Intellaegis, which operates in the repossession and recovery spaces as masterQueue, named a new head of sales this week.

Taking on the position is Brynn Layton, who will be reporting to Intellaegis chief operating officer Lance Suder and lead all sales and marketing efforts for the fintech company.

“We’re excited to have a seasoned professional like Brynn joining our sales team. He brings 25 years of valuable experience in the auto finance and data industries,” Suder said in a news release.

“We look forward to leveraging his background in data analytics, customer success and sales management to enhance our product offerings and execute on our enterprise sales strategy,” Suder continued.

Intellaegis highlighted Layton has held executive leadership roles in many aspects of the financial services industry. He has run high-profile call centers in debt collection at Chrysler Financial and Wells Fargo.

Layton also previously led credit and collections oversight at a rapidly expanding subprime auto finance company where his analytical expertise helped the company achieve significant revenue growth.

Furthermore the company said Layton also has led teams in third-party risk oversight and analytics at D&B and Supply Wisdom, and he spent several years leading a team at TransUnion that managed one of its largest credit card clients.

“Now that masterQueue has become a leading fintech platform in the identification and mitigation of high-risk accounts in auto finance and credit card servicing, and with our recent growth in govtech to help states with Medicaid enrollee communication, the need to bring in a sales leader to help our company grow these opportunities became apparent,” Intellaegis founder and CEO John Lewis said.

“We are confident in Brynn’s ability to use his deep experience to help us intensify our direct and channel partner sales coverage,” Lewis added.

Layton shared his perspectives about his newest professional stop.

“I am thankful for the opportunity to join the Intellaegis family. I joined Intellaegis for one main reason: they are proving to be a disrupter in the collections Industry,” Layton said.

“I believe the ability to gather, organize, and track disparate data to find the optimal Right Party Contact allows companies to control and maximize their OPEX costs and decrease delinquency/repo rates,” he went on to say.

To learn more about Intellaegis and its masterQueue platform, visit this website.

Rick Hackett said F&I Sentinel is “doing all the right things,” so the former Hudson Cook partner and assistant director of Consumer Financial Protection Bureau (CFPB) decided to move from an advisor to a member of the compliance service provider’s board of directors.

According to a news release distributed last week, F&I Sentinel’s move with Hackett is effective immediately, as its board of directors unanimously approved Hackett’s nomination.

Hackett now is F&I Sentinel’s seventh external board member.

“As a highly respected advisor, Rick provides invaluable insights and guidance to our Board and team,” F&I co-founder and CEO Stephen McDaniel said in the news release. “His expertise and knowledge in auto financing policy and compliance, coupled with his experience and familiarity working within the CFPB, have enhanced our product and service offerings, ultimately benefiting our customers. When given the opportunity to have Rick join our Board, we jumped at the opportunity to further expand his role with our company.”

Hackett focused on auto finance regulation while serving at the CFPB under former director Richard Cordray. His responsibilities included advising all CFPB divisions on market information and policy issues in the installment and specialty lending areas, including vehicle financing.

Hackett helped lead the CFPB’s initial charter into the auto finance industry, tasked with guiding strategy for examining and investigating dealer participation programs.

Hackett spent 31 years practicing law before joining the CFPB in 2011. He left that agency in 2013, and the next year joined Hudson Cook. He retired from Hudson Cook in 2019 and currently serves as an advisor and board member for several companies, including F&I Sentinel.

“I saw the writing on the wall and spoke at an industry conference in 2014 about the need for auto finance companies to adopt and execute a comprehensive compliance solution to meet emerging regulatory requirements and policies,” Hackett said.

“After serving as an advisor to F&I Sentinel since last May and seeing how F&I Sentinel’s innovative products and services meet this growing need, it was an easy decision to join the company’s board. It’s doing all the right things,” he went on to say.

Along with a new company branding, Portfolio announced the promotion of Cliff Childers to the position of managing director, effective immediately.

The company highlighted the 21-year industry veteran leads a national sales team driving reinsurance and F&I success for auto, RV and powersports dealers with a focus on innovation, sales and results.

“Anyone who has worked with or even spent a few moments with Cliff knows he is the genuine article — smart, savvy and passionate about helping agents and dealers achieve their goals,” Portfolio chief sales officer David Neuenschwander said in a news release. “As a managing director, he joins a select group of sales leaders dedicated to driving success for Portfolio and our valued partners.”

Childers began his career with Bridgestone/Firestone, then served as an account executive with Zurich before joining National Automotive Experts and NWAN, a Strongsville, Ohio-based provider and administrator, in 2012.

Childers’ tenure included four years leading that company’s business development team as national sales manager before NAE/NWAN was acquired by Portfolio.

“Very rarely are two companies able to come together and deliver best-of-both-worlds services and support to agents and dealers. Our partners have access to the best reinsurance platform in the industry,” Childers said. “I am honored to be in a position to drive unprecedented success for our partners and excited to get to work.”

And in other company news, Portfolio also announced its first brand redesign since the company’s founding in 1989, unveiling an updated logo designed to reflect the company’s position as a leading national reinsurance and F&I provider and administrator.

President and CEO Brent Griggs said Portfolio’s new look was several years in the making. The rebrand followed the 2020 acquisition of NAE and NWAN and a creative partnership with Trifactor, a Fort Lauderdale, Fla., digital marketing agency.

“Our ‘legacy’ look and feel served Portfolio well for more than 30 years, but our brand had to evolve with our company and the industries we serve,” Griggs said. “With input from key stakeholders at every level, Trifactor was able to deliver a brand identity that celebrates our history and embraces the future.”

According to a news release distributed this week, Scott Zucco joined F&I Sentinel as vice president of sales, in a move effective Jan. 3.

The automotive compliance and regulatory risk mitigation solutions provider highlighted Zucco is “an accomplished sales professional with unparalleled business acumen” gained over his 30-plus years of experience in business development and relationship management.

Zucco will lead the F&I Sentinel sales team in defining and executing key strategies to meet and exceed sales goals.

“Now more than ever, auto lenders need a comprehensive compliance solution that helps mitigate reputational, financial, litigation, and regulatory risks of financing F&I products. Millions of dollars are at stake,” F&I Sentinel co-founder and CEO Stephen McDaniel said in a news release. “Scott’s in-depth knowledge of emerging technologies coupled with his auto finance industry experience will drive continued growth and expansion of CITADEL and FAIRRCalc, two of our solutions designed to protect lenders.”

Most recently, Zucco served as senior account executive with Upstart, a leading artificial intelligence financing platform designed to improve access to affordable credit.

Previously, Zucco served as Senior Technology Sales Executive with defi SOLUTIONS (formerly Fiserv), a financial services company that offers originations and servicing, and was senior vice president at Lee and Mason of Maryland, a full-service program administrator providing risk management services.

“F&I Sentinel is an innovator and leader in the F&I compliance space with an outstanding team of compliance experts and software solution developers,” Zucco said. “With my extensive experience in AI platforms and risk management, I’m excited to serve as VP of Sales to expand implementation and use of CITADEL, the company’s signature compliance solution for auto finance lenders across the country.”

F&I Sentinel’s cloud-based CITADEL SaaS platform is a turn-key compliance solution that designed to protect finance sources, dealers and consumers by mitigating reputation, financial, litigation, and regulatory risks in connection with the sale and financing of vehicle finance and insurance products.

F&I Sentinel’s FAIRRCalc, proprietary software developed to assist finance sources with respect to F&I product refunds, leverages CITADEL to provide real-time, accurate, and compliant GAP waiver refund quotes, inclusive of cancellation fees, to automotive finance sources.

PassTime reinforced its executive team last week.

The provider of advanced asset tracking solutions announced it has hired Mike Roberts a new executive vice president of sales.

PassTime highlighted Roberts joined the team from Kenwood USA and is an executive sales leader with a 30-year track record of successful business development, marketing, and sales management in the consumer electronics and automotive aftermarket industries.

The company said Roberts specializes in driving multi-faceted sales strategies with experience throughout North America, including product introductions, sales campaigns, channel building, licensing, and strategic partnerships.

Over his career, Roberts has been a senior executive with mid-size and large companies who has cultivated relationships and built high performance sales teams.

“PassTime is very excited to have Mike joining the team as the new EVP of sales. His experience and sales training knowledge will be a great addition to an already solid team. We feel he will be a great fit to help the company continue its strong growth trajectory and ambitious goals,” PassTime president and COO Chris Macheca said in a news release.

For more information, about PassTime send a message to [email protected] or visit https://passtimegps.com.

Before the first quarter of this year closes, Santander Consumer USA will have a new top executive.

Santander Holdings USA recently announced that Bruce Jackson will assume the role of head of the Santander US Auto business and CEO of Santander Consumer USA through a move that will become effective in March.

Jackson will be reporting to Santander US CEO Tim Wennes.

Jackson will succeed Mahesh Aditya, who is taking on the role of Banco Santander’s Group chief risk officer in Madrid.

According to a news release, Jackson will be responsible for the Santander US Auto business with a continued focus on enhancing the dealer and manufacturer experience, increasing the Santander US Auto market share, and executing on the Santander US growth strategy.

Most recently, Jackson served as president of Chrysler Capital and has previously held senior auto finance leadership roles at JP Morgan, Ally Financial and Bank of America, among others.

“This appointment underscores the depth of leadership across the Santander US region,” Wennes said in the news release. “With his combination of industry knowledge, dealer and manufacturer relationships and leadership experience, Bruce is well positioned to continue to build upon the strong position that the Santander US Auto business holds in the marketplace.”

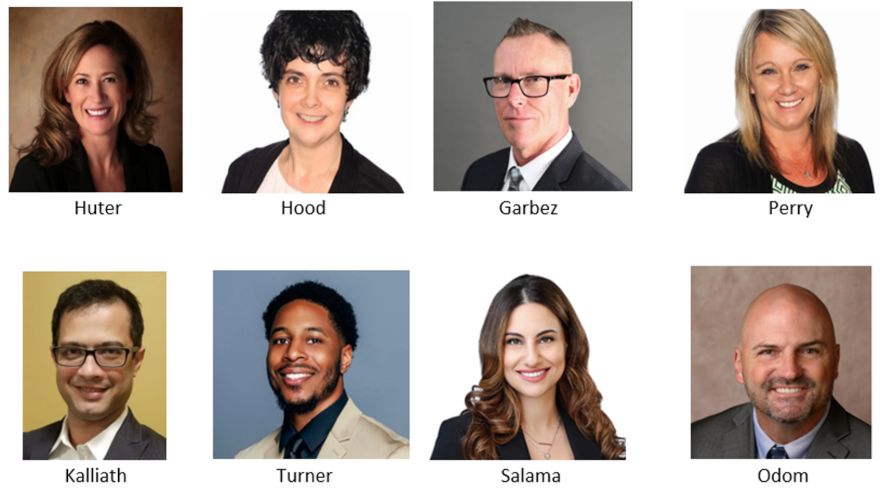

Location Services recently hired eight executives in a wide array of specialties to help strengthen the senior leadership team of the recovery management and loss mitigation service company.

Bringing 10 to 20 years of experience with them in some instances, the newest hires include:

—Carolynn Huter, vice president of human resources

—Peggy Hood, vice president of operations

—Ken Garbez, vice president of remarketing services

—Jennifer Perry, vice president of title operations

—Joseph Kalliath, director of technology

—Jeremy Turner, director of vendor relations

—Miriam Salama, director of business development

—Brett Odom, director of credit union services

“We are excited to add top industry talent to our already seasoned team,” Location Services CEO Jerry Kroshus said in a news release. “We are experiencing rapid growth and recognized we needed additional talent and depth to properly serve our clients and vendors. Our new team members are highly respected industry leaders, and we are thrilled they have joined us.”

The company said Huter, Hood, Garbez, Perry and Turner are all based in Carmel, Ind., at Location Services’ headquarters. Location Services highlighted these executives have extensive third-party servicing experience and have all worked together in the past.

Kalliath brings more than 20 years of management experience overseeing application development. Salama has more than 10 years working in vendor compliance, while Odom has a management background in the credit union servicing and insurance industries.

“We continue to build a first-class organization and adding this group further strengthens our ability to perform at the highest levels,” Location Services chief client and operations officer Jose Delgado said. “These new team members have already made immediate impacts in their respective divisions, and we look forward to many more contributions from all of them.”

Location Services also announced that its penetration levels with successful license plate recognition (LPR) recoveries continue to increase month-over-month.

“As InsightLPR, our LPR platform partner, continues to grow and gain market share with agents and clients, we are definitely benefiting from their momentum,” Kroshus said. “John Nethery, CEO at InsightLPR, has built a great team and model. They have made incredible progress as a company.”

“It’s a very exciting time for us at Location Services. The loyalty and opportunities received from clients that we previously serviced at other organizations is very rewarding. Their continued faith and trust in us is beyond gratifying,” Delgado added.

Kroshus pointed out another component that’s helped Location Services to enjoy success and expand its team.

“We are very fortunate to have Delaware Street Capital (DSC) as our parent company. The support and resources they provide us enable us to grow and expand in a positive direction,” Kroshus said.

Just before Halloween night, Credit Acceptance announced an addition to its senior leadership team.

Ravi Mohan joined the subprime auto finance company as chief technology officer as of Oct. 24.

In his role, Credit Acceptance said Mohan will be responsible for the technologies that support the company's team members, dealers, and consumers, implementing those technologies and providing services and products to help meet the company's goals.

According to a news release, Mohan most recently served as senior vice president of engineering and chief information offic at Datto.

At Datto, Mohan was responsible for leading all digital experience, technology and integration platforms and driving the enterprise-wide priority and roadmap. He also led internal IT and all employee experience platforms and tools.

Before Datto, Mohan served as vice president of SaaS cloud engineering at Oracle and head of cloud engineering ops at Adobe.

While at Oracle, Mohan led the marquee enterprise application, Fusion, to the cloud, as well as implemented large-scale initiatives spanning several teams and driving a customer-first mindset.

At Adobe, Mohan led a fast-growing, high-performing team and managed Adobe’s public cloud (AWS, Azure), one of the largest public cloud implementations in the industry, as well as driving efficient usage of cloud, saving millions for Adobe.

“I am excited to have Ravi join our senior leadership team,” Credit Acceptance chief executive officer Ken Booth said in the news release. “He brings a deep and strategic set of knowledge and experience to an already amazing team, and together I believe we will continue moving toward achieving our goals.”

Mohan shared why he made this professional move.

“I was attracted to Credit Acceptance’s great culture, expertise, and its proven role in helping make positive changes to the lives of its customers,” Mohan said. “In today’s turbulent financial environment, Credit Acceptance’s deep expertise and relationships, when coupled with the use of modern technologies, open up high impact opportunities.

“I am thrilled to be at Credit Acceptance to serve in that journey,” he added.

JM&A Group president Dan Chait recently announced a pair of executive leadership changes.

According to a news release distributed this week, the F&I subsidiary of JM Family Enterprises promoted Scott Gunnell to senior vice president and chief operating officer, while the company also said Mike Casey will serve as senior advisor and retire at the end of 2023.

“As our industry continues to evolve, we remain committed to developing our associates and positioning our teams to further accelerate our dealers’ success,” Chait said in the news release. “Scott’s vast automotive experience and strong leadership will help propel our business and support our dealer partners for years to come.”

Gunnell joined JM Family in 2003 as an F&I specialist trainee at JM&A Group. He transferred to sister company Southeast Toyota Distributors in 2005 where he held various positions, including district sales manager.

Upon returning to JM&A Group in 2010, Gunnell moved into multiple sales and operations roles, ultimately being promoted into his most recent position of group vice president of strategy, marketing and sales success.

In his elevated role, the company said Gunnell will oversee all sales and operational activities, while continuing to drive JM&A Group’s long-term strategy and focus on growing its capabilities to increase dealership performance, while navigating the evolution of the consumer, vehicle and digital journey.

Gunnell has been at the helm of the company’s strategy for several years and has been instrumental in developing JM&A Group as a pioneer in several areas, including Virtual F&I, which can enable a dealership to sell products to their customers anytime, anywhere, and the reorganization of its national sales team to better support dealers.

More recently he oversaw the launch of EV+ Protect, an F&I product suite designed for new and used electric vehicles. The branded products, including a comprehensive limited warranty for EVs, are available to dealers nationwide.

“I am honored by this opportunity and eager to leverage the experience of our teams and JM&A Group’s expertise to help maximize our dealers’ businesses,” Gunnell said. “Going forward, we remain committed to assisting our dealers as they prepare for, and adjust to, the future of the industry by offering best-in-class product innovation and insights on consumer trends.”

Casey, whose career with JM&A Group has spanned nearly 40 years, most recently as the company’s group vice president of sales, will serve as senior advisor, consulting with JM&A Group’s leadership and assisting with the coaching and development of the sales team.

Following his retirement at the end of next year, the company said Casey will continue to remain close to JM&A Group and JM Family, consulting on matters from time to time.

“Mike has been a pillar of our leadership team for many years and helped establish JM&A Group as a trusted partner to our dealers. In his ongoing advisory role, he will continue to be an invaluable resource to Scott and me as we successfully transition key dealer and strategic relationships,” Chait said.

For more information about JM&A Group’s products and services, call (800) 553-7146 or go to www.jmagroup.com.

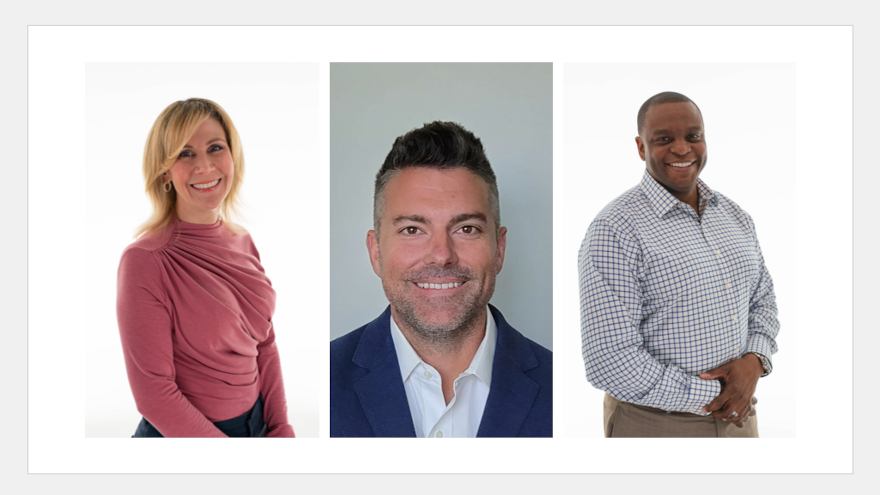

This week, APCO Holdings announced the addition of three new hires to its executive team.

Coming aboard the provider and administrator of automotive F&I products and home to the EasyCare and GWC Warranty brands are Dell Birch, Heather Sachs and Ben Winter.

Birch is APCO Holdings’ new vice president of operations and technology. Birch brings more than 25 years of experience in operations, technology, change management, enterprise strategy and leadership experience to his new role.

Birch has previously worked for JM Family Enterprises, EIS Group, Fortegra, Hewlett Packard and Delta Air Lines.

Sachs has been named vice president of finance and accounting and brings more than 25 years of finance experience to her new position.

Prior to joining APCO Holdings, Sachs worked for JM Family Enterprises and Deloitte, where she gained experience in the automotive industry and public accounting, respectively.

Sachs also brings leadership, strategic planning and change management experience through her role as head of finance within the healthcare industry.

Winter is APCO Holdings’ new vice president of corporate development and brings over 16 years of experience to his role.

Winter will be responsible for leading APCO’s efforts for identifying and evaluating new acquisition opportunities, developing acquisition priorities and strategies, and supporting the execution of integration plans for acquired businesses.

Before to joining APCO, Winter managed the corporate development process at a Berkshire Hathaway affiliate and served as a mergers and acquisitions advisor within investment banking and public accounting.

“We continue to build out our leadership team at APCO to ensure that our business is well-positioned for future growth and acceleration,” APCO Holdings CEO Scot Eisenfelder said in a news release. “Each of these executives has tremendous insights, experience and talent to help us achieve these goals, and I look forward to their contributions.”

For more information, visit https://apcoholdings.com.