Along with highlighting how total outstanding balances are approaching $1.3 trillion, Experian’s Q1 2021 State of the Automotive Finance Market report also delved into some metrics based on geography.

Experian pinpointed the average credit score of used-vehicle paper bought in Q1 by state. The top 10 lowest averages where perhaps the most subprime financing took place included:

1. Mississippi: 635

2. Alabama: 640

3. Georgia: 643

4. North Carolina: 645

5. Texas: 645

6. Maryland: 647

7. South Carolina: 647

8. Oklahoma: 651

9. Tennessee: 652

10. Florida: 658

On the new-vehicle side, Experian noticed the average crept out of the non-prime space but involved many of the same states, including:

1. Maryland: 708

2. Mississippi: 710

3. New Mexico: 710

4. Texas: 710

5. Georgia: 711

6. West Virginia: 712

7. Alabama: 713

8. Louisiana: 714

9. Oklahoma: 715

10. North Carolina: 716

Experian also share a breakdown of regional percentages by provider, including banks, credit unions, captives, as well as what analysts classify as finance companies that often serve the subprime market along with a final category simply dubbed, other.

Here are those figures for used financing:

West

Bank: 26.58%

Captive: 11.12%

Credit union: 31.78%

Finance company: 15.55%

Other: 14.95%

Midwest

Bank: 36.42%

Captive: 6.65%

Credit union: 28.23%

Finance company: 14.95%

Other: 13.75%

South

Bank: 31.69%

Captive: 7.91%

Credit union: 19.01%

Finance company: 18.87%

Other: 22.52%

Northeast

Bank: 41.98%

Captive: 14.90%

Credit union: 20.54%

Finance company: 14.30%

Other: 8.28%

And as you might expect since they’re directly connected with the automaker, Experian highlighted that captives led the way in each region for new-vehicle financing in Q1. Here are those details

West

Bank: 24.27%

Captive: 54.13%

Credit union: 13.61%

Finance company: 1.59%

Other: 6.41%

Midwest

Bank: 28.60%

Captive: 55.66%

Credit union: 9.36%

Finance company: 5.58%

Other: 0.80%

South

Bank: 29.48%

Captive: 49.20%

Credit union: 11.43%

Finance company: 8.85%

Other: 1.05%

Northeast

Bank: 22.36%

Captive: 67.69%

Credit union: 5.63%

Finance company: 2.02%

Other: 2.30%

Escalating vehicle prices are impacting auto-finance data, too, as Experian’s Q1 2021 State of the Automotive Finance Market report showed outstanding balances jumped 10.3% year-over-year from $1.168 trillion to $1.288 trillion.

So, SubPrime Auto Finance News posed this one to Experian:

In light of rising prices for both new and used vehicles, how close is the market to the point of consumers saying, “I can’t afford this,” followed by sales and financing momentum softening?

In response …

Read more

In what’s likely a positive sign for auto-finance companies of all sizes, both the Federal Reserve and S&P Global Ratings offered positive assessments of the current banking system for both national institutions as well as regional firms.

According to the newest banking systems conditions report from the Fed posted in April, policymakers said, “The benefits of a resilient banking system have been

Read more

It appears subprime consumers took most advantage of refinancing availability in April provided through RateGenius.

Soon after Cox Automotive discussed last month’s credit availability at the time of origination, RateGenius released its monthly Auto Refinance Rate Report, which highlighted that the average overall auto refinance interest rate grew to 6.45% in April

The firm noted this number is an average across all contract terms (36 to 72 months) and all credit profiles for approved contracts during the course of the month within its network of more than 150 finance companies.

Other major metrics contained in the newest report included:

• 6.45%: The average overall auto refinance interest rate in April for all approved auto refinance applicants

• $91.50: The average auto refinance savings per month for contract holders who successfully refinanced

• $23,391: The average outstanding balance refinanced

The firm indicated the April overall average auto refinance interest rate slightly increased from March’s rate of 6.42%, almost reaching January’s high of 6.48%.

Among consumers with excellent credit, the average rate was 3.97%, the lowest rate so far this year.

RateGenius pointed out that consumers with credit scores below 640 stood the most to gain in April, saving close to $100 per month on average after refinancing their contracts, whereas borrowers with credit scores above 750 saved the least with an average savings of just below $80 per month.

AUTO REFINANCE REPORT FINDINGS

Average Auto Refinance Interest Rates by Month

|

Credit Tier

|

Jan-21

|

Feb-21

|

Mar-21

|

Apr-21

|

|

All Borrowers

|

6.48%

|

6.21%

|

6.42%

|

6.45%

|

|

750+ Excellent

|

4.14%

|

4.09%

|

4.01%

|

3.97%

|

|

700-749 Good

|

5.00%

|

4.87%

|

4.85%

|

4.79%

|

|

640-699 Fair

|

7.31%

|

6.93%

|

7.00%

|

6.81%

|

|

<640 Poor

|

12.21%

|

11.98%

|

12.05%

|

11.56%

|

Average Monthly Auto Refinance Savings by Credit Tier

|

Credit Tier

|

Jan-21

|

Feb-21

|

Mar-21

|

Apr-21

|

|

All Borrowers

|

$86.11

|

$90.77

|

$89.63

|

$91.50

|

|

750+ Excellent

|

$80.17

|

$85.13

|

$80.85

|

$79.74

|

|

700-749 Good

|

$85.82

|

$87.40

|

$89.69

|

$91.71

|

|

640-699 Fair

|

$90.78

|

$98.00

|

$94.25

|

$97.50

|

|

<640 Poor

|

$88.28

|

$93.80

|

$95.91

|

$98.76

|

Monthly Average Auto Loan Balance Refinanced by Credit Tier

|

Credit Tier

|

Jan-21

|

Feb-21

|

Mar-21

|

Apr-21

|

|

All Borrowers

|

$23,222

|

$23,220

|

$23,271

|

$23,391

|

|

750+ Excellent

|

$23,652

|

$23,553

|

$24,651

|

$24,119

|

|

700-749 Good

|

$24,041

|

$23,941

|

$23,596

|

$23,789

|

|

640-699 Fair

|

$22,707

|

$23,050

|

$22,636

|

$23,192

|

|

<640 Poor

|

$21,274

|

$21,184

|

$21,032

|

$23,394

|

May 2021: Current Auto Refinance Interest Rates

|

Credit Tier

|

36-month term

|

48-month term

|

60-month term

|

72-month term

|

|

750+ Excellent

|

2.85%

|

2.43%

|

2.89%

|

2.99%

|

|

700-749 Good

|

3.07%

|

2.99%

|

3.14%

|

3.30%

|

|

640-699 Fair

|

5.10%

|

6.37%

|

6.79%

|

6.90%

|

|

<640 Poor

|

3.99%

|

10.81%

|

10.93%

|

11.39%

|

Source: RateGenius database

Car Capital continues to make moves to establish itself as an up-and-coming auto-finance technology company that strives to get any deal bought no matter the consumer credit background.

After securing two separate rounds of funding, the company announced the appointment of two company advisors this week who have professional backgrounds with companies such as Bank of America and Hertz.

Now serving in this role according to a news release are John Binnie and Kirk Shryoc.

Most recently, Binnie was vice chairman of corporate and investment banking at Bank of America. He previously was a partner at Moelis & Co., head of the diversified financials group at Morgan Stanley and co-head of the bank and diversified financial services group at Salomon Smith Barney.

Shryoc is managing partner at Hard Right Solutions and co-founder of Mobility Financial Management. Shryoc is also a board member of several private companies and previously served as vice president and assistant treasurer of Hertz.

The company highlighted Binnie and Shryoc are also investors in Car Capital and bring a wealth of experience and ideas to contribute to Car Capital’s upward trajectory of tremendous growth since it launched operations earlier this year.

“We are thrilled to welcome John Binnie and Kirk Shryoc as company advisors,” Car Capital co-founder and chief executive officer Justin Tisler said in the news release. “Their broad experience will be invaluable to Car Capital as we continue to build the company, expand into additional markets and pursue future fundraising and strategic initiatives.”

With 100% automated instant approvals available to their dealer partners through its propriety web-based platform — Dealer Electronic Auto Loan System (DEALS) — Car Capital said it can make it possible for any consumer regardless of credit history to feel confident in the ability to purchase a vehicle when entering the dealership.

“I’m excited to work with Justin and the team at Car Capital to help develop this exceptional company into a sector-leading organization,” Binnie said.

“With their innovative technology that benefits both dealers and consumers, they are on track to make a significant impact on the retail auto industry in the best way.”

And Shryoc added, “As an investor and now advisor to Car Capital, I’m looking forward to supporting the company’s growth and their unique strategy to provide consumers with the opportunity to buy a car no matter their credit situation.”

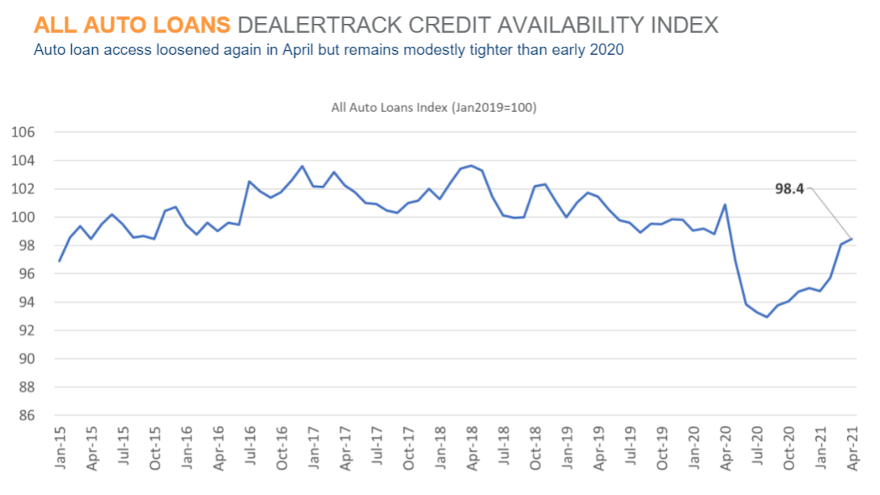

Cox Automotive reported this week that auto financing availability in April was the most accessible since April 2020, according to the Dealertrack Auto Credit Availability Index.

But analysts acknowledged that making year-over-year comparisons is challenging, since they’re versus the outset of the pandemic.

The index reading increased 0.4% to 98.4 in April, reflecting that credit was easier to get in the month compared to March. Analysts said access is tighter by 2.4% year-over-year, but that comparison is against “abnormal credit conditions” from April 2020.

Compared to February 2020, Cox Automotive said access is tighter by just 0.7%.

Looking closer at the data, analysts discovered that financing provided through independent dealers tightened the most.

“On a year-over-year basis, independent used financing, non-captive new-vehicle financing and franchised used financing are now looser,” Cox Automotive said in the report that accompanied the latest index update.

“Other channels remain tighter year-over-year, with new-vehicle loans and used CPO having tightened the most,” analysts added.

Cox Automotive also mentioned credit availability loosened the most in April at captives, expanding by 1.1%, while credit tightened at credit unions by 1.3%.

“On a year-over-year basis, auto-focused finance companies and banks have loosened credit access, while credit unions are unchanged, and captives have tightened,” analysts said.

“However, the year-over-year comparison for captives is against a time when lending by captives was particularly aggressive during the pandemic lockdown period,” they continued.

“However, the subprime share and the negative equity share increased while down payments also increased, and those factors moved against credit expansion,” analysts went on to say.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Across all auto financing in April, Cox Automotive said approval rates increased, yield spreads narrowed and the share of terms longer than 72 months increased, which all made credit more accessible.

Cox Automotive also included some general consumer observations and what they could mean for vehicle retailing and financing.

“The trend in daily new COVID cases ended April on a declining trend as substantial progress was made in vaccinations so that more than 100 million Americans were fully vaccinated,” Cox Automotive said.

“Consumer confidence according to the Conference Board increased 11.7% in April and left confidence down only 8% compared to February 2020,” analysts continued. “Plans to purchase a vehicle in the next six months jumped in April to a 23-month high.”

APCO Holdings is looking to cater to the wide array of approaches to retailing vehicles with its latest strategy for reinsurance programs.

The provider and administrator of F&I products and home to the EasyCare and GWC Warranty brands said this week that it now is offering dealerships a consultative approach designed to match dealers’ unique business situations and goals with an appropriate reinsurance program structure.

The company explained the approach aims to educate dealers amid an increasingly complex reinsurance market, so they can better understand options and increase the probability of success.

“Multiple factors come into play when choosing a reinsurance program structure, but many dealers are presented with a one-size-fits-all approach that is not appropriate to their unique business models as well as their short-, medium- and long-term goals,” said Dave DeCredico, senior vice president of business operations at APCO Holdings.

In the past several years, APCO Holdings acknowledged significant activity has affected dealer F&I participation programs, including an increased number and variations of reinsurance program structures available, tax law changes that require disclosure on multiple levels, and increased market misinformation.

With APCO’s Consultative Approach, the company said a dealer receives an in-depth consultation from a reinsurance expert to determine which equity participation program best fits their individual needs.

APCO noted that the discussions can evaluate many factors including anticipated volumes, risk tolerance, programs to be written, income objectives, anticipated distribution plans and investment strategies.

APCO offers a variety of reinsurance program structures to dealerships, including non-controlled foreign corporation (NCFC), controlled foreign corporation (CFC), dealer owned warranty company (DOWC), retrospective premium program as well as a hybrid structure combining more than one of these options.

APCO’s consultative approach also includes recommendations and training for aligning a dealership’s F&I product strategy with its reinsurance strategy, in order to maximize profitability.

“This is an area of missed opportunities for many dealers,” DeCredico said. “The close alignment of F&I and reinsurance strategies is key to maximizing program profitability.”

DeCredico added that APCO’s consultative approach also includes an up-front evaluation, quarterly reinsurance statements and an in-depth, annual review of reinsurance positions to discuss new opportunities and areas for improvement.

For more information about the APCO Holdings’ family of brands, visit apcoholdings.com.

If you didn’t already know, StoneEagle F&I senior vice president of business development Joe St. John is one of the most enthusiastic executives anywhere in the automotive industry.

Well, when St. John dissected the first-quarter data gathered via StoneEagleMETRICS, his excitement level ticked up a few notches because he found what might be a “silver lining” for dealerships and finance companies.

The specific data is included in the current edition of SubPrime Auto Finance News and a further discussion about it is available through this Auto Remarketing Podcast episode featuring St. John.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Nearly a month after Car Capital secured a funding round of almost $9 million, the new auto-finance technology company that strives to get any deal bought no matter the consumer credit background closed on a credit line more than double that funding amount.

According to a news release distributed on Tuesday, Car Capital secure a $20 million credit line with Medalist Partners. The company highlighted this transaction gives Car Capital access to capital to expand their business, fund deals and ultimately get consumers into vehicles.

Car Capital’s proprietary, web-based platform, Dealer Electronic Auto Loan System (DEALSSM) is designed to allow franchise and independent dealers to make 24/7 immediate auto financing decisions for 100% of their customers.

“Car Capital is excited to be able to help our dealer partners offer financing to their customers through the debt we’ve secured with Medalist Partners. We are planning to significantly expand our dealer network and grow our revenue with this additional capital,” Car Capital co-founder and chief executive officer Justin Tisler said in that news release.

“Medalist has been an invaluable partner, first through their contribution to our Series A funding round, and now with this debt deal. We look forward to further building on our relationship with Medalist,” Tisler continued.

As Tisler referenced, Car Capital previously announced that it closed an $8.8 million Series A funding round that was led by FM Capital with participation from more than 50 individual and institutional investors, including Automotive Ventures and Medalist Partners.

“We’re excited to partner with Car Capital to provide their inaugural debt financing following a successful Series A equity round,” said John Slonieski, director of private credit and partner at Medalist Partners.

“We believe the extensive experience of the management team, proprietary technology, and innovative lending strategy make this company an ideal fit for a secured debt transaction within our asset-based private credit business,” Slonieski continued in this week’s news release.

Car Capital can allow its dealer partners to make immediate modifications to deal terms in real-time based on the economics of each unique vehicle and consumer.

Then, dealers can make back-end profit off their sales based on performance, instead of requiring them to reach a minimum portfolio size.

Car Capital said it takes pride in how the company works together with its dealer partners to ensure everyone in the buying process succeeds.

“We are thrilled to work with Medalist to grow our dealer network. The debt capital from Medalist will help us to get more underserved consumers into transportation at a time when many people could use some help,” Car Capital chairman Brian Reed said.

Within hours of it being announced that CarMax was poised to acquire full ownership of the firm, Edmunds shared its first-quarter used-vehicle financing data, highlighting increases in both average down payments and total amount financed.

Edmunds reported that the average down payment for a used vehicle financed during Q1 came in at $23,958 with the average down payment being $3,345. A year earlier, Edmunds pinpointed those amounts at $22,200 and $2,679.

A surge into the used market probably will continue since Edmunds explained that consumers in the market for a new vehicle will likely have a harder time finding what they want at an affordable price right now due to severe supply shortages affecting the automotive industry.

Fueling record weekly wholesale-price rise, Edmunds determined new-vehicle inventory at franchised dealerships nationwide was down 36% in March compared to a year ago.

Analysts projected that the average transaction price (ATP) for new vehicles would climb to $40,563 in March compared to $38,601 a year ago, while the ATP for used vehicles is expected to hit $22,663 compared to $20,273 last year.

“The chipset shortage has snowballed into a bigger crisis for the automotive industry,” Edmunds executive director of insights Jessica Caldwell said. “Major auto manufacturing plants are implementing temporary closures, and we’re seeing the industry being hit hard on both sides: Retail customers are being offered fewer choices and paying higher prices, while fleet customers are likely seeing their orders delayed as auto manufacturers shift their focus to serving consumers.”

Edmunds noted that full-size trucks and large SUVs are among the vehicle categories most disproportionately affected by these shortages.

According to Edmunds data, full-size truck inventory was down by 60% in March compared to a year ago. Analysts suspected that the average transaction price for new full-size trucks is expected to climb to $54,763 compared to $51,164 a year ago, while the average transaction price for used full-size trucks is expected to climb to $34,445 compared to $28,156 a year ago.

Edmunds also mentioned in the new-model space that large SUV inventory decreased 56% in March compared to last year while the average transaction price for new large SUVs is forecasted to climb to $67,542 compared to $62,620 last March. And analysts added the average transaction price for used large SUVs is expected to climb to $35,035 compared to $31,232 a year ago.

“Full-size trucks and large SUVs have been a bright spot for automakers throughout the pandemic because of their profitability, but unsurprisingly these high-demand vehicles have also been the quickest to fly off the lot,” Caldwell said. “Unfortunately, these supply shortages translate to a bigger financial hit for automakers, and the Detroit Three are likely the most affected.”

And just like within used vehicles, the average down payment and amount financed for new models are higher year-over-year, too. Edmunds pegged the average down payment for a new vehicle at $4,729 in Q1, up by nearly $500 with the average amount financed jumping by more than $1,400 to $35,040.

“So far, automakers have been able to comfortably count on financially stable consumers focusing their spending on bigger-ticket vehicle purchases during the pandemic,” Caldwell said. “But as vaccines continue to roll out and consumers crave new experiences and products to spend their money on, automakers and dealers will need to prepare to get more creative in marketing the limited inventory that they have on hand.”

In what could be good news for franchised store managers, Edmunds experts advised consumers in the market for a new vehicle to start shopping sooner rather than later, as they anticipate that the chipset shortage is likely to affect pricing and inventory through at least the second half of 2021.

“Americans looking forward to their newfound freedom this summer in the form of a road-trip vehicle should be doing their research now,” Edmunds senior manager of insights Ivan Drury said.

“The summer sales that consumers can typically look forward to might not look the same this year, and even with stimulus checks on the way, the only relief that price-sensitive car shoppers might find might be in lower interest rates and the increased value of their trade-in,” Drury went on to say.

Quarterly New-Car Finance Data

(Averages)

| |

Q1 2021

|

Q1 2020

|

Q4 2020

|

|

Term

|

70.0

|

69.9

|

69.9

|

|

Monthly Payment

|

$575

|

$569

|

$581

|

|

Amount Financed

|

$35,040

|

$33,594

|

$35,335

|

|

APR

|

4.51%

|

5.70%

|

4.59%

|

|

Down Payment

|

$4,729

|

$4,246

|

$4,720

|

Quarterly Used-Car Finance Data

(Averages)

| |

Q1 2021

|

Q1 2020

|

Q4 2020

|

|

Term

|

68.2

|

67.5

|

68.1

|

|

Monthly Payment

|

$432

|

$410

|

$437

|

|

Amount Financed

|

$23,958

|

$22,200

|

$24,384

|

|

APR

|

8.1%

|

8.5%

|

7.8%

|

|

Down Payment

|

$3,345

|

$2,679

|

$3,280

|

Source: Edmunds