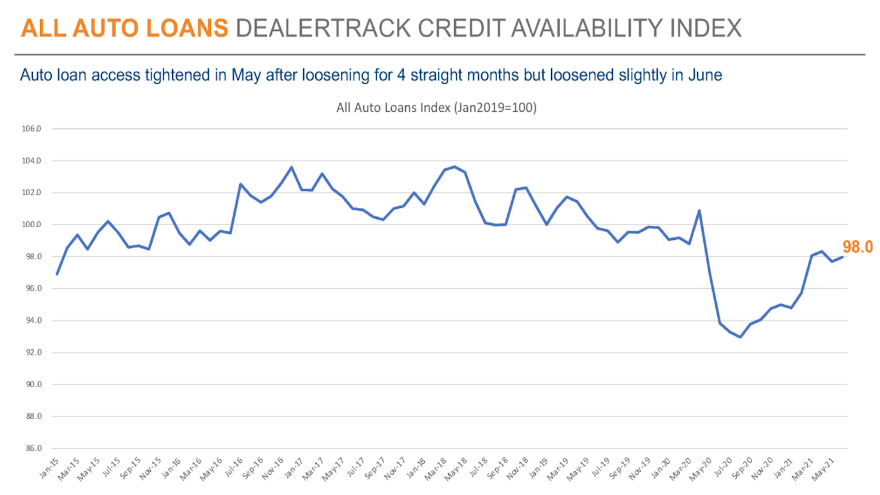

While consumer confidence might be mixed, Cox Automotive discovered more access to credit last month for potential vehicle buyers who needed it — especially if they had stronger credit backgrounds.

According to the newest Dealertrack Auto Credit Availability Index released this week, credit for auto financing improved modestly in June after tightening in May.

Read more

LAUNCHER.SOLUTIONS wants to provide a smooth communication path from application to underwriting and then on to funding and delivery.

The technology provider specializing in originations recently announced the release of its new product offering, appTRAKER CONNECT for its clients using appTRAKER Loan Origination System and launchPAD Loan Origination System.

LAUNCHER.SOLUTIONS believes this unified communication tool is the first of its kind, seamlessly supporting two-way communication between finance companies and their customers.

The company pointed out that the appTRAKER Loan Origination System has provided built-in support for email, SMS text messaging and faxing without the need for any third-party integrations or contracts. With its new product appTRAKER CONNECT, dealers and customers are now able to communicate back to finance companies.

“In today’s climate, more and more deals are being conducted virtually so creating a two-way communication solution within appTRAKER was a natural evolution of the product,” LAUNCHER.SOLUTIONS president Nikh Nath said in a news release.

“We want our users and their customers to be able to communicate in the way they prefer, and this product facilitates that,” Nath continued.

The company also mentioned that CONNECT allows for the sending and receipt of email and SMS text messages, including messages with attachments. Inbound communications can automatically be tagged to the right application, alerting the underwriting team in real-time.

Documents received can update stipulations automatically. CONNECT has built-in compliance, configurable to a finance company’s specific legal requirements.

“The increased engagement and connection between lenders and their customers and dealers ensure that there are no lost communications between personal emails, cell phones and other third-party texting applications,” the company said.

“Launcher understands that with this multichannel approach, customer service representatives are able to be more flexible in their problem-solving, and even reduce funding times,” LAUNCHER.SOLUTIONS added. “CONNECT enhances the user experience for all parties involved, allowing for increased productivity and happier customers and dealers.”

To learn more details, go to http://www.launcher.solutions or call 877.5LNCHER.

Nearly a month after Car Capital secured a funding round of almost $9 million, the new auto-finance technology company that strives to get any deal bought no matter the consumer credit background closed on a credit line more than double that funding amount.

According to a news release distributed on Tuesday, Car Capital secure a $20 million credit line with Medalist Partners. The company highlighted this transaction gives Car Capital access to capital to expand their business, fund deals and ultimately get consumers into vehicles.

Car Capital’s proprietary, web-based platform, Dealer Electronic Auto Loan System (DEALSSM) is designed to allow franchise and independent dealers to make 24/7 immediate auto financing decisions for 100% of their customers.

“Car Capital is excited to be able to help our dealer partners offer financing to their customers through the debt we’ve secured with Medalist Partners. We are planning to significantly expand our dealer network and grow our revenue with this additional capital,” Car Capital co-founder and chief executive officer Justin Tisler said in that news release.

“Medalist has been an invaluable partner, first through their contribution to our Series A funding round, and now with this debt deal. We look forward to further building on our relationship with Medalist,” Tisler continued.

As Tisler referenced, Car Capital previously announced that it closed an $8.8 million Series A funding round that was led by FM Capital with participation from more than 50 individual and institutional investors, including Automotive Ventures and Medalist Partners.

“We’re excited to partner with Car Capital to provide their inaugural debt financing following a successful Series A equity round,” said John Slonieski, director of private credit and partner at Medalist Partners.

“We believe the extensive experience of the management team, proprietary technology, and innovative lending strategy make this company an ideal fit for a secured debt transaction within our asset-based private credit business,” Slonieski continued in this week’s news release.

Car Capital can allow its dealer partners to make immediate modifications to deal terms in real-time based on the economics of each unique vehicle and consumer.

Then, dealers can make back-end profit off their sales based on performance, instead of requiring them to reach a minimum portfolio size.

Car Capital said it takes pride in how the company works together with its dealer partners to ensure everyone in the buying process succeeds.

“We are thrilled to work with Medalist to grow our dealer network. The debt capital from Medalist will help us to get more underserved consumers into transportation at a time when many people could use some help,” Car Capital chairman Brian Reed said.

Artificial intelligence is playing a role within the subprime market for financing motorcycles, too.

On Monday, Scienaptic, an AI-powered credit decision platform provider, announced the deployment of its solution at American Cycle Finance (ACF).

According to a news release, this implementation will enable ACF to use AI for making sharper credit decisions and assist dealers in selling more units to customers with limited or no credit history.

ACF partners with more than 450 motorcycle retailers across 24 states in the U.S., offering borrowers a unique opportunity to re-establish credit and a second chance to finance a motorcycle.

“We are very excited to deploy Scienaptic’s AI-powered credit decisioning platform,” American Cycle Finance president Ben Donnarumma said in the news release.

“Through Scienaptic’s adaptive AI, credit access for motorcycle buyers is further enhanced. Many more customers (up to 1.5-2 times) who have experienced credit turn-downs or declines in the past will be able to get approval, regardless of FICO score,” Donnarumma continued.

Scienaptic president Pankaj Jain added, “We are very pleased to help ACF increase credit approvals while reducing delinquencies. Early results are very promising, and we hope to build on it as we test and learn on Scienaptic’s AI-powered credit decisioning platform.”