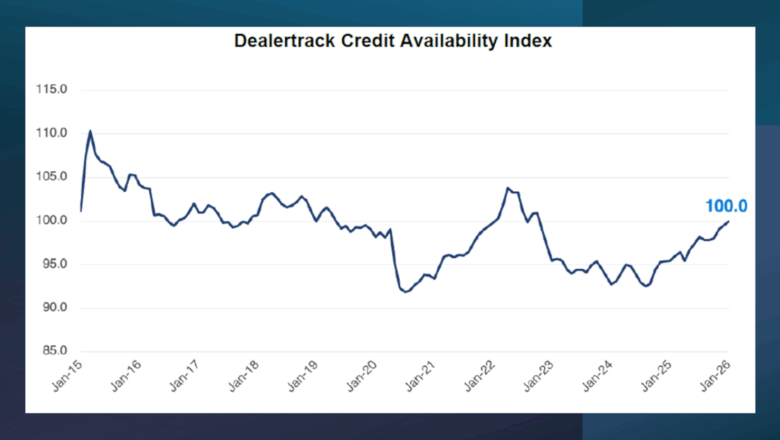

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

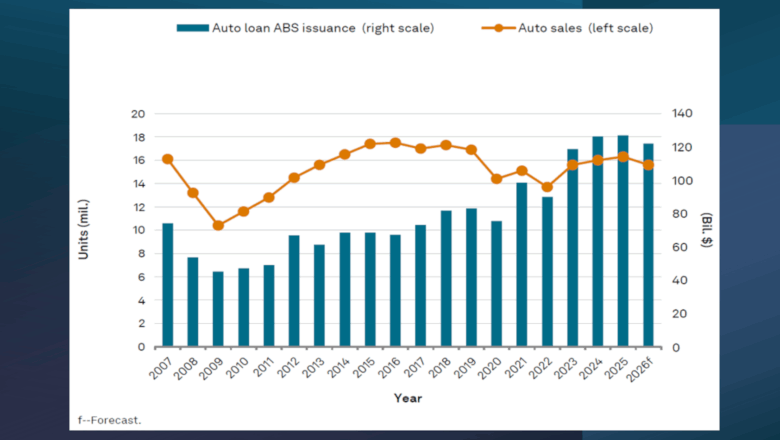

Despite ‘mixed year’ for subprime, S&P Global Ratings watches auto ABS volume generate another record in 2025

Monday, Feb. 16, 2026, 10:59 AM

Debt Awareness Week meant to be ‘wake-up call’

Tuesday, Feb. 17, 2026, 10:21 AM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Cox Automotive on the vanishing divide between wholesale & retail

Used Car Week 2025 extended the ongoing conversation about how the wholesale and retail portions of the used-car market aren’t quite as distinct as they used to be. Cherokee Media Group’s Bill Zadeits hosted a fireside chat about the subject ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

2025 Women in Remarketing honorees describe their careers, industry changes & more

One of the foundational parts of Used Car Week each year is the lively conversation among the Women in Remarketing honorees. Moderated again by Brenda Rios of award program sponsor, Ally, hear the valuable perspectives and wisdom from some of ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

VMI & USAA to Provide New Financing and Exclusive Incentives on Wheelchair Accessible Vehicles

Wednesday, Nov. 26, 2014, 04:09 PM

SubPrime Auto Finance News Staff

Vantage Mobility International (VMI) recently announced an agreement with USAA that will make it easier for USAA members to secure a wheelchair accessible vehicle. Under the agreement, USAA members can apply directly for financing from USAA and access special promotional ... [Read More]

Q3 Originations Rise to Highest Amount in Nearly 10 Years

Wednesday, Nov. 26, 2014, 03:58 PM

SubPrime Auto Finance News Staff

The new and used vehicles moving out of dealership showrooms and their installment contracts filling finance company portfolios are now producing an origination pace not seen in almost a decade. The Federal Reserve Bank of New York’s Q3 2014 Household ... [Read More]

WeGoLook and IFS Partner to Streamline Financing and Purchasing Process Online

Monday, Nov. 24, 2014, 04:23 PM

SubPrime Auto Finance News Staff

WeGoLook and Innovative Funding Services (IFS) recently launched their new partnership designed to assist buyers with auto financing and warranties through WeGoLook’s partner services — which can equip consumers with resources for completing their entire vehicle purchase online. The companies ... [Read More]

Subprime Delinquencies Still in ‘Healthy’ Range

Monday, Nov. 24, 2014, 04:16 PM

SubPrime Auto Finance News Staff

TransUnion explained why a rise in delinquencies within the subprime segment of the auto financing market reflects a “healthy” condition. Analysts indicated the subprime delinquency rate — those consumers with a VantageScore 3.0 credit score lower than 601 — increased ... [Read More]

TFS Completes 1 Millionth eContract

Friday, Nov. 21, 2014, 04:49 PM

SubPrime Auto Finance News Staff

Toyota Financial Services recently celebrated its 1 millionth eContract, an accomplishment that company officials believe to have demonstrated the success of this pioneering auto financing process. In January of last year, TFS introduced an electronic contract (eContracting) system for its ... [Read More]

2 More F&I Vets Pass Difficult AFIP Tests

Friday, Nov. 21, 2014, 04:47 PM

SubPrime Auto Finance News Staff

An owner of an industry service provider as well as a veteran dealership manager recently achieved great success in examinations orchestrated by the Association of Finance & Insurance Professionals. Joining the ranks of a handful of professionals who have advanced ... [Read More]

Q3 Delinquencies Rise Due in Part to More Subprime Paper

Friday, Nov. 21, 2014, 04:44 PM

SubPrime Auto Finance News Staff

More subprime paper in finance company portfolios nowadays is continuing to push delinquencies higher. Experian Automotive determined both 30- and 60-day auto loan delinquencies climbed during the third quarter of 2014. According to its latest State of the Automotive Finance ... [Read More]

Veros Credit Surpasses $1B in Loan Originations

Wednesday, Nov. 19, 2014, 03:20 PM

SubPrime Auto Finance News Staff

Veros Credit and its affiliates recently surpassed the $1 billion milestone in loan originations. Veros Credit’s recent expansion, coupled with a storied history of originating loans in California, Arizona and Nevada, helped the company hit this new mark. As part ... [Read More]

S&P/Experian: Rising Sales Pushes Default Uptick Drift

Wednesday, Nov. 19, 2014, 03:19 PM

SubPrime Auto Finance News Staff

The upward drift surfacing in the auto loan segment of the S&P/Experian Consumer Credit Default Indices is now six months old, but analysts are attributing the movement to the amount of metal moving out of showrooms and paper filling finance ... [Read More]

New AFSA Study Refutes CFPB Allegations

Wednesday, Nov. 19, 2014, 02:20 PM

SubPrime Auto Finance News Staff

Through findings applauded by the National Automobile Dealers Association, the American Financial Services Association offered its latest rebuttal this morning to contentions by the Consumer Financial Protection Bureau about problems with the indirect auto financing process. A comprehensive study commissioned ... [Read More]

X