Another month has passed. That must mean another record high for Canadian used-vehicle values.

That’s right: The positive trend for the Canadian market that started in the summer of 2010 continues. Canadian Black Book’s Used Vehicle Retention Index posted a January result of 105.2. This is the highest level for the index — which tracks the health of the Canadian wholesale vehicle market by looking at retained values of two- to six-year-old values in Canada — since it began tracking the market using January 2005 data.

Canadian Black Book vice president of research and editorial Brian Murphy stated in a news release that the continuing positive run has been “impressive and delightful news for those selling or trading in vehicles to retailers in Canada.”

But he added that Canadian Black Book expects those high values to soften as Canada and U.S. used supply increases begin. Murphy said that is a direct result of cars “coming back from record new sales and (an) increase in leasing uptake over the past couple years.”

Compact and midsize cars were among the biggest gainers compared to December, with both segments hitting record highs.

That is an interesting development, according to Canadian Black Book, because of industry “chatter” that those segments’ popularity is dipping. But despite the chatter, the index shows that the two- to six-year-old products in these segments are performing better than ever.

Subcompact and midsize cars are also performing well, with year-over-year gains of 8.0 and 5.6 respectively. These increases are quite significant, as some may assume the demand is focused on SUVs in this market.

Minivans aren’t performing as well, but they are also up a full point for January. They are, however, seven points behind their all-time high in June 2016.

And now, the flipside: Across the index’s 20 segments, compact luxury SUVs, luxury cars and mid-size luxury SUVs declined the most compared to the previous month. Compact luxury SUVs fell by 1.8 points, while mid-size luxury SUVs dipped by 2.4, and luxury car values were also lower by 1.9. Full-size vans, with a 4.2-point drop, declined the most compared to the same period last year. Luxury cars dipped 8.0 points, and the more expensive prestige luxury cars fell 7.1 points from January.

Canadian Black Book commented that despite the January strengthening of the dollar by 3 cents since Christmas, Canadian market values have not slowed. The Canadian dollar is at 0.76 cents to the U.S. dollar, which Canadian Black Book says is still quite a bit off the levels that would slow exports to the United States significantly and that would cause a decline in market values.

Canadian Black Book calculates the Used Vehicle Retention Index using its published Wholesale Average value on two- to six-year-old used vehicles, as a percentage of original typically-equipped MSRP.

Along with four other interesting statistics about how the Canadian retail used-vehicle market closed 2018, analysts also highlighted prices for the majority of the Top 10 funded used vehicles sold through the Dealertrack Canada stayed nearly steady.

With six of the vehicles recording year-over-year increases and four recording declines, the average cash price of the Top 10 funded used vehicles in December remained relatively flat with a rise of only 0.9 percent compared to 12 months earlier.

Despite the hold on pricing in 2018, the company said the total number of Top 10 funded used vehicles the Dealertrack Canada online credit application network rose by 4.1 percent.

Among the top 10 used vehicles, the second place Honda Civic saw the largest year-over-year average cash price gain with an 8.4 percent increase to $15,310.

Recording the most significant annual price drop was the Dodge Journey sliding by 6.8 percent to $18,356.

Other insights from December’s overall Top 10 funded used vehicles data included:

— The most popular trade-in year was 2015.

— The average Top 10 funded vehicle was 40.0 months old, down from 40.7 months a year earlier.

— The average cash price paid was $20,088, up $19,539 a year earlier.

— Used buyers average annual income was $57,777, up from $55,318 a year earlier.

Top Funded Used Vehicles in Canada – December 2018

| |

Model |

Top

Model Year |

Average

Cash Price

Dec. 2018 |

Average

Cash Price

Nov. 2018 |

Price Percentage

Change vs.

Nov. 2018 |

Price Percentage

Change vs.

Dec. 2017 |

| 1. |

Ram 1500 |

2017 |

$32,029 |

$31,969 |

0.2% |

-3.8% |

| 2. |

Honda Civic |

2015 |

$15,310 |

$15,137 |

1.1% |

8.4% |

| 3. |

Dodge Grand Caravan |

2017 |

$20,536 |

$21,130 |

-2.8% |

3.7% |

| 4. |

Hyundai Elantra |

2017 |

$14,843 |

$15,226 |

-2.5% |

2.6% |

| 5. |

Ford F-150 |

2016 |

$30,768 |

$30,587 |

0.6% |

-0.9% |

| 6. |

Nissan Rogue |

2015 |

$21,876 |

$21,307 |

2.7% |

-1.3% |

| 7. |

Ford Escape |

2014 |

$18,374 |

$18,363 |

0.1% |

2.9% |

| 8. |

Chevrolet Cruze |

2014 |

$14,115 |

$14,173 |

-0.4% |

0.7% |

| 9. |

Toyota Corolla |

2015 |

$14,672 |

$14,622 |

0.3% |

3.3% |

| 10. |

Dodge Journey |

2015 |

$18,356 |

$19,127 |

-4.0% |

-6.8% |

Source: Dealertrack Canada

Carfax Canada has released a new pricing tool available on the Kijiji Autos site and an app that the companies say will help Canadians better understand used-vehicle values and empower them to make better decisions about used cars. The tool, according to Carfax Canada, will also help used-car sellers set competitive asking prices.

The company says its price analysis uses a proprietary algorithm that calculates the average price for a vehicle by considering its available history. That history could include factors such as odometer readings, damage and actual selling prices for similar vehicles in nearby locations. Carfax Canada says sellers and shoppers can use those findings as a benchmark to understand what similar cars are worth.

Carfax Canada says it is the exclusive source of vehicle history information on Kijiji Autos’ platform, and the company's president and general manager Mark Rousseau said in a news release that the company is "proud to now also power the platform’s price analysis tool with Carfax’s valuation data."

Leanne Kripp, director of autos at Kijiji, said in a news release that Canadians mentioned transparency when telling her company which factors would be an important factor for them in using the new platform.

“By integrating CARFAX Canada data into our price analysis tool, we're able to provide millions of Canadians with a greater level of transparency that will empower them to feel more confident in their car buying journey," Kripp said.

Another month, another best-ever month for used-car value retention.

Canadian Black Book said in an analysis this week that its Used Vehicle Retention Index reached 103.6 last month, which is the highest level recorded in the 13 years of the index.

The last time the index hit a record? July.

CBB attributed the high used-car retention to economic strength and Canadian-U.S. exchange rates that make exporting used cars to the U.S. ideal.

“Certainly, all industry eyes are on the NAFTA renegotiations, at the time of writing this commentary,” the company said in its analysis.

“If any vehicle types or nations are singled out for tariffs by the U.S., it is our expectation that the coming months will see some very dramatic shifts in value.”

Separately, the ADESA Canada Used Vehicle Price Index, powered by ALG Canada, was up in August, following seasonal adjustments. Its report pointed to a 0.46-percent month-over-month increase in wholesale prices for August.

Within the various segments it tracks, the ADESA report said pricing activiity was “mostly positive.”

Mid-compact prices were down 4.2 percent month-over-month, and midsize SUVs were off 3.2 percent.

However, the other four segments in the report showed gains from July: The midsize segment was up 1.4 percent, minivan prices climbed 4.9 percent, compact SUVs were up 3.3 percent and full-size pickups were up 3.8 percent.

Informing Ontario car-buyers about their right to all-in price advertising is the aim of a new province-wide consumer awareness campaign launched by the Ontario Motor Vehicle Industry Council (OMVIC) this week.

The Ontario vehicle sales regulator said that despite current laws regarding consumer protection rights, recent research shows that some car-buyers may be uninformed that dealer advertising with the price for a new or used-vehicle must include all fees and charges.

Via TV, radio and social media, OMVIC began advertising on Monday to educate consumers who are unfamiliar with Ontario’s existing consumer protection regulations aimed at restricting dealers from making transactions that include unexpected fees.

“This illegal practice is not only unfair to car-buyers, it gives non-compliant dealers an unfair advantage over those dealers whose advertised prices include all fees and charges and provide transparency to consumers,” OMVIC chief executive officer and interim registrar John Carmichael said in a news release.

According to OMVIC, since 2010, it’s been the law that with the exception of the harmonized sales tax in Ontario and safety standards certificate, if the vehicle is advertised unfit or as-is, dealers must advertise a price that includes all fees and charges.

Meanwhile, just last year, 29 of 50 Greater Toronto Area new-car dealers attempted to add what OMVIC called “surprise fees” to their advertised prices when visited by OMVIC mystery shoppers.

OMVIC said that fees or charges such as freight, pre-delivery inspection/expense, administration fees and government levies must be included in the advertised vehicle price from a dealer. And if a dealer wants to charge for products or services that they have pre-installed on a vehicle, those costs must be included in the advertised price, as well.

“Less than half of Ontario car-buyers know they have a right to all-in price advertising,” said Carmichael. “And this is problematic because OMVIC still finds unacceptable levels of non-compliance with the all-in pricing regulations by some dealers.”

June marked the first time in five months that there was a dip in the Canadian Black Book Wholesale Used Vehicle Retention Index. But take that with a grain of salt.

It was a relatively modest month-over-month decline (0.4 percent), and the index is still strong, and vehicles are retaining values as well as they have in the 13 years the index has been tracking values.

What’s more, the index in June was up 3.9 percent year-over-year.

On a segment level, fuel price gains are helping to push up smaller cars.

“Looking across the segments in greater detail, the subcompact and compact cars have shown impressive growth of 8 percent and 7.4 percent, respectively, since the same time last year,” Canadian Black Book said in its analysis.

“Subcompact cars are up 0.6 percent from last month alone. No doubt some higher fuel prices are helping these two segments stay strong,” it noted.

CBB also spotlighted the compact crossovers, which jumped 4.4 percent-over-year and 0.5 percent month-over-month. Midsize cars have fallen 1.4 percent year-to-date but climbed 7.4 percent year-over-year in June.

Conversely, there was a 2.2-percent year-over-year decline and a 0.7-percent month-over-month drop for full-size pickups, according to CBB.

Minivans were 3.9 percent softer through six months of the year and were off 1.3 percent month-over-month. Luxury cars dipped 1.5 percent year-over-year.

Separately, the ADESA Canada Used Vehicle Price Index, powered by ALG, was up in June after seasonality adjustment.

However, the report on that index found that wholesale price fell an average of 0.3 percent from May.

By segment, transaction prices on mid-compacts were down 4.7 percent month-over-month, midsize cars were down 10.4 percent, minivans fell 2.1 percent and compact SUVs were off 4 percent, according to the ADESA index report.

Midsize SUVs were up 1.2 percent, and full-size picks were down 1 percent.

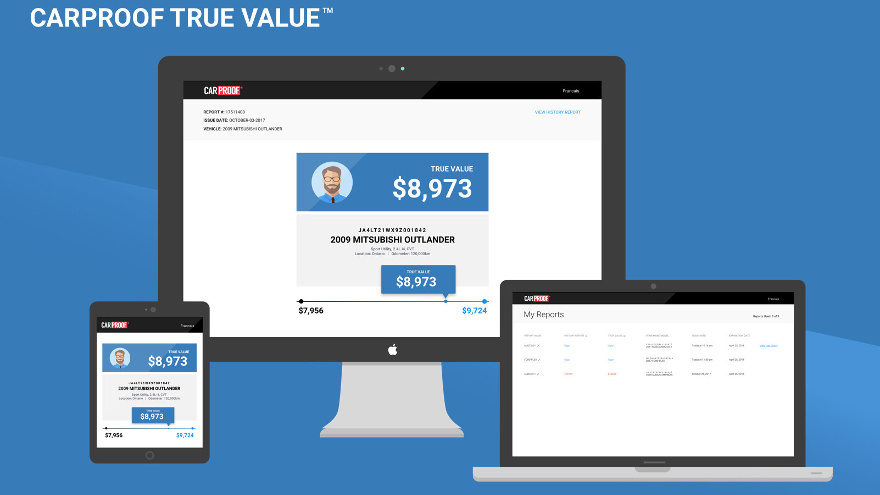

CARPROOF’s newly released data-driven appraisal tool — CARPROOF True Value — can provide more accurate values of used vehicles because it looks at vehicles' unique history, rather than just what it’s being listed for within a particular geographic area, according to company vice president of product management Greg Beckman.

To calculate a specific appraisal, the new online tool leverages the company's extensive automotive data such as listing information, along with reports on prior damage, odometer readings and even where a car has been registered.

“Based on the full data we have, we’re able to give a very accurate value for what that vehicle is worth,” Beckman explained during a recent phone interview.

In addition to CARPROOF’s free True Value range, car buyers and sellers can also upgrade to get the specific True Value that includes the vehicle's unique history records.

“What we’re doing with that is we’re providing a range of values for similar vehicles in a geographic area, and rate is based on full data, so it’s not based on what cars are being listed for. It’s actually generated and calculated based on what the cars are selling for in that area,” Beckman said. “With that range you get a good idea of what that vehicle would be worth but then get a vehicle’s specific amount, which is our ‘True Value’ — that value is calculated based on a car’s unique history,” Beckman explained.

CARPROOF’s exact True Value is based on a combination of what similar vehicles have sold for and history reports.

“In order to get that value you have to purchase our history report, which is anywhere from $40 to $52 for the full story,” Beckman added. “With that purchase of the history report, you get the actual specific value for your vehicle as opposed to just a free range.”

Along with odometer readings and more, vehicle history information also includes important information regarding how the vehicle has been serviced or any accidents it may have been in, according to Beckman.

“Our mission is to help Canadians make informed decisions about buying and selling used cars,” said CARPROOF president Mark Rousseau in a news release announcing the launch of CARPROOF True Value. “Our aim is to reduce the guesswork around used-car value, helping private sellers set competitive asking prices and giving buyers peace of mind that the price they're paying is fair.”

CARPROOF is one of the presenting sponsors at the Auto Remarkting Canada Conference later this month. The event is being held March 27-28 at the Westin Harbour Castle in Toronto.

At the close of 2017, Dealertrack Canada saw significant annual price gains for used vehicles in its network.

The Average Cash Price of the Top 10 Funded Used Vehicles in its online credit application network rose by 5.23 percent compared to 2016, according to the company.

Like in November, nine of the 10 top vehicles experienced gains last month.

Up 13.50 percent, and with an average cash price of $14,019, the 6th-place Chevrolet Cruze saw the largest annual gain, while the 7th-place Ford Escape saw the largest year-to-year drop. The model is down 4.6 percent with an average cash price of $17,865.

“2017 was a solid year overall for the used-car business and our Dealertrack Canada network, and we expect this trend to continue in 2018,” Dealertrack Canada vice president and general manager Richard Evans said in a news release.

Additionally, the average 2017 top 10 funded vehicle was 40.7 months old, and the average cash price paid was $19,539 last year.

What has been a staple of its used-vehicle analysis in the United States is now coming to Canada.

As Black Book has compiled in the U.S., Canadian Black Book announced today the release of its first Used Vehicle Retention Index for Canada.

Editors highlighted the index will serve to offer what they called “unbiased and accurate” insights and statistics regarding the health of the used wholesale vehicle market in Canada. This inaugural edition covers the month of November.

“We’ve used this type of index data internally for many years, and are now packaging it up to provide Canada’s auto industry a free monthly resource to help monitor the ongoing vital signs of used vehicle pricing domestically,” said Brad Rome, president of Canadian Black Book.

“This information is impartial to any brand, and can help guide decision makers with accurate figures regarding the strength or weakness of used-vehicle prices,” Rome continued.

Just like in the U.S., the Canadian Black Book Used Vehicle Retention Index is calculated using Canadian Black Book’s published wholesale average value on 2- to 6-year-old used vehicles, as a percent of original typically-equipped MSRP. Canadian Black Book’s wholesale average is a benchmark value for used vehicles selling in the wholesale auctions with the vehicle quality in average condition. The index is weighted based on used vehicle sales volume and adjusted for seasonality, vehicle age, mileage, condition, and inflation (MSRP).

Aggregated from daily vehicle value updates, and captured throughout thousands of wholesale vehicle transactions across the country, the Canadian Black Book Used Vehicle Retention Index is designed to represent data across all regions of Canada.

“The index is based on a comprehensive list of vehicles included in the Canadian Black Book wholesale database, and includes no bias toward any brand, data source or region, ensuring an accurate report of the used-vehicle market,” the company said

The index will provide automotive industry professionals and watchers with insight regarding trends with comparisons year-over-year and month-over-month. From a more macroeconomic perspective, it will illustrate pricing performance since the index commenced with data from 2005.

“We are always being asked about the overall state of used vehicle value retention, which we are happy to answer. This new regularly published index will just make it easier and provide a more visual means to get those answers and see the direction of prices in Canada,” said Brian Murphy, vice president of research and editorial at Canadian Black Book.

This first index illustrates the effects of the “economic pain” of 2008-2009 in the index. This “pain” becomes even more visible after examining full-size trucks during that time as prices fell more than 15 percent nationally.

Late 2009 saw what editors dubbed as a false recovery of prices, followed by falling prices again. However since the middle of 2010, Canadian Black Book noted there has been a remarkable and steady growth in prices overall.

Today the index — which can be downloaded here — is currently at its highest level (102.4) since it was first calculated using 2005 data.

Editors determined the strongest segments are full-size luxury crossovers/SUVs, midsize crossovers and small pickup trucks. The segments with weakest performance are the near-luxury cars and subcompact cars, both perform considerably below the market average. Both however have strengthened in recent months.

A more detailed index at the more granular segment level will be made available for Canadian Black Book clients upon request.

The index will be posted monthly on CanadianBlackBook.com.

The latest U.S. index update can be found here.

While the exchange rate climbed, Canada’s used-car prices moved downward in the first full month of summer.

That’s according to RVI Group, whose Market Update for August indicated that the RVI Used Vehicle Price Index (Real) dipped 0.1 percent month-over-month in July and declined 0.3-percent year-over-year.

Nominally, there was a 1.1-percent decline in used-car prices from June but a 1.9-percent uptick from July 2016, RVI said.

The U.S.-to-Canadian exchange rate was 0.79 in July, compared to 0.75 in June and 0.77 a year ago, RVI said.

Segment trends

Delving into the individual segments within the index, RVI found that nine showed year-over-year price gains, with nine showing decreases. The largest overall decrease was for luxury coupes (down 15.8 percent from July 2016), with small SUVs (down 7.6 percent) with the largest decline when just looking at high-volume segments.

Leading the increases was the luxury full-size sedan (up 15.1 percent).

But among high-volume segments, compacts showed the most price growth (up 5.9 percent), according to RVI.