A big shift has hit the wholesale market, sparking discussion and initiatives among dealers and auctions, alike — multiplatform selling.

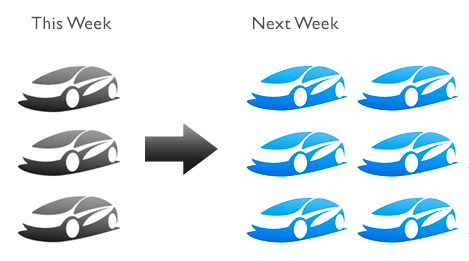

Multiplatform selling is gaining steam, as more and more dealers and others in the industry warm to the concept of having vehicles loaded for sale on one channel simultaneously appear on other channels available for bidding or purchase.

Brad Hart, industry veteran and chief operating officer of TradeRev, talked a bit about the plusses of multiplatform selling during a panel discussion at the 2014 Auto Remarketing Canada conference in March.

Hart says multiplatform selling will cut down on buyer time in lanes and online searches as it “eliminates the need to surf multiple channels for product.”

Hart said this does help dealers buy, of course, but also has the potential to make bidding more competitive as more eyes see the same vehicles.

That said, as for what’s on the horizon, Hart says he “most certainly see multiplatform selling being made available to dealer sellers.”

The Developments

One of the most recent developments for this push occurred In early March at the NAAA/CAR/IARA event in Las Vegas, where in a joint announcement, Manheim, ADESA and the independent auctions said they have made significant progress toward the creation of a multiplatform bidding solution that would facilitate simultaneous bidding on vehicles listed on multiple online auction sites.

The statement from these auction parties says that the proposed multiplatform solution is different from any other technology solution currently available in that it would allow a consigned car to receive bids from multiple online auctions from the moment the car is offered for sale until the time the car receives the winning bid.

A multiplatform steering committee was also formed by Manheim, ADESA and representatives from the U.S. independent auctions. This committee will oversee the development of the industry-wide initiative.

There has also been a technical committee formed by industry representatives, who are approaching the final design of the architecture of the multiplatform bidding solution.

Additionally, the steering committee has brought in Auto Auction Services Corp. to build and maintain the hub technology used to facilitate the distribution of the inventory and the synchronization of the bidding activity between the multiple online platforms, the statement said.

This is just one development among many as the industry pushes toward multi-platform selling and the changes that are bound to come with it, such as standardization of condition reports.

In mid-January, U.S.-based Auto Auction Services Corp. announced a new industry standard for vehicle condition data reporting — developed in partnership with Manheim — that is designed to foster consistency throughout the business.

Hart said the industry must find “a balance between standardization and competitive differentiation.”

“Customer report technology improvement and the ability to create the virtual vehicle is a competitive advantage and will come from different channels. So, I am all for standardization but also for innovation. May the best condition report win,” Hart explained.

An Auction Perspective

Interestingly, Matt Rispin, owner and partner at North Toronto Auction, already has direct experience with the multi-platform selling model.

In 2009, North Toronto Auction launched multi-platform selling with the wholesale platforms AutoGavel, OPENLANE (pre-ADESA ownership), OVE and SmartAuction.

“We were very successful, and it was a nice complement to our existing procedures. Then two of the platforms underwent major changes, and it wasn’t worth the efforts because frankly our customers just weren’t selling cars,” said Rispin. “Bottom line, they didn’t feel the service of multiplatform selling was worth it. We laugh, because four years later it is all new again. I guess things have come full-circle and consignors are evaluating their options again.”

The bottom line: If multiplatform selling and bidding become the norm, buyers and sellers are in for some big changes.

Rispin explained first off, “the thought process is that the sellers will gain more buyer exposure, and the buyer will gain the convenience of a larger inventory.”

That said, he noted he is always cautious when competitors start working together.

“I believe in Canada; the various auctions supply very fair fees and excellent service which the buyers and sellers enjoy. Competition between the auctions is the reason for this,” he said. “I’m interested to see how competitor cooperation effects the industry. In the end, I think we all believe that our customer’s success will be our success.”

At North Toronto Auction, Rispin said they haven’t heard much talk from consumers on the topic, but their ears are to the ground.

“Our customer’s haven’t asked us directly about it, so we are in a cautious wait and see. That being said, we have built our business by working with our customer’s to achieve their goals. If we start hearing about interest, we will take the next steps,” he concluded.

For more on the latest developments in strategies for selling, stocking and sourcing used vehicles, see the Auto Remarketing Canada May/June issue set to hit the Web this week. The Technology Issue covers digital trends and strategies as well as info on new Web-based tools that are helping dealers otpimize their pre-owned performance.

The ADESA Canada Used Vehicle Price Index powered by ALG Canada has been updated through October, and it shows wholesale prices have recently seen one of the biggest drops this year.

With all segments experiencing negative price movement, the index shows that wholesale prices fell on average by 0.5 percent month-over-month in October.

As winter weather rolls in, seasonality trends were evident in October wholesale price movement.

Mid-compact cars declined at the fastest percentage rate, according to the Index, dropping by a 10.6 percent, or $776.

This segment was followed by midsize SUVs, which saw a drop of 8.0 percent ($1,193).

Midsize cars (down 5.5 percent or $499), minivans (down 4.0 percent or $328), compact SUVs (down 3.5 percent or $399), and full-size pickups (down 0.8 percent or $126) rounded out the top price declines in October.

Looking forward to the end of this year, RVI is predicting that used-car prices will finish up 2013 at about 2.5 percent higher than 2012 rates.

“Exchange rates and supply are lower than last year, contributing to higher used-car prices. Used-car prices could’ve been higher, but higher gas prices and high new-car sales put downward pressure on the market,” Wayne Westring, manager of RVI analytical services at RVI Group, told Auto Remarketing Canada in November.

And as we approach the new year, Tom Kontos, ADESA’s chief economist, is predicting “similar price increases in 2014 and the years to come.”

Editor’s Note: For more on wholesale price movement and what to expect in 2014, see the December edition of Auto Remarketing Canada Digital Magazine set to come out later this month. This issue includes a special Year-End Market Intelligence Report.

The ADESA Canada Used Vehicle Price Index powered by ALG Canada has been updated through October, and it shows wholesale prices have recently seen one of the biggest drops this year.

With all segments experiencing negative price movement, the index shows that wholesale prices fell on average by 0.5 percent month-over-month in October.

As winter weather rolls in, seasonality trends were evident in October wholesale price movement.

Mid-compact cars declined at the fastest percentage rate, according to the Index, dropping by a 10.6 percent, or $776.

This segment was followed by midsize SUVs, which saw a drop of 8.0 percent ($1,193).

Midsize cars (down 5.5 percent or $499), minivans (down 4.0 percent or $328), compact SUVs (down 3.5 percent or $399), and full-size pickups (down 0.8 percent or $126) rounded out the top price declines in October.

Looking forward to the end of this year, RVI is predicting that used-car prices will finish up 2013 at about 2.5 percent higher than 2012 rates.

“Exchange rates and supply are lower than last year, contributing to higher used-car prices. Used-car prices could’ve been higher, but higher gas prices and high new-car sales put downward pressure on the market,” Wayne Westring, manager of RVI analytical services at RVI Group, told Auto Remarketing Canada in November.

And as we approach the new year, Tom Kontos, ADESA’s chief economist, is predicting “similar price increases in 2014 and the years to come.”

Manheim Canada announced this week it has chosen a new director of commercial accounts.

Joining the company’s leadership team is Steve Coulman, effective this coming Monday.

Commenting on the hire, Russ Stegall, executive director of Manheim customer management, said, “We’re very pleased to have Steve on board.

“He brings a valuable customer perspective to the role, and a great depth of knowledge about the business. He’s served on our Manheim Canada Client Advisory Board, and even has some Manheim auction experience. His background will be a great benefit to our customers and our company,” he said.

In his new position, Manheim Canada explained, Coulman will focus on the needs and opportunities of “key” remarketers in Canada.

He will be responsible for developing strategic relationships with new customers as well as continuing to enhance the experience of existing customers.

Coulman will be replacing Don Wallace, who previously led the company’s efforts in this area.

Wallace was recently made general manager of Manheim Toronto.

Coulman most recently served as national remarketing manager for BMW Group Financial Services Canada.

His experience also includes senior operations manager for Ford Remarketing Operations Center, among other business solution-oriented roles in the automotive industry.

Manheim Toronto announced a new hire this week.

Tapped for the position of general manager is Don Wallace.

In his new role as GM, Wallace will be responsible for all business operations at Manheim’s Canadian flagship location, the company reported.

Wallace has worked with Manheim Canada for two years now, leading e-business and product development for the company. In his most recent role, he served as director of national accounts.

“Don has been instrumental in enhancing our customers’ experience in Canada,” said Jerry Tassone, Manheim’s vice president of Northeast operations. “His efforts have helped to expand our product offerings and our customer opportunities, including operations in the West. I have no doubt he’ll apply the same energy and enthusiasm in his new role.”

Before joining Manheim, Wallace spent more than 20 years with Chrysler Financial Services.

Commenting on his new role as GM, Wallace said, “I have the advantage of already knowing that we have a great group of employees and customers at Manheim Toronto.

“I’m happy for the chance to build on such a solid foundation. The auction is where it all comes together for employees, customers, vehicles, technology, products and processes. I’m excited to have the opportunity to have a positive impact where the rubber meets the road,” he continued.

After rising almost every month this year, it seems wholesale prices have slowed their game, as fall is bringing lower rates at auction.

The ADESA Canada Used Vehicle Price Index, powered by ALG Canada, has been updated through August, and shows a decrease of 0.5 percent from July.

And the negative price movement was consistent among nearly all the segments. After showing strong price retention this year, full-size pickups declined at the fastest rate in August, according to the index. This segment saw prices fall by 5.67 percent, or $1,066.

Minivans followed, falling 5 percent ($454).

Midsize cars (down 4.3 percent or $405), mid-compact cars (down 4.1 percent or $302) and midsize SUVs (down 3.8 percent or $565) rounded out the top five declining segments in August.

And this price trend may continue, as ALG reported in its September/October Canada Market Outlook that used market supply is forecasted to rise very slightly this month and into October.

In the analysis, ALG officials said the bump in supply will have no significant effect on residuals, though impacts by segment will range from -0.4 percent to 0.4 percent.

And according to ALG’s latest Canada Market Outlook report, new-vehicle sales in August were the highest on record.

ALG Canada reported sales increased 6.5 percent year-over-year to 159,004 last month.

"This marks the best August result ever, surpassing the previous peak of 158,394 units reached in August 2007,” ALG Canada reported.

This brings year-to-date sales (as of the end of August) up 3.4 percent to a total of 1,201,664 vehicles sold.

And a strong new-car market bodes well for used departments in the near future as trade-ins may serve to loosen used supply in the coming years.

On Credit Group recently announced its dealer wholesale program has expanded to reach across Canada. In support of its national presence, the company hired a new vice president of Inventory on Credit.

Tapped for the position is Rick Wilson, who is a 25-year veteran of the automotive industry, with specific experience in the inventory finance market.

The company expansion may help dealers to have better access to secondary inventory finance for both franchised and independent dealers.

“It’s not always easy to find a company that shares the same vision when it comes to creating, developing and executing a business plan. The On Credit Group has built a culture that is second to none. The team has embraced the philosophy and mission statement and it is an honor to be joining them at this stage in my career,” Wilson said.

The Inventory on Credit branch of the company touts two programs: a Starter and a Standard program.

Why the split?

Chris McMunn president and chief executive officer of the On Credit Group, explained the company’s reasoning, noting, “We wanted to make it easy for a dealer to attain a small credit line in the event they hadn’t had one before. They can then move into the Standard program after they have built some positive history.

“This gives the dealer the opportunity to get started in the wholesale game, so they can learn as they go, in a comfortable, controlled environment.”

Company officials also stressed they worked throughout 2012 to “ensure” their internal systems were ready for a national presence.

“It is so exciting to walk into a company that is not only ready to grow, but has the best systems and technology available” Wilson said. “The opportunity for success is right here and I couldn’t be happier to be an integral part of it.”

– See more at: http://www.autoremarketing.com/print/technology/credit-group-offer-dealer-wholesale-program-national-level-canada?wt_mc_id=Email-ARCanada#sthash.T2fiqBIv.dpuf