The QuickQualify platform offered by 700Credit now includes data via the Experian Boost tool.

According to a news release distributed this week, 700Credit’s web-based consumer prequalification solution that does not require a consumer’s Social Security Number or date of birth and does not affect their credit file has been integrated with a product offered by Experian that allows consumers to potentially “boost” or improve their FICO score.

The company said this new product feature is available at no charge to dealers who have the QuickQualify platform with Experian enabled. The credit score “boost” will occur after the consumer prequalifies and before they make it into the finance office to apply for financing.

When consumers enroll in Experian Boost, they provide Experian secured access to their online bank or credit card accounts to add positive cable, cell phone, and other utility bill payment history (as tradelines) to their Experian credit file.

Once the credit score is boosted, consumers can see the new score and it is reflected in their Experian credit report immediately.

“The addition of the Experian Boost tool to our QuickQualify solution adds a level of depth and value for both the dealer and the consumer,” 700Credit managing director Ken Hill said. “Consumers increasing their FICO score translates to better rates for the consumer when they reach the finance office and happy consumers make for increased and return sales for the dealer.”

Jeff Softley, president of direct-to-consumer at Experian Consumer Services, elaborated on the potential impact of this move with 700Credit.

“This integration allows more consumers to have control over their credit and leverage a good credit score to their advantage,” Softley said. “Experian Boost gives consumers the exclusive opportunity to add positive data like utility payments into their Experian credit file to give lenders a better view of their credit worthiness.

“And with an improved credit score, dealers can potentially offer improved financing and savings to consumers, so it’s a win-win situation,” Softley went on to say.

With a funding round now completed, a new auto-finance technology company now has more resources to fulfill its pledge to get any deal bought no matter what credit background the potential vehicle buyer has.

This week, Car Capital, which said it has developed a proprietary, web-based platform to give every dealer partner the power to approve 100% of consumers regardless of credit history, announced that it closed an $8.8 million Series A funding round.

According to a news release, the round was led by FM Capital with participation from more than 50 individual and institutional investors, including Automotive Ventures and Medalist Partners.

Car Capital launched operations with a select group of beta dealers. The company said it will roll out to a broader group of dealer partners in the coming weeks.

What’s propelling the company’s business is what it has dubbed the Dealer Electronic Auto Loan System (DEALS).

“We saw a need in the market for a technology solution that helps franchise and independent dealers sell more cars to underserved consumers. Our web-based tools give the dealer, not a lender, the ability to optimize their profit on each car in their inventory,” Car Capital co-founder and chief executive officer Justin Tisler said in the news release.

“We want our dealer partners’ customers to feel confident when shopping for a car at the dealership that approvals can be available to all,” Tisler continued. “Anyone, no matter their credit situation, should be able to buy a car for personal transportation, particularly during these trying times.”

The Car Capital program is designed to allow dealer partners to make real-time, instant changes to deal terms based on the economics of each unique vehicle and consumer. Car Capital said the company and dealer partners can work together to align the interests of all parties “so everyone wins.”

Brian Reed, who co-founded F&I Express that was later acquired by Cox Automotive, now is chairman at Car Capital.

“We felt it was important to give each Car Capital dealer partner back-end profit based on performance, instead of requiring a minimum pool size,” Reed said. “Through our unparalleled business model and DEALS platform, we provide more profit opportunities for our dealer partners and more financing options for car buyers.”

Car Capital is currently licensed to operate in Florida, Georgia, Indiana, Ohio, Oklahoma, Tennessee and Texas. With the Series A funding, the company said it will expand operations, grow their network of dealers and add more states to broaden their geographic reach.

“We’re excited to be an investor in Car Capital,” FM Capital managing partner Chase Fraser said. “The company possesses the technology to make vehicle financing accessible to all consumers, and dealers will benefit by increasing their monthly unit sales.”

For more information, visit carcapital.com.

At the onset of the pandemic, many industry pundits made comparisons to the Great Recession; though we quickly learned that the similarities were few and far between. The underlying causes and economic impact of COVID-19 are vastly different from those more than a decade earlier, yet some experts still find some of the trends in the automotive industry — which resemble trends in 2008 — a bit concerning; the most noteworthy being the decrease in subprime originations.

History might suggest that automotive lenders have tightened credit standards and pulled back on lending to the highest risk borrowers; all designed to mitigate potential losses down the road. But that’s not necessarily the case. We’ve actually observed a gradual decline in subprime originations since Q2 2015 — it’s not a byproduct of the pandemic.

According to Experian’s Q3 2020 State of the Automotive Finance Market, subprime and deep subprime originations accounted for 17.5% of the total automotive financing market, with overall volume for subprime dropping 17% and deep subprime 35%, compared to last year. Broken out by risk segment, during Q3 2020, subprime and deep subprime originations accounted for 15.19% and 2.34%, respectively.

There are myriad reasons for the gradual decline.

First, over the past few years, consumers have prioritized their financial health. More and more consumers are educating themselves on sound financial habits and ways to improve their credit standing. In fact, many have leveraged services like Experian Boost to incorporate alternative data, such as utility, telecom and streaming service accounts into their credit reports, which is helpful for consumers with limited credit history. We’ve seen these efforts have a substantive impact. The average credit score for a new vehicle loan in Q3 2020 was 725, up 11 points from Q3 2016. Meanwhile, the average score for a used vehicle loan was 665, up from 656 in 2016.

But, it’s not just the improvement in consumers’ financial position. Unlike more than a decade ago, when lenders had a surplus of high-risk loans in their portfolios, the reasons for the decline in the subprime market can also be attributed to declines in volume. Lower volumes of vehicle inventory and business restrictions minimized the opportunity for car shoppers across risk tiers to take out loans. Add to that, with high unemployment rates, some consumers (particularly those that fall within high-risk tiers) may not have been in the market for a vehicle.

Let’s also remember, there are options for subprime borrowers to secure financing. Amid the Great Recession, we saw lenders across the board become hesitant to take on additional risk. Consumers turned to specialists in subprime financing, such as buy-here, pay-here lenders and finance companies, particularly in the used market. In Q3, buy-here, pay-here lenders accounted for 7.9% of used financing, up from 7.4% a year ago, while financing companies accounted for 13.2%, down from 14.03% in 2019.

While lenders haven’t pulled back on subprime and deep subprime originations, we’re not suggesting that lenders shouldn’t be mindful of the risk in their portfolios. With the average loan amount for new and used vehicles continuing to increase, along with the unknowns that lie ahead, it’s important for lenders to understand the market and find ways to help make vehicles more affordable and manageable for car shoppers, while minimizing risk.

Making an informed decision built on data and trending insight, ensures that consumers will have available financing options and dealers and lenders can continue to move cars. The future is still uncertain, but the more we understand about the market, the better positioned we will be to move forward.

Melinda Zabritski is the senior director of automotive financial solutions at Experian.

Perhaps nowadays more than ever, risk decisions are based on consumer income and employment information to grasp a potential retail installment contract holder’s ability to pay

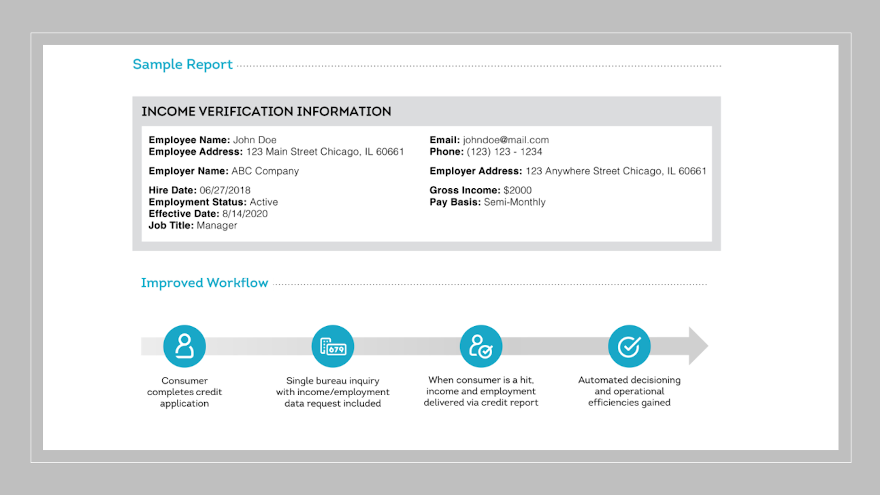

This week, TransUnion rolled out a new seamless and real-time service to provide finance companies and other businesses access to verified income and employment data so underwriters have a more complete picture of their potential customer.

For the first time, TransUnion said this income and employment verification can be seen directly within the credit report. The company explained this capability can remove unnecessary overhead of separate integration efforts and related costs and improve the consumer experience.

“The economic downturn and rising unemployment mean that financial institutions and other organizations are seeking a more complete picture of the consumer as part of their acquisition and risk mitigation strategies,” TransUnion chief global solutions officer Tim Martin said in a news release.

“The current process is cumbersome as consumers often have to provide their own data, or lenders subscribe to separate processes — which could prohibit or slow consumers from accessing credit products and offers. TransUnion income and employment verification provides a much-needed alternative that improves the overall consumer experience,” Martin continued.

TransUnion noted that its income and employment verification is initially launching in collaboration with one of the leading payroll providers in the U.S., which will provide immediate access to tens of millions of active employment records.

The company pointed out that data is updated every pay cycle to supply the most recent view of a consumer’s employment status and income.

Martin added that this rollout marks TransUnion’s entrance into the income and employment verification market and is the first phase of a suite of solutions that will meet the evolving needs of both lenders and consumers.

“This launch demonstrates TransUnion’s commitment to developing innovative solutions that provide consumers access to the credit and services they need and deserve,” Martin said.

For more information on TransUnion’s income and employment verification, go to this website.

According to Experian’s latest State of Alternative Credit Data report, 80% of consumers feel including items such as utility or mobile phone payment history would have a positive impact on their credit score.

And nearly 90% of finance believe alternative credit data allows them to extend credit to more consumers.

Experian vice president of data business Alpa Lally came on the podcast to discuss the report in more detail with COVID-19 as the backdrop.

To listen to the entire conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Finance companies mitigated their risk a bit during the third quarter as data released by Edmunds on Thursday showed higher average down payments for both used and new financing booked during the past three months.

Edmunds determined the more robust increase in average down payments came in connection with new vehicles, rising to $4,457 in the third quarter, compared to $3,891 last quarter and $4,045 a year ago.

Edmunds data also indicated that the average transaction price (ATP) for new vehicles rose significantly during the third quarter. Edmunds estimated that the ATP in Q3 climbed to $39,303, compared to $38,893 last quarter and $37,207 in Q3 of 2019.

Meanwhile, the valuation analysts at Kelley Blue Book reported the estimated average transaction price for a light vehicle in the United States was $38,723 in September. KBB said on Thursday that new-vehicle prices increased $940 or 2.5% from last September while ticking up $23 or 0.1% from August.

Due to increases in average down payments and average transaction prices for new vehicles, Edmunds mentioned that finance companies mitigated risk in other ways, too, as average contract terms dipped slightly in Q3 compared to the previous quarter. Edmunds also mentioned the average annual percentage rate (APR) for new vehicles saw a small lift, hitting 4.6% in Q3 compared to 4.2% in Q2.

“It’s clear that consumers who are purchasing vehicles right now are feeling quite secure in their financial position despite the pandemic. The discouraging unemployment numbers we’re seeing across the country likely aren’t reflective of the Americans in the new car market,” Edmunds executive director of insights Jessica Caldwell said in a news release.

“New-car shoppers are putting down more money and taking advantage of continued low interest rates to upsize either to bigger vehicles or vehicles with more amenities,” Caldwell continued.

Kelley Blue Book analyst Sara Richards added this forward-looking perspective after reviewing that firm’s new-vehicle financing information.

“New-car transaction prices have climbed year-over-year, but remained flat for the past few months,” Richards said. “This may indicate supply challenges experienced over spring and summer have been corrected and OEMs are finally able to build up stock.

“If automakers seek to recover sales lost earlier in the year, incentives could climb dramatically, and transaction prices could remain flat or even dip in the future,” she went on to say.

Meanwhile, Edmunds analysts noted that some of these financing trends are trickling down into the used market as well.

Edmunds determined that the average down payment for a used vehicle also rose in the third quarter, climbing to $3,306 compared to $2,937 in the second quarter and $2,636 a year ago.

“These affluent car shoppers are also making the shift to used vehicles,” Caldwell said. “This could be due to supply shortages in the new market, or because some of these consumers are looking to be slightly more financially conservative with their vehicle purchase given the current economic environment.”

Quarterly New-Car Finance Data (Averages)

|

|

Q3 2020

|

Q2 2020

|

Q3 2019

|

|

Term

|

70.2

|

71.4

|

69.6

|

|

Monthly Payment

|

$568

|

$573

|

$556

|

|

Amount Financed

|

$34,683

|

$36,119

|

$32,674

|

|

APR

|

4.6%

|

4.2%

|

5.7%

|

|

Down Payment

|

$4,457

|

$3,891

|

$4,045

|

Quarterly Used-Car Finance Data (Averages)

|

|

Q3 2020

|

Q2 2020

|

Q3 2019

|

|

Term

|

67.7

|

67.8

|

67.5

|

|

Monthly Payment

|

$420

|

$412

|

$413

|

|

Amount Financed

|

$23,235

|

$22,701

|

$22,351

|

|

APR

|

7.9%

|

8.2%

|

8.5%

|

|

Down Payment

|

$3,306

|

$2,937

|

$2,636

|

Source: Edmunds

Ally Financial and Santander Consumer USA are just two examples of what Cox Automotive chief economist Jonathan Smoke said finance companies have been doing for the past four months amid the coronavirus pandemic.

Smoke said underwriting has tightened since April. Perhaps a reversal is not likely any time soon since the Labor Department reported on Thursday morning that initial claims for unemployment benefits rose for the second consecutive week, coming in at 1,434,000 and surpassing the 1-million threshold for the 19th week in a row.

The Labor Department did point out that the total number of people claiming benefits in all programs for the week ending July 11 was 30,202,498, a decrease of 1,601,699 from the previous week.

“The downturn has not fallen equally on all Americans, and those least able to bear the burden have been the most affected. In particular, the rise in joblessness has been especially severe for lower-wage workers, for women, and for African Americans and Hispanics. This reversal of economic fortune has upended many lives and created great uncertainty about the future,” Federal Reserve chair Jerome Powell said on Wednesday following a unanimous vote to keep interest rates unchanged.

No matter what the rate might be, finance companies do not appear to be booking every potential piece of paper that arrives in its underwriting department. Here is what Smoke wrote in a blog post on Wednesday following the Fed’s latest action.

“While credit remains available and has been supporting the recovery in retail vehicle sales, the composition of credit has been shifting towards higher credit tiers as lenders tighten standards and become more selective in which loan applications they approve. Likewise, even those with higher credit scores are seeing slightly higher rates and less beneficial terms than available in April and May,” Smoke said.

“The Fed’s actions have led to lower rates, and it looks like they will try to keep rates low,” he continued. “However, not everyone can get the lower rates, and credit tightening seems to be leading to modestly higher, not lower, auto loan rates. Combined with higher new- and used-vehicle prices, payments are likely to drift higher. Higher payments will limit the strength of demand and will likely remain this way as long as supply and credit conditions are tight.”

This week when Santander Consumer USA shared its second-quarter financial statement, chief financial officer Fahmi Karam explained how the finance company is approaching underwriting.

“I think it’s still prudent for us to take a cautious approach, similar to what we discussed, in April. We're seeing signs that things are improving. But there's a lot of signs that give us a lot of caution that, we should be very diligent in our underwriting,” Karam said.

“We mentioned this a few times. We have to appropriately price for the risk that we put on our balance sheet, and we have to monitor our risk-adjusted return,” Karam continued. “So for now, we still continue to be very cautious. We're going to be very disciplined in our underwriting approach and utilize all the different tools that we do to assess risk. I think you’ll continue to see that until we get further clarity on the market.”

Ally Financial chief financial officer Jennifer LaClair offered a similar anecdote when that company reported its Q2 performance earlier this month.

“Specifically, we increased manual underwriting in lieu of automated decisioning and adjusted our buy box across our riskiest credit segments. As we closed the quarter, we were pleased to generate higher year-over-year volume in June at an appropriate risk adjusted return,” LaClair said.

The credit availability for consumers with steady employment, solid credit histories and healthy income is even more pronounced, especially with offers made by captives.

According to the newest J.D. Power Auto Industry Impact Report, incentive spending per new unit retailed for the week ending July 26 was $4,230, an increase of $57 from the prior week. Analysts explained the week-over-week change stemmed mostly by supported lease and finance mix edging higher.

Despite rising take-rates for supported finance offers, J.D. Power also mentioned 84-month APR mix of all retail sales dropped 1.8 points to 6.5%, lower than pre-virus levels.

TurboPass is continuing to build relationships with finance companies that specialize in subprime paper.

Soon after announcing a finalized strategic partnership with Turner Acceptance, TurboPass also shared that it’s working with Automotive Credit Corp. (ACC) to leverage its universal income validation solution and find more details about consumers’ ability to pay on a retail installment contract.

The companies highlighted that dealers can now send a simple text message to a consumer at the point of sale or during their shopping process to validate “ability” that’s ready in seconds, saving valuable time in the vehicle buying and closing process.

This process can enable finance companies to have funding dashboard access to validate dealer-initiated reports eliminating the need to send personal identification documents in the funding package.

“After analyzing alternatives and in light of the current unemployment situation, we are moving forward to sign up all of our dealers nationwide onto the TurboPass platform. This will allow dealers to collect income, employment and proof of residence data, streamlining the stip-clearing process to get deals done faster and to minimize incidents of errors and fraud,” ACC chief operating officer Mike Opdahl said in a news release.

Founded in Michigan in 1992, ACC has partnerships with thousands of dealers throughout the United States including Arizona, California, Colorado, Florida, Illinois, Indiana, Michigan, Minnesota, Nevada, Ohio, New York, and Utah.

“Our team members are happy to leverage this innovation because it helps our dealers succeed in many ways,” ACC business development director Michael Blasius said. “It also helps our underwriting teams make solid and fast decisions.

“With the new COVID realities, this novel method is not only customer-authorized and (trusted), it allows us to deliver great value to our dealership partners around the country,” Blasius went on to say.

TurboPass can eliminate the hassle and risk associated with document-based verification of income, employment and residence and provides trusted direct (bank and credit union) source data that can fulfill finance companies’ need for copies of bank statements, proof of income, proof of employment and other stipulations.

“The TurboPass report is a unique solution in the auto finance ecosystem. It’s something that our dealers have said is a long-time coming,” TurboPass co-founder and chief executive officer Mike Jarman said.

“In light of the coronavirus environment, verifying income and employment is difficult, yet more important than ever,” Jarman continued. “The fact that ACC, an innovative and important lender to so many used-car dealers in America, recommends and accepts TurboPass to clear stips and is now actively promoting its adoption to its thousands of dealers is both exciting for our company and indicative of where the industry is moving.”

For more details about the companies, go to automotivecredit.com and turbopassreport.com.

Davis & Gilbert partner Joseph Cioffi makes another podcast appearance to offer more insights about the Credit Chronometer report that surveyed executives from throughout the subprime auto finance sector about the space’s prospects to navigate through the coronavirus pandemic.

What Cioffi uncovered was the vast majority of survey participants remain upbeat, and he tells senior editor Nick Zulovich some of the reasons why.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Turner Acceptance is bringing on some technology reinforcement to help the subprime auto finance company navigate its way through underwriting during the coronavirus pandemic.

This week, Turner Acceptance finalized a strategic partnership with TurboPass to leverage its universal income validation solution and find more details about consumers’ ability to pay on that retail installment contract.

The companies highlighted that dealers can now send a simple text message to a consumer at the point of sale or during their shopping process to validate “ability” that’s ready in seconds, saving valuable time in the vehicle buying and closing process.

This process can enable finance companies to have funding dashboard access to validate dealer-initiated reports eliminating the need to send personal identification documents in the funding package.

“Ensuring affordability is something we take very seriously at Turner Acceptance,” chief executive officer Jonathon Levin said in a news release. “We want to help our customers succeed and after testing most of the major VOI/VOE/VOR providers in the industry, we’ve found that TurboPass reports are the best way to do help our customers get into the right car at the right terms”.

Turner chief originations and marketing officer Andres Huertas added, “Because we feel that the TurboPass solution is in the best interest of our dealers, our customers and for our industry, we are not only including the requirement of TurboPass on our call-backs, but were also actively working to sign our dealers up on the solution.”

TurboPass co-founder and chief operating officer Ken Jarman elaborated about working with finance companies like Turner Acceptance, especially now as the U.S. economy has been impacted dramatically by COVID-19.

“The TurboPass Report is something that has been sorely needed for dealers for a long time. Just as dealers pull credit on almost every customer to help customize the right offering for each customer, the same can and should be done as it relates to income and employment,” Jarman said.

“In light of COVID-19, verifying income and employment is more difficult than ever,” Jarman went on to say. “Having Turner as a committed partner is exciting for our company and for the industry in general.”

For more details about the companies, go to www.turneracceptance.com or www.turbopassreport.com.