Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

DriveItAway partners with another fintech firm to help consumers rebuild credit

Tuesday, Aug. 17, 2021, 02:41 PM

SubPrime Auto Finance News Staff

DriveItAway is continuing to forge partnerships to help dealerships turn vehicles while giving consumers the opportunity to secure transportation and rebuild their credit. Via a news release distributed Tuesday, the provider of subscription to ownership technology that can enable anyone, ... [Read More]

Right Direction Financial Services to leverage Scienaptic AI-powered platform

Monday, Aug. 16, 2021, 02:07 PM

SubPrime Auto Finance News Staff

After recently forging a relationship with an independent dealership group, Scienaptic bolstered its client roster of independent finance companies on Monday. The credit decision platform provider fueled by artificial intelligence now is working with Right Direction Financial Services, which looks ... [Read More]

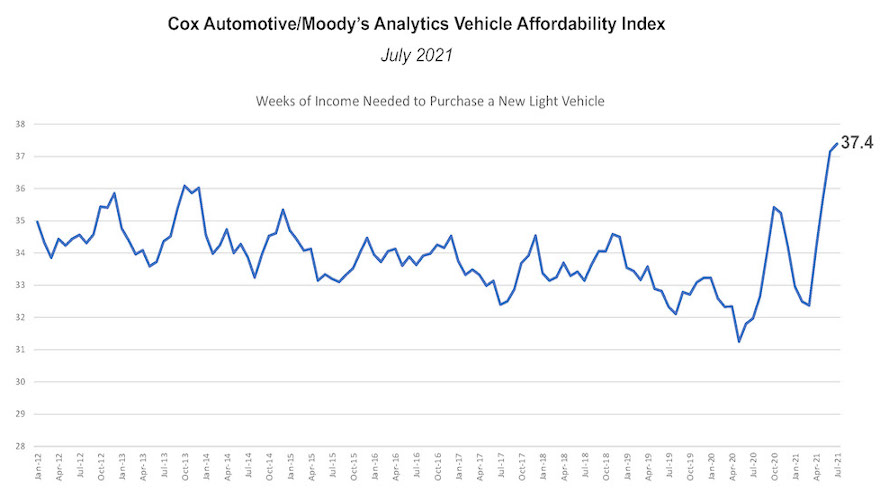

Cox Automotive/Moody’s Analytics Vehicle Affordability Index sets new record in July

Monday, Aug. 16, 2021, 02:05 PM

SubPrime Auto Finance News Staff

No matter where the individual might land on the credit spectrum, the financial capability needed to acquire a new vehicle is now at the most difficult point ever seen by experts from Cox Automotive and Moody’s Analytics. According to the ... [Read More]

3 ingredients of ‘Disciplined Listening Method’ that could help in F&I

Friday, Aug. 13, 2021, 02:20 PM

SubPrime Auto Finance News Staff

An expert from outside of the auto-finance industry offered three recommendations that could help F&I professionals work with potential customers who are not sitting in person across the desk from them in the finance office. InQuasize president Michael Reddington is ... [Read More]

PODCAST: Industry update with NAF Association president Joel Kennedy

Thursday, Aug. 12, 2021, 03:16 PM

SubPrime Auto Finance News Staff

National Automotive Finance Association president Joel Kennedy appeared again on the Auto Remarketing Podcast less than three weeks ahead of the Non-Prime Auto Financing Conference that begins on Aug. 30 in Plano, Texas. Kennedy discussed how the organization is continuing after ... [Read More]

US Equity Advantage leader among Orlando CEOs of the Year

Wednesday, Aug. 11, 2021, 03:59 PM

SubPrime Auto Finance News Staff

Robert Steenbergh is being rewarded for executive leadership that began long before the pandemic. According to a news release, the US Equity Advantage (USEA) founder and chief executive officer has been named one of the 2021 CEOs of the Year ... [Read More]

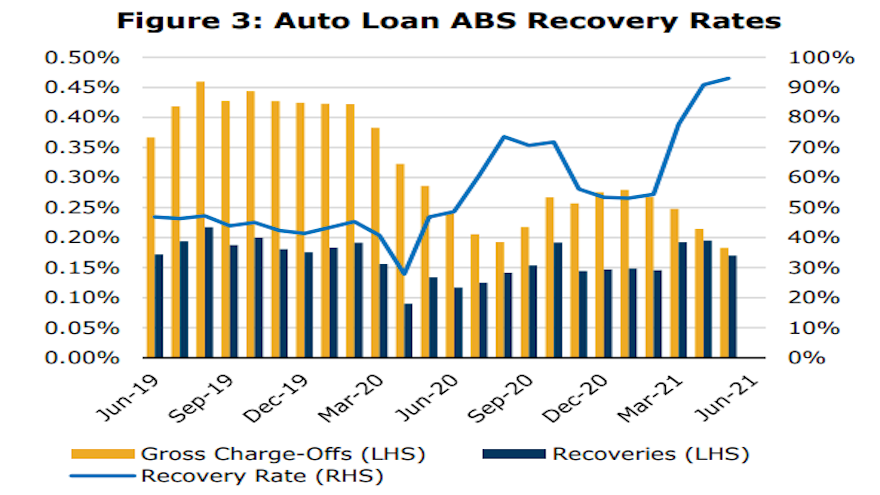

KBRA forecasts softening recovery rates as used-vehicle prices dip

Wednesday, Aug. 11, 2021, 03:56 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) released new research on Tuesday that analyzed the impacts of “skyrocketing” used-vehicle prices on auto finance credit performance metrics, as well as discusses future implications as the economy marches toward a return to pre-pandemic norms. [Read More]

TransUnion pinpoints how high credit scores could jump if rent payments are integrated

Tuesday, Aug. 10, 2021, 02:16 PM

SubPrime Auto Finance News Staff

TransUnion sees consumers who rent where they live as constituting as much as half of the individuals who possess non-prime or lower credit profiles; if they even have a credit score at all. Credit bureau analysts see that if rent ... [Read More]

House members consider new resources to help FTC

Monday, Aug. 9, 2021, 02:24 PM

SubPrime Auto Finance News Staff

The Subcommittee on Consumer Protection and Commerce of the U.S. House Committee on Energy and Commerce recently conducted a hearing on how best to modernize the Federal Trade Commission. With all five current commissioners participating, the subcommittee deliberated 16 proposals ... [Read More]

US adds 943K jobs in July, triggering ‘large’ drop in unemployment rate

Friday, Aug. 6, 2021, 03:30 PM

SubPrime Auto Finance News Staff

No doubt a key component to having a healthy auto-finance portfolio is the contract holders being gainfully employed. The U.S. Bureau of Labor Statistics shared some positive news on that front on Friday. The Labor Department reported that nonfarm payroll ... [Read More]

X