The Consumer Financial Protection Bureau now is taking its regulatory aim at loans connected with workers involved in the gig economy and ride-sharing.

The CFPB recently filed a proposed settlement against Driver Loan and chief executive officer Angelo Jose Sarjeant. If entered by the court, the settlement would require the defendants to refund about $1 million in deposits to harmed consumers, stop deceptive practices and pay a civil penalty.

According to a news release, the CFPB alleges that Driver Loan and Sarjeant violated federal law by misrepresenting the risks associated with their deposit product and the annual percentage rate associated with the consumer loans they make.

“Driver Loan deceived consumers on both sides of its business model. The company deceived depositors seeking a safe rate of return, while deceiving ride-share workers about the cost of its 900% APR loans,” CFPB acting director David Uejio said in the news release.

“This case highlights that something is going wrong in the gig economy. The only reason this niche market for high-cost credit exists is because of billion-dollar companies shifting their costs onto their low-income workers,” Uejio continued.

The bureau said Driver Loan, based in Doral, Fla., offers short-term, high-interest loans to consumers funded by deposits made by other consumers. The proposed settlement seeks to resolve a pending lawsuit against Driver Loan and Sarjeant filed in federal district court in Florida in November.

The CFPB alleged that Driver Loan and Sarjeant engaged in deceptive acts or practices in violation of the Consumer Financial Protection Act of 2010 (CFPA). The allegations involved

— Hiding risks about their loan deposit product: The CFPB alleged that in 2020, Driver Loan began taking deposits from consumers to fund the loans it makes. Driver Loan represented to consumers that their deposits would have a fixed and guaranteed 15% annual percentage yield, and were deposited at FDIC-insured institutions. The CFPB alleged that Driver Loan’s representations were false: the funds were not held in FDIC-insured accounts and the rate of return was not 15% APY.

The CFPB also alleges that most deposited funds are lent to borrowers at rates that violate Florida’s criminal-usury law, rendering the loans uncollectable and creating substantial risk that obligations could not be met to depositors who sought to withdraw their deposited funds.

— Hiding the actual interest rate: The CFPB alleged that, since 2017, Driver Loan has offered short-term, high-interest personal loans, totaling more than $30 million, typically to drivers who work with ride-share companies. The loans have ranged from $100 to $500 each and are repayable in 15 daily installments.

The CFPB also alleged that Driver Loan deceptively markets its loans as having an APR of 440% when the actual APRs are over 900%.

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the CFPB said it has the authority to take action against institutions that violate federal consumer financial laws, including those who engage in unfair, deceptive, or abusive acts or practices.

The proposed settlement would require Driver Loan and Sarjeant to:

— Refund harmed consumers: The defendants would be required to return consumers’ deposits — roughly $1 million — plus all interest due to consumers under the terms of the advertised product.

— Stop deceptive practices: The defendants would be permanently banned from engaging in deposit-taking activity and from making deceptive statements to consumers.

— Pay a civil penalty: The order would also impose a penalty of $100,000 to be paid to the CFPB and deposited into the bureau’s civil penalty fund.

The proposed order can be downloaded on this website, while the 2020 complaint against Driver Loan can be viewed on this website.

Venable partner Allen Denson offered some context that might help finance companies understand why the Consumer Financial Protection Bureau (CFPB) reached its second consent order in less than a year through an action involving what the regulator deemed to be unfair loss damage waiver practices

On Friday, the CFPB announced that it issued a consent order against 3rd Generation — doing business as California Auto Finance — for illegally charging interest for

Read more

Perhaps here’s some news on a Friday that might help finance companies and their collectors exhale a bit.

The Consumer Financial Protection Bureau this week proposed extending the effective date of two recent debt collection rules to give affected parties more time to comply due to the ongoing COVID-19 pandemic.

According to a news release, the CFPB issued a notice of proposed rulemaking (NPRM) to delay by 60 days the effective date of two final rules issued under the Fair Debt Collection Practices Act (FDCPA).

The debt collection rules, issued late last year, were scheduled to take effect on Nov. 30. The CFPB is proposing to extend the effective date of both rules to Jan. 29.

“The proposed delay would allow stakeholders affected by the pandemic additional time to review and implement the rules,” the bureau said.

The CFPB recapped that the first debt collection rule issued in October focuses on the use of communications related to debt collection and clarifies prohibitions on harassment and abuse, false or misleading representations and unfair practices by debt collectors when collecting consumer debt.

Officials added that the second debt collection rule rolled out in December clarifies disclosures debt collectors must provide to consumers at the beginning of collection communications. The CFPB said the rule also prohibits debt collectors from making threats to sue, or from suing, consumers on time-barred debt.

“The rule requires debt collectors to take specific steps to disclose the existence of a debt to consumers before reporting information about the debt to a consumer reporting agency,” officials said.

The CFPB added the latest proposal will be open for comment for 30 days following publication in the Federal Register. You can read the text of the entire proposal on this website.

One of the great ironies of the Supreme Court’s decision in Seila Law versus CFPB, in which the Supreme Court held that the Consumer Financial Protection Bureau’s (CFPB) structure was unconstitutional, is that it effectively provided no relief to Seila Law, the party that took the case all the way to the Supreme Court.

On remand, the Ninth Circuit held that the CFPB’s case against Seila Law could continue. Now, for the first time, a court has held that a pending CFPB enforcement action must be dismissed because of that constitutional infirmity.

On March 26, a federal district court dismissed the CFPB’s action against the National Collegiate Student Loan Trusts, a series of 15 special purpose Delaware statutory trusts that own $15 billion of private student loans (the NCSLTs or trusts), finding that the agency lacked the authority to bring suit when it did; that its attempt to ratify its prior action came too late; and that based on its conduct, the CFPB could not benefit from equitable tolling. In doing so, the court avoided ruling on a more substantial question with greater long-term implications for the CFPB and the securitization industry—whether statutory securitization trusts are proper defendants in a CFPB action.

In Seila Law, the Supreme Court held that Congress’s decision to establish the CFPB as an agency headed by a single director removable by the president only for cause violated separation-of-powers principles. But it also held that because “the CFPB director’s removal protection is severable from the other statutory provisions bearing on the CFPB’s authority, the agency may therefore continue to operate . . . .” Going forward, therefore, the CFPB retains all of its powers and authorities, but the president can remove the director at any time and for any reason.

But what about pending cases, including the CFPB’s action against Seila Law?

The Supreme Court remanded Seila Law for the lower courts to decide whether the CFPB had validly ratified the decision to bring the Seila action. The CFPB, in turn, filed formal ratifications in all of its other pending enforcement actions, indicating that then-director Kathleen Kraninger had ratified the decision to bring the lawsuits. The Ninth Circuit ultimately upheld the CFPB’s suit against Seila Law, and other courts had—until Friday—similarly upheld the CFPB’s pending enforcement actions.

Which brings us to the March 26 decision in the CFPB’s case against the NCLTs.

The case was filed against the trusts in 2017 when the CFPB was headed by then-director Richard Cordray. The complaint sought to hold the trusts responsible for various collection practices of the loan servicers servicing the loans owned by the trusts. Along with the complaint, the CFPB filed a proposed consent judgment, which the defendant trusts purportedly consented to.

Shortly after the case was filed, however, various trust-related parties moved to intervene and opposed entry of the proposed consent judgment, arguing that the attorneys who executed it on behalf of the trusts lacked the authority to do so. After discovery, the district court denied the motion to enter the proposed consent judgment, finding that the attorneys who executed it were not authorized by the proper trust parties (and that, with respect to at least some of the trusts, the CFPB knew that the proper parties had not consented). The CFPB was therefore left to litigate a case that it thought it had settled.

After the district court declined to enter the proposed consent judgment, the intervenors moved to dismiss the complaint on various grounds. The intervenors argued that the trusts — which the complaint recognized were special purpose vehicles with no employees and that relied entirely on third-party service providers — were not “covered persons” subject to the CFPB’s enforcement authority for alleged unfair, deceptive, or abusive acts or practices (UDAAP). The intervenors argued that because the trusts lacked employees, they could not “engage” in the various activities that define a “covered person.”

This argument had broad implications for the CFPB’s authority over similar securitization trusts. The intervenors also argued that director Kraninger’s ratification of the decision to file the complaint — which came more than three years after the CFPB’s discovery of the purported violations—was untimely and therefore invalid, and that equitable tolling did not apply to save the CFPB’s case.

On March, the court agreed with the second argument.

First, the court noted that “there is no question that the Bureau initiated this action against the Trusts at a time when its structure violated the Constitution’s separation of powers,” and that a valid ratification of the decision to file suit was therefore a necessary prerequisite for the suit to continue. Under Third Circuit precedent, for a ratification to be valid, the party doing the ratification must have the power to do the act ratified (here, filing a lawsuit against the Trusts) at the time of ratification. Accordingly, “ratification is, in general, not effective when it takes place after the statute of limitations has expired.” The CFPB did not dispute that director Kraninger’s ratification came outside the three-year statute of limitations period for UDAAP claims, but argued that the ratification was valid because equitable tolling should be applied to save its claims.

The district court disagreed, finding that the CFPB did not diligently pursue its rights in the case. The district court focused on the fact that the CFPB “could not identify a single act that it took to preserve its rights in this case in anticipation of the constitutional challenges” that came to pass.

The court also noted that there was a dispute as to whether the lawsuit itself had been filed within the statute-of-limitations period, further suggesting that the CFPB did not diligently pursue its rights.

And finally, the court noted that the CFPB had not identified any facts suggesting it had pursued the litigation against the Trusts diligently once the case was filed. Although the court made no reference to the rejected proposed consent judgment, it seems likely that the history of the case impacted the court’s assessment of the CFPB’s entitlement to equitable relief.

The court’s decision may impact other pending CFPB enforcement actions where ratification occurred outside the statute-of-limitations period. But the true impact to the CFPB — and to the securitization industry more broadly — would have come from a decision regarding the “covered person” issue, either affirming or rejecting the agency’s position that securitization trusts can be held liable under the CFPB’s UDAAP authority for actions taken in the trusts’ name by third parties. Here, the district court chose not to address the issue. But the court did note that it “harbors some doubt that the Trusts are ‘covered persons’ under the plain language of the statute,” suggesting that the CFPB may face an uphill battle in asserting such authority in the future.

Ori Lev is a partner and James Williams is an associate at Mayer Brown, a global services provider comprising an association of legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian partnership).

The three largest credit bureaus extended free weekly availability of credit reports for another year to help consumers across the country manage their financial health during the ongoing hardship caused by COVID-19.

However, the Consumer Financial Protection Bureau also is returning to the pre-pandemic level of intensity in monitoring the data and information furnishers send to the bureaus that eventually land in those credit reports.

The three nationwide consumer credit reporting agencies — Equifax, Experian and TransUnion — are extending free weekly credit reports to Americans for an additional year to April 20, 2022.

Under federal law, all consumers are entitled to obtain one free credit report every 12 months from each of the three national consumer reporting agencies, and under other special circumstances. At the start of the pandemic, however, the agencies increased the frequency to weekly for a one-year period to help Americans understand and manage their financial health.

Equifax chief executive officer Mark Begor, Experian CEO Brian Cassin and TransUnion CEO Chris Cartwright made this joint statement about the extension.

“Access to financial information and records on a more frequent basis helps people plan for their future while also taking care of the present. We strive to make credit more accessible and available to people every day and we hope continuing to make free credit reports available each week is helpful to consumers,” they said.

The Consumer Data Industry Association (CDIA) recommended that individuals should review all items appearing in each section of their credit report. If an error is identified, they should contact the credit reporting agency immediately to initiate a dispute of that information.

“For consumers, ensuring that one’s credit remains in good standing during this time goes beyond paying mortgages, auto loans, credit card bills and other financial obligations each month. Consumers should have the tools they need to be knowledgeable about their financial information. The extension of free weekly credit reports is another way for people to regularly monitor their finances,” CDIA president and CEO Francis Creighton said in a statement.

Weekly credit reports can be requested at www.annualcreditreport.com.

Greater scrutiny from the bureau

Meanwhile, the CFPB announced it rescinded seven policy statements issued last year that provided temporary flexibilities to financial institutions in consumer financial markets including mortgages, credit reporting, credit cards and prepaid cards.

The bureau explained the seven rescissions — which became effective on Thursday — are designed to provide guidance to financial institutions on complying with their legal and regulatory obligations.

With the rescissions, the CFPB said it also is providing notice that it intends to exercise the full scope of the supervisory and enforcement authority provided under the Dodd-Frank Act.

Furthermore, the CFPB added that it is also rescinding its 2018 bulletin on supervisory communications and replacing it with a revised bulletin describing its use of matters requiring attention (MRAs) to effectively convey supervisory expectations.

In the statement made by the bureau specifically about credit reporting and references to the Fair Credit Reporting Act (FCRA), the CFPB said:

The statement expressed the bureau’s recognition of the impact of the COVID-19 pandemic on the operations of many consumer reporting agencies and furnishers, including staffing and related resource challenges confronting consumer reporting agencies and furnishers and their counsel. The bureau has concluded that since release of this statement such circumstances have changed. Since March 2020 and over the course of the COVID-19 pandemic, consumer reporting agencies and furnishers, have adjusted operations by, for example, shifting to a remote mode of operation. As states and other jurisdictions have rescinded and modified stay-at-home orders over the course of the pandemic, the bureau has learned that many entities have resumed some level of in-person operations and, in many instances combined with more robust remote capabilities, have demonstrated improved business continuity.

With regard to the temporary flexibility announced in the statement, the bureau believes that consumer reporting agencies and furnishers have had sufficient time to adapt to the pandemic and should be able to regularly meet their obligations under FCRA and Regulation V. In addition, because the statement did not create binding legal obligations on the bureau or create or confer any substantive rights on external parties, it did not create any reasonable reliance interests for industry participants.

CFPB acting director Dave Uejio recapped that the rescinded policy statements were initially issued between March 26 through June 3

“We are now over a year into the disruptive and deadly COVID-19 crisis. The virus has affected industry as well as consumers, but individuals and families have been hardest-hit by the pandemic’s health and economic impacts,” Uejio said in a news release. “Providing regulatory flexibility to companies should not come at the expense of consumers.

“Because many financial institutions have developed more robust remote capabilities and demonstrated improved operations, it is no longer prudent to maintain these flexibilities. The CFPB’s first priority, today and always, is protecting consumers from harm,” he went on to say.

Many consumers already have seen a financial boost arrive in their bank accounts courtesy of the Economic Impact Payment (EIP) funds distributed through the American Rescue Plan signed by President Biden last week.

Meanwhile, the Consumer Financial Protection Bureau (CFPB) is looking for the latest round of federal stimulus payments to make it to consumers rather than be intercepted by collectors or other finance companies seeking payment for overdue accounts.

Acting director Dave Uejio issued a statement on Wednesday regarding the matter, mentioning conversations the regulator has had with industry associations.

“The Consumer Financial Protection Bureau is squarely focused on addressing the impact of the COVID-19 pandemic on economically vulnerable consumers and is looking carefully at the stimulus payments that millions are now receiving through the American Rescue Plan,” Uejio said. “The bureau is concerned that some of those desperately needed funds will not reach consumers, and will instead be intercepted by financial institutions or debt collectors to cover overdraft fees, past-due debts, or other liabilities.

“In recent days, many financial industry trade associations in dialogue with the CFPB have said they want to work with consumers struggling in the pandemic,” he continued. “Many of these organizations have told us they have begun or soon will take proactive measures to help ensure that consumers can access the full value of their stimulus payments. If payments are seized, many financial institutions have pledged to promptly restore the funds to the people who should receive them. We appreciate these efforts, which recognize the extraordinary nature of this crisis and the extraordinary financial challenges facing so many families across the country.”

Uejio also mentioned more dialogue he intends to have as well as other potential actions while the economic recovery happens.

“I applaud the actions of our state partners, who have taken rapid action and concrete measures to protect stimulus funds,” he said. “We will remain in touch with them to better understand the effectiveness of these actions. I’ll also stay in touch with the bureau’s consumer stakeholders who provide valuable ‘voice of the consumer’ insight on problems with accessing their stimulus payments. The bureau will continue to closely monitor consumer complaint data and other information that will help us to better understand how these issues are affecting consumers.

“The bureau will stay closely engaged on this issue as the COVID relief payment rollout continues,” he went on to say.

Experts projected that the Consumer Financial Protection Bureau (CFPB) would become more active with President Biden now in the White House.

Randy Henrick put it this way in a previous commentary: “It is reasonable to expect changes in the automobile world to be evolutionary, not revolutionary.”

The regulator reinforced that expectation last week when it rescinded a Jan. 24, 2020 policy statement titled, “Statement of Policy Regarding Prohibition on Abusive Acts or Practices.”

Going forward, the CFPB said it intends to exercise its supervisory and enforcement authority consistent with the full scope of its statutory authority under the Dodd-Frank Act as established by Congress.

“The CFPB has made these changes to better protect consumers and the marketplace from abusive acts or practices, and to enforce the law as Congress wrote it,” the bureau said in a news release.

The CFPB recapped that Congress defined abusive acts or practices in section 1031(d) of the Dodd-Frank Act. Paraphrasing Congress, that standard prohibits companies from:

— Materially interfering with someone’s ability to understand a product or service

— Taking unreasonable advantage of someone’s lack of understanding

— Taking unreasonable advantage of someone who cannot protect themself

— Taking unreasonable advantage of someone who reasonably relies on a company to act in their interests

Officials explained the 2020 policy statement was “inconsistent” with the bureau’s duty to enforce Congress’s standard and rescinding it will better serve the CFPB’s objective to protect consumers from abusive practices.

For example, officials noted that the 2020 policy statement stated that the CFPB would decline to seek civil money penalties and disgorgement for certain abusive acts or practices. The CFPB said it deters abusive practices and compensates certain harmed consumers using penalties, so the policy statement undermined deterrence and was contrary to the CFPB’s mission of protecting consumers.

“Going forward, the CFPB intends to consider good faith, company size and all other factors it typically considers as it uses its prosecutorial discretion,” officials said.

“But a policy of declining to enforce the full scope of Congress’s definition of an abusive practice harms both the consumers who were taken advantage of and the honest companies that have to compete against those that violate the law,” they went on to say.

The rescission of the policy statement can be found here.

Vehicle traffic might be flowing faster on the Capital Beltway because multitudes of federal employees continuing to work from home. However, the process to confirm President Biden’s nomination to be the director of the Consumer Financial Protection Bureau showed that gridlock on Capitol Hill is as snarled as ever.

On Wednesday, the vote by U.S. Senate Banking Committee members involving CFPB director nominee Rohit Chopra finished in a 12-12 tie. But Chopra’s nomination still will move on to the Senate floor for a later vote by the entire upper chamber.

Banking Committee chair Sen. Sherrod Brown, an Ohio Democrat, pointed out that Chopra received a unanimous approval vote by the committee in 2018 on his way to becoming a commissioner at the Federal Trade Commission. Brown also mentioned Chopra has voted with Republican-appointed FTC commissioners more than 90% of the time.

“Mr. Chopra is nominated to lead the Consumer Protection (Financial) Bureau at a time when the agency is needed more than ever to help struggling families weather the economic fallout from the COVID-19 pandemic,” Brown said during Wednesday’s proceedings. “Just last week, the CFPB issued a report warning that more than 11 million families are at risk of losing their home.

“We have also seen the American people reach out in record numbers to the CFPB with complaints about credit reporting companies, banks, and debt collectors,” Brown continued. “No one should have their financial future ruined because of a global pandemic outside any family’s control.

“I’m confident Mr. Chopra will be equally willing to engage with members of both parties,” Brown went on to say. “And he has a strong record of standing up for small businesses and American manufacturers that are harmed by abusive and anti-competitive practices by foreign companies, or by Big Tech companies like Amazon and Facebook.

“I have heard members raise concerns that he’s ‘anti-business’ — but there’s nothing anti-business about that record,” Brown added.

Meanwhile, the committee’s ranking member and a Pennsylvania Republication, Sen. Pat Toomey, was among the dozen lawmakers to vote against Chopra's nomination.

“Based on commissioner Chopra’s record, I’m deeply concerned that he’d return the CFPB to the hyper-active, law-breaking, anti-business, unaccountable agency it was under Obama administration,” Toomey said.

“At the CFPB and FTC, he’s taken aggressive anti-business stances. And we know from his statements and writings that he favors unaccountable regulators with vast powers,” Toomey continued. “Nothing commissioner Chopra said at his hearing—or since—has alleviated my concerns.

“For example, I asked him in a question for the record whether there was a single CFPB enforcement action or rule that he believed was too burdensome or punitive,” Toomey went on to say. “Even though he spent five years in a leadership position at the CFPB, he could not identify a single one, despite the well-known evidence that CFPB’s actions limited consumer choice, drove up the cost of credit, and hamstrung job creators through overregulation.

“I am also troubled by his past accusation that my colleagues and I who support structural accountability for the CFPB are ‘shilling for predatory lenders,’ and that ‘there’s no real good argument for it other than representing those who are essentially breaking the law,’” Toomey added. “When I asked him about this statement at his hearing he responded, in part, by continuing to defend the CFPB’s unaccountable structure.”

Also during Wednesday’s hearing, the Senate Banking Committee voted to approve Biden’s nomination to oversee the Securities and Exchange Commission. The 14-10 vote advanced the process to install Gary Gensler to run the SEC.

The Consumer Financial Protection Bureau (CFPB) made a forceful declaration on Tuesday, stating the “industry is on notice” and that the bureau “will not tolerate illegal discrimination against the LGBTQ+ community.”

The regulator issued an interpretive rule clarifying that the prohibition against sex discrimination under the Equal Credit Opportunity Act (ECOA) and Regulation B includes sexual orientation discrimination and gender identity discrimination.

Officials explained this prohibition also covers discrimination based on actual or perceived non-conformity with traditional sex- or gender-based stereotypes, and discrimination based on an applicant’s social or other associations.

“In issuing this interpretive rule, we’re making it clear that lenders cannot discriminate based on sexual orientation or gender identity,” CFPB acting director David Uejio said in a news release. “The CFPB will ensure that consumers are protected against such discrimination and provided equal opportunities in credit.”

In 2016, in response to an inquiry from Services & Advocacy for GLBT Elders, the CFPB indicated that the law supports arguments that the prohibition against sex discrimination also affords broad protection from discrimination based on an applicant’s sexual orientation and gender identity under ECOA.

Then on June 15, the U.S. Supreme Court issued a landmark decision in Bostock v. Clayton County, Georgia, 140 S. Ct. 1731, 207 L. Ed. 2d 218 (2020), holding that the prohibition against sex discrimination in Title VII of the Civil Rights Act of 1964 encompasses sexual orientation discrimination and gender identity discrimination.

Subsequently, on July 28, the CFPB recapped that it issued a request for information (RFI) to solicit public comments and information to identify opportunities to prevent credit discrimination and encourage responsible innovation under ECOA and Regulation B.

Among the questions posed, the CFPB asked whether the Bostock decision should affect how the CFPB interprets ECOA.

The CFPB emphasized that issuing the interpretive rule is consistent with the Supreme Court’s Bostock decision and supported by many of the public comments received in response to the ECOA RFI.

The bureau noted that it will review its publications and examination guidance documents and, if needed, update these and other materials to reflect this interpretive rule.

And, where appropriate, the CFPB added that it will take enforcement action under ECOA to hold financial institutions accountable for their actions that violate ECOA.

“The CFPB also looks forward to working with Congress on the Equality Act, which, if enacted, would codify protections for consumers against sexual orientation and gender identity discrimination in all financial products and services,” officials went on to say.

To read the interpretive rule, go to this website.

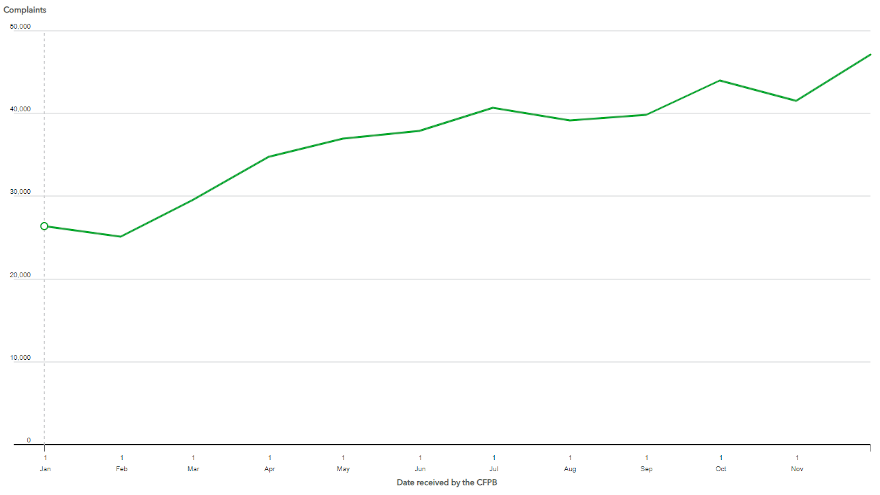

Consumer advocates and other regulators began National Consumer Protection Week on Monday in part by pointing to the significant jump in cases recorded in the complaint database housed by the Consumer Financial Protection Bureau.

According to the CFPB’s online dashboard, complaints in 2020 came in at 443,143; that’s up from the 206,607 complaints registered in 2019.

All told, the CFPB dashboard indicated there have been 1,987,591 complaints sent to the regulator since the database’s inception in December 2011.

By far, the category where the most complaints landed with the CFPB in 2020 fell within credit reporting. The dashboard said that category contained 282,977, more than double the next four categories combined. Those other four segments included debt collection, credit cards, mortgage and checking/savings accounts.

The U.S. PIRG Education Fund used those metrics as part of a report it released on Monday, stating that the number of complaints about credit reporting doubled in 2020 demonstrating what “a headache this industry causes for Americans.” The report pointed to consumer clashes with Experian, TransUnion and Equifax arriving amid the pandemic.

“Mistakes in credit reports lead to lower credit scores and denial of credit, housing or employment, but under President Trump, the CFPB gave the credit bureaus a free pass from handling consumer disputes in a timely manner,” said Lucy Baker, U.S. PIRG Education Fund’s consumer program associate.

“That hands-off approach couldn’t have happened at a worse time. It exacerbated family finance problems during a pandemic that had already left many consumers teetering on the edge of financial ruin,” Baker continued in a news release.

The report included several recommendations to Congress and the CFPB, including three steps that the consumer advocate organization said should be taken immediately. The suggestions included mitigating the financial harms posed by the COVID-19 pandemic; rescinding the actions the Trump administration took “to weaken CFPB rules against predatory payday lending,” and rolling back Trump-era rules that allow debt collectors “to harass debtors and other consumers.”

Frontier Group analyst and report co-author Gideon Weissman added, “The surge in complaints is a signal of the strain the pandemic put on consumers, and of the minefield of tricks and traps they face in the financial marketplace. Americans who share their stories are telling us exactly what kinds of help they need, and the CFPB would do well to start listening and responding.”

On Tuesday, the Senate is set to hold a hearing to question President Biden’s nominee, Rohit Chopra, to lead the CFPB. Should Chopra be confirmed, he would replace acting director Dave Uejio, who has taken an active stance since coming into the position in an interim capacity.

“Dave Uejio has acted swiftly to get the CFPB back on track to protecting consumers,” said Mike Litt, U.S. PIRG Education Fund’s consumer campaign director.

“The next step is Senate confirmation of Rohit Chopra to direct the bureau. Chopra helped build the CFPB from the start and he is the right person Americans need in the driver’s seat.”

Meanwhile, one of the most active state attorneys general also made an announcement on Monday in connection National Consumer Protection Week

New York attorney general Letitia James listed the top 10 categories of consumer complaints sent to her office last year. What James’ office classified as internet related led the way at 9,832 cases. Coming in No. 5 was automotive, including sales, financing and repairs, with 2,561.

“The havoc unleashed by the COVID-19 pandemic, in addition to the numerous other ways consumers were defrauded in 2020, sadly resulted in my office receiving a record number of consumer fraud complaints in 2020,” James said in a news release.

“Consumers who have helped identify and report issues to our office have been invaluable partners in our efforts to stop deceptive scams and will continue to be vital partners going forward,” she went on to say.