Equifax created a new high-level executive position and filled the post with an expert who previously roles with Oracle, FICO and Verisk Analytics.

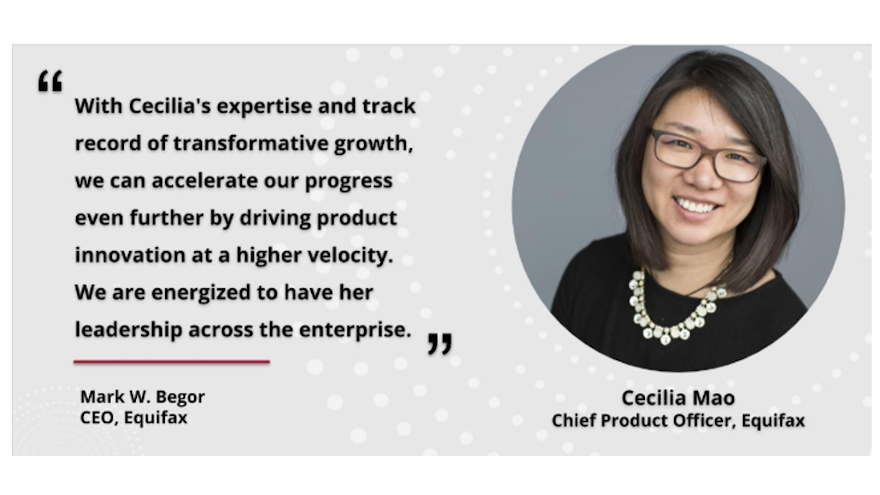

According to a news release distributed last week, Equifax named Cecilia Mao to a new global role as the company’s chief product officer. In this newly created position, Equifax said Mao will lead the company’s global product portfolio strategy and directly lead the execution and growth of Equifax’s fraud, identity, APIs, digital commerce and collections and recoveries product lines.

In addition, the company said Mao will provide leadership across all of the company’s product teams to accelerate the progress of the EFX2020 technology transformation and drive innovation that cuts across business units and geographic boundaries. In this role, Mao will also serve as a member of Equifax’s extended senior leadership team.

“As a leading data, analytics and technology company, new product innovation is at the center of our strategy as we continue to deliver for our customers,” Equifax chief executive officer Mark Begor said in the news release. “With Cecilia’s expertise and track record of transformative growth, we can accelerate our progress even further by driving product innovation at a higher velocity. We are energized to have her leadership across the enterprise.”

For more than two decades, Equifax highlighted Mao has created products that combine data, predictive analytics and cloud technology for clients around the globe. Most recently, she was vice president of product at Oracle Data Cloud where she led teams in business strategy, product management and delivery for identity, data management platform and digital audience-targeting products.

Prior to Oracle, Mao held product management roles at FICO and Verisk Analytics for analytics products from originations, account management and collections and recovery in retail banking, credit card and mortgage products.

“I’m thrilled to have Cecilia join our product and technology team in this new role,” Equifax chief technology officer Bryson Koehler said. “She has deep experience in accelerating revenue through new products and solutions, driving large-scale organizational change, and anticipating market dynamics to create new products and segments.”

Equifax mentioned Mao will relocate from Denver to the company’s headquarters in Atlanta in the near future.

On Friday, Toyota Motor North America and Toyota Financial Services announced executive changes that the companies said further strengthen their leadership in key areas.

According to a news release, Holly Walters, president and chief executive officer of Toyota Financial Savings Bank, was promoted to chief information officer and group vice president of information systems for TMNA. In her new role, Toyota said, Walters will oversee the company’s information systems, solutions and technology.

The company said Walters will report directly to Zack Hicks, chief digital officer and executive vice president of digital transformation and mobility.

Walters joined Toyota in 2007 as TFSB chief technology officer, responsible for the bank’s technology strategy and implementation. Prior to joining Toyota, Walters held a number of other senior roles focusing on the integration of technology and business operations, solution development and deployment, and IT risk and compliance.

Elsewhere, Toyota also said Mike Owens was promoted to group vice president and chief risk officer at TFS. In this expanded role, Owens will have the added responsibility of overseeing TFS’ international affiliates in the Americas Oceania region.

The company noted Owens will continue to serve as chairman of the board of directors for TFSB and report to Mark Templin, president and CEO of TFS.

Owens joined Toyota in 2002 and has more than 25 years of experience in credit analysis, risk management, account management, and business development across the auto, home mortgage, commercial and credit card lines of business.

White Clarke Group recently welcomed Wayne Ross as its chief technical officer.

With 25 years of experience in engineering, technology development and business management, the company said in a news release that Ross will be working with White Clark Group’s executive board to lead the company’s vision and strategy for its use of innovative technology.

The company pointed out that Ross continues to invest time into deepening his knowledge of artificial intelligence, blockchain, machine learning and deep learning, all of which will guide the direction of White Clarke Group’s technical development in the future.

Within Ross’ previous roles, including global CTO of Excelian (part of Luxoft Financial Services), founder of Jaalso Limited and head of engineering at Lab49, he has led the construction of a range of transformative applications and platforms for world leaders in financial services and retail.

More recently, Ross held the position of head of modern applications at GFT Financial, where he led a hands-on approach to infrastructure initiatives, evolving technological architecture and developing product delivery programs.

“Wayne’s significant expertise in software engineering and overseeing the deployment of technological services is sure to be an incredible asset to our growth,” said Brendan Gleeson, group chief executive officer of White Clarke Group. “He will play a vital role in the achievement of our strategic business goals, IT and innovation projects in the years to come.”

The series of executive promotions GM Financial made this month all point to making the experience better for the captive’s customers; from consumers who enter into a lease or retail installment contract to dealerships that are completing tasks in the finance office or searching for future inventory through consignment.

“Our end goal is for that customer to have a great experience and go back to a GM dealership and purchase another GM vehicle,” said Kyle Birch, who now is president of North America operations and one of six executives promoted by GM Financial, according to a memo from president and chief executive officer Dan Berce and shared with Auto Fin Journal.

Replacing Birch is Jonas Hollandsworth, who now is executive vice president of U.S. sales and credit operations. Also mentioned in Berce’s memo were:

— Will Stacy, who has been promoted to executive vice president and chief marketing and digital officer

— Bob Beatty, who now is executive vice president and chief experience officer

— Scott Dishman, who now is executive vice president of servicing

— Howard Cobham, who now is senior vice president of Canadian dealer services

“It’s really exciting. I’ve been here 22 years so I’ve seen in from the infancy stage of AmeriCredit to where we’re at today with GM Financial and the partnership with GM,” Birch said during a recent phone conversation with Auto Fin Journal.

“I’ve seen the growth from $1 billion to $100 billion so it’s been the case where things have been changing at a rapid pace. It’s great to be involved with all of it,” he continued.

Birch shared how he and Berce arrived at these modifications, stemming from changes made by the automaker, including Deborah Wahl becoming global chief marketing officer at General Motors.

“It’s a restructuring really for the purpose of aligning us closer in our partnership with General Motors, as well as being laser-focused on our dealer community and our customers once they get on the books with the lien, leases and loans,” Birch said.

“It’s not that everybody was new to each other, but it just kind of firmed up the partnership that we needed to have even further on the sales side of the organization, the marketing side of the organization and the customer experience side of the organization,” Birch added.

“Really the whole focus is to make sure we’re aligned from a go-to market sales strategy and making sure that we’re trying to grow (GM Financial) volumes and share, put more customers on the books so that we can continue to be the leader in loan and lease loyalty out there and drive repeat customers back to GM dealerships,” he went on to say.

Stacy also joined the conversation, describing his “exciting” time since joining the company five years ago. Stacy elaborated on the digital component to his responsibilities.

“I think the biggest piece for us is how do we reduce friction for our consumers and for our dealers? How do we make that dealer experience better? Dealers always say they want to have the easy button when it comes to dealing with us,” Stacy said.

Stacy pointed to the success of GM Financial’s mobile app, which he said has been downloaded more than 1 million times. The app can provide consumers the path not only to communicate with the captive and make their monthly payments, but Stacy noted the tool also can give users the chance to arrange service at GM dealerships and more.

Stacy then noted how he plans to collaborate with Beatty on how GM Financial can improve as a vehicle consignor through GMF Dealer Source. Stacy said GM Financial plans to create a dealer council to gather feedback about its remarketing efforts and platform so improvements that are most crucial to used-car managers can be made.

“We want more and more feedback from dealers that use that software to make that platform easier, more friendly to us, help them buy the cars, trucks and SUVs they’re are looking for on a daily basis,” he said.

Now with what GM Financial believes is the appropriate leadership structure, Birch and Stacy both see the company on track for success this year and beyond.

“Well, we feel very good about 2020,” Birch said. “We’re in position to grow all parts of our business.”

Ally Financial is asking Sathish Muthukrishnan to complete an array of tasks as the company’s new chief information, data and digital officer.

According to a news release distributed on Monday morning announcing he joined the company, Ally said Muthukrishnan will lead its technology, data and digital transformation teams, with a focus on advanced technical capabilities, including cyber security and infrastructure, as well as accelerating Ally’s growth as a leading digital financial services provider.

Muthukrishnan reports to Ally chief executive officer Jeffrey Brown and is based in Charlotte, N.C.

“Ally’s success is the direct result of a relentless focus on offering consumers the best digital platforms developed by some of the brightest and most talented resources in the financial services industry,” Brown said.

“Sathish’s track record for delivering industry-leading digital solutions within the financial services sector as well as other industries makes him ideally suited for this highly important and critical role as we look to enhance our technology vision to further cement our leadership position in the sector. I am excited to welcome him to the Ally team.”

Muthukrishnan has held a number of senior technology leadership roles with substantial scale and global reach, most previously serving as the chief digital and information officer for Honeywell Aerospace.

Prior to Honeywell, Muthukrishnan spent 10 years at American Express leading its digital transformation efforts.

Ally highlighted Muthukrishnan has a passion for innovation with a history of having filed more than 25 patents in the manufacturing, payments and digital technology space.

“I look forward to advancing the technology and digital transformation strategy and vision for the IT organization at Ally, which is already seen as a leader in the digital financial services sector,” Muthukrishnan said.

“Taking an entrepreneurial approach to technology development and execution is consistent with Ally’s reputation as a disruptor in the digital space, and I look forward to a bright future as the company expands its product portfolio while digitizing the business end-to-end,” he went on to say.

Finastra recently turned to a former Experian executive to be its new chief data officer.

Formed in 2017 by the combination of Misys and D+H, the cloud-based platform for open innovation designed to help global financial institutions as well as community banks and credit unions hired Lisa Fiondella to lead its comprehensive data strategy, including how data is collected through the FusionFabric.cloud platform and various cloud-based solutions.

Finastra said Fiondella also will be responsible for developing a data product roadmap and manage the process of bringing new data products to market.

“Data is an underused asset and a key source of competitive advantage,” Finastra chief product and technology officer Eli Rosner said in a news release. “We’re committed to unlocking that advantage for our clients and have made great strides in this area, including the recent launch of our Fusion Mortgagebot Data Insights solution.

“Under Lisa’s guidance, we will be able to identify new and exciting ways to leverage data to benefit our customers,” Rosner continued.

The company highlighted Fiondella brings with her an extensive background spanning data, analytics, financial services, product management, product development, marketing, sales and operations. She most recently served as vice president of analytic products for Experian, where she was responsible for developing analytic products harnessing vast data assets and advanced analytics, including machine learning and artificial intelligence.

“Access to high quality data and advanced analytics are essential to financial institutions, providing insight into customer profitability, channel preferences and overall financial needs,” Fiondella said.

“The breadth of Finastra’s solutions available via the cloud, as well as the firm’s ongoing cloud strategy means there is a wealth of data to be mined and utilize,” she continued. “I am excited to tap into this resource to create new solutions and identify new opportunities for our clients.”

CarLabs.ai, which counts three automakers and one of its captives among clients, recently added former J.D. Power and Affinitive leaders to meet rapid user growth.

CarLabs.ai, best known for creating Kia's AI-powered digital assistant Kian, recently added three new automakers to its existing client roster of six, including, Kia Motors America, Kia Motors Mexico, Kia Motors India, Kia Motor Finance, American Honda Motor Co. and Hyundai Motor America.

To meet this increased product and client demand, the company brought on Geoffrey Prince as the new vice president of product and Robert Dalton as senior director of project management. Both Prince and Dalton worked previously at J.D. Power, serving various roles in the product and technology development sides of the business.

Prince also previously served as the head of product at Affinitiv, one of the leading martech providers of sales and fixed operations solutions for automotive retail. At Affinitiv, he assisted the executive team and private equity partners in delivering a technology-centric vision of the company and a roadmap for the needed digital transformation of the product offering.

At CarLabs, Prince is leading the company's product set as it expands its SaaS services throughout the auto industry both within the U.S. market and internationally.

Dalton has spent two decades as a product, project, and program management professional. In past roles at Disney and J.D. Power, he was instrumental in transforming high-potential projects into financial and operational successes through the implementation of appropriate methodologies, procedures and guidance techniques.

Dalton will continue that effort at CarLabs.ai as the 4-year-old software company transitions from true start-up to a more structured organization representing some of the world's largest corporations.

“We have reached an exciting time in our company's growth where we need proven experts to manage the rapidly developing opportunities presented to CarLabs,” CarLabs.ai chief executive officer and co-founder Martin Schmitt said.

CarLabs.ai, headquartered in Calabasas, Calif., is one of the auto industry's first AI-powered, conversational engagement platform to successfully automate and personalize sales and customer service via chat on social channels, websites, voice and other messaging channels. Its conversational platform can allows consumers to interact directly with an automotive brand’s data and digital assets as if they were talking to a human via a 1:1 chat/voice interface.

CarLabs.ai insisted its clients see increased sales conversion, better website engagement, reduced call center costs, improved customer experiences and unprecedented consumer analytics.

To learn more about the firm, visit www.carlabs.ai.

Telenav announced its new chief financial officer on Monday.

The provider of connected-car and location-based services selected Hewlett Packard Enterprise (HPE) executive Adeel Manzoor to become the company’s CFO. Manzoor comes to Telenav after serving in a variety of roles for HPE, including:

— Chief financial officer and vice president of storage and big data

— Chief financial officer and vice president of mission critical systems and high performance compute

— Chief financial officer and vice president of converged infrastructure

At Telenav, Manzoor succeeds Fuad Ahmad, who has served as Telenav’s consulting interim CFO since January. Ahmad, a partner of consulting firm FLG Partners, plans to continue to provide financial consulting services to the company until the end of September for transition purposes.

“Adeel is an accomplished financial executive, and we are extremely pleased to have him join Telenav,” Telenav chairman and chief executive officer HP Jin said in a news release. “His years of successful and meaningful leadership at HPE and its predecessor Hewlett-Packard Company (HP) are a clear indication of his capabilities.

“We will leverage his extensive operational and financial expertise as Telenav delivers its next generation of enabled software and services for automobile manufacturers,” Jin continued.

In Manzoor’s multiple CFO positions at HPE, his key responsibilities spanned across full P&L management, short-term forecasting, budgeting, strategic planning, go-to-market, OPEX management, R&D portfolio planning, NPI, executive scorecard, executive communications, business intelligence, and strategic initiatives, including M&A.

Prior to joining HP, Manzoor worked for accounting and professional services firm Ernst & Young in the assurance and advisory practice.

“I am honored and very excited as I start the next chapter in my career at Telenav,” Manzoor said. “This is an exciting time for Telenav, as the company evolves from a respected leader in in-car navigation services to a company whose goal is to create the world’s largest network of connected vehicles. To me, being a part of that is exciting and challenging.”

Manzoor joined Telenav on July 1 and is based at the company’s headquarters in Santa Clara, Calif.

Later this summer, a new chief financial officer will take his spot within the leadership team at FICO.

FICO announced on Monday that the global analytics software company has appointed Michael McLaughlin as its new CFO. According to a news release, McLaughlin will start with the company on Aug. 3

McLaughlin replaces outgoing CFO Mike Pung, who announced his retirement in January. FICO indicated Pung will help facilitate a smooth transition and will remain with the company until Dec. 31.

McLaughlin leaves a position as managing director and head of technology corporate finance at Morgan Stanley, where he has worked for the past 12 years. During his 26-year investment banking career, McLaughlin has advised leading technology, financial services and real estate companies on a wide range of strategic and financial topics, also holding leadership positions at BofA Securities, UBS Investment Bank and Montgomery Securities.

“Michael brings us a wealth of leadership experience at the intersection of financial services and technology, which is FICO’s sweet spot,” FICO chief executive officer Will Lansing said. “The board and our leadership team are excited about this strategic appointment.

“I would also like to thank Mike Pung for his leadership and stewardship over the past 15 years. We wish him well as he transitions to a new phase in his life,” Lansing continued.

McLaughlin also shared about beginning the next segment of his professional career.

“FICO’s industry-leading suite of analytics and decision support tools, combined with its trusted brand and global customer base, uniquely positions the company to drive tremendous value creation in the years ahead,” he said.

“FICO has been a phenomenal success story over the last several years, and I am excited to join this exceptional team,” McLaughlin went on to say.

Expansion Capital Group (ECG), a technology-enabled specialty lender that leverages data and analytics to offer customized solutions to small businesses, recently hired two directors to lead efforts in marketing and human resources.

According to a news release, the company announced Jason Gross has joined the team to lead efforts in organic customer lead acquisition, social media, public relations and branding, while Kelsey Hillberg was hired to lead all human resources efforts, including benefits management, recruiting and strategic leadership development.

ECG indicated the strategic appointments will play a key role in supporting the company’s rapidly expanding small business lending platform driven by technology, data, and analytics. Since inception, ECG has connected more than 12,000 small businesses nationwide to approximately $350 million of capital.

“ECG was established to provide fast and simple solutions for small businesses seeking capital. Our investments in superior technology, process, and people have put ECG at the top of the list for small businesses that need access to capital,” ECG chief executive officer Vincent Ney said.

“Recruiting and supporting leaders that share the same values as our customers and live our mission remain key to our success,” Ney continued. “We look forward to the innovation and many contributions of our newest team members.”

Gross joins Expansion Capital Group as the director of marketing where he will be providing leadership to ECG’s direct marketing strategies. He comes to ECG from US Foods, where most recently he was leading digital strategy and customer experience to attract new business and increase customer retention.

Gross brings to ECG more than 15 years of experience accelerating e-commerce growth for businesses. Prior to US Foods, Jason developed digital and customer journey expertise in his roles at Best Buy, Cabela’s and Argus Leader.

Hillberg joins Expansion Capital Group as the director of human resources that will drive ECG’s strategy for recruiting, team retention and employee satisfaction. Hillberg brings past experiences with LifeScape and Sanford Health to her new role at ECG, which said she has developed and trained hundreds of leaders in leadership development, team building and strategy.